Organic Pigments Market Size, Share, Analysis, Growth, Forecasts, 2032

Organic Pigments Market Size - By Type (Azo Pigments, Phthalocyanine Pigments, High-Performance Pigments (HPPs), And Others) And By Application (Printing Inks, Paints & Coatings, Plastics, And Others), By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.07 Billion | USD 8.79 Billion | 4.20% | 2023 |

Organic Pigments Industry Perspective:

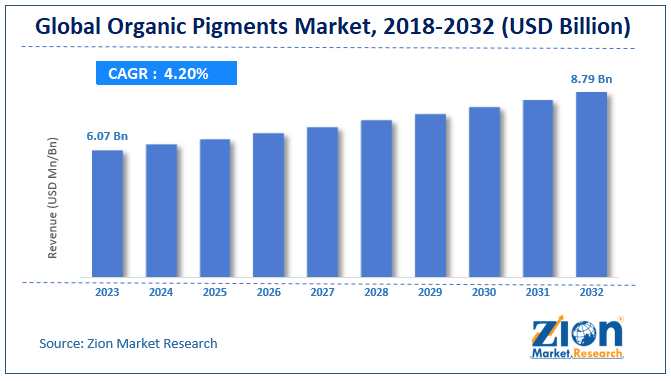

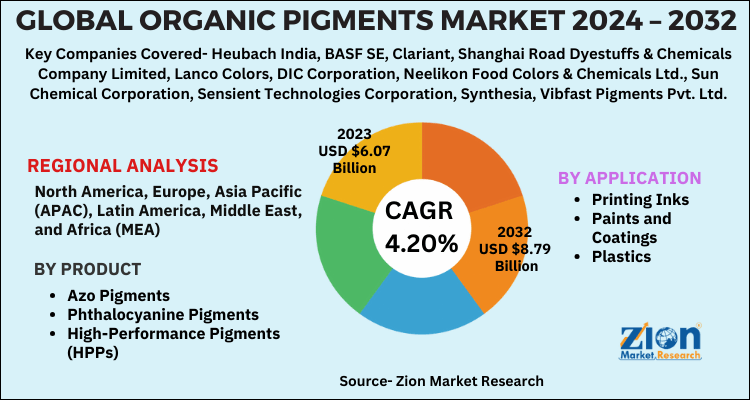

The global organic pigments market size was worth around USD 6.07 Billion in 2023 and is predicted to grow to around USD 8.79 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.20% between 2024 and 2032.bThe report analyzes the global organic pigments market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the organic pigments industry.

The report covers a forecast and an analysis of the organic pigments market on a global and regional level. The study provides historical data for 2018 and 2022 along with a forecast from 2024 to 2032 based on volume (Kilotons) and revenue (USD Billion). The study includes drivers and restraints of the organic pigments market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the organic pigments market on a global level.

In order to give the users of this report a comprehensive view of the organic pigments market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and the product portfolios of various companies.

Organic Pigments Market: Overview

Pigments are mostly utilized for coloring a variety of materials, including plastic, paint, ink, and fiber, amongst others. Pigments are primarily composed of organic and inorganic substances. Through the process of selective absorption and the scattering of light, these pigments are able to change the shape of the substrate that they are applied on. Both synthetic and natural sources are utilized in the production of organic pigments. In contrast to natural organic pigments, which are derived from plants and animals, synthetic organic pigments are composed of carbon and are primarily derived from petroleum chemicals. Organic pigments are utilized in the form of powders that have been crushed for the purpose of coloring a variety of products and in the performing arts. Organic pigments are more desirable in a variety of end-user sectors since they are relatively less expensive, they do not include any harmful substances, and they have a high color strength.

Organic Pigments Market: Growth Factors

The expansion of the global organic pigments market is predicted to be driven by the growing demand for organic pigments from a variety of industries, including the textile and plastic industries, among others, throughout the course of the forecast period. It is more appealing and visually appealing for the application of organic pigments in visual arts since they are present in a variety of tones that are unique to themselves. During the period of time that has been estimated, the following are some of the aspects that are expected to drive the operating in the organic pigments market worldwide. On top of that, it is anticipated that the growing utilization of organic pigments in a variety of high technology applications, such as photo-reprographics, optoelectronic displays, and optical data storage, will present lucrative growth opportunities for players operating in the organic pigments market worldwide in the years to come.

Organic Pigments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Organic Pigments Market Research Report |

| Market Size in 2023 | USD 6.07 Billion |

| Market Forecast in 2032 | USD 8.79 Billion |

| Growth Rate | CAGR of 4.20% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Heubach India, BASF SE, Clariant, Shanghai Road Dyestuffs & Chemicals Company Limited, Lanco Colors, DIC Corporation, Neelikon Food Colors & Chemicals Ltd., Sun Chemical Corporation, Sensient Technologies Corporation, Synthesia, Vibfast Pigments Pvt. Ltd., and Neochem Industries, among others. |

| Segments Covered | By Product, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Organic Pigments Market: Segmentation

The study provides a decisive view of the organic pigments market by segmenting the market based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032. The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East, and Africa. This segmentation includes demand for organic pigments market based on all segments in all the regions and countries.

Organic Pigments Market: Regional Analysis

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa are the regions that make up the worldwide market for organic pigments at the individual regional level. In the year 2023, the Asia Pacific area was the most important market for organic pigments. This was mostly due to the fact that the construction, packaging, and automotive industries in the region were experiencing an increase in their demand for the product. Furthermore, the Asia Pacific region is seeing significant population growth, which provides a large client base for food, beverages, and fast-moving consumer goods (FMCG) products. This, in turn, will have a favorable impact on the packaging industry, which is anticipated to be the primary segment driving the market for organic pigments in the area during the course of the forecast time period. As a result of the increasing number of people who are concerned about their health and the improvement in lifestyles, Europe held a substantial market share in the global market for organic pigments in the year 2023.

Organic Pigments Market: Competitive Space

Some major players in the global organic pigments market are

- Heubach India

- BASF SE

- Clariant

- Shanghai Road Dyestuffs & Chemicals Company Limited

- Lanco Colors

- DIC Corporation

- Neelikon Food Colors & Chemicals Ltd.

- Sun Chemical Corporation

- Sensient Technologies Corporation

- Synthesia

- Vibfast Pigments Pvt. Ltd.

- Neochem Industries

- And Others

This report segments the global organic pigments market into:

Global Organic Pigments Market: By Product Type Analysis

- Azo Pigments

- Phthalocyanine Pigments

- High-Performance Pigments (HPPs)

- Others

Global Organic Pigments Market: By Application Analysis

- Printing Inks

- Paints and Coatings

- Plastics

- Others

Global Organic Pigments Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pigments are mostly used for coloring plastic, paint, ink, and fiber, among other materials, which are mainly organic and inorganic solids. These pigments alter the form of the substrate on which they are applied through selective absorption and by scattering light. Organic pigments are prepared by synthetic and natural sources.

The rising demand for organic pigments from various industries, such as plastic, textile, etc., is anticipated to drive the global organic pigments market growth over the forecast timeline.

According to the report, the global organic pigments market size was worth around USD 6.07 Billion in 2023 and is predicted to grow to around USD 8.79 Billion by 2032.

The global organic pigments market is expected to grow at a CAGR of 4.20% during the forecast period.

The Asia Pacific was the largest regional market for organic pigments in the year 2023, owing to the rising product demand by the region’s construction, packaging, and automotive industries.

Some major players in the global organic pigments market are Heubach India, BASF SE, Clariant, Shanghai Road Dyestuffs & Chemicals Company Limited, Lanco Colors, DIC Corporation, Neelikon Food Colors & Chemicals Ltd., Sun Chemical Corporation, Sensient Technologies Corporation, Synthesia, Vibfast Pigments Pvt. Ltd., and Neochem Industries.

The global organic pigments market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed