Nylon 66 Market Demand Size, Share, Demand, Forecast 2032

Nylon 66 Market by Grade (Fiber Grade and Resin Grade) and by Application (Textiles, Industrial/Machinery, Carpets, Automotive, Consumer Goods & Appliances, Carpets, Packaging, Films & Textiles, and Other Applications (Wires & Cables, etc.)): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

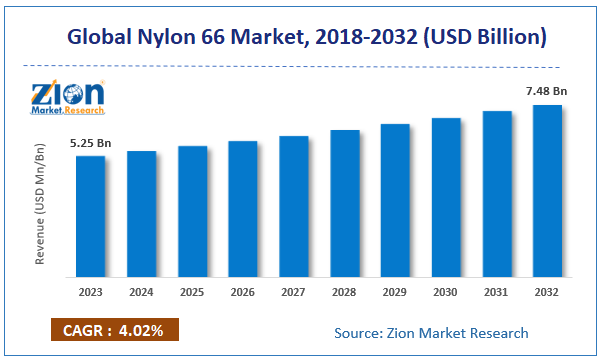

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.25 Billion | USD 7.48 Billion | 4.02% | 2023 |

Nylon 66 Industry Perspective:

The global Nylon 66 market size was worth around USD 5.25 billion in 2023 and is predicted to grow to around USD 7.48 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.02% between 2024 and 2032.

Nylon 66 Market Overview

Nylon 66 has excellent mechanical properties apart from being cost-effective. It is extensively used in various end-user industries. Moreover, the Nylon 66 has the ability to resist high temperatures and hence it is highly preferred in high-temperature applications. Nylon 66 is widely used in the engineering thermoplastic materials.

The rising electronic and electrical production and increasing product use in the engineering plastic for engine mechanisms and the vehicle engines are expected to drive the global Nylon 66 market. However, the rising prices of Nylon 66 and unavailability of raw materials might impede the Nylon 66 market. Nevertheless, the key players are investing more in this market to enhance the production of nylon 66, which is likely to boost the Nylon 66 market trends over the years to come.

The report covers a global and regional level estimation and analysis of the Nylon 66 market. The study provides forecasts from 2024 to 2032 along with historical data from 2018 to 2022 based on volume (Kiloton) and revenue (USD Billion). The study includes major drivers and restraints for the Nylon 66 market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Nylon 66 market on a global level.

To provide the users of this report with a comprehensive view of the Nylon 66 market, we have included a product portfolio of the key vendors and a detailed competitive scenario. To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the Nylon 66 market has also been included. The Nylon 66 market report covers an in-depth study of the global and regional market and market attractiveness analysis, wherein the application, grade, and regional segments are benchmarked based on their growth rate, general attractiveness, and market size.

Nylon 66 Market Segmentation Analysis

The Nylon 66 market is fragmented into grade and application. By grade, the Nylon 66 market is segmented into resin grade and fiber grade. The resin grade held the largest market share in 2023, both in terms of revenue and volume. Resin grade plays an important role in the manufacturing of electronic components and light-weight car engine components. It enhances the performance of glass fibers and helps in the manufacturing of light-weight vehicles. On the basis of application, the Nylon 66 market is segmented into textiles, carpets, industrial/machinery, consumer goods and appliances, automotive, packaging, films and coatings, and others (cables & wires, etc.). The automotive segment accounted for the largest market share in 2023, owing to its properties, such as lightweight and emission reduction.

Nylon 66 Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nylon 66 Market |

| Market Size in 2023 | USD 5.25 Billion |

| Market Forecast in 2032 | USD 7.48 Billion |

| Growth Rate | CAGR of 4.02% |

| Number of Pages | 220 |

| Key Companies Covered | UBE INDUSTRIES, Ltd., BASF SE, Ascend Performance Materials LLC, Ensinger GmbH, LANXESS, RadiciGroup, Asahi Kasei Corporation, Royal DSM, DowDuPont Inc., CELANESE CORPORATION, EMS-GRIVORY, and others. |

| Segments Covered | By Grade, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America accounted for the largest global Nylon 66 market share in 2023, followed by the Asia Pacific and Europe. The U.S. dominated North America in terms of revenue and volume in 2023 and is also expected to be the dominating country in the forecast time period. The rising demand for high-temperature resistant and lightweight engineering plastics and the increasing use of Nylon 66 in electrical and electronics and automotive applications and the presence of major manufacturers in the country is likely to drive the Nylon 66 market in the U.S. Asia Pacific, North American and European markets are anticipated to expand at the highest speed in the upcoming years. Latin American and the Middle Eastern and African markets are projected to exhibit sluggish growth in the years to come, owing to low economic and industrial growth and lack of manufacturers’ presence in the region.

Nylon 66 Market: Competitive Analysis

The global Nylon 66 market is dominated by players like:

- UBE INDUSTRIES, Ltd.

- BASF SE

- Ascend Performance Materials LLC

- Ensinger GmbH

- LANXESS

- RadiciGroup

- Asahi Kasei Corporation

- Royal DSM

- DowDuPont Inc.

- CELANESE CORPORATION

- EMS-GRIVORY

This report segments the Nylon 66 market as follows:

Nylon 66 Market: Grade Analysis

- Fiber Grade

- Resin Grade

Nylon 66 Market: Application Analysis

- Textiles

- Industrial/Machinery

- Carpets

- Automotive

- Consumer Goods & Appliances

- Electrical & Electronics

- Packaging

- Films & Coatings

- Others (Wires & Cables, etc.)

Nylon 66 Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Nylon 66 is a commonly used and highly popular engineering thermoplastic polymer. Nylon 66 possesses outstanding mechanical qualities in addition to being cost-efficient. Additionally, Nylon 66 has strong temperature resistance, making it a popular choice for applications that require such properties.

According to a study, the global Nylon 66 market size was worth around USD 5.25 billion in 2023 and is expected to reach USD 7.48 billion by 2032.

The global Nylon 66 market is expected to grow at a CAGR of 4.02% during the forecast period.

North America is expected to dominate the Nylon 66 market over the forecast period.

Leading players in the global Nylon 66 market include UBE INDUSTRIES, Ltd., BASF SE, Ascend Performance Materials LLC, Ensinger GmbH, LANXESS, RadiciGroup, Asahi Kasei Corporation, Royal DSM, DowDuPont Inc., CELANESE CORPORATION, and EMS-GRIVORY, among others.

The Nylon 66 market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed