Global Polishing/Lapping Film Market Size, Share, Growth Analysis Report - Forecast 2034

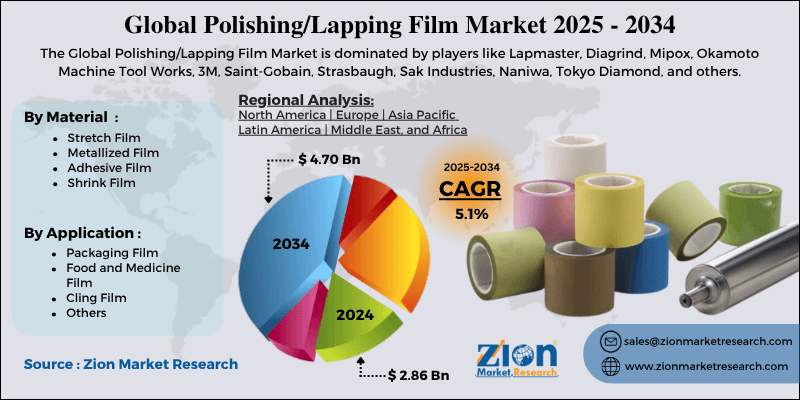

Polishing/Lapping Film Market By Material (Stretch Film, Metallized Film, Adhesive Film, Shrink Film), By Application (Packaging Film, Food and Medicine Film, Cling Film, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.86 Billion | USD 4.70 Billion | 5.1% | 2024 |

Polishing/Lapping Film Market: Industry Perspective

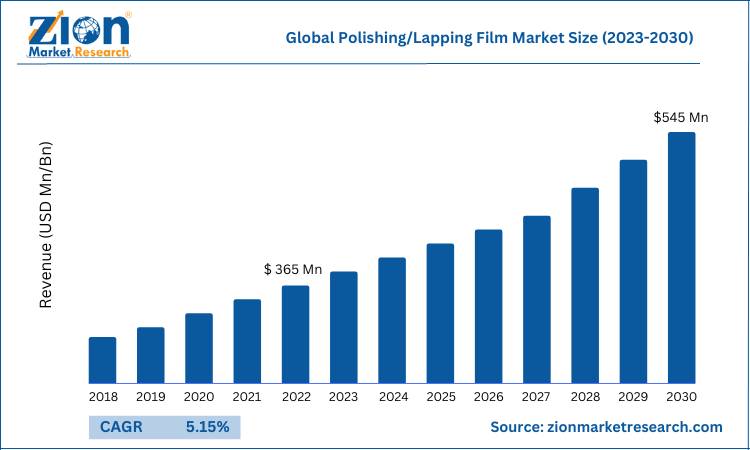

The global polishing/lapping film market size was worth around USD 2.86 Billion in 2024 and is predicted to grow to around USD 4.70 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.1% between 2025 and 2034. The report analyzes the global polishing/lapping film market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the polishing/lapping film industry.

Polishing/Lapping Film Market: Overview

Polishing refers to the process of creating a shiny and smooth surface using some form of chemical treatment or with the help of a polishing film. At the end of the process, the polished surface should be clean but also leave a significant regular reflection or specular reflection. In most cases, the polishing film is preferred in such processes. It is a micro-abrasive substance that is embedded with micron-graded grains slurry with an out coating of 75 micrometers (µm) / 3 mil film with high precision.

Polishing films can create finishing that is highly accurate along with features like durability and flexibility. Lapping is the process of rubbing two separate surfaces together with an abrasive substance between them. It involves the use of machines or may also be done by hand. Lapping films are polyester base sheets consisting of a coating with minutely graded minerals like aluminum oxide or diamond, which are highly preferred to polish knife edges. They are generally mounted on sheets with multiple strips, 10 in most cases, with every strip coming along with an adhesive back to help quick change-outs.

Key Insights

- As per the analysis shared by our research analyst, the global polishing/lapping film market is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2025-2034).

- Regarding revenue, the global polishing/lapping film market size was valued at around USD 2.86 Billion in 2024 and is projected to reach USD 4.70 Billion by 2034.

- The polishing/lapping film market is projected to grow at a significant rate due to increasing demand for high-precision surface finishing in industries such as electronics (especially semiconductors and fiber optics), automotive, aerospace, and medical devices, coupled with the continuous technological advancements in manufacturing processes requiring ultra-smooth and precise surfaces.

- Based on Material, the Stretch Film segment is expected to lead the global market.

- On the basis of Application, the Packaging Film segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Key Growth Drivers

The polishing/lapping film market is primarily driven by rapid expansion in electronics and semiconductor manufacturing, where high-precision surface finishing is essential for wafers, substrates, and electronic components. Growth in demand for advanced materials such as glass, ceramics, and hard metals in industries like automotive, aerospace, and medical devices also fuels demand for specialized polishing films. Continuous improvements in film technology — offering finer abrasives, longer life, and better consistency — increase adoption by improving process efficiency and reducing total cost of ownership. Additionally, rising investment in LED, optical, and battery manufacturing (particularly for EVs) where ultra-smooth surfaces are required further supports market growth.

Restraints:

Market expansion is constrained by the high cost of premium polishing/lapping films and the associated capital expenditure for integrating advanced surface-finishing processes, which can deter small and mid-sized manufacturers. Variability in raw material prices, especially for specialized abrasives and backing materials, creates margin pressure for producers. Another restraint is the availability of skilled operators and process engineers capable of optimizing polishing parameters to achieve required tolerances; poor process control can lead to high scrap rates. Environmental and disposal regulations related to abrasive slurries and used films in some regions can increase compliance costs and complicate waste management.

Opportunities:

Significant opportunities exist in developing tailored polishing films for emerging applications such as microelectromechanical systems (MEMS), advanced optics, and next-generation battery components where surface quality directly impacts performance. Expansion into rapidly industrializing regions offers growth potential as local electronics, automotive, and solar manufacturing facilities scale up. Innovations in eco-friendly backing materials and recyclable film systems can open new markets and meet stricter environmental standards. Collaborations with OEMs to develop application-specific solutions and value-added services (process consulting, on-site trials, and lifecycle management) present avenues to differentiate and capture higher-margin business.

Challenges:

Key challenges include intense competition and price pressure from low-cost manufacturers, which can erode profitability for established suppliers. Rapid technological change in end-use industries requires continuous R&D investment to keep products relevant, imposing ongoing cost burdens. Ensuring consistent quality at very tight tolerances across large production volumes is technically demanding and can lead to customer dissatisfaction if not met. Supply-chain disruptions for critical abrasive grains or backing substrates — whether from geopolitical issues or production bottlenecks — can interrupt deliveries and harm customer relationships. Finally, educating end users about the benefits of higher-performance films versus cheaper alternatives remains a persistent commercialization challenge.

Polishing/Lapping Film Market: Segmentation Analysis

The global polishing/lapping film market is segmented based on Material, Application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on Material, the global polishing/lapping film market is divided into Stretch Film, Metallized Film, Adhesive Film, Shrink Film.

On the basis of Application, the global polishing/lapping film market is bifurcated into Packaging Film, Food and Medicine Film, Cling Film, Others.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Polishing/Lapping Film Market: Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Polishing/Lapping Film Market |

| Market Size in 2024 | USD 2.86 Billion |

| Market Forecast in 2034 | USD 4.70 Billion |

| Growth Rate | CAGR of 5.1% |

| Number of Pages | 187 |

| Key Companies Covered | Lapmaster, Diagrind, Mipox, Okamoto Machine Tool Works, 3M, Saint-Gobain, Strasbaugh, Sak Industries, Naniwa, Tokyo Diamond, and others. |

| Segments Covered | By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polishing/Lapping Film Market: Regional Analysis

The Polishing/Lapping Film market shows clear regional differences driven by local manufacturing strength, end-use industries, and cost dynamics: North America (especially the U.S.) leads in high-precision industries—semiconductors, aerospace and advanced optics—favoring premium, high-performance films and strong aftermarket/service demand; Europe (with hubs in Germany and the U.K.) emphasizes quality, environmental compliance and applications in automotive, precision engineering and renewable-energy component production, supporting steady demand for specialty and eco-friendly films; Asia-Pacific (notably China, Japan, South Korea and India) is the fastest-growing region thanks to large-scale electronics, semiconductor, and auto manufacturing, high-volume consumption of both standard and advanced lapping films, and a strong local supplier base that competes on price and scale; Latin America shows selective adoption centered on mining, metalworking and growing industrial maintenance needs, with adoption driven by cost sensitivity and aftermarket availability; the Middle East and Africa are emerging markets where demand is concentrated in oil & gas, heavy industry and construction, often relying on imports and project-based purchases; overall regional strategies differ—mature markets prioritize high-value, specialized formulations and technical support, while emerging markets prioritize affordability, supply reliability and broad availability—shaping how manufacturers position products, distribution and value-added services across regions.

Polishing/Lapping Film Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the polishing/lapping film market on a global and regional basis.

The global polishing/lapping film market is dominated by players like:

- Lapmaster

- Diagrind

- Mipox

- Okamoto Machine Tool Works

- 3M

- Saint-Gobain

- Strasbaugh

- Sak Industries

- Naniwa

- Tokyo Diamond

The global polishing/lapping film market is segmented as follows;

By Material

- Stretch Film

- Metallized Film

- Adhesive Film

- Shrink Film

By Application

- Packaging Film

- Food and Medicine Film

- Cling Film

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Polishing refers to the process of creating a shiny and smooth surface using some form of chemical treatment or with the help of a polishing film. At the end of the process, the polished surface should be clean but also leave a significant regular reflection or specular reflection. In most cases, the polishing film is preferred in such processes. It is a micro-abrasive substance that is embedded with micron-graded grains slurry with an out coating of 75 micrometers (µm) / 3 mil film with high precision.

The global polishing/lapping film market is expected to grow due to rising demand in semiconductor and electronics manufacturing, precision surface finishing needs, and advancements in nanotechnology applications.

According to a study, the global polishing/lapping film market size was worth around USD 2.86 Billion in 2024 and is expected to reach USD 4.70 Billion by 2034.

The global polishing/lapping film market is expected to grow at a CAGR of 5.1% during the forecast period.

Asia-Pacific is expected to dominate the polishing/lapping film market over the forecast period.

Leading players in the global polishing/lapping film market include Lapmaster, Diagrind, Mipox, Okamoto Machine Tool Works, 3M, Saint-Gobain, Strasbaugh, Sak Industries, Naniwa, Tokyo Diamond, among others.

The report explores crucial aspects of the polishing/lapping film market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed