Medical Supplies Market Size, Share, Growth & Forecast 2034

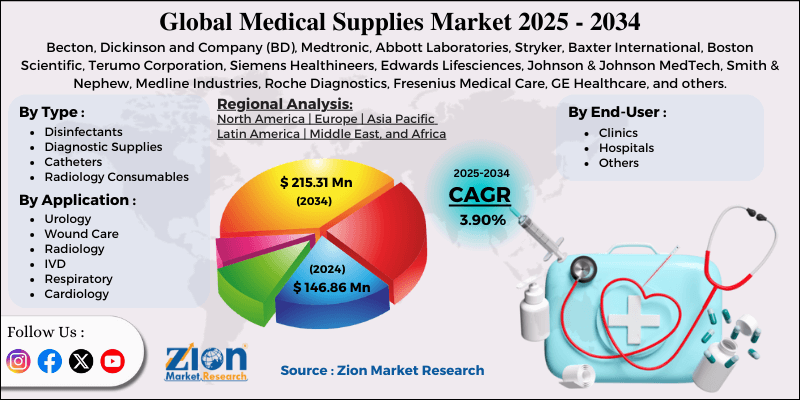

Medical Supplies Market By Type (Disinfectants, Diagnostic Supplies, Catheters, Infusions & Injectable Supplies, Radiology Consumables, Sterilization Consumables, Dialysis Consumables, PPE, Wound Care Consumables, and Others), By Application (Urology, Wound Care, Radiology, IVD, Respiratory, Cardiology, Infection Control, and Others), By End-User (Clinics, Hospitals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

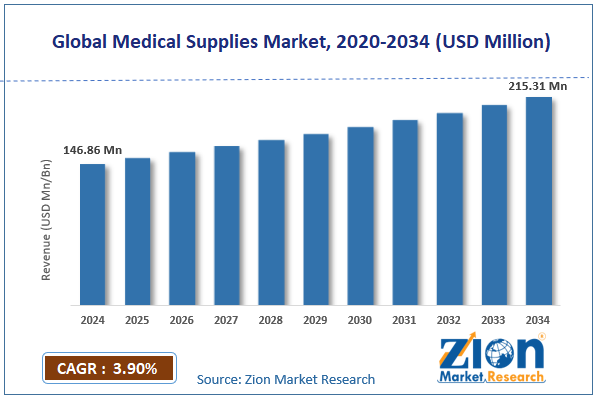

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 146.86 Million | USD 215.31 Million | 3.90% | 2024 |

Medical Supplies Industry Perspective:

The global medical supplies market size was worth around USD 146.86 million in 2024 and is predicted to grow to around USD 215.31 million by 2034, with a compound annual growth rate (CAGR) of roughly 3.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global medical supplies market is estimated to grow annually at a CAGR of around 3.90% over the forecast period (2025-2034)

- In terms of revenue, the global medical supplies market size was valued at around USD 146.86 million in 2024 and is projected to reach USD 215.31 million by 2034.

- The medical supplies market is projected to grow at a significant rate due to the growing prevalence of diseases worldwide.

- Based on the type, the catheters segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user, the hospitals segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Medical Supplies Market: Overview

Medical supplies include instruments, tools, consumables, and devices used for the treatment, diagnosis, or monitoring of patients. Medical supplies consist of a large range of healthcare-related basic products, such as syringes, band-aids, and more complicated items such as ventilators. Medical supplies are used across outpatient and inpatient healthcare settings. In addition, the average cost of medical supplies can range from a few dollars to thousands, depending on the product and its level of complexity. Clinical supplies are essential tools and products used by healthcare providers to deliver quality patient care.

Furthermore, the items ensure the effectiveness of treatment and the accuracy of diagnosis. The most common types of medical supplies used across healthcare centers include durable medical equipment (DME), consumables, surgical instruments, diagnostic equipment, and sterilization supplies. During the forecast period, demand for medical supplies is expected to continue growing due to the rising number of patients registered worldwide. Additionally, the growing expansion of healthcare facilities and regional medical care infrastructure will promote market expansion in the long run. The industry growth trend is expected to be affected by growing concerns over excessive medical waste generated worldwide.

Medical Supplies Market Dynamics

Growth Drivers

Growing prevalence of diseases worldwide is expected to fuel market expansion during the forecast period

The global medical supplies market is expected to be influenced by the rising number of patients across the globe. In the last decade, developed and emerging economies have registered an unprecedented increase in patients requiring short-term and long-term medical care. Hospital admissions have increased due to multiple factors such as higher prevalence of chronic illnesses, weakened immune system of the current population, and a rise in accidents. For instance, according to the World Health Organization (WHO), more than 830 million people worldwide have diabetes, especially in low and middle-income economies.

Additionally, cancer is one of the most common chronic conditions reported across the globe. Infectious diseases are spreading rapidly in densely populated regions. The COVID-19 pandemic overburdened the existing healthcare infrastructure in developed and developing countries. The surge in the number of patients suffering from minor illnesses or more severe conditions will promote higher consumption and usage of medical supplies in the coming years.

Will the expansion of remote healthcare and telemedicine push the medical supplies industry revenue to new heights?

Since 2020, remote healthcare has witnessed exceptional growth. It deals with delivering healthcare services using digital solutions without the patient having to visit hospital premises. Over the years, remote healthcare has registered excellent expansion by encompassing a wider range of services such as remote diagnosis, patient management, and treatment. With the emergence and rapid expansion of telemedicine and remote healthcare, companies operating in the global medical supplies market are required to undertake innovation-based marketing growth opportunities in the long run.

Restraints

Do the growing concerns about excessive waste generated limit the medical supplies market expansion trends?

The global medical supplies industry is expected to be restricted by rising concerns over excessive medical waste generated across the globe. According to Practice Greenhealth, more than 5 million tons of waste are generated every year from across healthcare facilities. Most countries lack effective disposal systems for medical waste, resulting in increased pollution and environmental damage. WHO estimates that nearly 15% of the global medical waste is hazardous, resulting in a long-term impact on the ecological system. Excessive use of one-time and disposable medical supplies without proper disposal systems will affect market expansion during the forecast period.

Opportunities

How will the rising launch of eco-friendly clinical supplies offer growth opportunities for medical supplies market players?

The global medical supplies market is expected to generate growth opportunities due to the rising launch and demand of eco-friendly products. Sustainable medical supplies not only ensure improved patient care but are less harmful to the environment. For instance, in February 2024, researchers at the Advanced Study in Science and Technology (IASST) developed an eco-friendly wound dressing solution using banana fibers. The researchers utilized agricultural waste, specifically banana pseudo-stems, to transform them into effective medical supplies.

Growing investments in developing efficient medical waste disposal infrastructure to promote industry expansion

Governments and private companies around the globe are working on developing more efficient and robust medical waste disposal infrastructure. In December 2024, Bertin Technologies, a France-based provider of high-end industrial tools and instruments for researchers, launched Sterilwave. The breakthrough technology will allow healthcare facilities to treat infectious medical waste onsite, thus promoting the proper disposal of discarded medical supplies within healthcare settings. Such advancements in medical waste disposal solutions will be helpful to the industry’s overall revenue in the long run.

Challenges

Economic volatility and supply chain disruptions are expected to affect market revenue

The global medical supplies industry is expected to be challenged by the growing economic volatility reported worldwide. It can affect business decisions during the forecast period as the cost of essential medical supplies continues to increase. Additionally, supply chain disruptions resulting from changing geopolitics and other external factors may affect the market's final growth trends. The industry is further expected to be influenced by frequent fluctuations in end demand, creating a growth barrier for product suppliers.

Medical Supplies Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Supplies Market |

| Market Size in 2024 | USD 146.86 Million |

| Market Forecast in 2034 | USD 215.31 Million |

| Growth Rate | CAGR of 3.90% |

| Number of Pages | 214 |

| Key Companies Covered | Becton, Dickinson and Company (BD), Medtronic, Abbott Laboratories, Stryker, Baxter International, Boston Scientific, Terumo Corporation, Siemens Healthineers, Edwards Lifesciences, Johnson & Johnson MedTech, Smith & Nephew, Medline Industries, Roche Diagnostics, Fresenius Medical Care, GE Healthcare, and others. |

| Segments Covered | By Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Supplies Market: Segmentation

The global medical supplies market is segmented based on type, application, end-user, and region.

Based on type, the global market divisions are disinfectants, diagnostic supplies, catheters, infusions & injectable supplies, radiology consumables, sterilization consumables, dialysis consumables, PPE, wound care consumables, and others. In 2024, the highest growth was witnessed in the catheters segment due to the rising prevalence of medical conditions such as dementia, diabetes, and stroke, among others. Furthermore, the growing cases of urinary incontinence may also impact segmental revenue in the future. According to the WHO, between 10% to 36.5% of the world population suffers from urinary incontinence.

Based on application, the global medical supplies industry is divided into urology, wound care, radiology, IVD, respiratory, cardiology, infection control, and others.

Based on the end-user, the global market divisions are clinics, hospitals, and others. In 2024, the highest revenue was listed in the hospitals segment as the number of patient admissions continues to grow every year. The rising expansion of healthcare facilities and growing use of advanced medical supplies in medical centers will fuel segmental dominance during the forecast period.

Medical Supplies Market: Regional Analysis

What factors will aid North America in dominating the medical supplies market during the forecast period?

The global medical supplies market is expected to be dominated by North America during the forecast period. In 2024, the region held prominence over 36.6% of global revenue. Growth in North America is driven by the increasing prevalence of long-term medical conditions, as well as the rise of medical tourism.

Furthermore, increasing demand for cosmetic surgeries and the presence of a robust healthcare ecosystem help North America take the lead. In addition to this, North American clinical facilities are rapidly incorporating the latest and most advanced medical supplies to enhance patient care, further helping the region thrive.

Asia-Pacific is expected to emerge as the second-highest revenue generator in the medical supplies industry, with the growing expansion of the region’s healthcare infrastructure. A growing geriatric population, a rising number of surgeries, and growing cases of mild illnesses will promote regional growth trends. In addition to this, countries across the Asia-Pacific are also investing in deploying efficient medical waste disposal systems, creating greater growth prospects for regional players.

For instance, in February 2025, India’s All India Institute of Medical Sciences (AIIMS) hospital launched an innovative waste disposal system called Srjanam, developed by the Council of Scientific and Industrial Research (CSIR) - National Institute for Interdisciplinary Science and Technology (NIIST).

Medical Supplies Market: Competitive Analysis

The global medical supplies market is led by players like:

- Becton

- Dickinson and Company (BD)

- Medtronic

- Abbott Laboratories

- Stryker

- Baxter International

- Boston Scientific

- Terumo Corporation

- Siemens Healthineers

- Edwards Lifesciences

- Johnson & Johnson MedTech

- Smith & Nephew

- Medline Industries

- Roche Diagnostics

- Fresenius Medical Care

- GE Healthcare

The global medical supplies market is segmented as follows:

By Type

- Disinfectants

- Diagnostic Supplies

- Catheters

- Infusions & Injectable Supplies

- Radiology Consumables

- Sterilization Consumables

- Dialysis Consumables

- PPE

- Wound Care Consumables

- Others

By Application

- Urology

- Wound Care

- Radiology

- IVD

- Respiratory

- Cardiology

- Infection Control

- Others

By End-User

- Clinics

- Hospitals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical supplies are instruments, tools, consumables, and devices that are used for the treatment, diagnosis, or monitoring of patients.

The global medical supplies market is expected to be influenced by the rising number of patients across the globe.

According to study, the global medical supplies market size was worth around USD 146.86 million in 2024 and is predicted to grow to around USD 215.31 million by 2034.

The CAGR value of the medical supplies market is expected to be around 3.90% during 2025-2034.

The global medical supplies market is expected to be dominated by North America during the forecast period.

The global medical supplies market is led by players like Becton, Dickinson and Company (BD), Medtronic, Abbott Laboratories, Stryker, Baxter International, Boston Scientific, Terumo Corporation, Siemens Healthineers, Edwards Lifesciences, Johnson & Johnson MedTech, Smith & Nephew, Medline Industries, Roche Diagnostics, Fresenius Medical Care, and GE Healthcare.

The report explores crucial aspects of the medical supplies market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed