Plastic Rigid IBC Market Size, Share, Trends, Growth 2032

Plastic Rigid IBC Market By Product Type (Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), and Others), By Capacity (Less Than 500 Liters, Between 500 and 1000 Liters, Between 1000 and 1500 Liters, Between 1500 and 2000 Liters, and More Than 2000 Liters), and By End-User (Petroleum & Lubricants, Industrial Chemicals, Paints, Inks and Dyes, Food & Beverages, Pharmaceuticals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

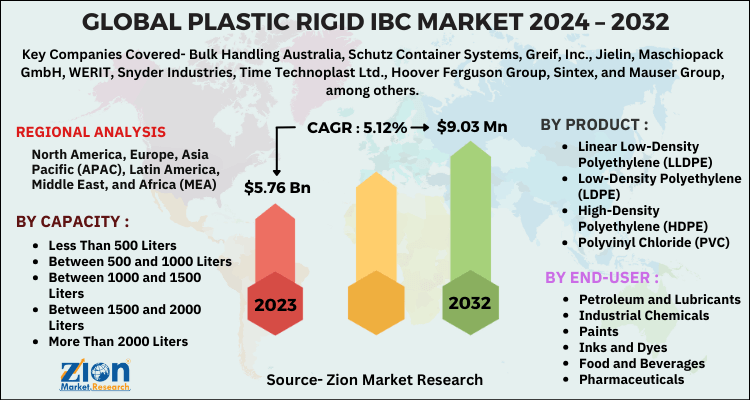

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.76 Billion | USD 9.03 Billion | 5.12% | 2023 |

Plastic Rigid IBC Industry Perspective:

The global plastic rigid IBC market size was worth around USD 5.76 billion in 2023 and is predicted to grow to around USD 9.03 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.12% between 2024 and 2032.

In order to give the users of this report a comprehensive view of the plastic rigid IBC market, we have included a competitive landscape and an analysis of Porter’s Five Forces model of the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Plastic Rigid IBC Market: Growth Drivers

Plastic rigid intermediate bulk containers are cost-effective and reusable in nature. In rigid bulk packaging, the plastic material is largely used due to their numerous performance benefits. Plastic rigid IBC is a rigid and self-standing container, which is made from polymeric material. IBCs are mostly used to store and transport liquids in bulk quantity, such as food ingredients, chemicals, solvents, pharmaceutical products, and granulated substance. The general volume of plastic rigid IBCs ranges between 119 and 793 gallons. IBCs are made from metal, plastic, or composite materials.

Composite IBCs are a combination of blow-molded plastic containers in a metal cage or plastic bag in corrugated box. These IBCs are industrial containers that can be reused for the transportation purpose and storage of liquids including pharmaceuticals, beverages, chemicals, solvents, and food.

The escalating product demand across food and beverages sector, owing to the wide use of plastic rigid IBCs for storing and transporting food items and beverages in bulk quantity from their manufacturing location is likely to drive the plastic rigid IBC market in the future. The lubricants and petroleum industry are also witnessing an increased use of plastic rigid IBC, as these containers can safely transport all types of solid or liquid products.

The report provides company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers the product portfolio of various companies according to regions.

Plastic Rigid IBC Market: Segmentation

The study provides a decisive view of the plastic rigid IBC market by segmenting the market based on product type, capacity, end-user, and region.

By product type, the plastic rigid IBC market is segmented into linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), high-density polyethylene (HDPE), polyvinyl chloride (PVC), and others.

By capacity, the market is divided into less than 500 liters, between 500 and 1000 liters, between 1000 and 1500 liters, between 1500 and 2000 liters, and more than 2000 liters.

The end-user segment includes petroleum and lubricants, industrial chemicals, paints, inks and dyes, food and beverages, pharmaceuticals, and others.

Plastic Rigid IBC Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plastic Rigid IBC Market |

| Market Size in 2023 | USD 5.76 Billion |

| Market Forecast in 2032 | USD 9.03 Billion |

| Growth Rate | CAGR of 5.12% |

| Number of Pages | 110 |

| Key Companies Covered | Bulk Handling Australia, Schutz Container Systems, Greif, Inc., Jielin, Maschiopack GmbH, WERIT, Snyder Industries, Time Technoplast Ltd., Hoover Ferguson Group, Sintex, and Mauser Group, among others |

| Segments Covered | By product type, By capacity, By end-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plastic Rigid IBC Market: Regional Analysis

The regional segmentation includes North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

By region, Asia Pacific is expected to dominate the plastic rigid IBC market in the upcoming years. This regional growth can be attributed to the increasing technological advancements and rapid industrialization in the Asia Pacific region. Moreover, the availability of cheap labor in the region and rising transportation and storage requirements for bulky goods is likely to further contribute toward the region’s plastic rigid IBC market. North America is expected to contribute significantly toward the global plastic rigid IBC market over the estimated timeframe. The region’s food and beverages industry majorly use plastic rigid IBCs to store and transport food products and liquids.

Plastic Rigid IBC Market: Competitive Analysis

The global plastic rigid IBC market is dominated by players like:

- Bulk Handling Australia

- Schutz Container Systems

- Greif, Inc

- Jielin

- Maschiopack GmbH

- WERIT

- Snyder Industries

- Time Technoplast Ltd

- Hoover Ferguson Group

- Sintex

- Mauser Group

This report segments the global plastic rigid IBC market into:

Global Plastic Rigid IBC Market: Product Type Analysis

- Linear Low-Density Polyethylene (LLDPE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyvinyl Chloride (PVC)

- Others

Global Plastic Rigid IBC Market: Capacity Analysis

- Less Than 500 Liters

- Between 500 and 1000 Liters

- Between 1000 and 1500 Liters

- Between 1500 and 2000 Liters

- More Than 2000 Liters

Global Plastic Rigid IBC Market: End-User Analysis

- Petroleum and Lubricants

- Industrial Chemicals

- Paints

- Inks and Dyes

- Food and Beverages

- Pharmaceuticals

- Others

Global Plastic Rigid IBC Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A rigid plastic The Intermediate Bulk Container (IBC) is a form of industrial-grade container that is employed for the storage and transportation of bulk liquids, semi-solids, pastes, or solids. IBCs are intended to accommodate substantial quantities of materials, with a typical capacity of 275 to 330 gallons (approximately 1,000 to 1,250 liters), although the exact dimensions may differ.

In the chemical and petrochemical industries, plastic rigid IBCs are utilized for the secure transportation and storage of hazardous and non-hazardous compounds. Consequently, the demand for these containers is closely associated with these sectors.

The global plastic rigid IBC market size was worth around USD 5.76 billion in 2023 and is predicted to grow to around USD 9.03 billion by 2032.

The global plastic rigid IBC market a compound annual growth rate (CAGR) of roughly 5.12% between 2024 and 2032.

The regional segmentation includes North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Some major players operating in the global plastic rigid IBC market are Bulk Handling Australia, Schutz Container Systems, Greif, Inc., Jielin, Maschiopack GmbH, WERIT, Snyder Industries, Time Technoplast Ltd., Hoover Ferguson Group, Sintex, and Mauser Group, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed