Oxygenated Solvents Market Size, Share & Growth Report 2032

Oxygenated Solvents Market by Type (Alcohols, Esters, Ketones, Glycol Ethers, Glycol, and Bio & Green Solvents) and by Application (Paints & Coatings, Crop Protection, Pharmaceuticals, Cleaners, Personal Care, Lubricants, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 35.19 Billion | USD 68.60 Billion | 7.70% | 2023 |

Oxygenated Solvents Market: Industry Perspective

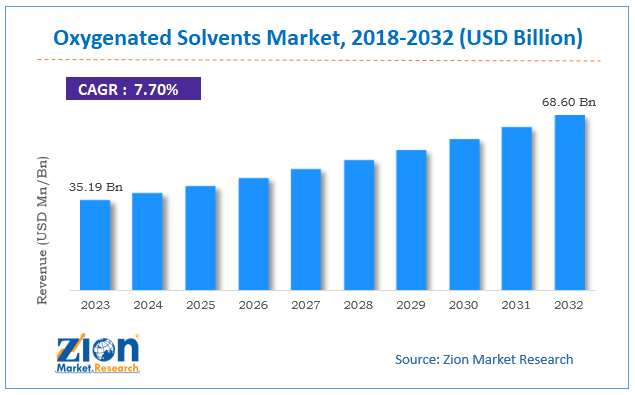

The global oxygenated solvents market size was worth around USD 35.19 billion in 2023 and is predicted to grow to around USD 68.60 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.70% between 2024 and 2032.

The report covers a forecast and an analysis of the oxygenated solvents market on a global and regional level. The study provides historical data for 2018 to 2022 along with a forecast from 2024 to 2032 based on both volume (Kilotons) and revenue (USD Billion).

Oxygenated Solvents Market: Overview

Oxygenated solvents are acetone derivatives widely used in various applications, such as cosmetics, aromas, and fragrances, cleaning products, paints, and coatings, etc. They are also used for chemical synthesis or as diluents in various formulation processes. Furthermore, these oxygenated solvents can be used as additives for concrete or froth flotation as well.

The growth in the end-user industries, such as paints and coatings, pharmaceuticals, and personal care, is the major factor that is likely to support the oxygenated solvents market in the future. The oxygenated solvents have low toxicity and high solvency power that is expected to boost the product demand in the upcoming years. Bio and green solvents are likely to dominate and slated to grow at the highest rate due to the high demand for eco-friendly products. Moreover, stringent regulations toward VOC emissions are likely to boost market development in the upcoming period. However, the solvent recycling technology can affect the demand for new solvents, which might restrain this market. On the other hand, the growing applications of oxygenated solvents in various industries are predicted to provide several opportunities for the participants operating in the oxygenated solvents market globally.

The study includes drivers and restraints for the oxygenated solvents market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the oxygenated solvents market on a global level.

This report offers a comprehensive analysis of the global oxygenated solvents market along with market trends, drivers, and restraints of the oxygenated solvents market. This report includes a detailed competitive scenario and product portfolio of the key vendors. To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the market has also been included. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Oxygenated Solvents Market: Segmentation

The study provides a decisive view of the oxygenated solvents market by segmenting the market based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the type, the market is segmented into alcohols, esters, ketones, glycol ethers, glycol, and bio and green solvents.

The application is segmented into paints and coatings, crop protection, pharmaceuticals, cleaners, personal care, lubricants, and others. Paints and coatings are expected to dominate the market and projected to maintain this trend over the forecast time period. The increase in the demand for paints by the construction industry is likely to indirectly impact the oxygenated solvents market growth in the upcoming years.

Oxygenated Solvents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oxygenated Solvents Market |

| Market Size in 2023 | USD 35.19 Billion |

| Market Forecast in 2032 | USD 68.60 Billion |

| Growth Rate | CAGR of 7.70% |

| Number of Pages | 220 |

| Key Companies Covered | BASF SE, The Dow Chemical Company, OXEA GmbH, Eastman Chemical Company, LyondellBasell Industries N.V., Royal Dutch Shell PLC, ExxonMobil, INEOS, China Petroleum & Chemical Corporation (Sinopec), Petroleum Nasional Berhad (PETRONAS), and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Oxygenated Solvents Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East, and Africa. Each region has been further segmented into major countries, such as the U.S., UK, France, Germany, China, India, Japan, and Brazil. The Asia Pacific held the most significant share of the oxygenated solvents market in terms of volume in 2023, due to the growing consumption of oxygenated solvents in developing countries, such as China and India. The North American oxygenated solvents market is likely to witness a noteworthy rate of growth over the forecast time period.

Oxygenated Solvents Market: Competitive Analysis

The global oxygenated solvents market is dominated by players like:

- BASF SE

- The Dow Chemical Company

- OXEA GmbH

- Eastman Chemical Company

- LyondellBasell Industries N.V.

- Royal Dutch Shell PLC

- ExxonMobil

- INEOS

- China Petroleum & Chemical Corporation (Sinopec)

- Petroleum Nasional Berhad (PETRONAS)

This report segments the global oxygenated solvents market into:

Oxygenated Solvents Market: Type Analysis

- Alcohols

- Esters

- Ketones

- Glycol Ethers

- Glycol

- Bio and Green Solvents

Oxygenated Solvents Market: Application Analysis

- Paints and Coatings

- Crop Protection

- Pharmaceuticals

- Cleaners

- Personal Care

- Lubricants

- Others

Oxygenated Solvents Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Oxygenated solvents are created through distillation of components to achieve a harmonious and consistent blend of various end-product elements. The solvents are primarily organic and consist of oxygen-containing molecules.

According to a study, the global oxygenated solvents market size was worth around USD 35.19 billion in 2023 and is expected to reach USD 68.60 billion by 2032.

The global oxygenated solvents market is expected to grow at a CAGR of 7.70% during the forecast period.

Asia Pacific is expected to dominate the oxygenated solvents market over the forecast period.

Leading players in the global oxygenated solvents market include BASF SE, The Dow Chemical Company, OXEA GmbH, Eastman Chemical Company, LyondellBasell Industries N.V., Royal Dutch Shell PLC, ExxonMobil, INEOS, China Petroleum & Chemical Corporation (Sinopec), and Petroleum Nasional Berhad (PETRONAS), among others.

The oxygenated solvents market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed