Nanocellulose Market Size, Share, Demand Analysis, Forecast 2032

Nanocellulose Market Analysis By Type (Nanofibrillated Cellulose, Nanocrystalline Cellulose, and Bacterial Nanocellulose) and By Application (Paper Processing, Composites & Packaging, Paints and Coatings, Oil and Gas, Biomedical & Pharmaceuticals, Electronics & Sensors, and Food and Beverages), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

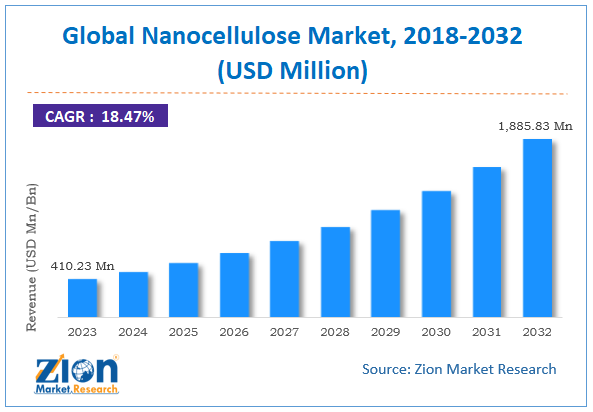

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 410.23 Million | USD 1,885.83 Million | 18.47% | 2023 |

Nanocellulose Market: Industry Perspective

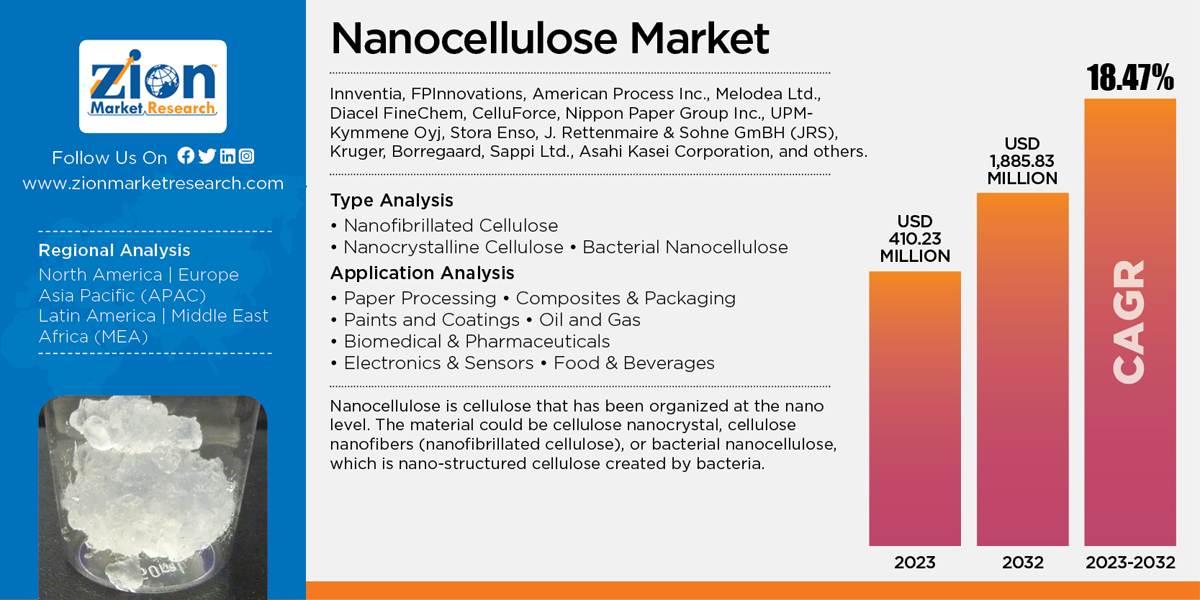

The global nanocellulose market size was worth around USD 410.23 million in 2023 and is predicted to grow to around USD 1,885.83 million by 2032 with a compound annual growth rate (CAGR) of roughly 18.47% between 2024 and 2032.

Nanocellulose Market Overview

Nanocellulose is nanostructured cellulose present in the form of nanocrystals or nanofibers. They are basically obtained from the chemical or mechanical treatment of cellulose, which is abundantly available across the world. The longitudinal dimensions of the nanocellulose ranges from a few 10's of nanometers to several microns, and lateral dimensions of the nanocellulose ranging from the 5 to 20 nm. The nanocellulose is lightweight, electrically conductive, non-toxic, and offers high tensile strength. Moreover, the crystalline form of the nanocellulose is transparent and gas impermeable in nature. Nanocellulose is majorly used for the body armor, in flexible screens, bendable batteries, and ultra-absorbent aerogels among others. Moreover, they can act as a low-calorie replacement for carbohydrate additives used as flavor carriers, thickeners, and suspension stabilizers. In addition to this, powdered form of the nanocellulose is used as an excipient in pharmaceutical formulations.

The report covers forecasts and analysis for the nanocellulose market on a global and regional level. The study provides historical data for 2018 to 2022 along with a forecast from 2024 to 2032 based on volume (Kilotons) and revenue (USD Million). The study includes drivers and restraints for the nanocellulose market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the nanocellulose market on a global level.

Nanocellulose Market Growth Dynamics

Increasing nanocellulose demand for a wide range of applications in several end-use industries such oil and gas, food and beverages, paper processing, and personal care products are positively influencing the market growth. Rising number of manufacturers across the world are capitalizing on the demand that is coming from various industries, particularly from the food & beverages and oil & gas industries. Moreover, the increase in demand for nanocellulose in the food and beverages packaging sector over the last few years is positively impacting the need for the eco-friendly and biodegradable packaging. The nanocellulose market is also benefitting from the increasing application of nanocellulose in the paper processing industries across the world. However, the lack of awareness regarding nanocellulose in the emerging countries together with the large investments required to scale up its production are the considerable factors anticipated to hamper the nanocellulose market growth.

In order to give the users of this report a comprehensive view of the nanocellulose market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein type and application are benchmarked based on their market size, growth rate, and general attractiveness.

Nanocellulose Market Segmentation Analysis

On the basis of type, the nanocellulose market is segmented into bacterial nanocellulose, nanofibrillated cellulose, and nanocrystalline cellulose. Based on the application, the nanocellulose market is divided into paper processing, composites & packaging, paints and coatings, oil and gas, biomedical & pharmaceuticals, electronics & sensors, and food and beverages.

On the basis of geography, North America accounted for the largest nanocellulose market share in terms of revenue in 2023. The growth in this region is attributed to the technological advancements and the presence of the major key players such as American Process, CelluForce, FPInnovations, and Kruger manufacturing nanocellulose. The U.S. contributes majorly towards the overall growth of nanocellulose market share as it is the largest consumer and manufacturer of nanocellulose. The rising demand for nanocellulose in this region is due to the growing automotive and construction industries in the region. Europe is anticipated to be the second largest region followed by North America in terms of revenue. Increasing applications of nanocellulose in various end-use industries are projected to support the nanocellulose market growth in the upcoming years as well.

Nanocellulose Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nanocellulose Market |

| Market Size in 2023 | USD 410.23 Million |

| Market Forecast in 2032 | USD 1,885.83 Million |

| Growth Rate | CAGR of 18.47% |

| Number of Pages | 209 |

| Key Companies Covered | Innventia, FPInnovations, American Process Inc., Melodea Ltd., Diacel FineChem, CelluForce, Nippon Paper Group Inc., UPM-Kymmene Oyj, Stora Enso, J. Rettenmaire & Sohne GmBH (JRS), Kruger, Borregaard, Sappi Ltd., Asahi Kasei Corporation, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The regional segmentation also includes the historic and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. These regions are further divided into countries.

Nanocellulose Market: Competitive Analysis

The global nanocellulose market is dominated by players like:

- Innventia

- FPInnovations

- American Process Inc.

- Melodea Ltd.

- Diacel FineChem

- CelluForce

- Nippon Paper Group Inc.

- UPM-Kymmene Oyj

- Stora Enso

- J. Rettenmaire & Sohne GmBH (JRS)

- Kruger

- Borregaard

- Sappi Ltd.

- Asahi Kasei Corporation

This report segments the global nanocellulose market as follows:

Global Nanocellulose Market: Type Analysis

- Nanofibrillated Cellulose

- Nanocrystalline Cellulose

- Bacterial Nanocellulose

Global Nanocellulose Market: Application Analysis

- Paper Processing

- Composites & Packaging

- Paints and Coatings

- Oil and Gas

- Biomedical & Pharmaceuticals

- Electronics & Sensors

- Food & Beverages

Global Nanocellulose Market: Region Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Nanocellulose is cellulose that has been organized at the nano level. The material could be cellulose nanocrystal, cellulose nanofibers (nanofibrillated cellulose), or bacterial nanocellulose, which is nano-structured cellulose created by bacteria.

According to a study, the global nanocellulose market size was worth around USD 410.23 million in 2023 and is expected to reach USD 1,885.83 million by 2032.

The global nanocellulose market is expected to grow at a CAGR of 18.47% during the forecast period.

North America is expected to dominate the nanocellulose market over the forecast period.

Leading players in the global nanocellulose market include Innventia, FPInnovations, American Process Inc., Melodea Ltd., Diacel FineChem, CelluForce, Nippon Paper Group Inc., UPM-Kymmene Oyj, Stora Enso, J. Rettenmaire & Sohne GmBH (JRS), Kruger, Borregaard, Sappi Ltd., and Asahi Kasei Corporation, among others.

The nanocellulose market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed