Industrial Tapes Market Demand, Size, Share & Forecast 2032

Industrial Tapes Market by Product Type (Aluminum Tapes, Filament Tapes, and Others), by Tape Backing Material (Paper, Polyvinyl Chloride, Polypropylene, Fiberglass, Glass Cloth, Fabrics, Polyimide, Polyester, PTFE, and Medical Grade Cloth), and by Application (Electrical Industry, Logistics Industry, Automotive Industry, Construction Industry, Manufacturing Industry, Electronics Industry, and Aerospace Industry): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

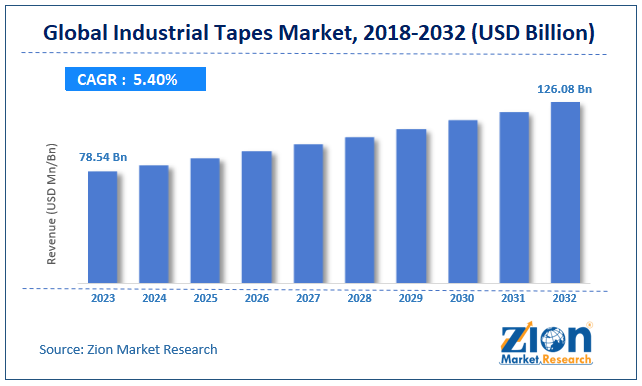

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 78.54 Billion | USD 126.08 Billion | 5.40% | 2023 |

The global industrial tapes market size was worth around USD 78.54 billion in 2023 and is predicted to grow to around USD 126.08 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.40% between 2024 and 2032.

The report covers forecasts and analysis for the industrial tapes market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the industrial tapes market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the industrial tapes market on a global level.

Industrial Tapes Market: Overview

Industrial tapes are used for the heavy duty applications in the industries. These types of tapes are majorly used for the binding purpose in various industrial operations. Industrial tapes provide high adhesive strength, durability, and resistance to the chemicals, moisture, & temperature compared to the normal tapes which are used in daily life. Industrial tapes are used for attaching various components which includes foams, lighting fixtures, and cushions. Moreover, bonding operations such as glass bonding, concrete bonding, and floor bonding are done with the help of industrial tapes. In addition to this, industrial tapes are also been used in operations such as electronic components assembly, vehicle assembly, and heating ventilation air conditioning (HVAC) operations. Furthermore, these tapes are shock resistant and water resistant for specific operations which include electrical equipment manufacturing and also can be used in the ultraviolet light, extremely high and cold temperatures, and solvents.

Growing industrialization leads to the rising demand for the industrial tapes in the manufacturing, medical device manufacturing market, food and beverages market, and others which positively influence the industrial tapes market growth. Moreover, physical and chemical properties such as elasticity, durability, resistance to the chemicals, moisture, & temperature, and high productivity boost its sale and growth in the market across the globe. In addition to this, an increase in the use of industrial tapes in the number of applications due to its adhesive property is also driving the industrial tapes market growth. However, an emission of volatile organic content (VOC) at the time of manufacturing the industrial tapes is restraining the market growth during the forecast period. Major players prefer on manufacturing the industrial tapes by using water-based technology instead of solvent-based technology to reduce the emissions.

In order to give the users of this report a comprehensive view of the industrial tapes market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein product type segment, tape backing material segment, and application segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launches, agreements, partnerships, collaborations & joint ventures, research & development, technology, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis, and sample portfolios of various companies according to the region.

Industrial Tapes Market: Segmentation

The study provides a decisive view of the industrial tapes market by segmenting the market based on product type, tape backing material, application, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

On the basis of product type, the industrial tapes market is fragmented into aluminum tapes, filament tapes, and others.

Based on the tape backing material, the market is divided into paper, polyvinyl chloride, polypropylene, fiberglass, glass cloth, fabrics, polyimide, polyester, PTFE, and medical grade cloth.

On the basis of application, the industrial tapes market growth is segmented into the electrical industry, logistics industry, automotive industry, construction industry, manufacturing industry, electronics industry, and aerospace industry.

Industrial Tapes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Tapes Market |

| Market Size in 2023 | USD 78.54 Billion |

| Market Forecast in 2032 | USD 126.08 Billion |

| Growth Rate | CAGR of 5.40% |

| Number of Pages | 225 |

| Key Companies Covered | Eastman Chemical Company, Adhesive Applications, Von Roll Holding AG, Avery Dennison, Saint-Gobain SA, Henkel AG & Company KGaA, The Dow Chemical Company, Berry Plastics, Ashland Inc., Advanced Flexible Composites, Avery Dennison Corporation, Merck Group, Sika AG, Microseal Industries, H.B Fuller, Essentra Specialty Tapes, FLEXcon, Intertape Polymer, Coating, and Converting Technologies, Adhesives Research, MACtac, Lamart, PPI Adhesive Products, Shurtape, DeWAL Industries, Scapa Group, TaraTape, Adchem, Chomerics, Navilux, CTT, Achem, Syntac Coated Products, Nestle, and others. |

| Segments Covered | By Product Type, By Tape Backing Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Tapes Market: Regional Analysis

The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. This segmentation includes demand for industrial tapes market based on all segments in all the regions and countries.

Based on the region, Asia Pacific dominates the overall industrial tapes market. The Asia Pacific accounted for a major revenue share in 2023 and is projected to continue with this trend during the forecast period. The growth is accredited to the growing urbanization and industrialization. The region has a huge automobile and electronics industry which is further positively influencing the market growth. Moreover, increasing manufacturing facilities coupled with rising demand for industrial tapes in the emerging countries such as China, India, and Indonesia is driving the market growth in the region.

Industrial Tapes Market: Competitive Analysis

The global industrial tapes market is dominated by players like:

- Eastman Chemical Company

- Adhesive Applications

- Von Roll Holding AG

- Avery Dennison

- Saint-Gobain SA

- Henkel AG & Company KGaA

- The Dow Chemical Company

- Berry Plastics

- Ashland Inc.

- Advanced Flexible Composites

- Avery Dennison Corporation

- Merck Group

- Sika AG

- Microseal Industries

- H.B Fuller

- Essentra Specialty Tapes

- FLEXcon

- Intertape Polymer

- Adhesives Research

- MACtac

- Lamart

- PPI Adhesive Products

- Shurtape

- DeWAL Industries

- Scapa Group

- TaraTape

- Adchem

- Chomerics

- Navilux

- CTT

- Achem

- Syntac Coated Products

- Nestle

This report segments the industrial tapes market as follows:

Industrial Tapes Market: Product Type Segment Analysis

- Aluminum Tapes

- Filament Tapes

- Others

Industrial Tapes Market: Tape Backing Material Segment Analysis

- Paper

- Polyvinyl Chloride

- Polypropylene

- Fiberglass

- Glass Cloth

- Fabrics

- Polyimide

- Polyester

- PTFE

- Medical Grade Cloth

Industrial Tapes Market: Application Segment Analysis

- Electrical Industry

- Automotive Industry

- Construction Industry

- Manufacturing Industry

- Aerospace Industry

- Electronics Industry

Industrial Tapes Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed