Next Generation Biometric Market Size, Share, Trends, Growth and Forecast 2032

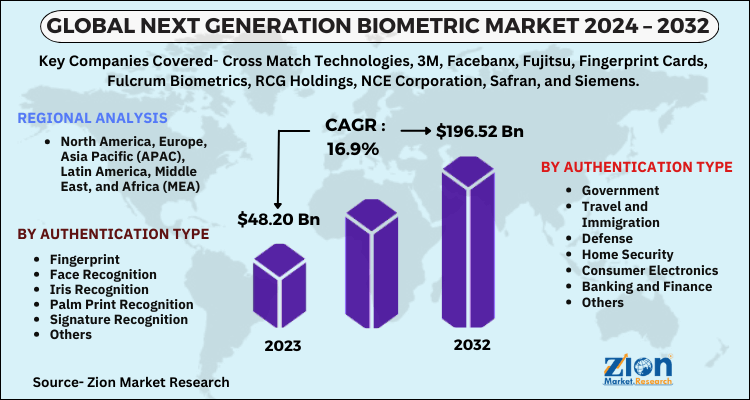

Next Generation Biometric Market By Authentication Type (Fingerprint, Face Recognition, Iris Recognition, Palm Print Recognition, Signature Recognition, and Others) and by Application (Government, Travel & Immigration, Defense, Home Security, Consumer Electronics, Banking and Finance, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

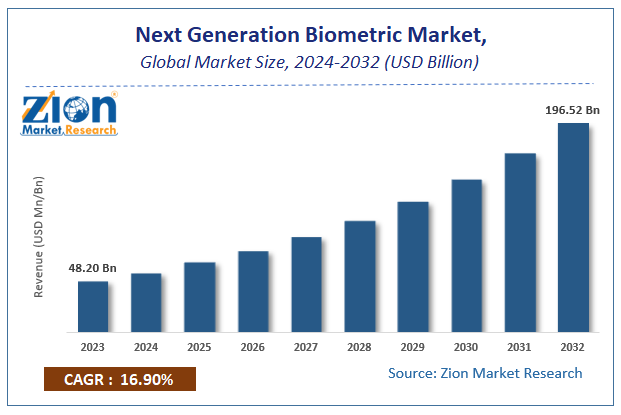

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 48.20 Billion | USD 196.52 Billion | 16.9% | 2023 |

Next Generation Biometric Market Insights

The global Next Generation Biometric Market size was worth around USD 48.20 Billion in 2023 and is predicted to grow to around USD 196.52 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 16.9% between 2024 and 2032.

The report covers a forecast and an analysis of the next generation biometric market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2023 to 2032 based on revenue (USD Million). The study includes drivers and restraints of the next generation biometric market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the next generation biometric market on a global and regional level.

Next Generation Biometric Market: Overview

The field of advanced biometric technology and solutions that go beyond conventional methods of personal identification and authentication is referred to as the Next Generation Biometric Market. Measurement and statistical analysis of an individual's physical and behavioral traits, including voice, facial features, iris patterns, fingerprints, and even distinctive typing habits, are part of biometrics. Modern technologies are integrated into the next generation of biometric systems to improve user experience, security, and accuracy.

Artificial intelligence (AI) skills, complex algorithms, and cutting-edge sensor technology are important elements of the Next Generation Biometric Market. More accurate biometric data collection and analysis is made possible by advanced sensors, which also make identification and authentication procedures more dependable. Modern AI and biometric algorithms are essential for deciphering intricate biometric patterns and minimizing false positives and negatives.

Next Generation Biometric Market: Growth Drivers

New generation biometrics fall under the category of newly introduced technology that is used to verify and authenticate the identity of individuals through certain biological and behavioral characteristics, such as fingerprints, facial expression, palm, voice, signature, eye, vein, iris, and DNA. Traditionally, identification documents and PIN were used to verify and confirm a person’s identity. But the introduction of the biometric system has made the verification of individuals for the purpose of security and safety easier and user-friendly in nature. The growing use of biometric technology is increasing worldwide due to the increasing number of crimes, security threats, terrorist activities, illegal ATM transactions, unauthorized infiltration across borders, etc. To solve all these criminal activities, biometric technology has been introduced. Biometric technology also offers several benefits to the users, such as a high degree of privacy, accuracy, uniformity across systems, interoperability, and ease of use.

The next generation biometric market is likely to grow owing to the increasing government initiatives for restricting illegal activities, growing e-passport programs, and rising number of terrorist and criminal activities that require a high level of security. Additionally, this market is also driven by numerous benefits offered by biometric technology and various technological advancement related to data security. Moreover, the penetration rate of smartphones with fingerprints, eye, or face recognition in the market is also another key growth driver factor for the next generation biometric market.

However, the high cost of biometric systems and risk of privacy intrusion may hamper this market. Conversely, the growing use of biometric technology in cloud computing and e-commerce will offer new growth opportunities in the market.

In order to give the users of this report a comprehensive view of the next generation biometric market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Next Generation Biometric Market: Segmentation

The next generation biometric market is fragmented on the basis of authentication type and application.

Based on authentication type the market is divided into iris recognition, palm print recognition, face recognition, signature recognition, fingerprint, and others. The fingerprint segment is expected to dominate the global market, owing to its wide application by various end-users.

By application, the market is categorized into travel and immigration, government, consumer electronics, home security, banking and finance, defense, and others. The travel and immigration segment accounts for the largest market share and is expected to register the highest CAGR in the future.

Next Generation Biometric Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Next Generation Biometric Market |

| Market Size in 2023 | USD 48.20 Billion |

| Market Forecast in 2032 | USD 196.52 Billion |

| Growth Rate | CAGR of 16.9% |

| Number of Pages | 110 |

| Key Companies Covered | Cross Match Technologies, 3M, Facebanx, Fujitsu, Fingerprint Cards, Fulcrum Biometrics, RCG Holdings, NCE Corporation, Safran, and Siemens |

| Segments Covered | By authentication type, By application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Next Generation Biometric Market: Regional Analysis

North America dominated the next generation biometric market globally in 2018, due to various technological advancements, a growing number of IT companies, and the easy availability of skilled personnel for conducting the biometric verification. Europe held the second-largest share of the market for next generation biometric globally in 2018, due to the increasing regional awareness about data security and growing government funding for e-passport programs. The Asia Pacific next generation biometric market is likely to register the highest CAGR in the future, owing to the growing use of consumer electronics, increasing use of biometric technology in healthcare centers, and rising regional awareness about safety and security.

Next Generation Biometric Market: Competitive Analysis

Some major players operating in the next generation biometric market are

- Cross Match Technologies

- 3M

- Facebanx

- Fujitsu

- Fingerprint Cards

- Fulcrum Biometrics

- RCG Holdings

- NCE Corporation

- Safran

- Siemens

This report segments the global next generation biometric market into:

Global Next Generation Biometric Market: By Authentication Type

- Fingerprint

- Face Recognition

- Iris Recognition

- Palm Print Recognition

- Signature Recognition

- Others

Global Next Generation Biometric Market: By Application

- Government

- Travel and Immigration

- Defense

- Home Security

- Consumer Electronics

- Banking and Finance

- Others

Global Next Generation Biometric Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Advanced biometric technologies and systems that surpass conventional biometric methods (such as fingerprint and facial recognition) to improve security, accuracy, speed, and usability are referred to as next-generation biometrics. These systems utilize state-of-the-art technologies, such as artificial intelligence (AI), machine learning (ML), and enhanced sensor capabilities, to identify individuals based on distinctive biological or behavioral characteristics.

The adoption of advanced biometric solutions for secure authentication across industries is being driven by the growing concerns about data breaches, identity fraud, and unauthorized access.

The global Next Generation Biometric Market size was worth around USD 48.20 Billion in 2023 and is predicted to grow to around USD 196.52 Billion by 2032.

The global Next Generation Biometric Market a compound annual growth rate (CAGR) of roughly 16.9% between 2024 and 2032.

North America dominated the next generation biometric market globally in 2018, due to various technological advancements, a growing number of IT companies, and the easy availability of skilled personnel for conducting the biometric verification. Europe held the second-largest share of the market for next generation biometric globally in 2018, due to the increasing regional awareness about data security and growing government funding for e-passport programs. The Asia Pacific next generation biometric market is likely to register the highest CAGR in the future, owing to the growing use of consumer electronics, increasing use of biometric technology in healthcare centers, and rising regional awareness about safety and security.

Some major players operating in the next generation biometric market are Cross Match Technologies, 3M, Facebanx, Fujitsu, Fingerprint Cards, Fulcrum Biometrics, RCG Holdings, NCE Corporation, Safran, and Siemens.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed