Microwave Equipment Market Size, Share, Analysis, Trends, Growth Report 2032

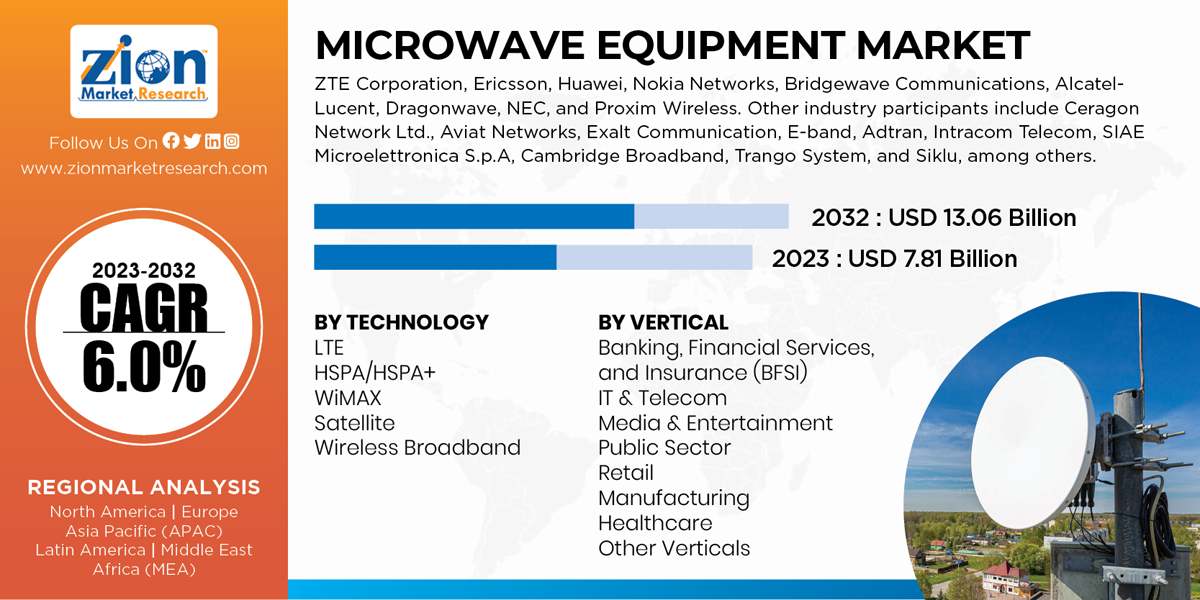

Microwave Equipment Market By Technology (LTE, HSPA/HSPA+, WiMAX, Satellite, and Wireless Broadband) and By Vertical (Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Media & Entertainment, Public Sector, Retail, Manufacturing, Healthcare, and Other Verticals), and By Region: Global Industry Perspective, Comprehensive Analysis And Forecast 2024-2032

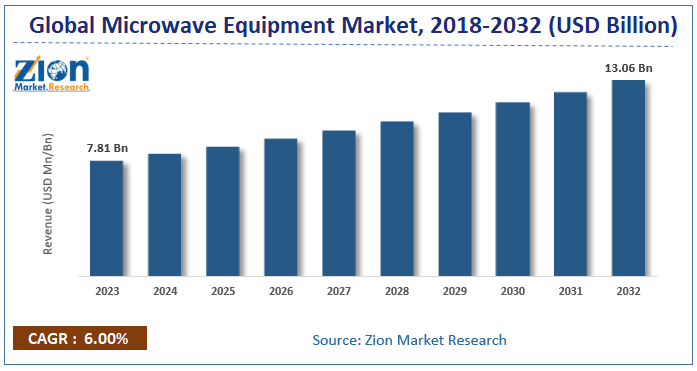

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.81 Billion | USD 13.06 Billion | 6.0% | 2023 |

Microwave Equipment Market: Size

The global microwave equipment market size accrued earnings worth approximately USD 7.81 Billion in 2023 and is predicted to gain revenue of about USD 13.06 Billion by 2032, is set to record a CAGR of nearly 6.0% over the period from 2024 to 2032.

Microwave Equipment Market Overview

A microwave is a major component of backhaul networks and is anticipated to evolve as a part of upcoming 5G's ecosystem. As microwave is a preferred self-built and transmission model, the key operators of the microwave equipment market are constantly focusing on mobile operators in order to improve their network performance. This is also considered as one of the notable trends to boost the microwave deployment thereby, contributing to the growth of the microwave equipment industry. Some of the best features of the microwave network include feasibility, reliability, cost-effectiveness, and less maintenance cost. These factors are expected to accelerate the demand for the microwave equipment industry.

The report gives a transparent view of the microwave equipment market. We have included a detailed competitive scenario and portfolio of prominent vendor’s operative in the microwave equipment market. To understand the competitive landscape of the microwave equipment market, an analysis of Porter’s Five Forces model for the market has also been included. The report offers a market attractiveness analysis, wherein technology, vertical, and regional segments are benchmarked based on their general attractiveness, market size, and growth rate.

Microwave Equipment Market: Segmentation

The study provides a crucial view of the microwave equipment market by segmenting the market based on technology, vertical, and regional segments. All the segments of the microwave equipment market have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

On the basis of technology, the market is divided into LTE, HSPA/HSPA+, WiMAX, satellite, and wireless broadband.

In terms of verticals, the market is categorized into banking & financial service, public sector, IT & telecom, media & entertainment, healthcare, and manufacturing. Microwave equipment market has further promoted its area for operators to install new base stations for providing a better quality of experience over LTE networks. One of the leading drivers in this market is increasing penetration of Ethernet-based microwave transmission. Moreover, the increasing hybrid TDM (Time Division Multiplexing) Ethernet system is another factor enhancing the development of the market. In addition, the new cell sites and increasing upgradation of 4G LTE will boost the market growth. However, increasing cost to upgrade the mobile networks is one of the aspects deteriorating the growth of the microwave equipment market. Site acquisition and growing competition among technologies are the two major challenging factors of the market.

Microwave Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Microwave Equipment Market |

| Market Size in 2023 | USD 7.81 Billion |

| Market Forecast in 2032 | USD 13.06 Billion |

| Growth Rate | CAGR of 6.0% |

| Number of Pages | 196 |

| Key Companies Covered | ZTE Corporation, Ericsson, Huawei, Nokia Networks, Bridgewave Communications, Alcatel-Lucent, Dragonwave, NEC, and Proxim Wireless. Other industry participants include Ceragon Network Ltd., Aviat Networks, Exalt Communication, E-band, Adtran, Intracom Telecom, SIAE Microelettronica S.p.A, Cambridge Broadband, Trango System, and Siklu, among others. |

| Segments Covered | By Technology, By Vertical, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Microwave Equipment Market: Regional Analysis

Geographically, the Asia Pacific microwave equipment market held the largest market share in 2015, followed by North America and Europe. The demand for the high-speed wireless network for smartphones, e-commerce portals, and high definition video broadcasting is very high in the Asia Pacific, thus it is predicted to be a key region for the growth of microwave equipment market over the forecast period. North America and Western Europe are anticipated to hold a significant share in microwave equipment market. The continuous focus on commercializing 5G network solutions and enhancing network performance are key reasons to drive the demand for the market in respective regions. The Middle East and Africa region are also anticipated to witness substantial growth due to increasing demand for a mobile network in this region.

Microwave Equipment Market: Key Players Analysis

The major participants for the microwave equipment market include

- ZTE Corporation

- Ericsson

- Huawei

- Nokia Networks

- Bridgewave Communications

- Alcatel-Lucent

- Dragonwave

- NEC

- Proxim Wireless

- Ceragon Network Ltd.

- Aviat Networks

- Exalt Communication

- E-band

- Adtran

- Intracom Telecom

- SIAE Microelettronica S.p.A

- Cambridge Broadband

- Trango System

- Siklu

The report segments the microwave equipment market as follows:

Global Microwave Equipment Market: By Technology

- LTE

- HSPA/HSPA+

- WiMAX

- Satellite

- Wireless Broadband

Global Microwave Equipment Market: By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Media & Entertainment

- Public Sector

- Retail

- Manufacturing

- Healthcare

- Other Verticals

Global Microwave Equipment Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A microwave is a major component of backhaul networks and is anticipated to evolve as a part of upcoming 5G's ecosystem.

According to study, the global Microwave Equipment Market size was worth around USD 7.81 billion in 2023 and is predicted to grow to around USD 13.06 billion by 2032.

The CAGR value of Microwave Equipment Market is expected to be around 6.0% during 2024-2032.

Asia Pacific has been leading the global Microwave Equipment Market and is anticipated to continue on the dominant position in the years to come.

The global Microwave Equipment Market is led by players like ZTE Corporation, Ericsson, Huawei, Nokia Networks, Bridgewave Communications, Alcatel-Lucent, Dragonwave, NEC, and Proxim Wireless. Other industry participants include Ceragon Network Ltd., Aviat Networks, Exalt Communication, E-band, Adtran, Intracom Telecom, SIAE Microelettronica S.p.A, Cambridge Broadband, Trango System, Siklu, and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed