Marine Insurance Market Size, Share, Trends, Growth 2032

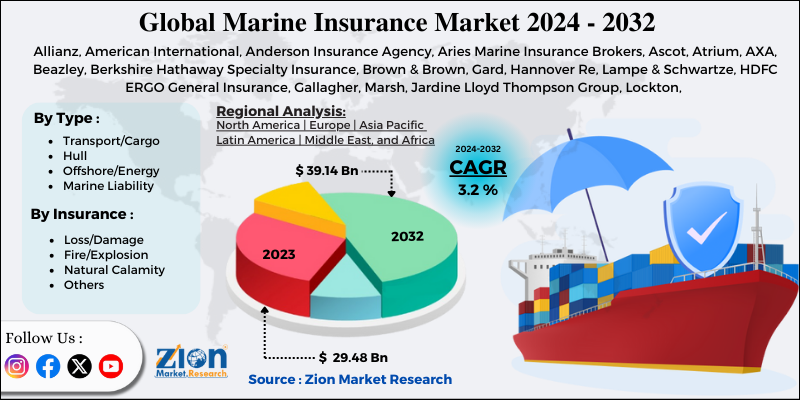

Marine Insurance Market By Type (Transport/Cargo, Hull, Offshore/Energy, and Marine Liability) and By Insurance (Loss/Damage, Fire/Explosion, Natural Calamity, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

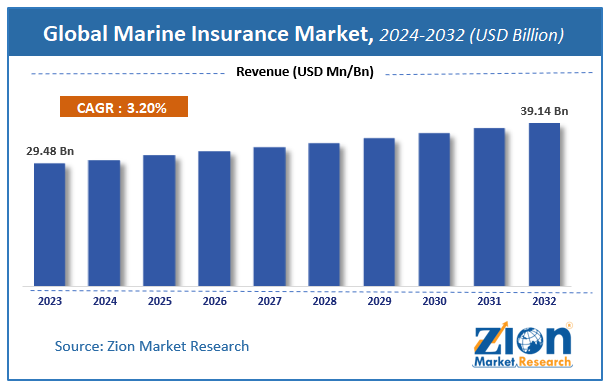

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 29.48 Billion | USD 39.14 Billion | 3.2% | 2023 |

Marine Insurance Market Insights

Zion Market Research has published a report on the global Marine Insurance Market, estimating its value at USD 29.48 Billion in 2023, with projections indicating that it will reach USD 39.14 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 3.2% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Marine Insurance Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

The report covers a forecast and an analysis of the marine insurance market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints of the marine insurance market along with their impact on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the marine insurance market on a global level.

Marine Insurance Market: Growth Factors

Marine insurance includes the damages or losses caused to terminals, ships, and transport or cargo that acquire, transfer, or hold goods between different points of source and final terminus. The term “marine insurance” also relates to inland marine. However, it is typically used in the setting of marine insurance of ocean. The damages caused to ships and transported cargoes are included in marine insurance. The sea is the riskiest route of transportation. The huge need for insurance in the marine industry is propelling the growth of the marine insurance market globally.

Moreover, the use of online gateways is also expected to boost the global marine insurance market development in the future. The introduction of advanced technologies in the marine industry, such as digitization and analytics, is further propelling the marine insurance market globally.

In order to give the users of this report a comprehensive view of the marine insurance market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new service type launch, agreements, partnerships, collaborations & joint ventures, research & development, service type, and regional expansion of major participants involved in the market.

Marine Insurance Market: Segmentation

The marine insurance market is fragmented into type and insurance.

By type, the global marine insurance market includes transport/cargo, hull, offshore/energy, and marine liability. The transport/cargo insurance segment accounted for a major share, i.e., more than 50%, in 2018 and is expected to register a high growth rate over the forecast time period.

Based on insurance, the global marine insurance market includes loss/damage, fire/explosion, natural calamity, and others. The loss/damage segment accounted for the largest market share, i.e., around 60%, in 2018, due to the increasing marine cases of accidental damages.

Marine Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Marine Insurance Market |

| Market Size in 2023 | USD 29.48 Billion |

| Market Forecast in 2032 | USD 39.14 Billion |

| Growth Rate | CAGR of 3.2% |

| Number of Pages | 110 |

| Key Companies Covered | Allianz, American International, Anderson Insurance Agency, Aries Marine Insurance Brokers, Ascot, Atrium, AXA, Beazley, Berkshire Hathaway Specialty Insurance, Brown & Brown, Gard, Hannover Re, Lampe & Schwartze, HDFC ERGO General Insurance, Gallagher, Marsh, Jardine Lloyd Thompson Group, Lockton, Mitsui Sumitomo Insurance, Munich Re, Sirius International Insurance Group, SOMPO Taiwan Brokers, Swiss Re, Thomas Miller, Tokio Marine Holdings, United India Insurance, Willis Towers Watson, XL Catlin, Zurich Insurance, and Chubb |

| Segments Covered | By type, By insurance and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Marine Insurance Market: Regional Insights

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

By geography, Europe accounted for the largest share of the global marine insurance market in 2018 and is expected to remain dominant over the forecast time period as well. Marine transport is one of the most important drivers of the European economy, as it carries half of Europe’s goods and maintains millions of jobs. Thus, there is an increased demand for marine insurance in the region, which is anticipated to boost the growth of the European marine insurance market in the years ahead. Asia Pacific is expected to register the highest CAGR in the future in the global marine insurance market.

Marine Insurance Market: Competitive Space

The global marine insurance market profiles key players such as:

- Allianz

- American International

- Anderson Insurance Agency

- Aries Marine Insurance Brokers

- Ascot

- Atrium

- AXA, Beazley

- Berkshire Hathaway Specialty Insurance

- Brown & Brown

- Gard

- Hannover Re

- Lampe & Schwartze

- HDFC ERGO General Insurance

- Gallagher

- Marsh

- Jardine Lloyd Thompson Group

- Lockton

- Mitsui Sumitomo Insurance

- Munich Re

- Sirius International Insurance Group

- SOMPO Taiwan Brokers

- Swiss Re

- Thomas Miller

- Tokio Marine Holdings

- United India Insurance

- Willis Towers Watson

- XL Catlin

- Zurich Insurance

- Chubb

This report segments the global marine insurance market into:

Global Marine Insurance Market: Type Analysis

- Transport/Cargo

- Hull

- Offshore/Energy

- Marine Liability

Global Marine Insurance Market: Insurance Analysis

- Loss/Damage

- Fire/Explosion

- Natural Calamity

- Others

Global Marine Insurance Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Protecting against losses or damages to ships, cargo, and other vessels during transit over water is a form of insurance coverage known as marine insurance. It encompasses a broad spectrum of hazards that are linked to maritime activities.

The demand for marine insurance is increasing due to the expansion of global trade and the growth of e-commerce, which are addressing the risks associated with the transportation of products by sea.

Zion Market Research has published a report on the global Marine Insurance Market, estimating its value at USD 29.48 Billion in 2023, with projections indicating that it will reach USD 39.14 Billion by 2032.

Zion Market Research has published a report on the global Marine Insurance Market is expected to expand at a compound annual growth rate (CAGR) of 3.2% over the forecast period 2024-2032.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Some key players operating in the global marine insurance market are Allianz, American International, Anderson Insurance Agency, Aries Marine Insurance Brokers, Ascot, Atrium, AXA, Beazley, Berkshire Hathaway Specialty Insurance, Brown & Brown, Gard, Hannover Re, Lampe & Schwartze, HDFC ERGO General Insurance, Gallagher, Marsh, Jardine Lloyd Thompson Group, Lockton, Mitsui Sumitomo Insurance, Munich Re, Sirius International Insurance Group, SOMPO Taiwan Brokers, Swiss Re, Thomas Miller, Tokio Marine Holdings, United India Insurance, Willis Towers Watson, XL Catlin, Zurich Insurance, and Chubb.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed