MHealth Market Size, Share, Trends, Growth 2032

MHealth Market By Device (Pulse Oximeters, Multi-Parameter Trackers, Blood Glucose Meters, Sleep & Apnea Monitor, Wearable Fitness Sensor Device, Neurological Monitoring Device, Heart Rate Meters, Blood Pressure Monitors, ECG Monitors, Cardiac Monitors, Peak Flow Meters, and Others), Stakeholder (Healthcare Providers, Mobile Operators, Application Players, Device Vendors, and Others) By Service (Treatment Services, Monitoring Services, Wellness Services, Diagnosis Service, Prevention Servicesm, Healthcare System Strengthening Services, Other Service), By Therapeutics (Neurology, Diabetes, Cardiovascular, Respiratory, Others), and By Application (Chronic Care Management Apps, Medical Apps, Women’s Health Apps, Medication Management, Personal Health Record (PHR) Apps, Healthcare and Fitness Apps, and Others: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 77.02 Billion | USD 250.47 Billion | 14% | 2023 |

Global MHealth Market Insights

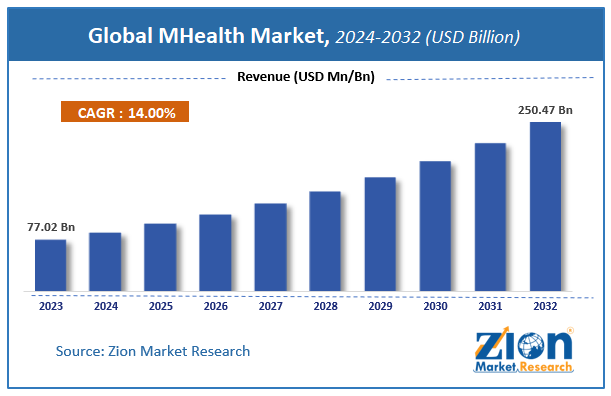

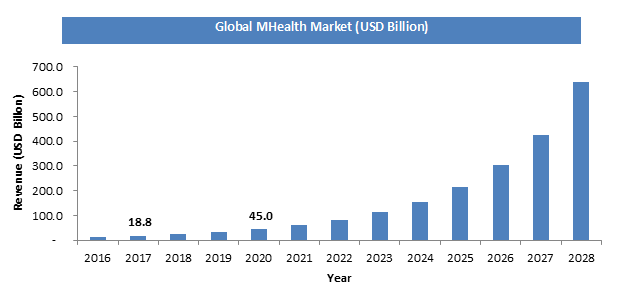

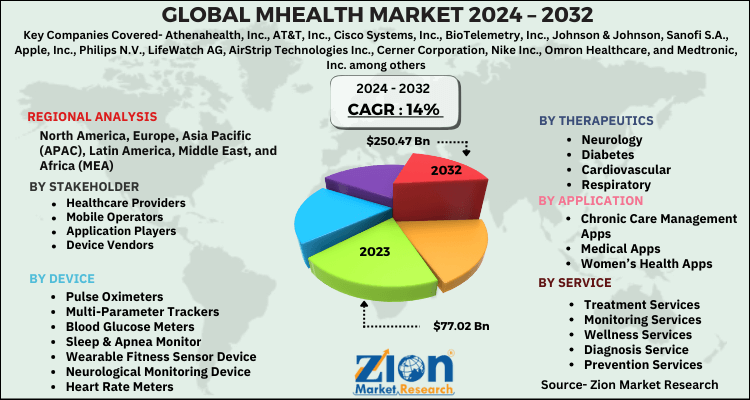

According to Zion Market Research, the global MHealth Market was worth USD 77.02 Billion in 2023. The market is forecast to reach USD 250.47 Billion by 2032, growing at a compound annual growth rate (CAGR) of 14% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the MHealth Market industry over the next decade.

mHealth technology is used to provide effective, safe, and affordable healthcare services via different mobile devices, such as mobile phones, PDA, tablet computers and wireless devices. mHealth apps offer patient consultations, health instructions, and many more healthcare services in the easiest way.

MHealth Market Overview

mHealth is a technology that involves use of mobile commination devices, such as mobile phones, PDAs (personal digital assistants), tablets, and other wireless devices for distributing health as well as services. It monitors chronic conditions and help developing the prevention aspect of the healthcare system. In addition to this, it enables to offer the services on consultation, diagnosis, care management, and self-management services by using information & communication technologies (ICT).

Moreover, the mHealth includes wide range of tactics and technologies to deliver virtual health, medical, and education services to the users. mHealth may include apparatus, instruments, machines or software (including mobile applications) that are involved in the delivery of healthcare services.

Global MHealth Market: Segmentation

The study provides a decisive view of the MHealth market by segmenting the market based on by device, by stakeholder, by service, by therapeutics, by application and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

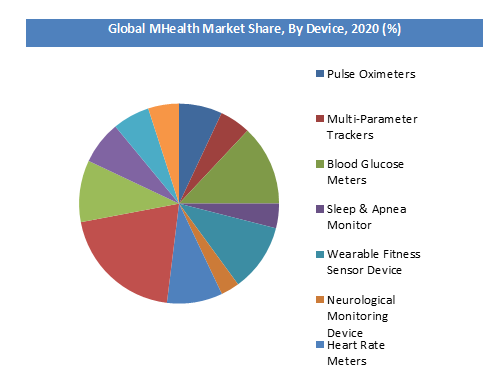

By device type segment analysis includes pulse oximeters, multi-parameter trackers, blood glucose meters, sleep & apnea monitor, wearable fitness sensor device, neurological monitoring device, heart rate meters, blood pressure monitors, ECG monitors, cardiac monitors, peak flow meters, others.

By stakeholder segment analysis includes healthcare providers, mobile operators, application players, device vendors, others.

By service segment analysis includes treatment services, monitoring services, wellness services, diagnosis service, prevention services, healthcare, system strengthening services, other service.

By therapeutics segment analysis includes neurology, diabetes, cardiovascular, respiratory, others.

By application segment analysis includes chronic care management apps, medical apps, women’s health apps, medication management, personal health record (PHR) apps, healthcare and fitness apps, others.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

MHealth Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | MHealth Market |

| Market Size in 2023 | USD 77.02 Billion |

| Market Forecast in 2032 | USD 250.47 Billion |

| Growth Rate | CAGR of 14% |

| Number of Pages | 150 |

| Key Companies Covered | Athenahealth, Inc., AT&T, Inc., Cisco Systems, Inc., BioTelemetry, Inc., Johnson & Johnson, Sanofi S.A., Apple, Inc., Philips N.V., LifeWatch AG, AirStrip Technologies Inc., Cerner Corporation, Nike Inc., Omron Healthcare, and Medtronic, Inc. among others |

| Segments Covered | By Device, By Stakeholder, By Service, By Therapeutics, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

MHealth Market Growth Factors

Rising awareness among the users about healthcare is one of the major factors that are responsible for the development of the global mHealth market, as per the analysts at Zion Market Research. In addition to this, various mergers and acquisitions by market players is also set to boost the global mHealth market. For example, in July 2022, Cisco purchased, Observable Networks, the network security startup. In addition, in June 2022, Actelion was obtained by Johnson & Johnson, thereby boosting the mHealth market.

The mHealth market is expected to witness strong growth within the forecast period. The global mHealth market is mainly driven by growing aging population and ubiquitous smartphones access. With increasing health awareness among people, growing chronic diseases such as diabetes, and increasing healthcare expenditure, the demand for mHealth is anticipated to witness outstanding growth over the forecast period. Cost efficacy of health care services, easily available on the mobile app and time efficiency are the key factor to fuel the mHealth monitoring and diagnostics devices market. However, some issues related to security and data safety may hamper the market. Nonetheless, increasing healthcare IT is expected to open up new growth opportunities in the years to come.

Pulse oximeters, multi-parameter trackers, blood glucose meters, sleep & apnea monitor, wearable fitness sensor device, neurological monitoring device, heart rate meters, blood pressure monitors, ECG monitors, cardiac monitors, peak flow meters and others are the key devices included in mHealth market. Blood pressure segment accounted for the largest share, in terms of revenue in 2014. The dominance of blood pressure monitors was attributed to rising health awareness among people for the monitoring and proper treatment. Glucose monitors are the fastest growing segment on account of growing prevalence of diabetes across the globe. Diagnosis & consultation segment is another important segment of this market.

Regional Analysis Preview

North America ruled the mHealth with more than 30% share for the year 2020 in terms of income followed by Asia Pacific and Europe owing to development of monitoring services segment. By therapeutics, the mHealth market can be divided into diabetes, neurology, respiratory, cardiovascular, and others. Monitoring services segment added up for more than 34% share of the total mHealth market in 2014. The diagnosis & consultation service segment was the second biggest division in global mHealth market. Diagnosis services permits healthcare professionals to link distantly with patients. Diagnosis services include IVR-based services and mobile telemedicine services in addition to call center services.

Key Market Players & Competitive Landscape

Some of key players in MHealth Market are-

- Athenahealth, Inc

- AT&T, Inc

- Cisco Systems, Inc

- BioTelemetry, Inc

- Johnson & Johnson

- Sanofi S.A., Apple, Inc

- Philips N.V., LifeWatch AG

- AirStrip Technologies Inc

- Cerner Corporation

- Nike Inc

- Omron Healthcare

- Medtronic, Inc

- Among others

The global MHealth Market is segmented as follows:

By Device

- Pulse Oximeters

- Multi-Parameter Trackers

- Blood Glucose Meters

- Sleep & Apnea Monitor

- Wearable Fitness Sensor Device

- Neurological Monitoring Device

- Heart Rate Meters

- Blood Pressure Monitors

- ECG Monitors

- Cardiac Monitors

- Peak Flow Meters

- Others

By Stakeholder

- Healthcare Providers

- Mobile Operators

- Application Players

- Device Vendors

- Others

By Service

- Treatment Services

- Monitoring Services

- Wellness Services

- Diagnosis Service

- Prevention Services

- Healthcare System Strengthening Services

- Other Service

By Therapeutics

- Neurology

- Diabetes

- Cardiovascular

- Respiratory

- Others

By Application

- Chronic Care Management Apps

- Blood Pressure & ECG Monitoring Apps

- Cancer Management Apps

- Diabetes Management Apps

- Mental Health and Behavioral Disorder Management Apps

- Others

- Medical Apps

- Alert and Awareness Apps

- Continuing Medical Education (CME) Apps

- Diagnostic Apps

- Medical Reference Apps

- Women’s Health Apps

- Breastfeeding Apps

- Fertility Apps

- Pregnancy Apps

- Others

- Medication Management

- Personal Health Record (PHR) Apps

- Healthcare and Fitness Apps

- Nutrition and Fitness Apps

- Health-Tracking Apps

- Weight Loss Apps

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global MHealth Market was valued at USD 77.02 Billion in 2023.

The global MHealth Market is expected to reach USD 250.47 Billion by 2032, growing at a CAGR of 14% between 2024 to 2032.

Some of the key factors driving the global MHealth Market growth are rising awareness among the users about healthcare and various mergers and acquisitions in the market.

North America ruled the mHealth with more than 30% share for the year 2023 in terms of income followed by Asia Pacific and Europe owing to development of monitoring services segment.

Some of the major companies operating in MHealth Market are Athenahealth, Inc., AT&T, Inc., Cisco Systems, Inc., BioTelemetry, Inc., Johnson & Johnson, Sanofi S.A., Apple, Inc., Philips N.V., LifeWatch AG, AirStrip Technologies Inc., Cerner Corporation, Nike Inc., Omron Healthcare, and Medtronic, Inc. among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed