Mold Inhibitors Market Size, Share, Trends, Growth 2032

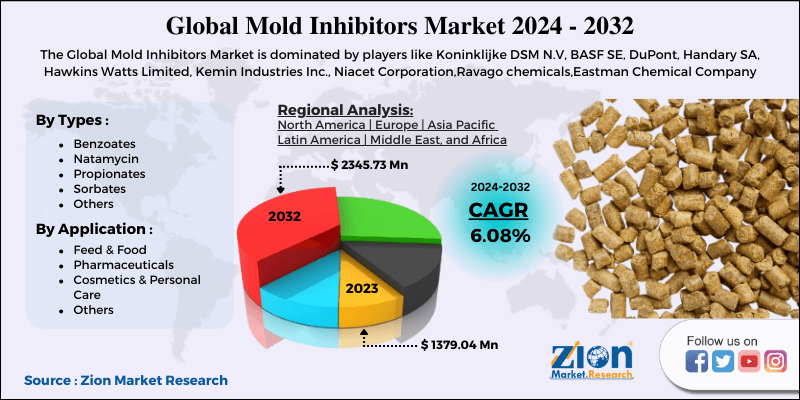

Mold Inhibitors Market By Types (Benzoates, Natamycin, Propionates, Sorbates, and others), By Application (feed & food, pharmaceuticals, cosmetics & personal care, and others) - Global Industry Perspective, Comprehensive Analysis And Forecast, 2024-2032

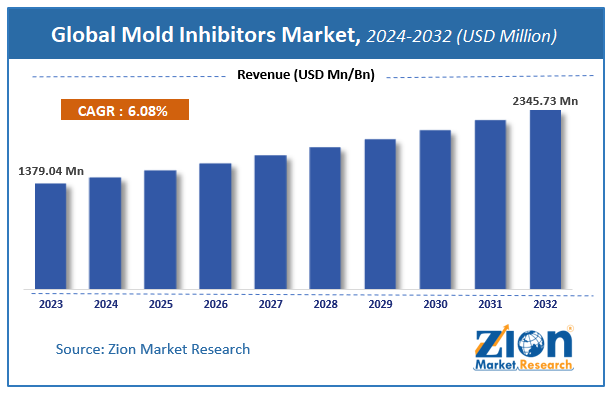

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1379.04 Million | USD 2345.73 Million | 6.08% | 2023 |

Mold Inhibitors Market Insights

According to a report from Zion Market Research, the global Mold Inhibitors Market was valued at USD 1379.04 Million in 2023 and is projected to hit USD 2345.73 Million by 2032, with a compound annual growth rate (CAGR) of 6.08% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Mold Inhibitors Market industry over the next decade.

Mold Inhibitors Market Size And Industry Analysis

Mold can grow almost everywhere and cause spoilage of food and cosmetic products. It can be deadly to people with mold allergies. But mold isn't just in dangerous things like mushrooms, blue cheese and black pepper; mold is also found in some common foods. Although some mold spores are dangerous, most mold is actually harmless; some molds even make certain foods taste better. The problem arises when these mold spores spread through moist air or water into other food where they begin to grow and digest nutrients like starch or sugars. This process of consuming an ingredient while growing mold can change the mold spores into toxins or allergenic chemicals. When molded food is eaten it can even be deadly, so mold must be removed from foods before they are sent to market.

To prevent mold in food, many manufacturers use mold inhibitors in their products. Some of these mold inhibitors are natural preservatives like honey and salt, while others are synthetic additives like potassium sorbate and sodium benzoate. Some mold inhibitors work by stopping mold spores from growing while other mold inhibitors destroy already existing mold; either way, mold growth in food is prevented because the mold inhibiting materials seal holes in cell walls that would otherwise allow air inside where moisture can cause molds to start growing again when condensation occurs. When mold spores are kept away from moisture and air they cannot grow mold, which is why mold inhibitors like potassium sorbate and sodium benzoate are used to prevent mold in spices and dry mixes.

COVID-19 Impact Analysis

COVID infection spread around the world quickly through human populations. One effect of this was that people changed their shopping habits in response. Though it appears that some types of products such as pharmaceuticals, food items and personal care products saw an increase in sales, demand for most products was unaffected. Over time, most product lines returned to their normal sales level.

It has been observed that during the initial period of pandemic people changed their buying preferences and shopping habits as they bought products that could help protect them from infection or treat disease symptoms. For instance, consumers were found buying food products that can boost their immunity. However, these changes were short-term and decreased over time. Moreover, it has been found that the demand for mold inhibitors increased dramatically in the pharmaceutical and food processing industry as the overall production output increased by a great extent. This has put further pressure on the demand and supply gap. Since most of the producers based in Asia Pacific region had to shut down their operations for some time or those who were working during this period had to cut down the production capacity due to limited movement of workers, raw material, stringent government guidelines and shortage of essential resources.

Mold Inhibitors Market: Growth Factors

The food processing industry has been evolving at an unprecedented pace since the mid-20th century. In the early decades, food processing was mainly done in homes and farms with a relatively small number of large-scale industrial production facilities that used days or weeks to produce a few product types. Today, however, innovative technologies have created a significant shift away from traditional practices towards more efficient and profitable methods.

The most notable of these is "just in time" delivery - essentially waiting until you need something before going out to get it. Also popular are the economies of scale fostered by mass production; large corporations can take advantage of their size to offer lower prices which benefit both producers (through increased sales) and consumers (by having access to a wider variety of foods at lower prices). And in no small part, the rising incomes and increased availability of refrigerators in homes across the country have contributed to giving billions access to an ever-growing spectrum of food options.

But while the changing face of food processing has brought many benefits and opportunities for growth, it has also created certain challenges; one such challenge - preventing mold growth during storage. As fungal spores are ubiquitous, they can be found anywhere and survive on nearly anything. So, when produce is picked or slaughtered for processing, the spores that contaminate it will go unharmed by washing or other standard food preparation procedures. And if the food in question isn't going to be eaten right away, then conditions have to be just right to prevent mold from growing - moisture coupled with a suitable temperature range.

Type Segment Analysis Preview

On the basis of types, the global market is segmented into Benzoates, Natamycin, Propionates, Sorbates, and others. Benzoic acid and sodium benzoate are widely used as antimicrobial agents in food preservation, pharmaceuticals, cosmetics, and other applications. Benzoates convert to benzene under acidic conditions via an autocatalytic process called "auto-ignition." As a result, they have the potential to create hazardous situations when dispersed into the air in fine particles. Although the current levels of benzoate use are not expected to cause adverse health effects, the potential to produce benzene under certain conditions is a concern.

Application Segment Analysis Preview

On the basis of application, the market is segmented into feed & food, pharmaceuticals, cosmetics & personal care, and others. The use of mold inhibitors in food and feed is a well-known practice because of the intrinsically high count of microorganisms, which could affect their safety and quality. In this regard, there are several types of chemicals that can be used as molded inhibitors.

Mold Inhibitors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mold Inhibitors Market |

| Market Size in 2023 | USD 1379.04 Million |

| Market Forecast in 2032 | USD 2345.73 Million |

| Growth Rate | CAGR of 6.08% |

| Number of Pages | 178 |

| Key Companies Covered | Koninklijke DSM N.V, BASF SE, DuPont, Handary SA, Hawkins Watts Limited, Kemin Industries Inc., Niacet Corporation,Ravago chemicals,Eastman Chemical Company |

| Segments Covered | By Application, By Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mold Inhibitors Market: Regional Analysis Preview

North America region accounting majority share in global mold inhibitors market due to improving economic condition along with increasing pharmaceutical industry which creates optimal conditions for usage of cosmetic preservatives thereby driving the market demand. However, environmental concerns over usage of these chemicals may pose a threat towards growth in near future. North America is one of the most significant manufacturers and users of mold inhibitors across the globe. The North American market for mold inhibitors is expected to witness a steady growth due to increasing demand from end-use industry such as pharmaceuticals, cosmetics, personal care, and food industry. The growing number of M&A activities in manufacturing and service sectors will further bolster the demand for mold inhibitors during the forecast period.

APAC emerging markets are expected to witness high growth on account of rapid development and increase in consumer spending, especially in countries such as Thailand and China. With growing consumer awareness about hygiene, manufacturers are focusing towards research & development for producing biological inhibitors with low toxicity thereby reducing the harmful effect of chemicals on human body. Growing R&D expenditure by players is also anticipated to boost mold inhibitor market.

Key Market Players & Competitive Landscape

Some of key players in Mold Inhibitors Market are

- Koninklijke DSM N.V

- BASF SE

- DuPont

- Handary SA

- Hawkins Watts Limited

- Kemin Industries Inc.

- Niacet Corporation

- Ravago chemicals

- Eastman Chemical Company

The Mold Inhibitors Market is segmented as follows:

By Types

- Benzoates

- Natamycin

- Propionates

- Sorbates

- Others

By Application

- Feed & Food

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

Global Mold Inhibitors Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Mold Inhibitors Market was valued at USD 1379.04 Million in 2023 and is projected to hit USD 2345.73 Million by 2032.

According to a report from Zion Market Research, the global Mold Inhibitors Market a compound annual growth rate (CAGR) of 6.08% during the forecast period 2024-2032.

The key factors driving the Mold Inhibitors Market are, the most notable of these is "just in time" delivery - essentially waiting until you need something before going out to get it. Also popular are the economies of scale fostered by mass production; large corporations can take advantage of their size to offer lower prices which benefit both producers (through increased sales) and consumers (by having access to a wider variety of foods at lower prices).

North America held a substantial share of the Mold Inhibitors Market in 2023.

Some of the major companies operating in the Mold Inhibitors Market are Koninklijke DSM N.V, BASF SE, DuPont, Handary SA, Hawkins Watts Limited, Kemin Industries Inc., Niacet Corporation, Ravago chemicals, Eastman Chemical Company.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed