Global Plasma Protein Therapeutics Market Size, Share, Growth Analysis Report - Forecast 2034

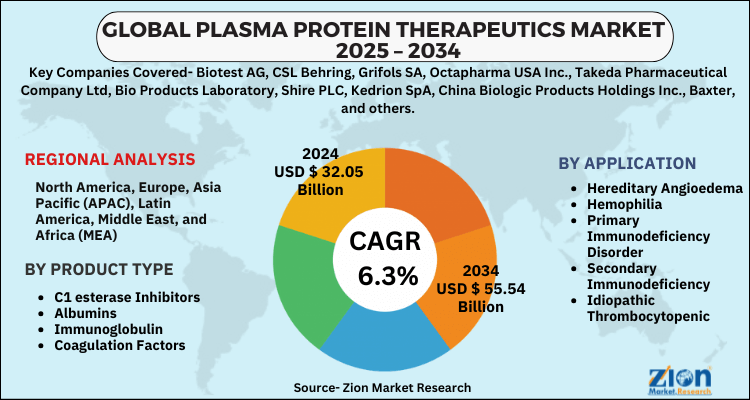

Plasma Protein Therapeutics Market By Product Type (C1 esterase Inhibitors, Albumins, Immunoglobulin, Coagulation Factors, and Others), By Application (Hereditary Angioedema, Hemophilia, Primary Immunodeficiency Disorder, Secondary Immunodeficiency, Idiopathic Thrombocytopenic, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

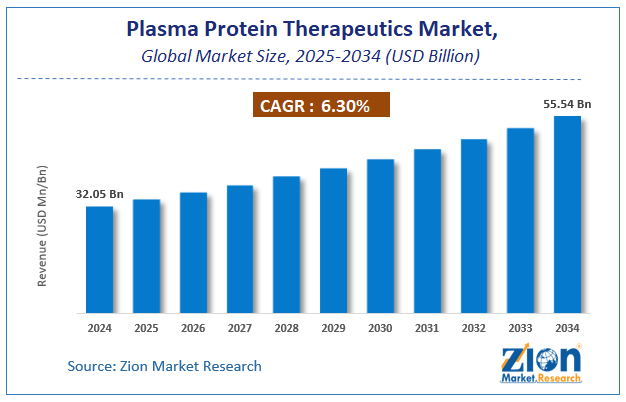

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 32.05 Billion | USD 55.54 Billion | 6.3% | 2024 |

Plasma Protein Therapeutics Market Size

The global plasma protein therapeutics market size was worth around USD 32.05 Billion in 2024 and is predicted to grow to around USD 55.54 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.3% between 2025 and 2034.

The report analyzes the global plasma protein therapeutics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the plasma protein therapeutics industry.

Plasma Protein Therapeutics Market: Overview

Plasma protein therapeutics is a type of biological therapy that uses plasma, a biological substance with a distinct biochemical profile that may be produced in a variety of ways. Plasma, which contains proteins, antibodies, salts, enzymes, and water, is the most abundant component in human blood. Platelets, white blood cells, and red blood cells are all excluded from plasma, which is the liquid component of blood. Plasma performs a variety of important transport tasks.

Various chronic, life-threatening, uncommon, and hereditary disorders are treated with plasma protein therapeutics. They're utilized to treat immunological and autoimmune deficiencies, as well as bleeding and neurological diseases, as well as burns and shocks.

Key Insights

- As per the analysis shared by our research analyst, the global plasma protein therapeutics market is estimated to grow annually at a CAGR of around 6.3% over the forecast period (2025-2034).

- Regarding revenue, the global plasma protein therapeutics market size was valued at around USD 32.05 Billion in 2024 and is projected to reach USD 55.54 Billion by 2034.

- The plasma protein therapeutics market is projected to grow at a significant rate due to increasing prevalence of immunodeficiency disorders, hemophilia, and other chronic diseases, coupled with advancements in plasma fractionation and purification technologies.

- Based on Product Type, the C1 esterase Inhibitors segment is expected to lead the global market.

- On the basis of Application, the Hereditary Angioedema segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Plasma Protein Therapeutics Market: Growth Drivers

Growing incidences of chronic diseases to foster market growth

The market is being primarily driven by the increasing incidence of over 200 life-threatening disorders that affect the neurological and immune systems, including idiopathic thrombocytopenic purpura, multifocal motor neuropathy, chronic inflammatory demyelinating polyneuropathy, and other infectious diseases such as varicella, tetanus, rabies, and hepatitis A & B. For instance, in the United States, the prevalence rate of idiopathic thrombocytopenic purpura (ITP) in individuals is around 66 incidences per 1,000,000 annually. Also, according to an epidemiological study on ITP in China, the annual incidence of ITP is 9.5 per 100,000, with adult females having a higher incidence than adult males (2:1), which might be connected to the fact that adult women are more prone to suffer autoimmune system illnesses.

Further, the global plasma protein therapeutics market is boosted due to technological developments in reliable and cost-effective processes for separating proteins from plasma. Additionally, factors such as an increase in drug discovery & development programs, growing investment in R&D activities, and an increase in the number of clinical trials are propelling the market growth.

Plasma Protein Therapeutics Market: Restraints

Strict regulations in different countries to impede market growth

Plasma collection standards in developing nations do not meet the fractionator's requirements. These countries have stringent laws and regulations in place to ensure the quality of their operations, beginning with the quality of the raw materials. Plasma fractionators are built specifically for it. In Europe, for example, the plasma pool for fractionation must be screened for hepatitis A, B, & C, HIV, as well as Parvovirus B. Many facilities that collect the blood are unable to meet those requirements, resulting in some retrieved plasma being wasted.

Additionally, each stage of the plasma protein therapy lifecycle is affected by the quality and regulatory norms, including donor compliance, quality, safety, pharmacovigilance, therapy safety & efficacy, and the biological license application process. All such factors may hinder the market growth.

Plasma Protein Therapeutics Market: Opportunities

High demand for Immunoglobulins (IG) to propel the market growth during the forecast period.

The number of medical indications for IG has been growing in recent years. Beyond primary immunodeficiency, IG has become a key therapy option for a variety of clinical reasons, including acute inflammatory and autoimmune diseases. Off-label prescription has also spread to nearly every medical profession. Demand for IG is rising as a result of off-label use in various applications, notably for the treatment of immunological deficiencies and neurological disorders. IG produced from plasma is used to treat a variety of inflammatory and autoimmune illnesses.

Increased awareness and treatment of immunological weaknesses in developing countries have increased the global demand for immunoglobulin. Clinical demand for these drugs has risen in recent years, and this trend is projected to continue as diagnostic technology improves and life expectancy rises thereby generating ample opportunities for the global plasma protein therapeutics market growth during the forecast period.

Plasma Protein Therapeutics Market: Challenges

Unfavorable reimbursement policies pose a major challenge to market growth

Budgets for health care are under increasing strain. Plasma protein treatments have been dragged into the terrain of Health Technology Assessments (HTA), including the prospective use of cost-utility analysis (CUA) in the allocation of reimbursement funds, owing to funding through reimbursement channels from commercial and public payers.

Given the high cost of medicines and the young nature of many indications, the use of these health economics methods may limit the availability of medications for patients in true need. This may serve as a major challenge to the growth of the market.

Plasma Protein Therapeutics Market: Segmentation Analysis

The global plasma protein therapeutics market is categorized into product type, application, and region.

Based on the product type, the global market is classified into coagulation factors, immunoglobulin, albumins, c1 esterase inhibitors, and others.

Based on application, the plasma protein therapeutics market can be divided into idiopathic thrombocytopenic, secondary immunodeficiency, primary immunodeficiency disorder, hemophilia, hereditary angioedema, and others. Growing government initiatives, increased awareness among the healthcare practitioners, and growing disposable income of the patients are some of the factors that drive the global market for plasma protein therapeutic.

Plasma Protein Therapeutics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plasma Protein Therapeutics Market |

| Market Size in 2024 | USD 32.05 Billion |

| Market Forecast in 2034 | USD 55.54 Billion |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 180 |

| Key Companies Covered | Biotest AG, CSL Behring, Grifols SA, Octapharma USA Inc., Takeda Pharmaceutical Company Ltd, Bio Products Laboratory, Shire PLC, Kedrion SpA, China Biologic Products Holdings Inc., Baxter, and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In April 2022, Biotest AG stated that the marketing authorization application for Biotest's expansion product IgG Next Generation under the decentralized procedure has been submitted in Austria and Germany by March 31, 2022. The preclinical and clinical research in the indications of chronic primary immune thrombocytopenia and primary immunodeficiency diseases (PID) are covered by the marketing authorization application, as well as the biochemical-pharmaceutical-technical portion (ITP).

- In April 2020, Takeda Pharmaceutical Company Limited and CSL Behring formed a collaboration with Octapharma, LFB, BPL, and Biotest to discover a possible plasma-derived treatment for COVID-19.

Plasma Protein Therapeutics Market: Regional Landscape

North America to lead the market during the forecast period

North America is likely to lead the global plasma protein therapeutics market during the projected period. Factors such as the rising incidence and prevalence of neurological & autoimmune diseases are driving market expansion. The United States is likely to be the region's largest market. The region's growing geriatric population further expands the patient pool, as the aged people are more susceptible to neurological diseases.

Furthermore, favorable government programs, rising blood donor awareness, the availability of improved protein fractioning processes, higher per capita income, and a spike in the proportion of research collaborations are all projected to boost market expansion in this region. On the other hand, Asia Pacific is estimated to grow at the fastest CAGR value owing to factors such as growing demand for advanced & effective options of treatment and developing healthcare infrastructure.

Plasma Protein Therapeutics Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the plasma protein therapeutics market on a global and regional basis.

The global plasma protein therapeutics market is dominated by players like:

- Biotest AG

- CSL Behring

- Grifols SA

- Octapharma USA Inc.

- Takeda Pharmaceutical Company Ltd

- Bio Products Laboratory

- Shire PLC

- Kedrion SpA

- China Biologic Products Holdings Inc.

- Baxter

The global plasma protein therapeutics market is segmented as follows;

By Product Type

- C1 esterase Inhibitors

- Albumins

- Immunoglobulin

- Coagulation Factors

- and Others

By Application

- Hereditary Angioedema

- Hemophilia

- Primary Immunodeficiency Disorder

- Secondary Immunodeficiency

- Idiopathic Thrombocytopenic

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global plasma protein therapeutics market is expected to grow due to rising demand for plasma-derived products, increasing prevalence of chronic diseases and immune disorders, advancements in protein therapy technologies, and growing awareness of the therapeutic benefits of plasma proteins.

According to a study, the global plasma protein therapeutics market size was worth around USD 32.05 Billion in 2024 and is expected to reach USD 55.54 Billion by 2034.

The global plasma protein therapeutics market is expected to grow at a CAGR of 6.3% during the forecast period.

North America is expected to dominate the plasma protein therapeutics market over the forecast period.

Leading players in the global plasma protein therapeutics market include Biotest AG, CSL Behring, Grifols SA, Octapharma USA Inc., Takeda Pharmaceutical Company Ltd, Bio Products Laboratory, Shire PLC, Kedrion SpA, China Biologic Products Holdings Inc., Baxter, among others.

The report explores crucial aspects of the plasma protein therapeutics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed