Ligating Clips Market Size, Growth, Global Trends, Forecast 2034

Ligating Clips Market By Type (Polymer Ligating Clips, Hemostatic Ligating Clips, Metal Ligating Clips, and Others), By Application (Surgery, Vascular Ligations, Endoscopy, and Others), By End-User (Hospitals and Clinics, Research Institutes, Ambulatory Surgical Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

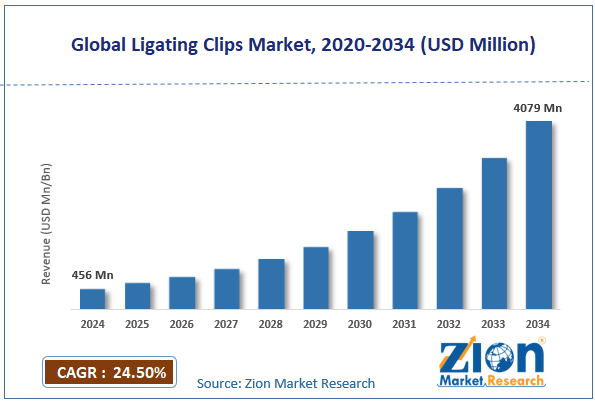

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 456 Million | USD 4079 Million | 24.5% | 2024 |

Ligating Clips Industry Perspective:

What will be the size of the global ligating clips market during the forecast period?

The global ligating clips market size was worth around USD 456 million in 2024 and is predicted to grow to around USD 4079 million by 2034, with a compound annual growth rate (CAGR) of roughly 24.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global ligating clips market is estimated to grow annually at a CAGR of around 24.5% over the forecast period (2025-2034).

- In terms of revenue, the global ligating clips market size was valued at around USD 456 million in 2024 and is projected to reach USD 4079 million by 2034.

- Rising prevalence of chronic disease and increasing number of surgeries are expected to drive the ligating clips market.

- Based on the type, in 2024, the polymer ligating clips segment dominates the market.

- Based on the application, the surgery dominates the market in 2024 and is expected to continue the same pattern over the projected period.

- Based on the end-user, the hospitals and clinics segment captures a significant market share in 2024.

- Based on region, North America is expected to lead the ligating clips market over the projected period.

Ligating Clips Market: Overview

Ligating clips are small, specialized surgical tools used to control bleeding from blood vessels, ducts, or tubular structures during surgery. They make sure that ligation and hemostasis are safe. Because they are faster and more accurate than regular suturing, they are widely employed in open, laparoscopic, and minimally invasive surgeries. Some ligating clips are constructed of high-tech polymers, titanium, or stainless steel. Some designs can be absorbed by the body, while others can't, depending on what the patient needs. Ligating clips are useful in many types of surgery, including general, gynecologic, urologic, and cardiovascular. They are easy to use, reliable, and can speed up the process.

Ligating Clips Market: Growth Drivers

Why do the aging population & rising burden of chronic diseases propel the development of the ligating clips market?

The ligating clips market is growing as more individuals age and develop long-term illnesses. This means that more procedures must be performed, and ligating clips are typically used for these procedures. As people get older, they are far more likely to suffer long-term illnesses that are linked to age, like heart disease, cancer, digestive issues, and urinary problems. Many illnesses need surgery or less invasive methods to diagnose, treat, or reduce symptoms. These therapies use ligating clips to quickly block blood vessels and ducts, making them essential surgical supplies. Chronic conditions, including diabetes, obesity, and high blood pressure, also make it more likely that surgery will go wrong and cause bleeding. This underscores the importance of reliable, accurate, and rapid hemostatic therapies. Surgeons are increasingly using ligating clips because they speed surgery, make procedures more consistent, and increase the likelihood of minimally invasive techniques. This is highly essential for older people, who heal faster and spend less time in the hospital.

Also, older patients typically need the same treatment more than once, often over time. This means that disposable surgical equipment, such as ligating clips, is still needed. This demographic and sickness trend, together with increased life expectancy and access to healthcare around the world, especially in emerging economies, is a long-term structural driver of growth for the ligating clips industry, not merely a short-term rise in demand.

For instance, according to data published by the World Health Organization, by 2030, one in six people worldwide will be 60 or older. At this point, the number of people aged 60 and up will grow from 1 billion in 2020 to 1.4 billion. By 2050, there will be 2.1 billion adults aged 60 and older worldwide. By 2050, the number of adults 80 and older is expected to triple, reaching 426 million.

Restraints

How does the availability of alternative closure methods impede the growth of the ligating clips industry?

The ligating clips sector is not growing as quickly as it should because other methods of wound closure are increasingly common, making clips less important in clinical settings, making prices more competitive, and making it harder to use clips in some operations. Energy-based vascular sealing devices, sutures, staples, and topical hemostatic agents are among the more advanced options that can often do the same job—closing a vessel or tissue—without requiring a permanent implant. Surgeons may prefer energy-based tools for some procedures, especially those that involve larger veins or tissue bundles. This is because they can seal and cut simultaneously, speeding up the workflow and reducing the need for supplementary tools like clips.

Because they are inexpensive, easy for surgeons to learn, and versatile, traditional methods such as sutures and staples remain widely used, particularly in healthcare systems concerned with cost. This makes it harder for ligating clips, which are generally considered high-end consumables, to be adopted solely based on their therapeutic value, especially when payment doesn't differ between closure methods. Some alternative technologies are also touted as having lower chances of migration or long-term foreign-body concerns. This can affect surgeons' preferences and hospitals' purchases. These alternatives may replace or reduce the number of ligating clips required per surgery as hospitals increasingly consider the full cost of the operation and clinical outcomes. This could slow the growth of the ligating clip market, even as the number of surgeries increases.

Opportunities

Will the expansion of healthcare infrastructure in emerging markets offer opportunities for the ligating clips market?

The expansion of healthcare infrastructure in developing countries creates many opportunities for the sector to grow, including increasing the number of surgeries performed, making it easier to access modern medical technologies, and accelerating the adoption of standardized surgical supplies. Rapid investments in new hospitals, specialist clinics, and ambulatory surgical centers throughout Asia Pacific, Latin America, the Middle East, and Africa are driving more surgeries, which in turn increase the need for essential tools like ligating clips. As these facilities become better at performing minimally invasive and laparoscopic surgeries, ligating clips are increasingly common because they are easy to use, reliable, and effective.

Also, hospitals are being forced to meet global surgical standards due to rising healthcare costs, greater insurance coverage, and increased medical tourism. This is leading to more use of disposable and high-quality ligation solutions. Due to the aforementioned factors, they create a strong environment for the ligating clips industry to maintain its market share and grow over time in developing countries.

Challenges

How do the complications & adverse reactions pose a significant threat to the industry's growth?

Complications and negative responses present a substantial threat to the expansion of the ligating clips sector, as they directly influence patient safety, surgeon confidence, regulatory oversight, and hospital procurement decisions. Clinically documented problems, such as clip migration, slippage, bleeding, infection, tissue injury, and inflammatory or allergic reactions, raise concerns over the long-term safety of ligating clips, particularly in sensitive anatomical regions. When such problems arise, they may require additional procedures or treatments, reducing the effectiveness of care and increasing costs. Surgeons may need to be very careful when using clips or use them only for particular reasons. From a regulatory perspective, reports of adverse incidents complicate post-market surveillance, lengthen approval processes, and increase the costs of complying with the law. Regulatory organizations may request additional clinical data or issue warnings. This can make it harder for new products to reach the market and slow innovation, especially in smaller enterprises.

Hospitals and healthcare systems are increasingly adopting value-based care models. In these models, the choice of equipment is based on the total treatment cost and the risk reduction. Devices that are more likely to cause problems may be removed from procurement lists or replaced with alternative methods to close, such as energy-based vessel sealing or improved suturing systems. These factors make it difficult for consumers to accept ligating clips, make it easier for other technologies to compete, and, in the end, slow the expansion of the ligating clip business.

Ligating Clips Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ligating Clips Market |

| Market Size in 2024 | USD 456 Million |

| Market Forecast in 2034 | USD 4079 Million |

| Growth Rate | CAGR of 24.5% |

| Number of Pages | 216 |

| Key Companies Covered | Johnson & Johnson (Ethicon Inc.), Genicon Inc., Braun Melsungen AG, Teleflex Incorporated, Medtronic plc, Scanlan International Inc., Grena Ltd., ConMed Corporation, Hangzhou Kangji Medical Instrument Co Ltd., Hakko Co. Ltd., Changzhou Anker Medical Co. Ltd., Ovesco Endoscopy AG, Gore & Associates, Marlow Medical Group, Surtex Instruments Ltd., and others. |

| Segments Covered | By Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ligating Clips Market: Segmentation

Type Insights

Why do polymer ligating clips dominate the ligating clips market in 2024?

In 2024, the polymer ligating clips segment dominates the market. The rise is because it has more clinical, technological, and workflow benefits than ordinary metal clips. Polymer ligating clips are not formed of metal, do not react with other materials, and do not show up on CT and MRI scans. This is becoming more and more significant in oncology, urology, and post-operative diagnostic surveillance. Surgeons trust them more because they remain locked and don't cause tissue irritation or allergic reactions. This is especially true for procedures that don't need a lot of cutting.

Polymer clips are particularly great for sophisticated laparoscopic and robotic surgeries that need to be very precise and close properly. Volume is increasing as more people use single-use, disposable devices to reduce infection risk, and outpatient surgery clinics are becoming more accepting of them. Polymer ligating clips are becoming more and more common as hospitals put safety, imaging compatibility, and efficiency first. This is causing revenue to expand more quickly than with old metal clips, especially in industrialized countries where healthcare systems are quickly becoming more contemporary.

Application Insights

Will the surgery segment hold the largest share of the ligating clips market over the projected period?

The surgery dominates the market in 2024 and is expected to continue the same pattern over the projected period. The segment is growing as more people undergo open and minimally invasive surgeries worldwide. Because more and more people are getting chronic conditions, including cancer, heart disease, gastrointestinal problems, and obesity, the number of surgeries that need reliable vessel and duct ligation has grown a lot. Ligating clips are often used in surgery because they save time, ensure bleeding stops, and support laparoscopic and robotic approaches, which are becoming more popular for better results and shorter hospital stays.

Additionally, the increasing use of day-care treatments and ambulatory surgical facilities has made the need for disposable surgical supplies that are easy to use and perform well even greater. The surgery segment maintains strong, steady demand as healthcare infrastructure expands and the number of surgeries rises, especially in emerging economies. This drives steady revenue development in the ligating clips market.

End-User Insights

Why will the hospitals and clinics segment dominate the ligating clips industry?

The hospitals and clinics segment captures a significant market share in 2024. The category is expanding due to the prevalence of surgeries and modern medical facilities in these areas. Hospitals and large clinics perform many open, laparoscopic, and minimally invasive surgeries across general surgery, gynecology, urology, and cardiovascular care. All of these surgeries rely heavily on ligating clips to properly seal arteries and ducts. Surgical admissions are going up because more people are getting chronic diseases, and the patient population is getting older.

At the same time, the shift to minimally invasive and robotic-assisted therapies is increasing the number of clips needed for each procedure. Also, hospitals and clinics are increasingly using single-use, sterile ligating clips to comply with strict safety rules and reduce the risk of infection. These factors, along with larger budgets for purchasing, standardized purchasing processes, and a steady flow of new patients, drive sustained, long-term revenue growth for hospitals and clinics in the ligating clips market.

Regional Insights

Why does North America hold the largest share in the ligating clips market?

North America holds the largest market share in 2024 and is expected to maintain this pattern over the analysis period. The region is growing because it has many surgeries, a strong healthcare infrastructure, and people are quickly learning to perform minimally invasive operations. There are a lot of older people in the area, and a lot of them have chronic conditions, including heart difficulties, cancer, and gastrointestinal disorders. These ailments all lead people to seek surgical procedures that require reliable vessel and duct ligation.

North American hospitals and ambulatory surgical centers were among the first to use laparoscopic, robotic-assisted, and day-care treatments. Ligating clips are often used to make procedures more efficient and reduce procedural time. Long-term market growth is further supported by robust reimbursement systems, numerous leading medical device companies, and ongoing innovation in polymer and disposable ligating clip systems. The ligating clips market in North America is growing steadily as greater focus on patient safety, infection control, and more efficient workflows drives demand.

Ligating Clips Market: Competitive Analysis

The global ligating clips market is dominated by players like:

- Johnson & Johnson (Ethicon Inc.)

- Genicon Inc.

- Braun Melsungen AG

- Teleflex Incorporated

- Medtronic plc

- Scanlan International Inc.

- Grena Ltd.

- ConMed Corporation

- Hangzhou Kangji Medical Instrument Co Ltd.

- Hakko Co. Ltd.

- Changzhou Anker Medical Co. Ltd.

- Ovesco Endoscopy AG

- Gore & Associates

- Marlow Medical Group

- Surtex Instruments Ltd.

The global ligating clips market is segmented as follows:

By Type

- Polymer Ligating Clips

- Hemostatic Ligating Clips

- Metal Ligating Clips

- Others

By Application

- Surgery

- Vascular Ligations

- Endoscopy

- Others

By End-User

- Hospitals and Clinics

- Research Institutes

- Ambulatory Surgical Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed