Mobile C Arms Market Size, Share, Trends, Growth 2034

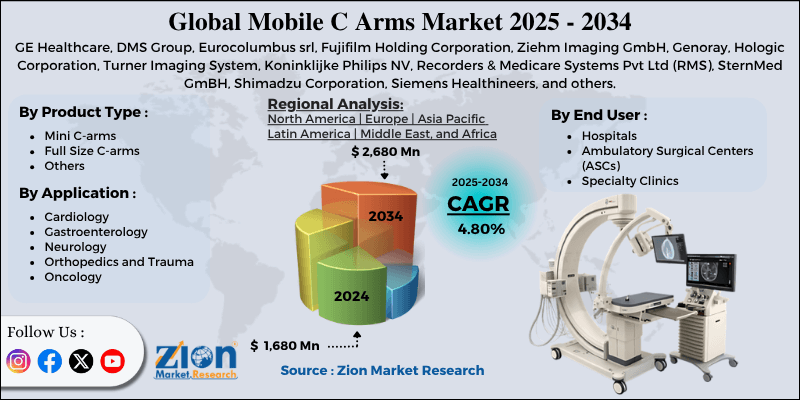

Mobile C Arms Market By Product Type (Mini C-arms, Full Size C-arms, and Others), By Application (Cardiology, Gastroenterology, Neurology, Orthopedics and Trauma, Oncology, and Others), By End-User (Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

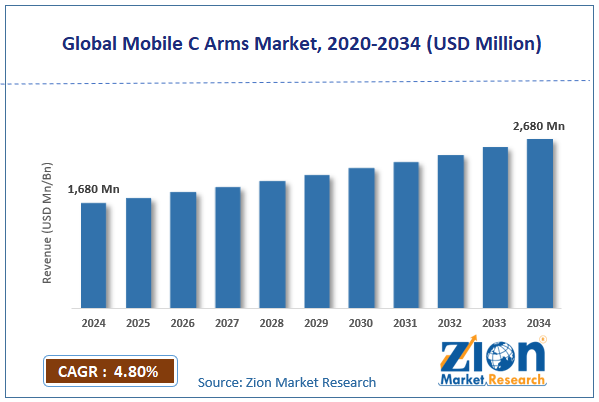

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,680 Million | USD 2,680 Million | 4.8% | 2024 |

Mobile C Arms Industry Perspective:

The global Mobile C Arms market size was worth around USD 1,680 million in 2024 and is predicted to grow to around USD 2,680 million by 2034, with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034.

Mobile C Arms Market: Overview

A portable medical imaging tool called a Mobile C Arm creates real-time images of a patient's anatomy during surgery by using X-ray technology. It is distinguished by the C-shaped arm that joins the detector and X-ray source, enabling flexible positioning around the patient.

Over the projected period, the growing number of orthopedic treatments and minimally invasive surgeries (MIS) is a key driver of growth for the mobile C-arm market. However, the radiation exposure risk posed by these devices hampers the industry expansion.

Key Insights

- As per the analysis shared by our research analyst, the global Mobile C Arms market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- In terms of revenue, the global Mobile C Arms market size was valued at around USD 1,680 million in 2024 and is projected to reach USD 2,680 million by 2034.

- The increasing prevalence of CVD across the globe is expected to drive the Mobile C Arms industry over the forecast period.

- Based on the product type, the Mini C-arms segment is expected to hold the largest market share over the forecast period.

- Based on the application, the orthopedics and trauma segment is expected to dominate the market expansion over the projected period.

- Based on the end-user, the hospitals segment is expected to dominate the market expansion over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Mobile C Arms Market: Growth Drivers

Rising surgical procedures drive market growth

The rise in surgical procedures is one of the primary factors driving the mobile C arms market. This is because the equipment is very important for providing real-time image guidance during surgeries. Mobile C arms are often used in minimally invasive surgeries (MIS) such as arthroscopy, laparoscopy, and vascular therapies. These therapies need accurate imaging during the procedure to have better results and fewer problems.

More bone fractures, joint replacements, and spinal injuries are also making the need for C Arms in orthopedic and trauma care even greater. Surgeons can see the alignment of bones, the locations of screws, and the positions of prosthetics in real time with C Arms. Thus, the aforementioned factor is propelling the mobile C Arms market.

Mobile C Arms Market: Restraints

Shortage of skilled professionals hinders market growth

One major barrier to the mobile C Arms sector is the lack of qualified personnel, which hinders the uptake and efficient application of these cutting-edge imaging technologies. Qualified radiologic technologists are needed to operate mobile C-arms, adjust settings, and ensure acceptable radiation exposure levels. There is a severe lack of these specialists in many places, particularly in rural and underdeveloped nations.

Furthermore, the use of C-Arms in surgery requires real-time fluoroscopic imaging, which demands certain expertise. To properly interpret C-Arm images and prevent radiation-related mistakes, surgeons and operating room personnel frequently require extra training.

Mobile C Arms Market: Opportunities

A growing product launch offers a lucrative opportunity for market growth

The growing product launch is expected to offer a lucrative opportunity to the mobile C Arms market over the forecast period. For instance, in February 2024, Royal Philips, a global pioneer in health technology, launched the Philips Image Guided Therapy Mobile C-arm System 9000 - Zenition 90 Motorized, which is intended to assist surgeons in providing high-quality care to a greater number of patients. This innovative mobile C-arm has an improved capability that is intended to fulfill complex vascular needs as well as a variety of clinical treatments, including cardiac interventions, pain management, and urology.

As healthcare providers strive to provide high-quality care to patients, Philips is collaborating with its customers at #ECR2024 to increase productivity and access to more sustainable healthcare.

Mobile C Arms Market: Challenges

Competition from alternative imaging modalities poses a major challenge to market expansion

The increasing competition from alternative imaging modalities is a significant impediment to the expansion of the mobile C Arms industry. There are several alternatives on the market, including ultrasound, MRI, CT scanners, and others.

Ultrasound, for instance, is radiation-free, portable, and low-cost, making it popular for vascular access, soft tissue imaging, and guided injections. They preferred operations that required real-time imaging but did not involve ionizing radiation (for example, obstetrics and some pain management).

Similarly, MRI is superior in terms of soft tissue contrast and neuroimaging. Mobile C-Arms in high-end hospitals face new issues as they are increasingly used in interventional MRI suites. Thus, the aforementioned benefits of alternatives pose a major challenge to the mobile C Arm industry over the anticipated timeframe.

Mobile C Arms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile C Arms Market |

| Market Size in 2024 | USD 1,680 Million |

| Market Forecast in 2034 | USD 2,680 Million |

| Growth Rate | CAGR of 4.80% |

| Number of Pages | 211 |

| Key Companies Covered | GE Healthcare, DMS Group, Eurocolumbus srl, Fujifilm Holding Corporation, Ziehm Imaging GmbH, Genoray, Hologic Corporation, Turner Imaging System, Koninklijke Philips NV, Recorders & Medicare Systems Pvt Ltd (RMS), SternMed GmBH, Shimadzu Corporation, Siemens Healthineers, and others. |

| Segments Covered | By Product Type, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile C Arms Market: Segmentation

The global Mobile C Arms industry is segmented based on product type, application, end-user, and region.

Based on the product type, the global market is bifurcated into Mini C-arms, Full Size C-arms, and Others. The Mini C-arms segment is expected to hold the largest market share over the forecast period. The increased prevalence of fractures, arthritis, sports injuries, and repetitive strain conditions is driving demand for targeted imaging. Mini C-arms are suited for treatments that require rapid, targeted imaging without the requirement for a full-size system.

Based on the application, the global Mobile C Arms industry is bifurcated into cardiology, gastroenterology, neurology, orthopedics and trauma, oncology, and others. The orthopedics and trauma segment is expected to dominate the market over the projected period. This is because mobile C-Arm systems are used significantly in orthopedic procedures, such as fixing broken bones, replacing joints, and performing spine surgery.

Mobile C Arms give high-quality images in real time, which is necessary for accurate positioning and guidance throughout these surgeries. In addition, the growing number of musculoskeletal issues, injuries from accidents, and an aging population are driving up the need for advanced imaging technologies in orthopedic and trauma care. The International Osteoporosis Foundation (IOF) states that by 2050, the number of hip fractures in males will rise by 310% and in women by 240%, compared to 1990 levels.

Based on the end-user, the global Mobile C Arms market is bifurcated into Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics. The hospitals are expected to capture a prominent market share over the projected period. This is owing to a significant demand for modern imaging technologies in hospitals, where transportable C-Arms are widely utilized for orthopedic, cardiovascular, and trauma procedures.

Hospitals are heavy users of mobile C Arm systems, which require excellent, real-time imaging to provide precise surgical procedures and better patient outcomes. The availability of comprehensive healthcare services, as well as the demand for high-quality diagnostic and surgical equipment, contribute to the hospital segment's leading position in the market.

Mobile C Arm Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global mobile C arm market during the projected period. The regional expansion of the mobile C Arms market is growing due to the increasing prevalence of several disorders such as cardiovascular disease, orthopedics, trauma, and neurological disorders.

For instance, according to the Association’s 2025 statistical report, in 2022, the overall number of cardiovascular disease (CVD) associated deaths in the U.S. was 941,652, an increase of more than 10,000 from the 931,578 CVD deaths in 2021.

Furthermore, the aging population in the area is a major contributor to the revenue growth of the mobile C-Arms industry. As per the data shared by the Population Reference Bureau, the number of Americans ages 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050 (a 47% increase).

In addition, the presence of major players and their innovative product launches influences the North American mobile C Arms sector over the analysis period.

Mobile C Arms Market: Competitive Analysis

The global Mobile C Arms market is dominated by players like:

- GE Healthcare

- DMS Group

- Eurocolumbus srl

- Fujifilm Holding Corporation

- Ziehm Imaging GmbH

- Genoray

- Hologic Corporation

- Turner Imaging System

- Koninklijke Philips NV

- Recorders & Medicare Systems Pvt Ltd (RMS)

- SternMed GmBH

- Shimadzu Corporation

- Siemens Healthineers

The global Mobile C Arms market is segmented as follows:

By Product Type

- Mini C-arms

- Full Size C-arms

- Others

By Application

- Cardiology

- Gastroenterology

- Neurology

- Orthopedics and Trauma

- Oncology

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A portable medical imaging tool called a Mobile C Arm creates real-time images of a patient's anatomy during surgery by using X-ray technology. It is distinguished by the C-shaped arm that joins the detector and X-ray source, enabling flexible positioning around the patient.

The Mobile C Arms industry is being driven by several factors such as growing surgical procedures, increasing technological advancements, rising aging population, increasing prevalence of several diseases, including CVD, orthopedics, trauma, and others.

According to the report, the global Mobile C Arms market size was worth around USD 1,680 million in 2024 and is predicted to grow to around USD 2,680 million by 2034.

The global Mobile C Arms market is expected to grow at a CAGR of 4.8% during the forecast period.

The global Mobile C Arms industry growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the adoption of advanced technology and the presence of major players.

The global Mobile C Arms market is dominated by players like GE Healthcare, DMS Group, Eurocolumbus srl, Fujifilm Holding Corporation, Ziehm Imaging GmbH, Genoray, Hologic Corporation, Turner Imaging System, Koninklijke Philips NV, Recorders & Medicare Systems Pvt Ltd (RMS), SternMed GmBH, Shimadzu Corporation, and Siemens Healthineers, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed