Global Mushroom Market Size, Share, Growth Analysis Report - Forecast 2034

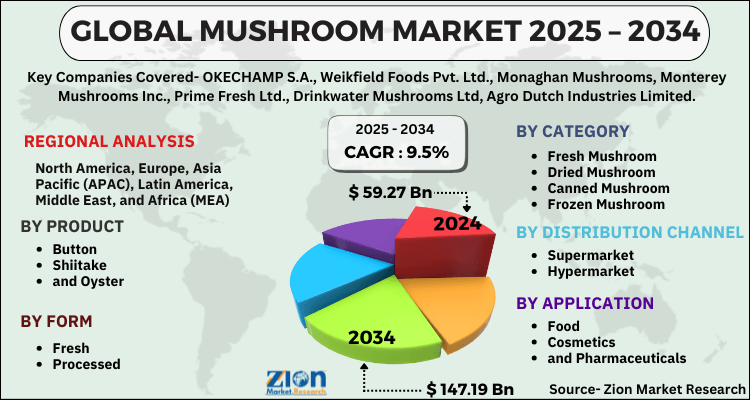

Mushroom Market By Product (Button, Shiitake, and Oyster), By Form (Fresh and Processed), Category (Fresh Mushroom, Dried Mushroom, Canned Mushroom, Frozen Mushroom, And Others), Distribution Channel (Supermarket and Hypermarket), Application (Food, Cosmetics, and Pharmaceuticals), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

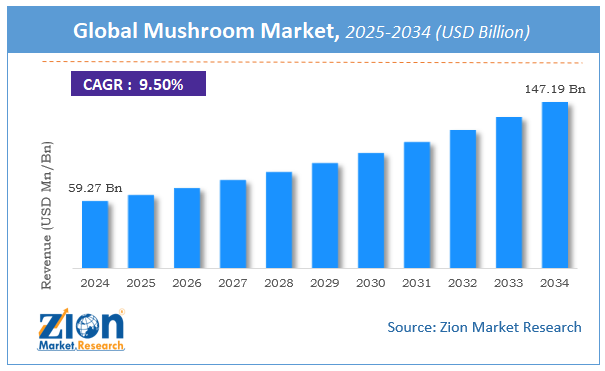

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 59.27 Billion | USD 147.19 Billion | 9.5% | 2024 |

Mushroom Market: Industry Perspective

The global mushroom market size was worth around USD 59.27 Billion in 2024 and is predicted to grow to around USD 147.19 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.5% between 2025 and 2034.

The report analyzes the global mushroom market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the mushroom industry.

Mushroom Market: Overview

Escalating awareness pertaining to intake of functional diet has produced boom in new era. Mushroom, being a functional constituent of diet, is widely consumed owing to its medicinal & nutritional property. Mushrooms belong to ascomycetes and have anti-oxidant & anti-microbial features. Reportedly, the product is rich source of immune-modulating & anti-cancer agents. They possess health-promoting features and are high source of new pharmaceuticals. Mushrooms find slew of applications in healthcare sector for treatment of skin disorders and AIDS. In addition to this, Mushrooms are anti-allergic and can be used as anti-choresterol, anti-cancer, and anti-tumor agents.

These products have high proportion of carbohydrates, xylans, like chitin, beta & alpha glucans, galactans, hemicellulose, and mannans. This has prompted their use as probiotics. It confers benefit to hosts through inhibition of exogenous pathogens.

Key Insights

- As per the analysis shared by our research analyst, the global mushroom market is estimated to grow annually at a CAGR of around 9.5% over the forecast period (2025-2034).

- Regarding revenue, the global mushroom market size was valued at around USD 59.27 Billion in 2024 and is projected to reach USD 147.19 Billion by 2034.

- The mushroom market is projected to grow at a significant rate due to increasing health consciousness and demand for plant-based proteins.

- Based on Product, the Button segment is expected to lead the global market.

- On the basis of Form, the Fresh segment is growing at a high rate and will continue to dominate the global market.

- Based on the Category, the Fresh Mushroom segment is projected to swipe the largest market share.

- By Distribution Channel, the Supermarket segment is expected to dominate the global market.

- In terms of Application, the Food segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific & Europe is predicted to dominate the global market during the forecast period.

Mushroom Market: Growth Factors

Rise in trend of consuming vegan diet across globe has become a key growth factor of mushroom market. High nutritional contents found in mushrooms have made their use popular in diet. Furthermore, ability of mushroom to reduce oxidative stress and need for minimizing risk of chronic diseases will open new growth avenues for mushroom industry. In addition to this, mushroom is a major source of myochemical and can boost defense mechanism of population. This will prop up use and penetration of product in diet, thereby driving market trends.

Moreover, surge in health awareness will pave a way for expansion of mushroom market. Apart from this, rise in funding of commercial cultivation activities will steer progression of mushroom industry. A prominent increment in fresh mushroom demand owing to growing preference for organic diet has culminated into rapid expansion of mushroom market.

Mushroom Market: Segmentation Analysis

The global mushroom market is segmented based on Product, Form, Category, Distribution Channel, Application, and region.

Based on Product, the global mushroom market is divided into Button, Shiitake, and Oyster.

On the basis of Form, the global mushroom market is bifurcated into Fresh and Processed.

By Category, the global mushroom market is split into Fresh Mushroom, Dried Mushroom, Canned Mushroom, Frozen Mushroom, And Others.

In terms of Distribution Channel, the global mushroom market is categorized into Supermarket and Hypermarket.

By Application, the global Mushroom market is divided into Food, Cosmetics, and Pharmaceuticals.

Mushroom Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mushroom Market |

| Market Size in 2024 | USD 59.27 Billion |

| Market Forecast in 2034 | USD 147.19 Billion |

| Growth Rate | CAGR of 9.5% |

| Number of Pages | 176 |

| Key Companies Covered | OKECHAMP S.A., Weikfield Foods Pvt. Ltd., Monaghan Mushrooms, Monterey Mushrooms Inc., Prime Fresh Ltd., Drinkwater Mushrooms Ltd, Agro Dutch Industries Limited, Scelta Mushrooms BV, Bonduelle, Modern Mushroom Farms, Hughes Mushroom, Banken Champignons BV, and Kulkarni Farm Fresh Private Limited., and others. |

| Segments Covered | By Product, By Form, By Category, By Distribution Channel, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mushroom Market: Regional Landscape

Asia Pacific Market To Experience Lucrative Surge Over Forecasting Years

Expansion of mushroom market in APAC in forecasting years can be attributed to rise in disposable income of population in countries such as China. Apart from this, surging intake of mushroom in Asia nations such as India and Japan will open new vistas of growth in region over forecasting timespan. Additionally, acceptance of new methods of mushroom cultivation in sub-continent will enlarge scope of industry in forthcoming years. Presence of reputed manufacturers in region will culminate into humungous regional market expansion over upcoming years.

Mushroom Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the mushroom market on a global and regional basis.

The global mushroom market is dominated by players like:

- OKECHAMP S.A.

- Weikfield Foods Pvt. Ltd.

- Monaghan Mushrooms

- Monterey Mushrooms Inc.

- Prime Fresh Ltd.

- Drinkwater Mushrooms Ltd

- Agro Dutch Industries Limited

- Scelta Mushrooms BV

- Bonduelle

- Modern Mushroom Farms

- Hughes Mushroom

- Banken Champignons BV

- and Kulkarni Farm Fresh Private Limited.

The global mushroom market is segmented as follows;

By Product

- Button

- Shiitake

- and Oyster

By Form

- Fresh

- Processed

By Category

- Fresh Mushroom

- Dried Mushroom

- Canned Mushroom

- Frozen Mushroom

- And Others

By Distribution Channel

- Supermarket

- Hypermarket

By Application

- Food

- Cosmetics

- and Pharmaceuticals

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global mushroom market is expected to grow due to rising consumer demand for plant-based protein, increasing health consciousness, and growing adoption in the food and pharmaceutical industries.

According to a study, the global mushroom market size was worth around USD 59.27 Billion in 2024 and is expected to reach USD 147.19 Billion by 2034.

The global mushroom market is expected to grow at a CAGR of 9.5% during the forecast period.

Asia-Pacific & Europe is expected to dominate the mushroom market over the forecast period.

Leading players in the global mushroom market include OKECHAMP S.A., Weikfield Foods Pvt. Ltd., Monaghan Mushrooms, Monterey Mushrooms Inc., Prime Fresh Ltd., Drinkwater Mushrooms Ltd, Agro Dutch Industries Limited, Scelta Mushrooms BV, Bonduelle, Modern Mushroom Farms, Hughes Mushroom, Banken Champignons BV, and Kulkarni Farm Fresh Private Limited., among others.

The report explores crucial aspects of the mushroom market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed