Organic Coffee Market Size, Share, Growth, Opportunities 2034

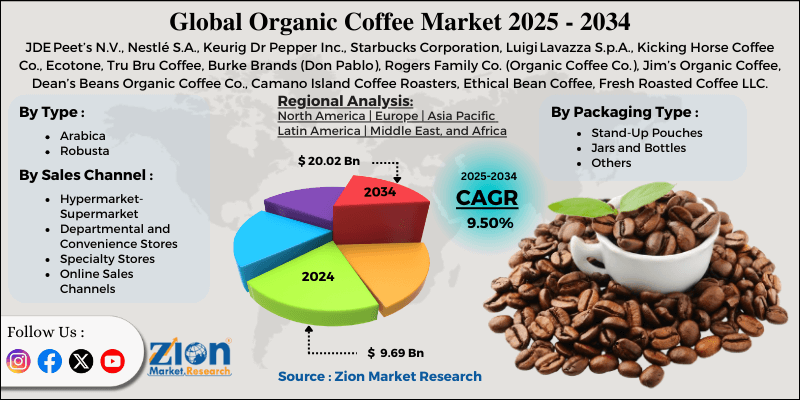

Organic Coffee Market By Type (Arabica, Robusta), By Packaging Type (Stand-Up Pouches, Jars and Bottles, and Others), By Sales Channel (Hypermarket/Supermarket, Departmental and Convenience Stores, Specialty Stores, Online Sales Channels, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

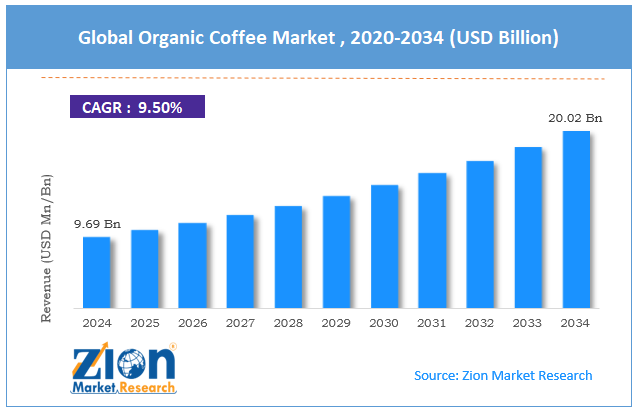

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.69 Billion | USD 20.02 Billion | 9.50% | 2024 |

Organic Coffee Industry Perspective:

The global organic coffee market size was around USD 9.69 billion in 2024 and is projected to reach USD 20.02 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global organic coffee market is estimated to grow annually at a CAGR of around 9.50% over the forecast period (2025-2034)

- In terms of revenue, the global organic coffee market size was valued at around USD 9.69 billion in 2024 and is projected to reach USD 20.02 billion by 2034.

- The organic coffee market is projected to grow significantly owing to rising environmental sustainability concerns, the growth of coffee shop culture, and increasing disposable incomes.

- Based on type, the Arabica segment is expected to lead the market, while the Robusta segment is expected to grow considerably.

- Based on packaging type, the stand-up pouches segment is the largest, while the jars and bottles segment is projected to record sizeable revenue over the forecast period.

- Based on sales channel, the hypermarket/supermarket segment is expected to lead the market, followed by the 'online sales' channel.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Organic Coffee Market: Overview

Organic coffee is grown without synthetic fertilizers, genetically modified organisms, or pesticides, relying instead on natural farming techniques that maintain biodiversity and soil health. This approach supports environmental sustainability, encourages fair trade practices, and can yield beans with more nuanced, more complex flavors. The global organic coffee market is likely to expand rapidly, fueled by growing health and wellness awareness, environmental and ethical consciousness, and the premiumization and specialty coffee trend. Organic coffee attracts consumers seeking healthier options free of synthetic chemicals. Its perception as a 'clean' product fuels demand. Growing global health consciousness supports industry growth. Consumers are increasingly preferring eco-friendly products that reduce pesticide use and promote biodiversity. Organic coffee farming supports sustainable agriculture. Ethical sourcing appeals to socially conscious buyers.

Furthermore, demand for high-quality and specialty coffee is surging, especially among urban consumers. Organic coffee often offers aromas and unique flavors. This premium positioning aligns brand loyalty and higher prices.

Despite growth, the global market is constrained by higher production costs and price premiums, limited supply and lower yields, and vulnerability to climate change. Organic farming comprises labor-intensive techniques and certification costs. Subsequently, higher retail prices restrict adoption in price-sensitive markets. Profitability may be hampered for small producers. Organic cultivation typically yields less than conventional farming. This hinders supply despite growing demand. Scarcity may limit large-scale growth. Similarly, organic coffee farms are sensitive to weather, diseases, and pests. Climate variability may adversely impact quality and yield. Long-term sustainability may be hampered.

Nonetheless, the global organic coffee industry stands to benefit from several key opportunities, including product diversification, transparency and traceability enabled by technology, and regenerative and climate-smart agriculture. Ready-to-drink, single-serve, and flavored organic coffees appeal to younger consumers. Novelty and convenience drive sales. Value-added products expand industry share. Supply chain and blockchain tracking enhance trust and authenticity. Transparency can justify premium pricing. Consumers are increasingly drawn to ethical and traceable products. Practices like biodiversity conservation and soil restoration add value. Consumers favor environmentally responsible brands. These techniques distinguish organic coffee in the industry.

Organic Coffee Market Dynamics

Growth Drivers

How is premiumization and specialty coffee culture driving the organic coffee market?

As coffee consumption evolves from a simple daily ritual into an experience, there is a growing demand for specialty, high-class, single-origin, or artisanal organic coffee, thereby driving the organic coffee market. Organic Arabica beans, known for smooth acidity and superior taste, are especially prominent among discerning users and specialty roasters. This premiumization enables brands to command higher margins and prices, thereby augmenting profitability for sellers and growers. Specialty cafes, upscale retailers, and boutique roasters progressively shock organic coffee to satisfy this demand. The trend elevates organic coffee from a commodity to a lifestyle product, widening its reach and appeal beyond eco- and health-conscious buyers.

How is emphasis on ethical sourcing, fair‑trade & social responsibility fueling the organic coffee market?

Consumers are increasingly concerned about the ethical dimensions of what they buy, including how coffee is grown, who grows it, and under what conditions. Organic coffee is often associated with fair trade practices, sustainable farming, and higher wages for farmers, making it appealing to socially conscious buyers. This ethical dimension augments consumer willingness to pay a premium and supports brand loyalty among values-driven segments.

For producers, the premium paid for organic coffee may translate into improved livelihoods, encouraging more farmers to adopt organic farming, thereby expanding sustainable supply. Over time, this virtuous cycle strengthens total organic coffee infrastructure and industry resilience.

Restraints

Limited supply & scalability issues negatively impact the market progress

Only a small share of global coffee production is certified organic, as many coffee-growing regions still rely on traditional farming methods. Transitioning farms to organic production requires time and resources and entails a multi-year conversion period, which discourages most producers. The limited number of certified farms means supply cannot always keep pace with growing demand, particularly as organic coffee becomes more prominent worldwide. This supply barrier hinders consistent industry expansion and makes organic coffee comparatively rare in several markets.

Opportunities

How do innovations in sustainable farming & regenerative practices create promising avenues for the organic coffee industry's growth?

Producers are increasingly adopting sustainable, regenerative farming techniques that enhance biodiversity and soil health. These practices improve long-term yield stability while attracting eco-conscious buyers. Farmers benefit from high-class beans and enhanced operational efficiency. For brands, combining organic certification with regenerative techniques creates a robust marketing differentiator. Sustainability innovation helps mitigate climate-related risks while reinforcing brand rankings, thereby fueling the organic coffee industry.

Challenges

High production & certification costs for farmers restrict the market growth

Organic coffee farming requires heavy labor and relies on manual practices and organic inputs, often resulting in lower yields than traditional methods. Compliance and certification add extra administrative and financial pressure for farmers. Higher production costs lead to premium retail prices, limiting adoption in price-sensitive regions. Smallholder farmers may find these costs burdensome, thereby limiting the overall growth of organic coffee production.

Organic Coffee Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Organic Coffee Market |

| Market Size in 2024 | USD 9.69 Billion |

| Market Forecast in 2034 | USD 20.02 Billion |

| Growth Rate | CAGR of 9.50% |

| Number of Pages | 215 |

| Key Companies Covered | JDE Peet’s N.V., Nestlé S.A., Keurig Dr Pepper Inc., Starbucks Corporation, Luigi Lavazza S.p.A., Kicking Horse Coffee Co., Ecotone, Tru Bru Coffee, Burke Brands (Don Pablo), Rogers Family Co. (Organic Coffee Co.), Jim’s Organic Coffee, Dean’s Beans Organic Coffee Co., Camano Island Coffee Roasters, Ethical Bean Coffee, Fresh Roasted Coffee LLC., and others. |

| Segments Covered | By Type, By Packaging Type, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Organic Coffee Market: Segmentation

The global organic coffee market is segmented based on type, packaging type, sales channel, and region.

Based on type, the global organic coffee industry is divided into Arabica and Robusta. The Arabica segment holds a substantial market share due to its complex, smooth flavor profile, appealing aroma, and lower acidity – traits that meet consumers' demand for high-quality, premium coffee. Its broader acceptance among specialty coffee drinkers and premium roasters strengthens its leading rank. Arabica's image as a gourmet bean fosters brand loyalty and helps justify higher prices.

Based on packaging type, the global organic coffee market is segmented into stand-up pouches, jars and bottles, and others. The stand-up pouches segment holds a dominant market share because it is cost-efficient, lightweight, and easy to store and transport. Their resealable closures and degassing valves help maintain optimal freshness, which is vital for coffee quality. The flexible design enables appealing branding and multiple size options. These advantages make them the leading choice for consumers and retailers.

Based on sales channel, the global market is segmented into hypermarket/supermarket, departmental and convenience stores, specialty stores, online sales channels, and others. The hypermarkets and supermarkets segment leads the market because they offer greater convenience and broader availability under one roof. Consumers feel confident buying organic coffee there during routine grocery shopping. The large retail footprint is consistent with high-volume, consistent sales. Their broad reach in suburban and urban areas makes them the leading segment.

Organic Coffee Market: Regional Analysis

What gives North America a competitive edge in the global Organic Coffee Market?

North America is anticipated to retain its leading role in the global organic coffee market, driven by substantial market share, high spending power, strong sustainability and health awareness, and a developed coffee culture and premium preferences. North America holds the largest share of the global organic coffee sector, contributing nearly 38-40% of overall revenues. This strong base offers the region significant influence over global demand trends. High consumer purchasing power backs consistent spending on premium organic products.

Moreover, consumers in the region are highly aware of environmental impacts, health considerations, and clean-label food choices. This makes organic coffee a natural fit for lifestyle preferences centered on sustainability and wellness. Such awareness keeps demand strong even at higher price points. Furthermore, the region has a well-developed coffee culture, with a strong preference for single-origin, premium blends, and specialty coffees. Organic coffee perfectly supports these quality-based expectations. This sophisticated industry setting allows speedy acceptance of organic varieties.

Europe ranks as the second-largest region in the global organic coffee industry, driven by a large coffee-consuming population, substantial market share in organic coffee sales, and a sustainability-oriented consumer base. Europe accounts for a substantial share of global coffee consumption, making it one of the leading coffee-drinking regions worldwide. This high consumption base creates robust potential demand for organic coffee. Even a small share of this market denotes significant sales volumes.

Europe accounts for the second-largest share of the market, contributing nearly 30% of the overall revenue. Both premium-segment and volume adoption are robust in Europe. This combination makes the region a key target for organic coffee producers. European consumers progressively value ethically sourced, eco-friendly, and chemical-free products. Organic coffee aligns with these preferences, driving its willingness and appeal to pay premium prices. Sustainability awareness fuels consistent demand in economies.

Organic Coffee Market: Competitive Analysis

The leading players in the global organic coffee market are:

- JDE Peet’s N.V.

- Nestlé S.A.

- Keurig Dr Pepper Inc.

- Starbucks Corporation

- Luigi Lavazza S.p.A.

- Kicking Horse Coffee Co.

- Ecotone

- Tru Bru Coffee

- Burke Brands (Don Pablo)

- Rogers Family Co. (Organic Coffee Co.)

- Jim’s Organic Coffee

- Dean’s Beans Organic Coffee Co.

- Camano Island Coffee Roasters

- Ethical Bean Coffee

- Fresh Roasted Coffee LLC.

Organic Coffee Market: Key Market Trends

Emphasis on sustainability & eco-friendly practices:

Sustainability is becoming a vital factor in purchasing decisions, with consumers increasingly choosing ethically sourced, eco-friendly products. Brands are responding with eco-friendly packaging, transparent supply chains, and compostable pods. These initiatives reinforce organic coffee's premium status and strengthen its responsible image.

Growth of private labels & value-oriented options:

Retailers are increasingly offering private-label organic coffee at competitive prices while maintaining the highest quality. These value-oriented options make organic coffee more accessible to cost-conscious users. The trend helps grow industry penetration beyond premium segments and appeals to a broader audience.

Rising online & direct-to-consumer sales:

Subscription models and e-commerce are becoming primary channels for organic sales. Consumers enjoy home delivery, convenience, and variety offered by online platforms. Direct-to-consumer approaches also enable small brands and specialty roasters to reach worldwide markets effectively, surging overall accessibility.

The global organic coffee market is segmented as follows:

By Type

- Arabica

- Robusta

By Packaging Type

- Stand-Up Pouches

- Jars and Bottles

- Others

By Sales Channel

- Hypermarket/Supermarket

- Departmental and Convenience Stores

- Specialty Stores

- Online Sales Channels

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed