Natural Food Colorants Market Size, Share, Trends, Growth and Forecast 2034

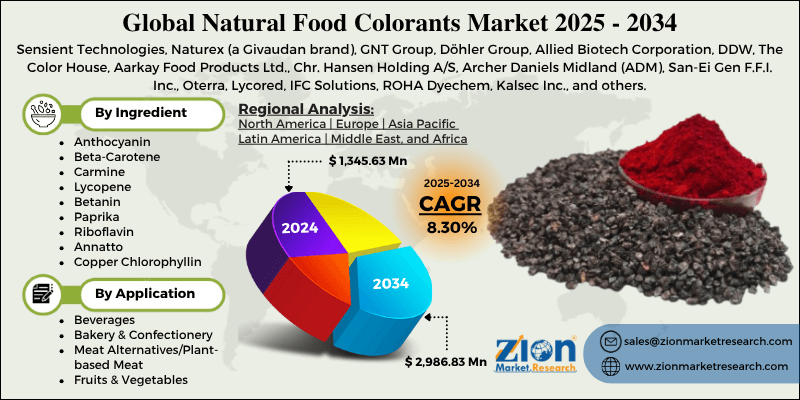

Natural Food Colorants Market By Ingredient (Anthocyanin, Beta-Carotene, Carmine, Lycopene, Betanin, Paprika, Riboflavin, Annatto, Copper Chlorophyllin, and Others), By Application (Beverages, Bakery & Confectionery, Meat Alternatives/Plant-based Meat, Fruits & Vegetables, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

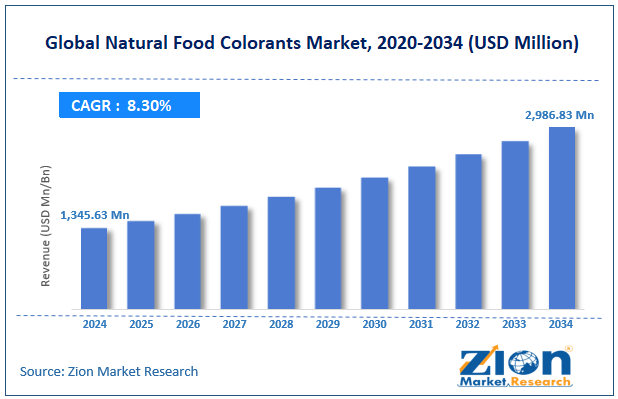

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,345.63 Million | USD 2,986.83 Million | 8.30% | 2024 |

Natural Food Colorants Industry Perspective:

The global natural food colorants market size was worth around USD 1,345.63 million in 2024 and is predicted to grow to around USD 2,986.83 million by 2034, with a compound annual growth rate (CAGR) of roughly 8.30% between 2025 and 2034.

Natural Food Colorants Market: Overview

Natural food colorants are additives derived from natural resources. They are obtained from vegetables, fruits, and naturally available minerals. Natural food colorants, as opposed to synthetic counterparts, are considered safer to use in food & beverages. Each country has a specific regulatory framework governing which food colorants are authorized for use.

For instance, some of the most popular natural food colorants approved by the US Food & Drug Administration (FDA) include black/purple carrot, blue spirulina extract, annatto extract, grape juice, paprika, and purple carmine. Many natural food colorants are insoluble in water, while most are derived from plant tissues.

Food colorants from natural resources can be easily obtained at home from items such as raspberries, strawberries, beets, sweet potatoes, carrots, tomatoes, turmeric, and saffron. Several studies indicate the benefits of using natural food colorants, such as exhibiting antioxidant properties, improving the appearance of edible items or beverages, and higher nutritional value.

During the forecast period, the demand for natural food colorants is expected to grow at a steady pace, driven by several factors, including increasing demand for clean-label food items. The higher cost of some natural food coloring variants is expected to emerge as the most dominant growth barrier during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global natural food colorants market is estimated to grow annually at a CAGR of around 8.30% over the forecast period (2025-2034)

- In terms of revenue, the global natural food colorants market size was valued at around USD 1,345.63 million in 2024 and is projected to reach USD 2,986.83 million by 2034.

- The natural food colorants market is projected to grow at a significant rate due to the increasing demand for clean-label food & beverages (F&B)

- Based on the ingredients, the beta-carotene segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the beverage segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Natural Food Colorants Market: Growth Drivers

Increasing demand for clean-label food & beverages (F&B) to promote market expansion

The global natural food colorants market is expected to be driven by the increasing demand for clean-label food & beverages. Consumers worldwide are increasingly shifting toward chemical-free dietary solutions since they are more health-friendly.

In addition, growing access to health-related information through online channels, government initiatives, and medical industry-led wellness programs has further amplified consumer awareness around the benefits of consuming naturally derived food ingredients.

According to market research, more than 50% of Americans are actively choosing clean-label food items. These products offer transparent insights into the exact ingredients used in food preparation.

Clean-label solutions generally incline more toward naturally derived ingredients and impart improved health to the consumers. In addition to this, clean-label solutions are allergen-free, making them edible for a wider range of end consumers.

Negative health impact of synthetic food colorants to promote market expansion in the coming years

Artificially prepared food colorants can be extremely harmful to the overall health of consumers. They are produced using specific chemical reactions. Some standard synthetic food colorants include indigo carmine, tartrazine, allura red, and others.

According to a recent study published on Science Direct, artificial food dyes are toxic and can lead to serious neurobehavioral effects among children. Extensive studies associate the consumption of synthetic food colorants with medical issues such as allergic reactions and hyperactivity.

Market studies also suggest that excessive intake of artificial food coloring agents can cause certain types of cancer. These factors are expected to encourage more consumers to incorporate solutions available in the global natural food colorants industry in their diet programs.

Natural Food Colorants Market: Restraints

High cost of naturally available food colorants to limit the market expansion rate

The global natural food colorants industry is expected to be limited by the high cost of some of the solutions available in the market. The higher price is a result of the use of a larger concentration of natural raw materials required to prepare the final product.

Additionally, the production method, along with variable raw material availability, further contributes to the price of natural food colorants.

Natural Food Colorants Market: Opportunities

Growing number of product launches and improved innovation to generate growth opportunities

The global natural food colorants market is expected to generate growth opportunities due to the rising number of products available in the market.

In March 2025, Oterra, a leading producer of natural colors for the F&B industry, announced the launch of a new color blending and application center in the Indian market. The company has launched the novel facility in the Kerala region in response to growing demand for its products in the Asian and Middle Eastern markets.

In September 2022, Sun Chemical announced the launch of SUNFOODSTM Natural Colorants. The product line, upon release, was made available in the European, Middle Eastern, American, and African markets.

The natural colorants are produced using vegetables, fruits, and algae and have shown applications in pet food, bakery, confectionery, dairy, beverage, and other segments.

Increasing the use of advanced production technologies in the industry to pave the way for further expansion

Natural food colorant production technologies have undergone several changes in the last few years. Some of the latest production solution innovations include the development of novel color blends and using precision fermentation. These next-generation production methods aim to improve overall product quality and quantity.

Furthermore, market players are focusing on improving product viability, durability, and overall effectiveness. The use of Artificial Intelligence (AI)-powered technologies in natural food colorant production will instill new growth prospects for the market players in the coming years.

Natural Food Colorants Market: Challenges

Regulatory concerns and limited color availability challenge market growth prospects

The global natural food colorants industry is expected to be challenged by the changing regulatory concerns over the production and use of food colorants.

Each regional market is governed by specific regulatory guidelines, making it difficult for market players to operate in new markets. In addition, natural food colorants are available only in a limited palette range, unlike synthetic variants, causing restricted revenue.

Natural Food Colorants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Natural Food Colorants Market |

| Market Size in 2024 | USD 1,345.63 Million |

| Market Forecast in 2034 | USD 2,986.83 Million |

| Growth Rate | CAGR of 8.30% |

| Number of Pages | 213 |

| Key Companies Covered | Sensient Technologies, Naturex (a Givaudan brand), GNT Group, Döhler Group, Allied Biotech Corporation, DDW, The Color House, Aarkay Food Products Ltd., Chr. Hansen Holding A/S, Archer Daniels Midland (ADM), San-Ei Gen F.F.I. Inc., Oterra, Lycored, IFC Solutions, ROHA Dyechem, Kalsec Inc., and others. |

| Segments Covered | By Ingredient, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Natural Food Colorants Market: Segmentation

The global natural food colorants market is segmented based on ingredients, application, and region.

Based on the ingredients, the global market segments are anthocyanin, beta-carotene, carmine, lycopene, betanin, paprika, riboflavin, annatto, copper chlorophyllin, and others. In 2024, the highest demand was listed in the beta-carotene segment, which dominated nearly 21% of the total revenue. Beta-carotene can be abundantly extracted from natural resources such as yeast, algae, and vegetables. The extensive applications of beta-carotene across the food industry are helping fuel the segmental revenue.

Based on the application, the natural food colorants industry divisions are beverage, bakery & confectionery, meat alternatives/plant-based meat, fruits & vegetables, and others. In 2024, the beverage segment emerged as the leading revenue generator. It dominated nearly 25% of the final return on investment (ROI) in the industry. The increasing health consciousness among consumers and rising demand for natural food additives will propel segmental growth in the coming years.

Natural Food Colorants Market: Regional Analysis

Europe to lead the market revenue during the forecast period, according to research

The global natural food colorants market is expected to be led by Europe during the forecast period. In 2024, the region accounted for nearly 33% of the global revenue. The presence of strict food standards across European countries is one of the key regional market growth boosters.

Europe has recently witnessed a steady shift toward naturally derived food ingredients, including food colorants. The regional population has become more health and environment-conscious, fueling the use of naturally derived sources in food & beverages.

The Middle East is expected to emerge as a pivotal revenue generator over the projection duration. In November 2024, Phyloton, an Israel-based biotechnology and food startup company, announced that it had secured fresh funding from Rich Products Ventures (RPV).

In the coming years, Phyloton will focus on producing and commercializing sustainable and innovative clean-label solutions for natural food colorings.

Asia-Pacific is another growing region in the natural food color industry with exceptional growth performance. Countries such as Japan, India, China, and others will contribute to regional expansion.

Rising food tourism, increased consumer awareness, and strict food regulatory codes in the region will promote growth in Asia-Pacific. Several regional countries enjoy the presence of an extensive domestic gastronomy with the use of naturally derived ingredients.

Natural Food Colorants Market: Competitive Analysis

The global natural food colorants market is led by players like:

- Sensient Technologies

- Naturex (a Givaudan brand)

- GNT Group

- Döhler Group

- Allied Biotech Corporation

- DDW

- The Color House

- Aarkay Food Products Ltd.

- Chr. Hansen Holding A/S

- Archer Daniels Midland (ADM)

- San-Ei Gen F.F.I. Inc.

- Oterra

- Lycored

- IFC Solutions

- ROHA Dyechem

- Kalsec Inc.

The global natural food colorants market is segmented as follows:

By Ingredient

- Anthocyanin

- Beta-Carotene

- Carmine

- Lycopene

- Betanin

- Paprika

- Riboflavin

- Annatto

- Copper Chlorophyllin

- Others

By Application

- Beverages

- Bakery & Confectionery

- Meat Alternatives/Plant-based Meat

- Fruits & Vegetables

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Natural food colorants are additives derived from natural resources. They are obtained from vegetables, fruits, and naturally available minerals.

The global natural food colorants market is expected to be driven by the increasing demand for clean-label food & beverages.

According to study, the global natural food colorants market size was worth around USD 1,345.63 million in 2024 and is predicted to grow to around USD 2,986.83 million by 2034.

The CAGR value of the natural food colorants market is expected to be around 8.30% during 2025-2034.

The global natural food colorants market is expected to be led by Europe during the forecast period.

The global natural food colorants market is led by players like Sensient Technologies, Naturex (a Givaudan brand), GNT Group, Döhler Group, Allied Biotech Corporation, DDW, The Color House, Aarkay Food Products Ltd., Chr. Hansen Holding A/S, Archer Daniels Midland (ADM), San-Ei Gen F.F.I., Inc., Oterra, Lycored, IFC Solutions, ROHA Dyechem, and Kalsec Inc.

The report explores crucial aspects of the natural food colorants market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed