Global Industrial Gaskets Market Size, Share, Growth Analysis Report - Forecast 2034

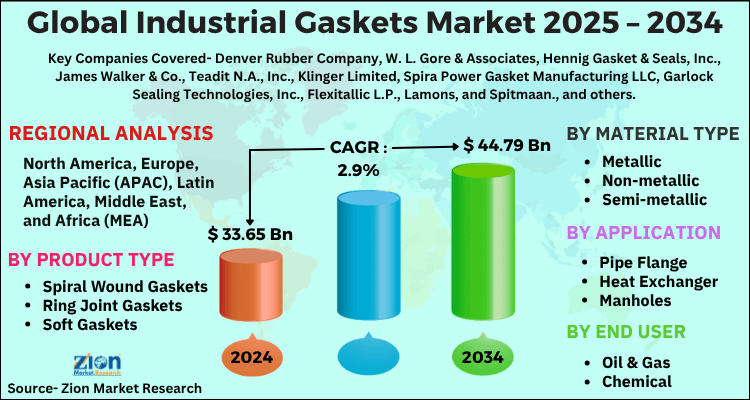

Industrial Gaskets Market By Product Type (Spiral Wound Gaskets, Ring Joint Gaskets, Soft Gaskets, Corrugated Gaskets, Jacketed Gaskets), By Material Type (Metallic, Non-metallic, Semi-metallic), By Application (Pipe Flange, Heat Exchanger, Manholes, Others), By End-user (Oil & Gas, Chemical, Power, Food & Beverage, Water Treatment, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

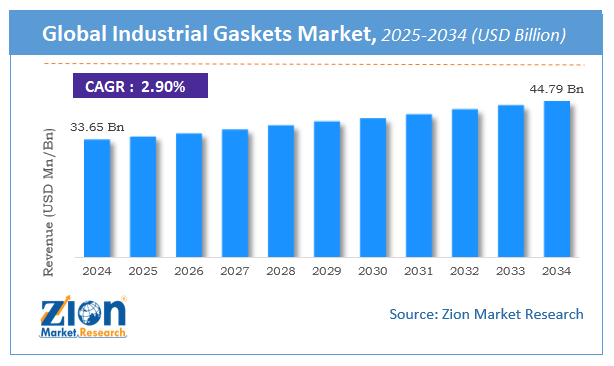

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 33.65 Billion | USD 44.79 Billion | 2.9% | 2024 |

Industrial Gaskets Market Size

The global industrial gaskets market size was worth around USD 33.65 Billion in 2024 and is predicted to grow to around USD 44.79 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 2.9% between 2025 and 2034. The report analyzes the global industrial gaskets market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the industrial gaskets industry.

Industrial Gaskets Market: Overview

Industrial gasket is a mechanical seal utilized for filling space between two or more than two surfaces. Moreover, it is used for preventing leakage from space occurring between two joined objects under compression. Apparently, the products are made from sheet, paper, metal, fiberglass, rubber, cork, silicone, and felt. Furthermore, industrial gaskets find extensive use in mining, refining, oil & gas, water treatment, electronic, and petro-chemical industries. Moreover, industrial gasket is used for storing energy such as spring.

The gasket is the seal, filling the space between two mating surfaces to prevent the leakage from the objects under compression. They are specially used in high-pressure steam systems. Gaskets used in industrial applications helps to limit the vibration, enhance mounting, and prevent leakage. Moreover, they maintain the required pressure and eradicate the contamination from any kind of external environmental condition. Industrial gaskets are manufactured from a different range of elastomers and materials. They are made up of flat materials which include a sheet from paper, rubber, metal, felt, silicone, nitrile rubber, cork, and others. These gaskets can be used in various end-user industries such as chemicals, oil and gas, power, and others.

Key Insights

- As per the analysis shared by our research analyst, the global industrial gaskets market is estimated to grow annually at a CAGR of around 2.9% over the forecast period (2025-2034).

- Regarding revenue, the global industrial gaskets market size was valued at around USD 33.65 Billion in 2024 and is projected to reach USD 44.79 Billion by 2034.

- The industrial gaskets market is projected to grow at a significant rate due to Growth in oil & gas, chemical, and power sectors drives demand for leak-proof sealing solutions. Increasing focus on equipment safety and efficiency supports the market.

- Based on Product Type, the Spiral Wound Gaskets segment is expected to lead the global market.

- On the basis of Material Type, the Metallic segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Pipe Flange segment is projected to swipe the largest market share.

- By End-user, the Oil & Gas segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Industrial Gaskets Market: Growth Drivers

Massive product demand for piping & heat-exchanger activities in oil & gas sector, chemical processing industry, and refineries will proliferate growth of industrial gaskets market. Apart from this, strict laws pertaining to leakage in factories and rise in investments for enhancing production capacity of product will steer development of industrial gaskets market.

Large-scale use of industrial gaskets in power generation, pulp & paper, and specialty chemical & chemical industries for preventing leakage of liquids & gases will prop up growth of industrial gaskets industry over forecast timespan. Moreover, beneficial features such as resistance to acids, chemicals, extreme temperatures, and alkaline will accentuate growth of industrial gaskets market. Surge in number of factories in developing nations will augment business landscape. However, fluctuations in raw material costs can impede growth of industrial gaskets market in years ahead.

Increasing demand for industrial gaskets in various applications is primarily driving the market growth. Gaskets in the oil and gas production avoid the leakage and wastage of gas. In addition to this, rising adoption of Polytetrafluoroethylene (PTFE) from different industries such as chemicals, oil & gas, etc. will drive the growth of the market in forthcoming years. Furthermore, the increase in the stringent regulations regarding spillage and contamination by Environmental Protection Agency (EPA) to prevent the damage to the environment is also a considerable factor boosting the market growth in the forecast period. Therefore, industrial gaskets market is estimated to record a healthy growth during the forecast period. However, utilization of low-priced asbestos-based gaskets in developing countries can hamper the market growth in upcoming years. Growing number of refineries in different regions can be an opportunity for the growth of the market.

Industrial Gaskets Market: Segmentation Analysis

The global industrial gaskets market is segmented based on Product Type, Material Type, Application, End-user, and region.

Based on Product Type, the global industrial gaskets market is divided into Spiral Wound Gaskets, Ring Joint Gaskets, Soft Gaskets, Corrugated Gaskets, Jacketed Gaskets.

On the basis of Material Type, the global industrial gaskets market is bifurcated into Metallic, Non-metallic, Semi-metallic.

By Application, the global industrial gaskets market is split into Pipe Flange, Heat Exchanger, Manholes, Others.

In terms of End-user, the global industrial gaskets market is categorized into Oil & Gas, Chemical, Power, Food & Beverage, Water Treatment, Others.

Industrial Gaskets Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Gaskets Market |

| Market Size in 2024 | USD 33.65 Billion |

| Market Forecast in 2034 | USD 44.79 Billion |

| Growth Rate | CAGR of 2.9% |

| Number of Pages | 187 |

| Key Companies Covered | Denver Rubber Company, W. L. Gore & Associates, Hennig Gasket & Seals, Inc., James Walker & Co., Teadit N.A., Inc., Klinger Limited, Spira Power Gasket Manufacturing LLC, Garlock Sealing Technologies, Inc., Flexitallic L.P., Lamons, and Spitmaan., and others. |

| Segments Covered | By Product Type, By Material Type, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Gaskets Market: Regional Outlook

Asia Pacific Industrial Gaskets Market To Record Fastest Growth By 2034

Expansion of industrial gaskets industry in Asia Pacific zone over assessment period is owing to easy availability of raw components and huge investments in end-use sectors. In addition to this, growing urbanization, rise in demand for power conservation, and increase in population in countries such as India and China is predicted to pave way for growth of industrial gaskets market in Asia Pacific over forecast period. Presence of large number of chemical factories in these countries is projected to create lucrative growth avenues for industrial gaskets market in Asia Pacific zone.

Based on the geography, North America accounted for a major market share in 2020. The trend is anticipated to continue during the upcoming years. Rising demand for industrial gaskets from chemical processing, power generation, and refineries sectors is estimated to propel the market growth. Moreover, Asia Pacific is attributed to register the fastest growth in the market. The growth in this region is accredited to the rising demand for power production in order to meet the increasing demand for power.

Industrial Gaskets Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the industrial gaskets market on a global and regional basis.

The global industrial gaskets market is dominated by players like:

- Denver Rubber Company

- W. L. Gore & Associates

- Hennig Gasket & Seals Inc.

- James Walker & Co.

- Teadit N.A. Inc.

- Klinger Limited

- Spira Power Gasket Manufacturing LLC

- Garlock Sealing Technologies Inc.

- Flexitallic L.P.

- Lamons

- and Spitmaan.

The global industrial gaskets market is segmented as follows;

By Product Type

- Spiral Wound Gaskets

- Ring Joint Gaskets

- Soft Gaskets

- Corrugated Gaskets

- Jacketed Gaskets

By Material Type

- Metallic

- Non-metallic

- Semi-metallic

By Application

- Pipe Flange

- Heat Exchanger

- Manholes

- Others

By End-user

- Oil & Gas

- Chemical

- Power

- Food & Beverage

- Water Treatment

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial gaskets are sealing components used to fill the space between two or more mating surfaces to prevent leakage of gases or fluids. Made from materials like rubber, metal, or composites, they are essential in machinery, pipelines, and industrial equipment.

The global industrial gaskets market is expected to grow due to Growth in oil & gas, chemical, and power sectors drives demand for leak-proof sealing solutions. Increasing focus on equipment safety and efficiency supports the market.

According to a study, the global industrial gaskets market size was worth around USD 33.65 Billion in 2024 and is expected to reach USD 44.79 Billion by 2034.

The global industrial gaskets market is expected to grow at a CAGR of 2.9% during the forecast period.

Asia-Pacific is expected to dominate the industrial gaskets market over the forecast period.

Leading players in the global industrial gaskets market include Denver Rubber Company, W. L. Gore & Associates, Hennig Gasket & Seals, Inc., James Walker & Co., Teadit N.A., Inc., Klinger Limited, Spira Power Gasket Manufacturing LLC, Garlock Sealing Technologies, Inc., Flexitallic L.P., Lamons, and Spitmaan., among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed