Global Line Scan Camera Market Size, Share, Growth Analysis Report - Forecast 2034

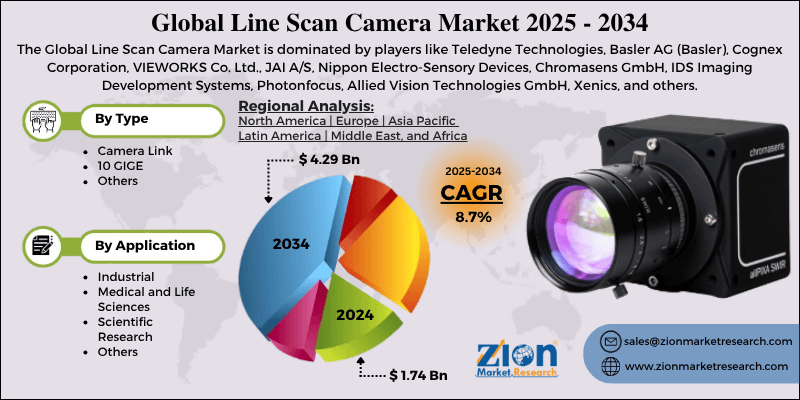

Line Scan Camera Market By Type (Camera Link, 10 GIGE, Others), By Application (Industrial, Medical and Life Sciences, Scientific Research, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.74 Billion | USD 4.29 Billion | 8.7% | 2024 |

Line Scan Camera Market: Industry Perspective

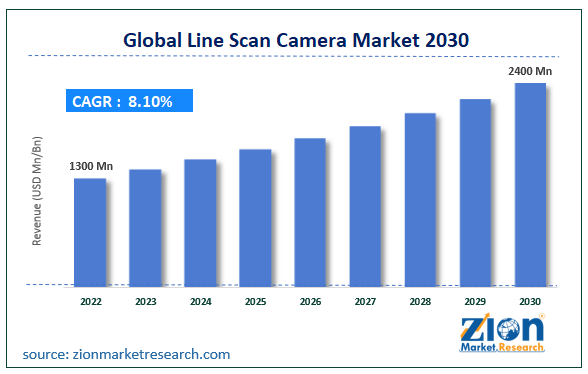

The global line scan camera market size was worth around USD 1.74 Billion in 2024 and is predicted to grow to around USD 4.29 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.7% between 2025 and 2034. The report analyzes the global line scan camera market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the line scan camera industry.

Line Scan Camera Market: Overview

With only one row of pixels, line scan cameras can gather data rapidly. The sensors in these cameras are long and thin. With a line scan camera, a 2D picture is produced by moving the object down the sensor's narrow axis, one line at a time, and then using software to reassemble the image. When the object passes in front of the camera, a picture is constructed line by line. To get steady and significant images, the line scan sensor's timing must be in sync with the object's movement. These cameras' linear pixel arrangement enables the creation of large arrays. The ideal uses for these cameras are high-speed tasks requiring measurements in microns, such as document scanning, print inspection, and comprehensive inspections.

Key Insights

- As per the analysis shared by our research analyst, the global line scan camera market is estimated to grow annually at a CAGR of around 8.7% over the forecast period (2025-2034).

- Regarding revenue, the global line scan camera market size was valued at around USD 1.74 Billion in 2024 and is projected to reach USD 4.29 Billion by 2034.

- The line scan camera market is projected to grow at a significant rate due to increasing automation across diverse industries, the rising demand for high-speed and high-resolution imaging for quality control and inspection, and continuous technological advancements in sensor and imaging capabilities.

- Based on Type, the Camera Link segment is expected to lead the global market.

- On the basis of Application, the Industrial segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Line Scan Camera Market: Dynamics

Key Growth Drivers:

The line scan camera market is primarily driven by the accelerating adoption of automation and machine-vision systems across manufacturing sectors, where high-speed, continuous inspection of moving products (textiles, paper, metals, food, and packaging) is essential. Demand from semiconductor and electronics industries for high-resolution, high-throughput imaging fuels investment in advanced line scan solutions. Technological advances—such as higher sensor resolutions, faster data interfaces (GigE, Camera Link, CoaXPress), multispectral and hyperspectral sensing, and improved on-camera processing—enhance performance and broaden use-cases. Growing needs for quality assurance, defect detection, and traceability in Industry 4.0 environments further push uptake of line scan cameras.

Restraints:

High upfront costs for premium line scan systems and their associated optics, illuminators, and processing hardware can limit adoption—especially among small and medium manufacturers. Integration complexity (synchronization with conveyors, specialized lighting setups, and tailored optics) raises deployment time and engineering costs. The requirement for specialized expertise in calibration, image analysis, and system tuning restricts rapid roll-out in regions lacking trained machine-vision engineers. Additionally, some applications may be served adequately by area-scan cameras or other inspection methods, reducing the addressable market for line scan solutions.

Opportunities:

Emerging opportunities include expanding applications in non-traditional sectors such as biomedical imaging, agricultural sorting, and postal/logistics scanning where continuous high-resolution inspection adds value. Miniaturization and cost reductions in sensors and interfaces open doors for more compact and budget-friendly line-scan modules suitable for SMEs. The combination of line scan hardware with AI-driven analytics and cloud-connected quality dashboards enables predictive quality control and remote monitoring, creating new value-added services and recurring revenue models. Growing investments in smart factories and the push for zero-defect manufacturing in automotive and electronics create long-term demand pipelines.

Challenges:

Key challenges include coping with the massive data volumes produced by high-resolution, high-speed line scan systems—requiring robust real-time processing, storage, and networking solutions. Ensuring uniform, application-specific illumination and optical alignment remains technically demanding and can make systems sensitive to environmental changes on the production line. Fragmentation of standards and a wide variety of custom application requirements complicate product roadmaps for vendors trying to balance versatility and cost. Finally, rapid technology evolution forces vendors and end-users to continually upgrade skills and hardware, creating budgetary and lifecycle-management pressures.

Line Scan Camera Market: Segmentation

The global Line Scan Camera industry is segmented based on the type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on the type, the global market is bifurcated into Camera Link, 10 GIGE, and Others. The 10 GIGE segment is expected to hold a significant market share over the forecast period. The segment growth is attributed to its high data transfer rates. When comparing 10 GigE technology to conventional Gigabit Ethernet, the data transmission speeds are noticeably higher. Line scan cameras, frequently produce significant volumes of data, especially in applications with high resolutions and quick imaging rates.

In addition, the increasing product launch is also driving the segment expansion. For instance, in October 2023, Emergent Vision Technologies, a pioneer in high-speed GigE Vision cameras and zero-data-loss vision technologies, introduced a new 10GigE line scan camera, the PACE LR-4KG35. Through its 10GigE SFP+ interface, the camera reaches a top single-line rate of 172KHz. The LR-4KG35 line scan camera features the 4Kx2 Gpixel GL3504 CMOS image sensor, with a 3.5×3.5µm pixel cell size and a 14.336 mm sensor scanning width. Both GigE Vision and GenICam compliant, the camera allows cable lengths from 1M up to 10 Km without the need for costly fiber converters/repeaters.

Based on the application, the global line scan camera industry is bifurcated into industrial, medical & life sciences, scientific research, and others. The industrial segment is expected to grow at the highest CAGR during the forecast period. The ongoing trend towards Industry 4.0 and smart manufacturing has significantly increased the demand for industrial line scan cameras. These cameras play a crucial role in automated processes, enabling high-speed and high-precision inspection in manufacturing lines. Industrial line scan cameras are widely utilized in inspection and quality control processes. In sectors including automotive, electronics, pharmaceuticals, food & beverage, and overall quality assurance, they support defect detection, guarantee product consistency, and improve overall quality assurance. Thus, driving the market growth.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Line Scan Camera Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Line Scan Camera Market |

| Market Size in 2024 | USD 1.74 Billion |

| Market Forecast in 2034 | USD 4.29 Billion |

| Growth Rate | CAGR of 8.7% |

| Number of Pages | 223 |

| Key Companies Covered | Teledyne Technologies, Basler AG (Basler), Cognex Corporation, VIEWORKS Co. Ltd., JAI A/S, Nippon Electro-Sensory Devices, Chromasens GmbH, IDS Imaging Development Systems, Photonfocus, Allied Vision Technologies GmbH, Xenics, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Line Scan Camera Market: Regional Analysis

Asia Pacific is expected to grow at the highest CAGR during the forecast period

The Asia Pacific is expected to grow at the highest CAGR in the global line scan camera market during the forecast period. The growth in the region is attributed to the automotive industry growth. The automotive industry in Asia Pacific, particularly in countries like China and India, has been expanding rapidly. Line scan cameras are employed in automotive manufacturing for tasks such as defect detection, assembly verification, and precision measurement.

For instance, according to the Society of Indian Automobile Manufacturers, the total number of passenger vehicles sold rose from 30,69,523 to 38,90,114. In comparison to the prior year, sales of passenger cars grew from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718, and vans from 1,13,265 to 1,39,020 units in FY-2022–2023. The total number of sales of commercial vehicles rose from 7,16,566 to 9,62,468 units. In comparison to the prior year, sales of Light Commercial Vehicles climbed from 4,75,989 to 6,03,465 units, while Sales of Medium and Heavy Commercial Vehicles increased from 2,40,577 to 3,59,003 units in FY-2022–2023. In comparison to the prior year, sales of three-wheelers grew to 4,88,768 units in FY 2022–2023. Sales of two-wheelers grew in FY-2022–2023 from 1,35,70,008 to 1,58,62,087 units over the prior year. Thus, the aforementioned stats drive the market growth in the region.

Line Scan Camera Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the line scan camera market on a global and regional basis.

The global Line Scan Camera market is dominated by players like:

- Teledyne Technologies

- Basler AG (Basler)

- Cognex Corporation

- VIEWORKS Co. Ltd.

- JAI A/S

- Nippon Electro-Sensory Devices

- Chromasens GmbH

- IDS Imaging Development Systems

- Photonfocus

- Allied Vision Technologies GmbH

- Xenics

The global Line Scan Camera market is segmented as follows:

By Type

- Camera Link

- 10 GIGE

- Others

By Application

- Industrial

- Medical and Life Sciences

- Scientific Research

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

With only one row of pixels, line scan cameras can gather data rapidly. The sensors in these cameras are long and thin. With a line scan camera, a 2D picture is produced by moving the object down the sensor's narrow axis, one line at a time, and then using software to reassemble the image. When the object passes in front of the camera, a picture is constructed line by line. To get steady and significant images, the line scan sensor's timing must be in sync with the object's movement. These cameras' linear pixel arrangement enables the creation of large arrays. The ideal uses for these cameras are high-speed tasks requiring measurements in microns, such as document scanning, print inspection, and comprehensive inspections.

The global line scan camera market is expected to grow due to rising demand for high-speed inspection in manufacturing, growth in automation and quality control applications, and advancements in machine vision technology.

According to a study, the global line scan camera market size was worth around USD 1.74 Billion in 2024 and is expected to reach USD 4.29 Billion by 2034.

The global line scan camera market is expected to grow at a CAGR of 8.7% during the forecast period.

North America is expected to dominate the line scan camera market over the forecast period.

Leading players in the global line scan camera market include Teledyne Technologies, Basler AG (Basler), Cognex Corporation, VIEWORKS Co. Ltd., JAI A/S, Nippon Electro-Sensory Devices, Chromasens GmbH, IDS Imaging Development Systems, Photonfocus, Allied Vision Technologies GmbH, Xenics, among others.

The report explores crucial aspects of the line scan camera market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed