Global Hydrocarbon Solvents Market Size, Share, Growth Analysis Report - Forecast 2034

Hydrocarbon Solvents Market By Type (Aliphatic Naphtha, Mineral Spirit, Heptane, Hexane, Aromatic), By Application (Paints & Coatings, Cleaning & Degreasing, Adhesives, Aerosols, Rubber & Polymer, Printing Inks, Pharmaceuticals, Agriculture Chemicals, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

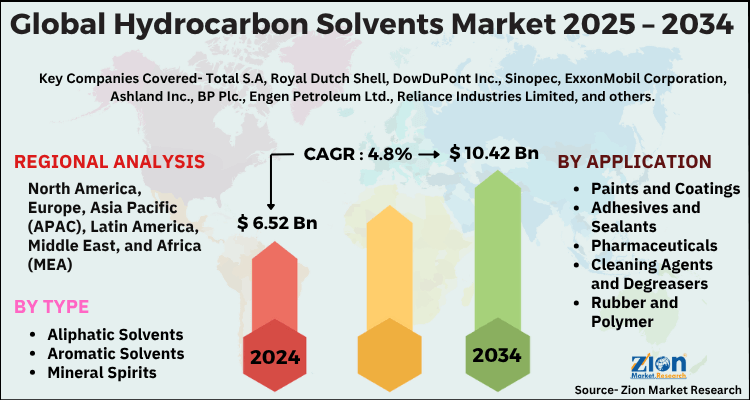

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.52 Billion | USD 10.42 Billion | 4.8% | 2024 |

Hydrocarbon Solvents Market: Industry Perspective

The global hydrocarbon solvents market size was worth around USD 6.52 Billion in 2024 and is predicted to grow to around USD 10.42 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034. The report analyzes the global hydrocarbon solvents market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hydrocarbon solvents industry.

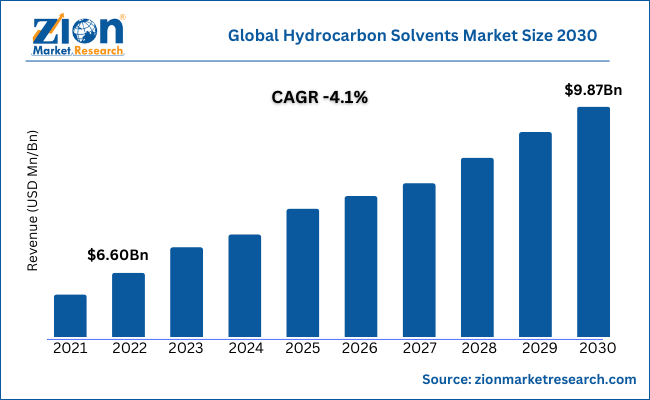

The global hydrocarbon solvents market size was worth around USD 6.60 billion in 2022 and is predicted to grow to around USD 9.87 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.1% between 2023 and 2030. The report analyzes the global hydrocarbon solvents market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hydrocarbon solvents industry.

Hydrocarbon Solvents Market: Overview

Hydrocarbon solvents are a class of chemical compounds that are composed exclusively of hydrogen and carbon atoms. They are derived from petroleum or natural gas and are widely used as solvents in various industrial applications and consumer products. Hydrocarbon solvents are known for their excellent dissolving power, which makes them effective in dissolving or dispersing a wide range of substances, including oils, greases, resins, waxes, adhesives, and many organic compounds. They are commonly used in industries such as coatings, paints, cleaning products, pharmaceuticals, and chemical manufacturing.

Aliphatic solvents have low to medium boiling points and include compounds such as naphtha, mineral spirits, and hexane. They are commonly used in paint thinners, degreasers, and industrial cleaning agents. Aromatic solvents have higher boiling points and include compounds such as benzene, toluene, and xylene. Aromatic solvents are commonly used in the production of paints, varnishes, adhesives, and rubber products. Oxygenated solvents contain oxygen atoms in addition to carbon and hydrogen. Examples include alcohols (such as ethanol and isopropyl alcohol), ketones (such as acetone), and esters (such as ethyl acetate). Oxygenated solvents are often used as solvents or co-solvents in various applications, including paints, inks, and cleaning products.

Key Insights

- As per the analysis shared by our research analyst, the global hydrocarbon solvents market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- Regarding revenue, the global hydrocarbon solvents market size was valued at around USD 6.52 Billion in 2024 and is projected to reach USD 10.42 Billion by 2034.

- The hydrocarbon solvents market is projected to grow at a significant rate due to rising demand from paints & coatings, pharmaceuticals, and adhesives industries, along with growth in manufacturing activities and cost-effective solvent solutions.

- Based on Type, the Aliphatic Naphtha segment is expected to lead the global market.

- On the basis of Application, the Paints & Coatings segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Hydrocarbon Solvents Market: Dynamics

Key Growth Drivers:

The hydrocarbon solvents market is propelled by robust demand from downstream industries such as paints & coatings, adhesives, printing inks, pharmaceuticals, and agrochemicals, where these solvents are valued for their excellent solvency and cost-effectiveness. Rising industrialization and construction activity in emerging economies increases consumption, while strong performance in cleaning, degreasing, and extraction applications (especially in manufacturing and automotive sectors) further stimulates growth. Easy availability from established petrochemical supply chains and ongoing product innovation (e.g., tailored solvent blends for specific formulations) also support market expansion.

Restraints:

Market growth is constrained by tightening environmental and occupational health regulations that limit volatile organic compound (VOC) emissions and restrict the use of certain hydrocarbon fractions. Increasing awareness of worker safety and public health concerns related to inhalation and long-term exposure discourages use in some applications. Price volatility tied to crude oil and petrochemical feedstock fluctuations raises operating costs and unpredictability for buyers and producers. These factors, combined with the rising adoption of water-based and low-VOC alternatives, act as significant restraints.

Opportunities:

There are clear opportunities in developing low-aromatic and reformulated hydrocarbon solvents that meet stricter regulatory and sustainability criteria while retaining performance. Growth in emerging markets with expanding industrial and consumer-goods sectors offers volume upside, and specialty applications (electronics cleaning, precision extraction, high-performance adhesives) demand higher-margin, tailor-made solvents. Investment in solvent recovery, recycling technologies, and hybrid bio-based blends presents pathways to reduce environmental impact and open new customer segments seeking greener solutions.

Challenges:

Key challenges include navigating an increasingly stringent regulatory landscape across regions, which raises compliance costs and can force reformulation or phase-out of legacy products. Competition from alternative solvent systems (water-based, ester- or glycol-based, and bio-solvents) requires continuous R&D and marketing effort to retain market share. Supply chain disruptions and feedstock price swings can squeeze margins and complicate planning, while the need to demonstrate safety and reduced environmental footprint demands costly testing, certifications, and capital investment in cleaner production methods.

Hydrocarbon Solvents Market: Segmentation

The global hydrocarbon solvents industry is segmented based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on the type, the global market is bifurcated into aliphatic solvents, aromatic solvents, mineral spirits, and others. The aromatic solvents segment is expected to capture the largest market share during the forecast period. Aromatic solvents are widely used in various applications due to their excellent solvency power and compatibility with different materials. They find extensive use in industries such as paints & coatings, adhesives, rubber & polymer, and chemical processing. Aromatic solvents, such as toluene, xylene, and benzene, offer high solvency and efficient dissolving capabilities, making them suitable for a wide range of applications. However, it's important to note that the hydrocarbon solvents market share can vary depending on factors such as regional preferences, specific industry requirements, and regulatory factors.

Based on the application, the global hydrocarbon solvent industry is divided into paints & coatings, adhesives & sealants, pharmaceuticals, cleaning agents & degreasers, rubber & polymer, chemical processing, and others. The paints and coatings segment is expected to dominate the market over the forecast period. The paints and coatings industry is Asia’s major consumer of hydrocarbon solvents. These solvents are used in the formulation of paints, varnishes, and coatings to dissolve and disperse pigments, enhance application properties, and facilitate drying. The paints and coatings industry encompasses various sectors, including architectural coatings, automotive coatings, industrial coatings, and more. The demand for hydrocarbon solvents in the paints and coatings industry is driven by factors such as infrastructure development, construction activities, maintenance & refurbishment projects, and the overall growth of the global construction & automotive sectors.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Hydrocarbon Solvents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hydrocarbon Solvents Market |

| Market Size in 2024 | USD 6.52 Billion |

| Market Forecast in 2034 | USD 10.42 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 213 |

| Key Companies Covered | Total S.A, Royal Dutch Shell, DowDuPont Inc., Sinopec, ExxonMobil Corporation, Ashland Inc., BP Plc., Engen Petroleum Ltd., Reliance Industries Limited, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Hydrocarbon Solvents Market: Regional Analysis

North America is expected to dominate the global hydrocarbon solvents market during the forecast period. The North American region has a strong presence in the paints and coatings industry, which drives the demand for hydrocarbon solvents. The construction sector and increasing infrastructure projects further fuel this demand. Environmental regulations in North America have prompted a shift towards eco-friendly solvents. Hydrocarbon solvent manufacturers are investing in research and development to offer low VOC or VOC-free solvents, aligning with sustainability goals and addressing regulatory requirements. The pharmaceutical industry in North America relies on hydrocarbon solvents for various applications, including drug formulation and extraction processes. The expanding pharmaceutical sector contributes to the increased demand for hydrocarbon solvents in the region.

Europe is expected to grow at the fastest rate during the forecast period. European countries have implemented strict regulations concerning VOC emissions and environmental sustainability. This has led to a higher demand for sustainable solvents, pushing the market towards eco-friendly alternatives. The European automotive industry is a major consumer of hydrocarbon solvents, using them in coatings, adhesives, and manufacturing processes. The region's strong automotive sector, coupled with advancements in electric vehicle production, drives the demand for hydrocarbon solvents in Europe. Further, the construction sector in Europe is witnessing growth due to infrastructure development projects. Hydrocarbon solvents are used in various construction applications, including paints, coatings, and adhesives, thereby bolstering market growth.

Hydrocarbon Solvents Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the hydrocarbon solvents market on a global and regional basis.

The global hydrocarbon solvents market is dominated by players like:

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- Chevron Phillips Chemical Company LLC

- LyondellBasell Industries N.V.

- BP plc

- Total Energies SE

- Hidemitsu Kosan Co. Ltd.

- SK Global Chemical Co. Ltd.

- Phillips 66

- Indian Oil Corporation Limited.

The global hydrocarbon solvents market is segmented as follows:

By Type

- Aliphatic Solvents

- Aromatic Solvents

- Mineral Spirits

- Others

By Application

- Paints and Coatings

- Adhesives and Sealants

- Pharmaceuticals

- Cleaning Agents and Degreasers

- Rubber and Polymer

- Chemical Processing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Hydrocarbon solvents are a class of chemical compounds that are composed exclusively of hydrogen and carbon atoms. They are derived from petroleum or natural gas and are widely used as solvents in various industrial applications and consumer products.

The global hydrocarbon solvents market is expected to grow due to increasing demand from diverse end-use industries like paints and coatings, adhesives, pharmaceuticals, and cleaning agents, alongside rapid industrialization, infrastructure development, and continuous advancements in solvent blends and sustainable alternatives.

According to a study, the global hydrocarbon solvents market size was worth around USD 6.52 Billion in 2024 and is expected to reach USD 10.42 Billion by 2034.

The global hydrocarbon solvents market is expected to grow at a CAGR of 4.8% during the forecast period.

Asia-Pacific is expected to dominate the hydrocarbon solvents market over the forecast period.

Leading players in the global hydrocarbon solvents market include Total S.A, Royal Dutch Shell, DowDuPont Inc., Sinopec, ExxonMobil Corporation, Ashland Inc., BP Plc., Engen Petroleum Ltd., Reliance Industries Limited, among others.

The report explores crucial aspects of the hydrocarbon solvents market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed