Insurtech Market Size, Share, Trends, Growth Report and Forecast 2023 - 2030

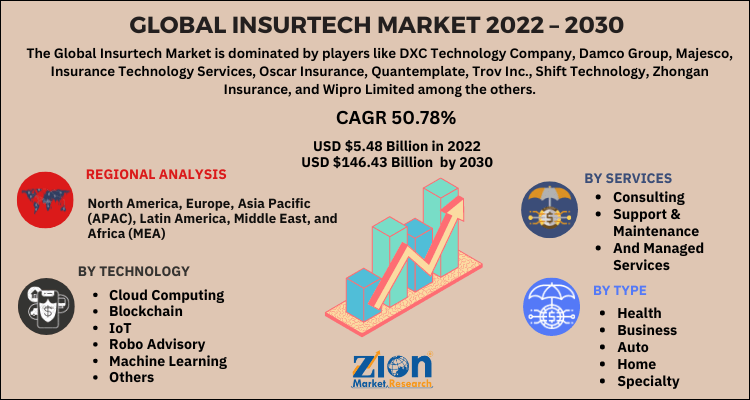

Insurtech Market: By Type (Health, Business, Auto, Home, Specialty, Travel, And Others), By Services (Consulting, Support & Maintenance, And Managed Services), By Technology (Cloud Computing, Blockchain, IoT, Robo Advisory, Machine Learning, And Others), And By Region: Global Industry Analysis, Size, Share, Price, Trends, And Forecast, 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.48 Billion | USD 146.43 Billion | 50.78% | 2022 |

Description

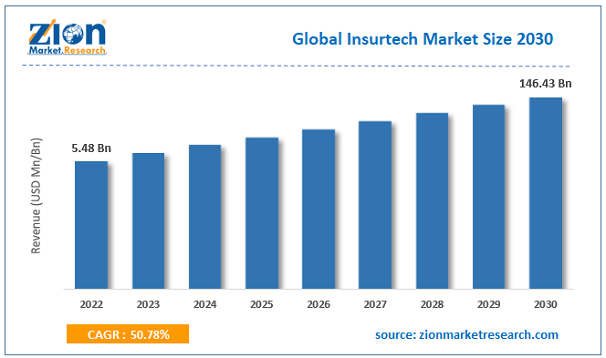

Global Insurtech Market Size

According to the report published by Zion Market Research, the global Insurtech Market size was valued at USD 5.48 Billion in 2022 and is predicted to reach USD 146.43 Billion by the end of 2030. The market is expected to grow with a CAGR of 50.78% during the forecast period. The report analyzes the global Insurtech Market’s growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Insurtech Market Industry.

Key Insights:

- As per the analysis shared by our research analyst, the insurtech market is anticipated to grow at a CAGR of 50.78% during the forecast period (2023-2030)

- The global insurtech market was estimated to be worth approximately USD 5.48 billion in 2022 and is projected to reach a value of USD 146.43 billion by 2030.

- The growth of the insurtech market is being driven by growing use of smartphones & tablets, and growing distribution & marketing of insurance policies through digital technologies.

- Based on the type, the health segment is growing at a high rate and is projected to dominate the market.

- On the basis of services, the consulting segment is projected to swipe the largest market share.

- In terms of technology, the cloud computing segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Global Insurtech Market: Overview

Over the past few years, there is the emergence of insurtechs in the insurance space. Insurtech is a new insurance technology that increases competition, simplifies policy management, and improves the customer experience. It is a varied set of technologies that are used in the insurance industry. Insurtech is counted as a subdivision of fintech which has made the buying process of all types of insurance convenient and easier, from consumer products to small business insurance.

Global Insurtech Market: Growth Factors

The major factors that are spurring the growth of the global insurtech market include rapid digital transformation in the insurance industry, growing use of smartphones & tablets, and growing distribution & marketing of insurance policies through digital technologies. Further, consumer empowerment, convenience, efficiency, and reduced costs are some of the benefits that the consumer can avail of insurtech. Additionally, there is a rise in adoption of insurtech from small and mid-sized enterprises.

This is because SMEs demand new & personalized products and insurtech provide them the required solutions with the help of artificial intelligence and easy access to open data. All such factors and the growing adoption of insurtech in the retail sector are fostering the growth of the global insurtech market. In addition to this, increase in the number of insurtech startups, strong presence of key vendors and financial sectors are also some of the factors that are propelling the growth of the global market. Moreover, rise in the emergence of insurtech across the lines of business & value chain with a concentration in distribution is also majorly contributing to the overall market growth.

Furthermore, continuous advancement in the technologies in insurance industry including blockchain, machine learning, and artificial intelligence will result in beneficial opportunities for the growth of the global insurtech market over the forecast period. However, high initial cost required for insurtech may hinder the growth of the global insurtech market.

In addition to this, advancement in the insurance sectors such as online or app-based insurance purchase and improved health insurance plans are expected to boost the market growth over the forecast period.

Key Growth Drivers

The insurtech market's growth is primarily fueled by the rapid adoption of technology and a fundamental shift in consumer behavior. Customers now expect a seamless, digital-first experience, from getting a quote to filing a claim, which traditional insurers often struggle to provide. Technologies like artificial intelligence (AI), machine learning (ML), big data analytics, and the Internet of Things (IoT) are enabling insurtech companies to offer more personalized, on-demand insurance products and streamline operations, leading to reduced costs and improved efficiency. The rise of a tech-savvy population and increasing digital penetration, especially in emerging economies, are further accelerating this trend.

Restraints

Despite its growth, the insurtech market faces several significant restraints. Complex and fragmented regulatory frameworks across different regions can be a major hurdle for companies looking to scale their operations globally. The insurance industry is heavily regulated, and new technologies must comply with strict rules regarding data privacy, consumer protection, and underwriting. Another key restraint is the lack of trust and brand recognition among new insurtech startups, as consumers often prefer to stick with established, traditional insurance providers. Additionally, many incumbent insurers are burdened by outdated legacy systems, making it difficult and expensive to integrate new technology and partner with insurtech firms.

Opportunities

The insurtech market is ripe with opportunities for innovation and growth. There is a vast opportunity in developing on-demand and usage-based insurance (UBI) products, which leverage data from IoT devices and telematics to offer customized pricing based on individual behavior. This can lead to fairer premiums and encourage positive habits (e.g., safe driving). Another major opportunity lies in embedded insurance, where coverage is integrated directly into the purchase of a product or service (e.g., travel insurance when booking a flight). This creates a seamless customer experience and expands the market to a new generation of buyers. The "missing middle" in health insurance and the need for simplified micro-insurance also present significant untapped markets, particularly in developing countries.

Challenges

The insurtech landscape is not without its challenges. The market is highly competitive, with both agile startups and large, well-funded traditional insurers vying for market share. Cybersecurity and data privacy are paramount concerns, as insurtechs handle vast amounts of sensitive customer information. A data breach could severely damage a company's reputation and lead to regulatory penalties. Furthermore, there's a constant need for customer education to build trust and explain the benefits of new, tech-driven insurance products, which can be a slow and resource-intensive process. Finding and retaining specialized tech talent is also a significant challenge, as the demand for experts in AI, data science, and blockchain far outstrips the supply.

Global Insurtech Market: Segmentation

The global Insurtech market is bifurcated based on type, services, technology, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2023 to 2030.

Based on Type, the insurtech market is categorized into health, business, auto, home, specialty, travel, and others.

Different services such as consulting, support & maintenance, and managed services are considered in the report.

Based on Technology, the global Insurtech market is divided into cloud computing, blockchain, IoT, Robo advisory, machine learning, and others.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Insurtech Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insurtech Market |

| Market Size in 2023 | USD 5.48 Billion |

| Market Forecast in 2030 | USD 146.43 Billion |

| Compound Annual Growth Rate | CAGR of 50.78% |

| Number of Pages | 210 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | DXC Technology Company, Damco Group, Majesco, Insurance Technology Services, Oscar Insurance, Quantemplate, Trov Inc., Shift Technology, Zhongan Insurance, and Wipro Limited among the others |

| Segments Covered | By Type, By Services, By Technology, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latian America, Middle East and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Development

- December 2024: Gallagher announced a landmark $13.45 billion acquisition of AssuredPartners—the largest-ever purchase of a U.S. insurance brokerage. The transaction was finalized in August 2025.

- October 2023: Gallagher significantly grew its brokerage footprint with the $904 million acquisition of Cadence Insurance from Cadence Bank.

- January 2022: French insurtech Luko acquired German counterpart Coya AG, merging operations and taking over its insurance licenses and policies. The combined company initially retained the Luko name before rebranding to GetSafe.

- In 2025, Zurich Insurance Group acquired BOXX Insurance Inc., strengthening its cyber insurance offerings and risk management services.

- In 2025, Huize, a Chinese digital insurance platform, acquired Vietnamese insurtech company Global Care, accelerating its expansion into Southeast Asia.

Global Insurtech Market: Regional Analysis

North America is expected to hold the maximum share in the Insurtech market over the forecast period. Some of the key factors contributing to the dominant share of the market in this region include increasing spending customers in the area of insurance-related products. In addition to this, technological advancement in the insurance sector is also propelling the growth of the market in North America. Asia Pacific is expected to be the most lucrative market for Insurtech over the forecast period. Factors such as increasing awareness regarding the importance of insurance in health and business sectors, coupled with large number of insurance providers are propelling the growth of the market.

Global Insurtech Market: Competitive Players

The global Insurtech market is highly competitive. Major market players are adopting advanced technical platforms to expand the reach to new customers.

Some of the key players operating in the global Insurtech market include:

- DXC Technology Company

- Damco Group

- Majesco

- Insurance Technology Services

- Oscar Insurance

- Quantemplate

- Trov Inc.

- Shift Technology

- Zhongan Insurance

- Wipro Limited

- Others

The Global Insurtech Market: Segmentation

By Type:

- Health

- Business

- Auto

- Home

- Specialty

- Travel

- Others

By Services:

- Consulting

- Support & Maintenance

- And Managed Services

By Technology:

- Cloud Computing

- Blockchain

- IoT

- Robo Advisory

- Machine Learning

- Others

By Region:

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed