Medical Fluid Bags Market Size, Share, Trends and Forecast 2034

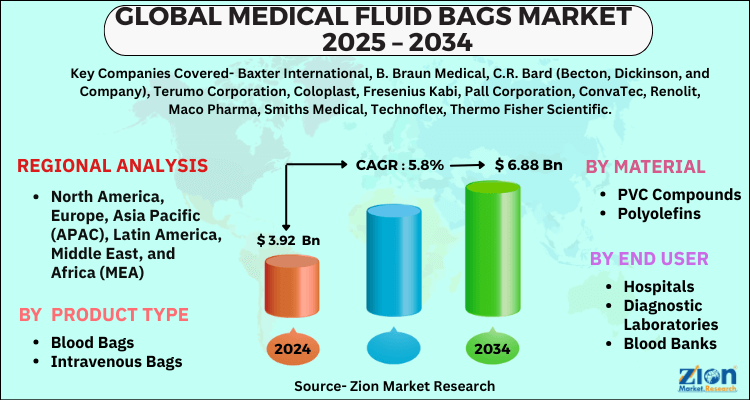

Medical Fluid Bags Market By Product Type (Blood Bags, Intravenous Bags, Dialysis Bags, and Others), By Material (PVC Compounds, Polyolefins, and Others), and By End-User (Hospitals, Diagnostic Laboratories, Blood Banks, Ambulatory Surgical Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

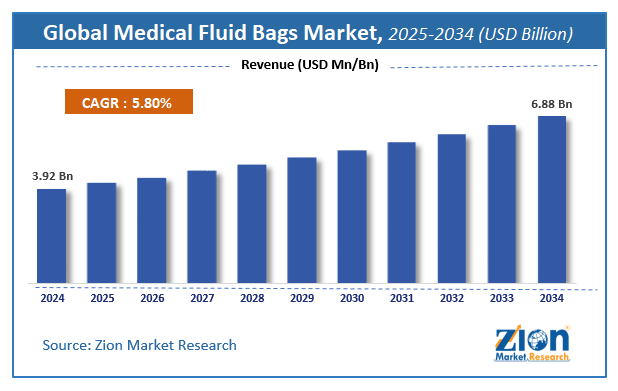

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.92 Billion | USD 6.88 Billion | 5.8% | 2024 |

Medical Fluid Bags Industry Perspective

The global medical fluid bags market size was worth around USD 3.92 Billion in 2024 and is predicted to grow to around USD 6.88 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.8% between 2025 and 2034. The report analyzes the global medical fluid bags market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the medical fluid bags industry.

Medical Fluid Bags Market: Overview

Medical fluid bags come in a variety of sizes and are made up of an interior pouch and an outside plastic coating. The separation of these bags into an inner pouch and an exterior covering serves to protect the contents until the pouches' specified expiry date. These bags are commonly utilized in healthcare settings with a multifunctional approach to maintain proper sterilized conditions for blood samples, which helps to ensure infection-free premises, reduce disease spread, and avoid any loss of blood samples or medications. Additionally, these bags are utilized in fluid replacement treatment, which is used to ensure blood transfusions, body fluid collection, electrolyte imbalances, and the patient's healthy nutritional intake via an oral or enteral route of administration.

Medical fluid bags are specialized bags which are widely used in critical patient care. Thousands of individuals living with serious diseases rely on collection bags and fluid pouches as a part of their everyday lives. These bags help patients who have gone through a surgery or suffering from some serious disorders. The bags are very useful in the management of various conditions such as blood transfusion, intravenous drug therapy, body fluid collection, etc.

Key Insights

- As per the analysis shared by our research analyst, the global medical fluid bags market is estimated to grow annually at a CAGR of around 5.8% over the forecast period (2025-2034).

- Regarding revenue, the global medical fluid bags market size was valued at around USD 3.92 Billion in 2024 and is projected to reach USD 6.88 Billion by 2034.

- The medical fluid bags market is projected to grow at a significant rate due to increasing hospital admissions, demand for sterile and disposable medical bags, and advancements in iv therapy solutions.

- Based on Product Type, the Blood Bags segment is expected to lead the global market.

- On the basis of Material, the PVC Compounds segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User, the Hospitals segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Medical Fluid Bags Market: Growth Drivers

Growing geriatric population may boost the market growth over the forecast period

The global increase in the number of geriatric and older persons is likely to boost the market. According to the World Health Organization, the share of the world population over 60 years old is predicted to rise by 22% by 2050, reaching 2 billion people. In the year 2020, the number of persons over 60 years old outweighed children under the age of five. By 2050, 80 percent of the world's elderly will be living in low- and middle-income countries. This is a significant problem for countries throughout the world since they must guarantee that their social and health systems are capable of dealing with this demographic transformation. Chronic obstructive lung disease, diabetes, obesity, and heart disease are all frequent illnesses in older people.

Geriatric syndromes refer to the rise of complicated health conditions such as urine incontinence, frailty, and cancer as people get older. As medical fluid bags are used to store blood, drain, glucose, and other liquids, it will have a significant impact on the growth of the global medical fluid bag market. Furthermore, the increase and development of numerous chronic diseases, such as obesity, cardiovascular diseases, and other associated conditions, are also driving the market.

The medical fluid bags market is expected to witness a robust growth in the near future. The market is mainly driven by the growing geriatric population and increasing prevalence of chronic diseases. Prevalence of chronic diseases such as heart diseases, diabetes, and cancer account for the high mortality rate across the globe. These chronic diseases lead to long-term hospital stays and require vital care during a hospital stay. Growing need for parenteral nutrition among the patients owing to the difficulty in swallowing is boosting the growth of the market. However, widespread use of polyvinyl chloride with Di(2-ethylhexyl)phthalate for manufacturing of medical fluid bags may hamper the market growth over the forecast period. Growing technological advancements in the production and design of polymer bags and pouches for a diverse range of medical applications are expected to offer lucrative business opportunities in the future.

Medical Fluid Bags Market: Restraints

Health hazards associated with components used in the manufacturing of medical fluid bags may impede market growth

Concerns about incorrect disposal having a negative influence on the environment, as well as difficulties linked with the usage of PVC-made medical fluid bags on patients’ overall health, might stymie market growth. Prolonged exposure to endocrine-disrupting di-(2-Ethylhexyl) phthalate (DEHP) and bisphenol-A (BPA) has been linked to major health problems, according to the National Centers for Biotechnology Information.

Medical Fluid Bags Market: Opportunities

Increasing the use of eco-friendly materials for the manufacturing of medical fluid bags will provide better growth opportunities for the market expansion

This growing emphasis on the usage of environmentally friendly materials in the creation of medical specialty bags will have a favorable influence on the market's growth in the coming years. Because of the negative effects of DEHP-PVC medical bags on human health and the environment, PVC-free medical bags have been developed. Several governmental and private groups are encouraging the adoption of environmentally friendly materials in medical disposables to safeguard caregivers and patients from the pollution generated by PVC manufacture and disposal. To limit the quantity of waste created during ostomy treatments, vendors are also producing washable and biodegradable pouch liners, which is one of the important trends in the global medical fluid bags market.

Medical Fluid Bags Market: Challenges

Stringent regulatory approvals for the manufacturing of medical fluid bags pose a major challenge to the market growth

The Food and Drug Administration (FDA) in the United States oversees the development, approval, and post-approval monitoring of medical devices, counting medical fluid bags. The majority of medical fluid bags are classed as Class I medical devices, requiring manufacturers to register their businesses. In order to receive FDA clearance, medical fluid bags must also have correct labeling and fulfill the packaging standard standards of 21 CFR 175.105. Such mandatory regulatory requirements may cause a delay in product launches, limiting the arrival of new medical fluid bags in the market.

Medical Fluid Bags Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Fluid Bags Market |

| Market Size in 2024 | USD 3.92 Billion |

| Market Forecast in 2034 | USD 6.88 Billion |

| Growth Rate | CAGR of 5.8% |

| Number of Pages | 190 |

| Key Companies Covered | Baxter International, B. Braun Medical, C.R. Bard (Becton, Dickinson, and Company), Terumo Corporation, Coloplast, Fresenius Kabi, Pall Corporation, ConvaTec, Renolit, Maco Pharma, Smiths Medical, Technoflex, Thermo Fisher Scientific,, and others. |

| Segments Covered | By Product Type, By Material, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Fluid Bags Market: Segmentation

The global medical fluid bag market is categorized into product type, material, end-user, and region. Based on product type, the market is categorized into intravenous bags, blood bags, dialysis bags, and others. The material segment of the market is bifurcated into polyolefins, PVC compounds, and others. The end-user segment is further divided into ambulatory surgical centers, hospitals, blood banks, diagnostic laboratories, and others.

Recent Developments

In November 2020, Fagron Sterile Services (FSS) introduced Intravenous (IV) Bags, which complement the company's current HYDROmorphone, fentaNYL, and midazolam brands. This introduction aided the corporation in expanding its product variety and increasing revenues.

Medical Fluid Bags Market: Regional Landscape

North America to lead the global market over the forecast period.

The Asia Pacific holds the major share of the global medical fluid bags market. This is primarily due to the high patient population, increasing prevalence of chronic diseases, large number geriatric population, and emerging healthcare infrastructure. China and India are expected to remain the major revenue contributor in the regional market owing to the huge patient population and presence of key vendors. North America and Europe are projected to contribute significant revenue to the global market during the forecast period

Medical Fluid Bags Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the medical fluid bags market on a global and regional basis.

Major players operating in the global medical fluid bags market include-

- Baxter International

- B. Braun Medical

- C.R. Bard (Becton

- Dickinson

- and Company)

- Terumo Corporation

- Coloplast

- Fresenius Kabi

- Pall Corporation

- ConvaTec

- Renolit

- Maco Pharma

- Smiths Medical

- Technoflex

- Thermo Fisher Scientific

The global medical fluid bags market is segmented as follows:

By Product Type

- Blood Bags

- Intravenous Bags

- Dialysis Bags

- Others

By Material

- PVC Compounds

- Polyolefins

- Others

By End User

- Hospitals

- Diagnostic Laboratories

- Blood Banks

- Ambulatory Surgical Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global medical fluid bags market is expected to grow due to increasing demand for iv therapy, blood transfusions, and dialysis treatments, along with advancements in biocompatible materials and rising healthcare expenditures.

According to a study, the global medical fluid bags market size was worth around USD 3.92 Billion in 2024 and is expected to reach USD 6.88 Billion by 2034.

The global medical fluid bags market is expected to grow at a CAGR of 5.8% during the forecast period.

North America is expected to dominate the medical fluid bags market over the forecast period.

Leading players in the global medical fluid bags market include Baxter International, B. Braun Medical, C.R. Bard (Becton, Dickinson, and Company), Terumo Corporation, Coloplast, Fresenius Kabi, Pall Corporation, ConvaTec, Renolit, Maco Pharma, Smiths Medical, Technoflex, Thermo Fisher Scientific,, among others.

The report explores crucial aspects of the medical fluid bags market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed