Liver Cancer Diagnostics Market Size, Share, Trends, Growth & Forecast 2034

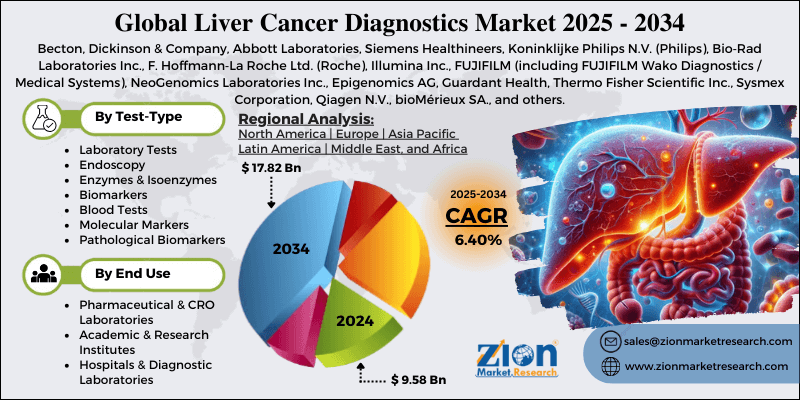

Liver Cancer Diagnostics Market By Test-Type (Growth Factors & Receptors, Laboratory Tests, Endoscopy, Enzymes & Isoenzymes, Biomarkers, Blood Tests, Molecular Markers, Oncofetal & Glycoprotein Antigens, Pathological Biomarkers, Biopsy, Imaging Tests, and Others), By End-Use (Pharmaceutical & CRO Laboratories, Academic & Research Institutes, and Hospitals & Diagnostic Laboratories), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

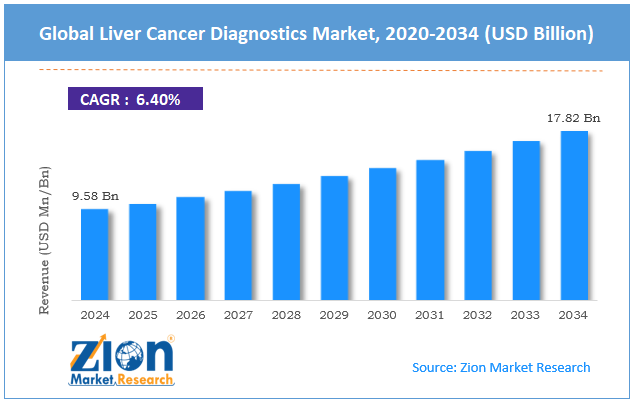

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.58 Billion | USD 17.82 Billion | 6.40% | 2024 |

Liver Cancer Diagnostics Industry Perspective:

The global liver cancer diagnostics market size was worth around USD 9.58 billion in 2024 and is predicted to grow to around USD 17.82 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.40% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global liver cancer diagnostics market is estimated to grow annually at a CAGR of around 6.40% over the forecast period (2025-2034)

- In terms of revenue, the global liver cancer diagnostics market size was valued at around USD 9.58 billion in 2024 and is projected to reach USD 17.82 billion by 2034.

- The liver cancer diagnostics market is projected to grow at a significant rate due to the rising prevalence of liver cancer and increasing pressure on the healthcare system.

- Based on the test type, the laboratory tests segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-use, the hospitals & diagnostic laboratories segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Liver Cancer Diagnostics Market: Overview

Liver cancer diagnostics refers to the wide range of tests and procedures conducted to diagnose the presence of liver cancer cells. According to the Mayo Clinic, different types of cancer can develop in the liver. However, the common type of liver cancer is hepatocellular carcinoma. It begins in the hepatocyte, which is the main type of liver cell. Other common forms of liver cancer include hepatoblastoma and cholangiocarcinoma. The industry for liver cancer diagnostic procedures comprises a growing number of tests that help confirm the presence of cancer cells in the liver and determine the type of cells. The tests include imaging procedures, blood tests, and the removal of a sample of liver tissue for testing. If the diagnosis of liver cancer is confirmed, medical professionals may recommend further tests to determine the liver cancer stage for further treatment.

During the forecast period, demand for effective liver cancer diagnostics is expected to continue growing with the rising prevalence of the disease across the globe.Additionally, improvements in diagnostic technology and increased cancer research may open new avenues for future growth. Advancements in multi-cancer early detection solutions may open new avenues for improved revenue for the industry players. The high cost of diagnostic procedures and growing cases of delayed diagnosis may impact market revenue in the long run.

Liver Cancer Diagnostics Market Dynamics

Growth Drivers

Rising prevalence of liver cancer and increasing pressure on the healthcare system are driving market demand

The global liver cancer diagnostics market is expected to be driven by the growing prevalence of the disease across the globe. According to the National Cancer Institute, liver cancer is the 6th most common type of cancer reported worldwide. Liver cancer develops due to mutations in the Deoxyribonucleic acid (DNA) of liver cells.

However, in certain cases, the actual cause of liver cancer may remain unclear. For instance, liver cancer may develop in individuals with no underlying condition, and researchers are unable to confirm the reason for it. There are certain risk factors that increase the chances of developing liver cancer. These risk factors include liver cirrhosis, chronic infection with the hepatitis C virus (HCV), and hepatitis B virus (HBV).

Furthermore, genetic factors play a crucial role as certain inherited liver diseases may also lead to the development of cancer cells. Other prominent risk factors are exposure to aflatoxins, nonalcoholic fatty liver disease, diabetes, and excessive alcohol consumption. Increasing cases of liver cancer have become a global public health concern. Early diagnosis of liver cancer can help improve the probability of successful treatment and final results.

How will the integration of advanced technologies for liver cancer diagnosis aid in higher revenue in the liver cancer diagnostics market?

Scientists and researchers across the globe are increasingly investing in integrating new and advanced technologies to enhance the performance of liver cancer diagnostic tools and solutions. According to industry analysis, some of the most promising breakthrough technologies expected to drive growth in the global liver cancer diagnostics market are Artificial Intelligence (AI), Machine Learning (ML), liquid biopsies, and next-generation sequencing (NGS).

For instance, in April 2025, researchers from the Mayo Clinic reported that AI that can recognize its mistakes can assist in improving the rate of liver cancer diagnosis. The novel approach is called uncertainty quantification and can prove beneficial to clinicians working on liver cancer and other diseases.

Restraints

Limited healthcare infrastructure and high cost of diagnosis can affect market revenue

The global liver cancer diagnostics industry is expected to be restricted due to limited healthcare infrastructure in developing and underdeveloped nations worldwide. A large number of countries have limited access to sophisticated and advanced cancer diagnostic facilities. Additionally, the high cost of diagnosis can further affect overall market revenue. A lack of access to external financial aid, such as insurance or reimbursement policies for liver cancer diagnostic tests, will impede the market growth rate during the forecast period.

Opportunities

Will the growing focus on early detection of liver cancer generate growth opportunities for liver cancer diagnostics industry leaders?

The global liver cancer diagnostics market is projected to generate growth opportunities as more focus is being directed toward the early detection of the disease. In April 2025, the US Food & Drug Administration (FDA) approved the breakthrough device designation for the EvoLiver test by Mursla Bio. The device is used for monitoring hepatocellular carcinoma (HCC) in patients with high-risk cirrhosis. During the MEV01 trial, the extracellular vesicle (EV) multiomics biomarker signature of Evoliver delivered 86% sensitivity for early-stage HCC. It also achieved 88% specificity.

In April 2025, researchers in Manchester reported success in identifying the curable and early stages of common liver cancer using a novel test. It is called Elecsys®GAAD and was developed by Roche Diagnostics. The test delivers results using a combination of blood tests with age and gender, thus improving the detection rate of HCC during its early stages.

Furthermore, industry leaders are also working on developing more effective multi-cancer early detection (MCED) tools, further aiding improved revenue in the industry. These diagnostic tests are designed to screen for multiple types of cancer using a simple blood sample before the symptoms appear. MCEDs are designed to enhance the efficiency of treatments by detecting cancer at its early stages.

Challenges

Does the lack of diagnosis and growing cases of misdiagnosis challenge the liver cancer diagnostics market revenue?

The global liver cancer diagnostics is projected to be challenged by the limited number of diagnostic facilities for rare liver cancers globally. In addition, the growing cases of delayed diagnosis or misdiagnosis may further affect market expansion trends. Such incidents can prove fatal for the patients or lead to worsening of health conditions. Ensuring the accuracy of new liver cancer diagnostic solutions will remain a major challenge for the industry players.

Liver Cancer Diagnostics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Liver Cancer Diagnostics Market |

| Market Size in 2024 | USD 9.58 Billion |

| Market Forecast in 2034 | USD 17.82 Billion |

| Growth Rate | CAGR of 6.40% |

| Number of Pages | 213 |

| Key Companies Covered | Becton, Dickinson & Company, Abbott Laboratories, Siemens Healthineers, Koninklijke Philips N.V. (Philips), Bio‑Rad Laboratories Inc., F. Hoffmann‑La Roche Ltd. (Roche), Illumina Inc., FUJIFILM (including FUJIFILM Wako Diagnostics / Medical Systems), NeoGenomics Laboratories Inc., Epigenomics AG, Guardant Health, Thermo Fisher Scientific Inc., Sysmex Corporation, Qiagen N.V., bioMérieux SA., and others. |

| Segments Covered | By Test-Type, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Liver Cancer Diagnostics Market: Segmentation

The global liver cancer diagnostics market is segmented based on test type, end-use, and region.

Based on the test type, the global market segments are growth factors & receptors, laboratory tests, endoscopy, enzymes & isoenzymes, biomarkers, blood tests, molecular markers, oncofetal & glycoprotein antigens, pathological biomarkers, biopsy, imaging tests, and others. In 2024, around 40% of the total revenue was a result of the laboratory tests segment. In the coming years, it will continue to deliver rapid results. Laboratory tests are highly cost-effective. Moreover, they are readily available. Increasing investments in advanced and more accurate laboratory tests will further help the segment thrive during the forecast period.

Based on end-use, the global market divisions are pharmaceutical & CRO laboratories, academic & research institutes, and hospitals & diagnostic laboratories. In 2024, the highest revenue-generating segment was hospitals & diagnostic laboratories, accounting for nearly 41% of the total revenue. It will continue to dominate in the coming years. Factors such as the growing demand for biopsies for diagnosing rare and advanced cases of liver cancer will fuel segmental expansion. Rising hospitalizations and a growing number of hospital-affiliated diagnostic laboratories will propel segmental demand.

Liver Cancer Diagnostics Market: Regional Analysis

What factors will help North America lead the global liver cancer diagnostics market during the forecast period?

The global liver cancer diagnostics market is expected to be led by North America during the forecast period. In 2024, the region accounted for around 40.05% of the global revenue, with the US dominating the regional landscape. North America dominates in terms of a robust and expanding healthcare sector, along with comprehensive national insurance policies covering serious medical cases. Moreover, easy access to advanced cancer diagnostic tools will further facilitate regional expansion. The US FDA is increasingly working with industry players to develop more effective diagnostic tools for greater application.

Asia-Pacific is projected to emerge as the second-highest revenue generator in the liver cancer diagnostics industry, with China, India, and Japan leading the region. China is expected to register a CAGR of over 8.31% during the projection period. The Asia-Pacific is witnessing a growing prevalence of liver cancer. Recent studies indicate a growing rate of people affected by non-alcoholic fatty liver disease (NAFLD). As per recent findings, around 40% of the regional population in India may be affected by NAFLD, creating demand for effective liver cancer diagnosis infrastructure.

Liver Cancer Diagnostics Market: Competitive Analysis

The global liver cancer diagnostics market is led by players like:

- Becton

- Dickinson & Company

- Abbott Laboratories

- Siemens Healthineers

- Koninklijke Philips N.V. (Philips)

- Bio‑Rad Laboratories Inc.

- F. Hoffmann‑La Roche Ltd. (Roche)

- Illumina Inc.

- FUJIFILM (including FUJIFILM Wako Diagnostics / Medical Systems)

- NeoGenomics Laboratories Inc.

- Epigenomics AG

- Guardant Health

- Thermo Fisher Scientific Inc.

- Sysmex Corporation

- Qiagen N.V.

- bioMérieux SA.

The global liver cancer diagnostics market is segmented as follows:

By Test-Type

- Growth Factors & Receptors

- Laboratory Tests

- Endoscopy

- Enzymes & Isoenzymes

- Biomarkers

- Blood Tests

- Molecular Markers

- Oncofetal & Glycoprotein Antigens

- Pathological Biomarkers

- Biopsy

- Imaging Tests

- Others

By End-Use

- Pharmaceutical & CRO Laboratories

- Academic & Research Institutes

- Hospitals & Diagnostic Laboratories

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Liver cancer diagnostics refers to the wide range of tests and procedures conducted to diagnose the presence of liver cancer cells.

The global liver cancer diagnostics market is expected to be driven by the growing prevalence of the disease across the globe.

According to study, the global liver cancer diagnostics market size was worth around USD 9.58 billion in 2024 and is predicted to grow to around USD 17.82 billion by 2034.

The CAGR value of the liver cancer diagnostics market is expected to be around 6.40% during 2025-2034.

The global liver cancer diagnostics market will be led by North America during the forecast period

The global liver cancer diagnostics market is led by players like Becton, Dickinson & Company, Abbott Laboratories, Siemens Healthineers, Koninklijke Philips N.V. (Philips), Bio‑Rad Laboratories, Inc., F. Hoffmann‑La Roche Ltd. (Roche), Illumina, Inc., FUJIFILM (including FUJIFILM Wako Diagnostics / Medical Systems), NeoGenomics Laboratories, Inc., Epigenomics AG, Guardant Health, Thermo Fisher Scientific, Inc., Sysmex Corporation, Qiagen N.V., and bioMérieux SA.

The report explores crucial aspects of the liver cancer diagnostics market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed