Global Hyperspectral Imaging System Market Size, Share, Growth Analysis Report - Forecast 2034

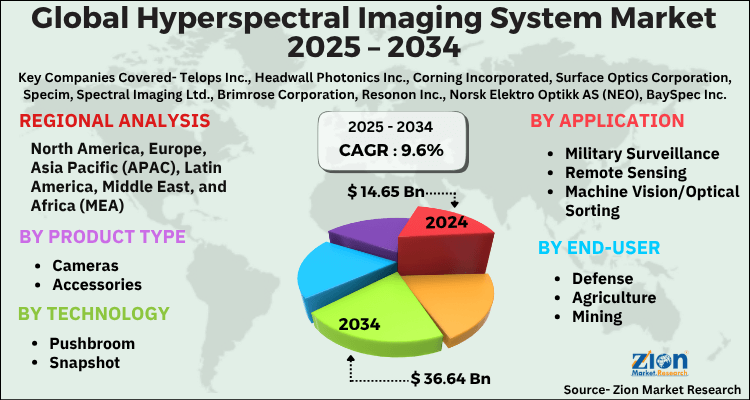

Hyperspectral Imaging System Market By Product Type (Cameras, Accessories), By Technology (Pushbroom, Snapshot, Others), By Application (Military Surveillance, Remote Sensing, Machine Vision/Optical Sorting, Life Sciences & Medical Diagnostics, Others), By End-user (Defense, Agriculture, Mining, Environmental Monitoring, Healthcare), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

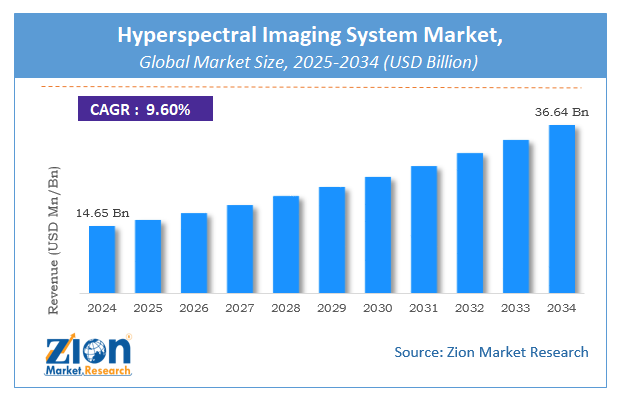

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.65 Billion | USD 36.64 Billion | 9.6% | 2024 |

Hyperspectral Imaging System Market: Industry Perspective

The global hyperspectral imaging system market size was worth around USD 14.65 Billion in 2024 and is predicted to grow to around USD 36.64 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.6% between 2025 and 2034. The report analyzes the global hyperspectral imaging system market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hyperspectral imaging system industry.

Hyperspectral Imaging System Market: Overview

Hyperspectral imaging systems are used for processing and collecting information from across the electromagnetic spectrum. It is the frequency range of electromagnetic radiation. The primary role of a hyperspectral imaging system is to determine and obtain the spectrum associated with each pixel in a given image. The end goal is to identify materials, find objects, and detect processes. In the commercial world, currently, there are three hyperspectral imaging systems including push broom scanners, band sequential scanners, and snapshot hyperspectral imagers. The human eye can only register and see three bands that are long, medium, and short wavelengths; however, the hyperspectral imaging system assists in dividing the spectrum into multiple bands. The system is therefore helpful in analyzing wavelengths that are beyond the capacity of the naked eye. The tool has several applications across end-user verticals such as molecular biology, astronomy, biomedical imaging, surveillance, agriculture, physics, and geosciences. The industry for hyperspectral imaging systems is expected to grow at a steady pace during the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global hyperspectral imaging system market is estimated to grow annually at a CAGR of around 9.6% over the forecast period (2025-2034).

- Regarding revenue, the global hyperspectral imaging system market size was valued at around USD 14.65 Billion in 2024 and is projected to reach USD 36.64 Billion by 2034.

- The hyperspectral imaging system market is projected to grow at a significant rate due to Growing use in agriculture, defense, and medical diagnostics drives adoption. Rising demand for precise imaging and remote sensing supports expansion.

- Based on Product Type, the Cameras segment is expected to lead the global market.

- On the basis of Technology, the Pushbroom segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Military Surveillance segment is projected to swipe the largest market share.

- By End-user, the Defense segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Hyperspectral Imaging System Market: Growth Drivers

Increasing application in space exploration activities to drive market growth

The global hyperspectral imaging system market is expected to grow owing to the increasing application of the device in growing space exploration activities. In recent times, nations across the globe have been working toward improving their space programs for several strategic and academic reasons. Space exploration is an important part of the modern world since it helps us gain more understanding of the outer environment. Hyperspectral imaging systems are critical components that facilitate astronomy-related adventures. Additionally, they are also helpful in aiding technological growth on Earth by providing necessary communication and image-based infrastructure from outer space. These tools are essential for identifying space objects with utmost precision and clarity. They are also helpful in detecting faint signals coming toward the planet or moving away from it. This technique is used for several space-related calculations and research. In December 2022, China launched a new hyperspectral earth-imaging tool in outer space. The satellite launched is called the Long March 2D rocket and is China’s one step forward toward its ambitious space-related vision. In 2018, the Indian space agency launched a massive number of 30 satellites in November. One of the launched satellites was capable of hyperspectral imaging for earth observations. The data thus obtained has applications across telecommunication, military, and other technology-oriented sectors.

Research toward 5-D imaging systems to create exceptional revenue streams

The hyperspectral imaging system market is projected to further gain benefits from the rising attention toward the development of 5-dimensional hyperspectral imaging systems. In 2018, the research team at Fraunhofer Institute for Applied Optics and Precision Engineering, Germany, and Stefan Heist of Friedrich Schiller University Jena in association with a research group belonging to Ilmenau University of Technology developed a new and compact imaging system with 5-D imaging capabilities. While capturing multiple wavelengths, it also deals with spatial coordinates as a function of time. The researchers claimed that the device, with further miniaturization, could be integrated with smartphones and used for agricultural or medical purposes.

Hyperspectral Imaging System Market: Restraints

High cost of equipment to restrict market growth

The global hyperspectral imaging system market growth is expected to be restricted due to the high cost associated with hyperspectral imaging systems. For instance, cameras with this technology developed by OPTOSKY with 400-1000 nm dimensions range between USD 45000 to USD 50000. Since these tools are resource-intensive, it is crucial that the performance attributes of the tool match the intended goal, and selecting ideal hyperspectral imaging systems becomes a crucial factor. In addition to these expenses, users also have to invest in supporting equipment required for data storage and interpretations leading to added costs.

Hyperspectral Imaging System Market: Opportunities

Growing collaboration between market players to assist in developing new opportunities

The growth trend for the hyperspectral imaging system industry will be presented with new growth opportunities as a result of ongoing and increasing strategic collaborations between market players. For instance, in April 2023, the Indian Institute of Technology (IIT)-Indore collaborated with research teams from the National Aeronautics and Space Administration (NASA)-Caltech and the University of Gothenburg for the development of a low-cost hyperspectral imaging camera that can provide multispectral imaging for 4 chemical species using only a Digital Single-Lens Reflex (DSLR) camera. In November 2020, XIMEA in collaboration with imec launched a brand new and improvised version of the previously popular xiSpec hyperspectral cameras. imec or Interuniversity Microelectronics Centre is a global research and development center whereas XIMEA is known for its industrial and scientific-grade cameras with all essential certifications. The new device has maintained its original dimensions but has worked on optimizing spectral performance. The market value will further be improved due to several advancements in the current imaging systems. A prime example is the September 2022 launch of new hyperspectral imaging system hardware by Raptor for Original Equipment Manufacturers (OEM). The new tool is equipped with an Owl 320HS camera and boasts a custom spectrometer with an option for the lens.

Hyperspectral Imaging System Market: Challenges

Accurate management of multiple bandwidths to challenge market expansion

The hyperspectral imaging system industry is plagued with several technical challenges that are mainly associated with the massive number of bandwidths these tools deal with. Some of the obstacles that arise during application are geometric distortion, noise-causing imaging calibration, noisy labels, and unbalanced labeled training samples. These factors impact storing, mining, and managing the data thus collected.

Hyperspectral Imaging System Market: Segmentation Analysis

The global hyperspectral imaging system market is segmented based on Product Type, Technology, Application, End-user, and region.

Based on Product Type, the global hyperspectral imaging system market is divided into Cameras, Accessories.

On the basis of Technology, the global hyperspectral imaging system market is bifurcated into Pushbroom, Snapshot, Others.

By Application, the global hyperspectral imaging system market is split into Military Surveillance, Remote Sensing, Machine Vision/Optical Sorting, Life Sciences & Medical Diagnostics, Others.

In terms of End-user, the global hyperspectral imaging system market is categorized into Defense, Agriculture, Mining, Environmental Monitoring, Healthcare.

Hyperspectral Imaging System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hyperspectral Imaging System Market |

| Market Size in 2024 | USD 14.65 Billion |

| Market Forecast in 2034 | USD 36.64 Billion |

| Growth Rate | CAGR of 9.6% |

| Number of Pages | 150 |

| Key Companies Covered | Telops Inc., Headwall Photonics Inc., Corning Incorporated, Surface Optics Corporation, Specim, Spectral Imaging Ltd., Brimrose Corporation, Resonon Inc., Norsk Elektro Optikk AS (NEO), BaySpec Inc., Galileo Group Inc., imec, ChemImage Corporation, and others., and others. |

| Segments Covered | By Product Type, By Technology, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Hyperspectral Imaging System Market: Regional Analysis

North America to lead with the highest market share in the near future

During the forecast period, the global hyperspectral imaging system market will be dominated by North America. In 2022, the region controlled more than 30.5% of the global revenue. One of the leading factors for higher regional growth is the extensive proliferation of hyperspectral imaging systems across industries including healthcare, military, aerospace, and others. The technology is used for cancer detection and the US has one of the most well-renowned infrastructures that supports cancer detection and treatment. Centers such as Roswell Park Cancer Institute in New York, Abramson Cancer Center in Philadelphia, and Johns Hopkins Hospital Sidney Kimmel Comprehensive Cancer Center are some of the leading institutes working toward intensive cancer research.

In addition to this, the growing research and development for technology advancement with an intention to improve product application is expected to further promote regional expansion trajectory. In June 2023, NASA announced that it would take the assistance of industry players to develop orbiting hyperspectral space sensors capable of measuring ocean ecosystems. In November 2022, the National Reconnaissance Office will expand its applications of commercial hyperspectral imaging technology thus providing extensive support to the US government.

Hyperspectral Imaging System Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the hyperspectral imaging system market on a global and regional basis.

The global hyperspectral imaging system market is dominated by players like:

- Telops Inc.

- Headwall Photonics Inc.

- Corning Incorporated

- Surface Optics Corporation

- Specim

- Spectral Imaging Ltd.

- Brimrose Corporation

- Resonon Inc.

- Norsk Elektro Optikk AS (NEO)

- BaySpec Inc.

- Galileo Group Inc.

- imec

- ChemImage Corporation

- and others.

The global hyperspectral imaging system market is segmented as follows;

By Product Type

- Cameras

- Accessories

By Technology

- Pushbroom

- Snapshot

- Others

By Application

- Military Surveillance

- Remote Sensing

- Machine Vision/Optical Sorting

- Life Sciences & Medical Diagnostics

- Others

By End-user

- Defense

- Agriculture

- Mining

- Environmental Monitoring

- Healthcare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed