Litigation Funding Investment Market Size, Share, And Growth Report 2032

Litigation Funding Investment Market By Application (Class Action Lawsuit Funding, Commercial Litigation Funding, Insolvency Litigation Funding, Patent Litigation Funding, Labor Lawsuit Funding, Consumer Disputes, Intellectual Property Litigation Funding, International Arbitration, and Others), and By End User (Individuals, Businesses, and Law Firms and Attorneys): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

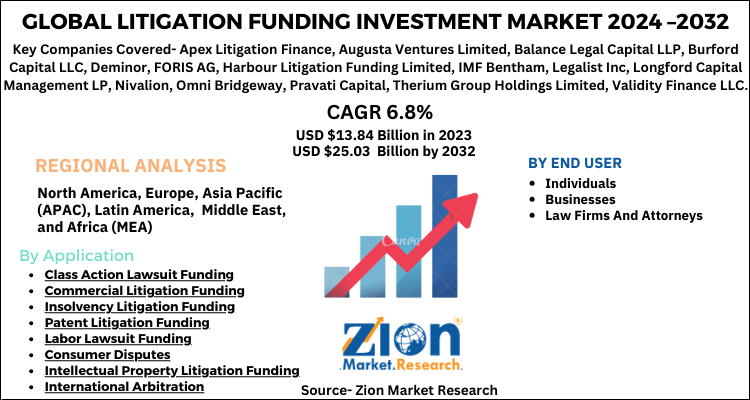

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.84 Billion | USD 25.03 Billion | 6.8% | 2023 |

Litigation Funding Investment Market Insights

Zion Market Research has published a report on the global Litigation Funding Investment Market, estimating its value at USD 13.84 Billion in 2023, with projections indicating that it will reach USD 25.03 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.8% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Litigation Funding Investment Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Litigation Funding Investment Market: Overview

Litigation funding investment is also known as legal financing and third-party litigation funding (TPLF). Litigation funding broadly refers to a financing arrangement whereby the legal costs and expenses of a party are funded by a third party that is not a party to the dispute. This is normally done in exchange for a financial reward of an agreed share of any favorable award or settlement.

The funded cases are usually those being adjudicated at a well-established and reliable forum with a realistic claim value and good prospects of success. In recent years, litigation funding investment has emerged as a lucrative, fast-growing, and attractive asset class. In the global market, the U.S., the UK, and Australia are some of the leading countries showing tremendous potential and growth during the forecast period in this market.

Global Litigation Funding Investment Market: Growth Factors

An increase in the investments of petty legal suits is driving the growth of the litigation funding investment market. In the case of class action lawsuits, consumer disputes, labor lawsuits, international arbitration, intellectual property disputes, and commercial lawsuit, this litigation funding is being utilized. Additionally, as stated by ICC, the top countries with parties represented 210 cases in the United States, 139 cases in France, 117 in Brazil, 110 in Spain, and 95 in Germany.

Moreover, as per the survey, between 1998 and 2017, consumer products had the highest share of patent litigation cases with 14 percent for practicing entities and 2 percent for non-practicing entities. Thereby, certain incidents are gradually influencing the demand for litigation funding investment market.

Notwithstanding decreasing risk, utilizing outsider subsidizing instead of self-financing lawful debates conveys prompt bookkeeping advantages to organizations and law offices. Advances add to working costs and consequently, lessen benefits. Interestingly, debate subsidizing eliminates that cost, and in certain conditions, even be treated as income, promptly boosting the monetary picture for an organization or law office.

Litigation Funding Investment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Litigation Funding Investment Market |

| Market Size in 2023 | USD 13.84 Billion |

| Market Forecast in 2032 | USD 25.03 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 110 |

| Key Companies Covered | Apex Litigation Finance, Augusta Ventures Limited, Balance Legal Capital LLP, Burford Capital LLC, Deminor, FORIS AG, Harbour Litigation Funding Limited, IMF Bentham, Legalist Inc, Longford Capital Management LP, Nivalion, Omni Bridgeway, Pravati Capital, Therium Group Holdings Limited, Validity Finance LLC, and Woodsford Litigation Funding Ltd among others. |

| Segments Covered | By Application, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Litigation Funding Investment Market: Segmentation

The global Litigation Funding Investment market can be segmented into application, end-user, and region. The application segment is bifurcated into Class Action Lawsuit Funding, Commercial Litigation Funding, Insolvency Litigation Funding, Patent Litigation Funding, Labor Lawsuit Funding, Consumer Disputes, Intellectual Property Litigation Funding, International Arbitration, and Others.

The end-user segment is bifurcated into individuals, Businesses, Law Firms, and Attorneys. Individual litigation funding is a new domain that is likely to pick up in the forecast period. The individual noncommercial dispute is difficult to objectify however, new technology artificial intelligence, and data analysis have made it possible to weigh individual cases on merits. Startups related to individual litigation funding are appearing on the horizon and in the future, the segment is likely to produce lucrative growth as efficiency in justice delivery mechanism will improve and awareness about it will be spread.

Global Litigation Funding Investment Market: Regional Analysis

Based on regions, the global Litigation Funding Investment market can be divided into five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The North American region is on the top of growth in terms of revenue for the litigation funding investment market. The development of case law in favor of commercial dispute funding in the United States helped warm its embrace by claimants as an alternative fee solution that served to dissolve financial barriers to the courts. These developments are likely to provide a fillip to the growth of litigation funding investments.

Within the Asia-Pacific region, Australia has a mature third-party funding market, while for the rest of the region, the market is still relatively new and growing. Nevertheless, the past few years have seen significant developments and the landscape is changing.

Global Litigation Funding Investment Market: Competitive Players

Some of the key players in the Litigation Funding Investment market are

- Apex Litigation Finance

- Augusta Ventures Limited

- Balance Legal Capital LLP

- Burford Capital LLC

- Deminor

- FORIS AG

- Harbour Litigation Funding Limited

- IMF Bentham

- Legalist Inc

- Longford Capital Management LP

- Nivalion

- Omni Bridgeway

- Pravati Capital

- Therium Group Holdings Limited

- Validity Finance LLC

- Woodsford Litigation Funding Ltd among others.

This Report Segments the Global Litigation Funding Investment Market into:

By Application

- Class Action Lawsuit Funding

- Commercial Litigation Funding

- Insolvency Litigation Funding

- Patent Litigation Funding

- Labor Lawsuit Funding

- Consumer Disputes

- Intellectual Property Litigation Funding

- International Arbitration

By End User

- Individuals

- Businesses

- Law Firms And Attorneys

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An increase in the investments of petty legal suits is driving the growth of the litigation funding investment market. Additionally, the surging trend of high yield, at potentially lower risk is fueling the market growth.

According to Zion Market Research, the global Litigation Funding Investment Market, estimating its value at USD 13.84 Billion in 2023, with projections indicating that it will reach USD 25.03 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.8% over the forecast period 2024-2032.

The North American region is expected to make notable contributions to the growth of the Litigation Funding Investment market.

Some main participants of the Litigation Funding Investment market Apex Litigation Finance, Augusta Ventures Limited, Balance Legal Capital LLP, Burford Capital LLC, Deminor, FORIS AG, Harbour Litigation Funding Limited, IMF Bentham, Legalist Inc, Longford Capital Management LP, Nivalion, Omni Bridgeway, Pravati Capital, Therium Group Holdings Limited, Validity Finance LLC, and Woodsford Litigation Funding Ltd among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed