Human Centric Workplace Market Size, Share, Trends, Growth & Forecast 2034

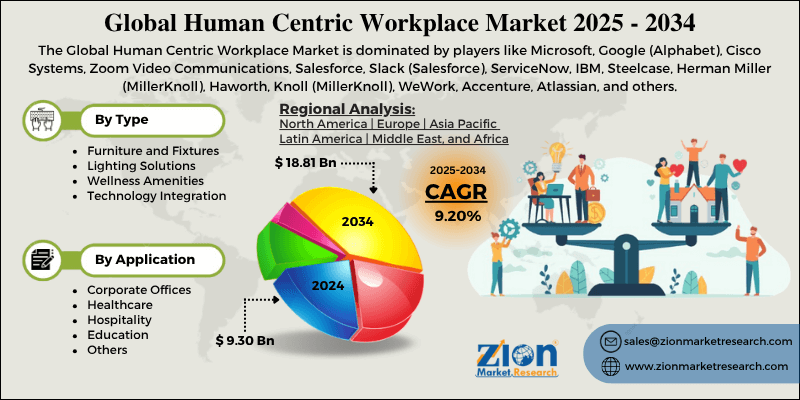

Human Centric Workplace Market By Type (Furniture and Fixtures, Lighting Solutions, Wellness Amenities, Technology Integration), By Application (Corporate Offices, Healthcare, Hospitality, Education, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

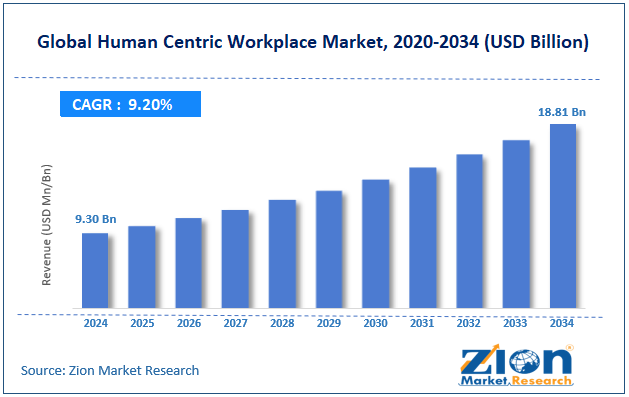

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.30 Billion | USD 18.81 Billion | 9.20% | 2024 |

Human Centric Workplace Industry Perspective:

The global human centric workplace market size was worth around USD 9.30 billion in 2024 and is predicted to grow to around USD 18.81 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global human centric workplace market is estimated to grow annually at a CAGR of around 9.20% over the forecast period (2025-2034)

- In terms of revenue, the global human centric workplace market size was valued at around USD 9.30 billion in 2024 and is projected to reach USD 18.81 billion by 2034.

- The human centric workplace market is projected to grow significantly due to the rapid adoption of flexible and hybrid work models, a focus on equity, diversity, and inclusion (DEI), and increased investment in smart and ergonomic workplace designs.

- Based on type, the technology integration segment is expected to lead the market, while the furniture and fixtures segment is expected to grow considerably.

- Based on application, the corporate offices segment is the dominating segment, while the healthcare segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Human Centric Workplace Market: Overview

A human-centric workplace is a work environment dedicated explicitly to the needs, productivity, and well-being of employees, rather than merely focusing on infrastructure or processes. It incorporates digital, physical, and cultural fundamentals to create supportive, adaptive, and inclusive spaces that improve engagement, comfort, and collaboration. The global human centric workplace market is likely to expand rapidly, fueled by employee experience economics and talent retention, mental health and well-being regulation pressure, and digital workplace transformation & experience platforms. Companies are actively linking workplace experience to retention, burnout reduction, engagement, and brand reputation. Employers are investing in human-centric design to lessen churn costs and enhance EVP (Employer Value Proposition). Internal EX rates are not C-suite KPIs, driving investment into people-first workplaces.

Moreover, governments in North America and the EU are introducing commands for psychological safety and ergonomics compliance. Companies are experiencing growing litigation and insurance risks from employee burnout and unhealthy workplaces. The structured well-being framework is now a compliance requirement, not just a benefit. Furthermore, the adoption of seamless digital workplace packages, sentiment analytics, occupancy sensing, and adaptive lighting/air systems fuels industry growth. Real-time workplace personalization engines and AI-based comfort controls improve employee productivity and comfort. Investment in smart workplace stacks is becoming a standard in HQs.

Despite the growth, the global market is impeded by factors such as cultural resistance in hierarchical businesses and challenges in ROI attribution and measurement. Traditional dominance cultures undervalue employee-experience investments as soft expenses. Adoption fails where management disapproves of autonomy, flexibility, and design democratization. Human-centric architecture flops without leadership buy-in.

Likewise, benefits like retention, engagement, and mental health are challenging to quantify. Boards waver to commit without hard ROI metrics like revenue or delta effect. The absence of a standardized EX measurement architecture slows the adoption.

Nonetheless, the global human centric workplace industry stands to gain from a few key opportunities like AI-based adaptive workplace experience engines, neurodiversity-inclusive standards, and cross-border standardization for global enterprises. AI can dynamically adjust temperature, lighting, meeting allocations, seating, and acoustic zoning according to work modes and employee personas. This transforms static spaces into living, adaptive systems—a significant monetization opportunity in SaaS-layer orchestration. Companies are beginning to mandate design for ADHD, sensory fatigue, hypersensitivity, and autism. Vendors offering neuro-inclusive standards will hold premium demand.

Additionally, MNCs demand unified employee experience standards across continents to normalize EX equity. Vendors offering worldwide architectures and certifications win high-value multi-region accounts. Standardization will fuel premium enterprise contracts.

Human Centric Workplace Market Dynamics

Growth Drivers

How is the explosion in workplace digitalization boosting the human centric workplace market?

Corporate campus digitalization is fastening: IDC predicted >USD 60B in 2023-24 global spend on workplace experience platforms, behavior analytics, adaptive workplace tech, and comfort controls. Cisco's 2024 Workplace Report shows that 72% of businesses are scaling or piloting sensor-based occupancy, comfort modulation, and air quality in offices. The growth of AI space-orchestration allows real-time optimization of sound, light, seating, and temperature to human outcome metrics. This digital substrate makes HCW tunable and scalable, rather than being a one-time design. Banks and tech hyperscalers are publishing case studies showing double-digit experience surge using these stacks.

How do ESG, DEI & board-level reporting drive the human centric workplace market?

ESG reporting architecture essentially encodes human capital disclosure – the SEC's 2024 human capital disclosure rules add pressure on S&P 500 firms to provide equitable, evidence safe, and inclusive workplace conditions. S&P Global ESG ratings and MSCI added workforce well-being indicators in 2023-24, directly impacting fund inclusion and capital access. Large fund managers like Norges Bank, State Street, and BlackRock publicly pushed portfolio companies in 2024 to publish human-centric workplace commitments with numeric targets. The move pulls HCW out of the HR initiative and into Board-material strategic KPI. This makes the adoption budget-protected and durable, impacting the global human centric workplace market.

Restraints

Economic uncertainty and fluctuating corporate investment priorities negatively impact the market progress

Worldwide economic volatility, comprising inflation, geopolitical stresses, and growing interest rates, affects long-term capital allocation towards human-centric workplace initiatives. According to McKinsey's 2024, nearly 46% of corporate real estate and HR leaders have downsized or paused HCW initiatives because of financial constraints. In APAC, a majority of tech companies delayed planned office redesigns in Q1-Q2 2024 amidst slowing growth projections. This unpredictability decreases the pace of adoption, mainly in the mid-market businesses and SMEs. Corporate hesitancy to commit to multi-year investments is still a significant restraint.

Opportunities

How does the expansion in emerging markets and tier-2 cities create promising avenues for the human centric workplace industry growth?

HCW adoption is no longer limited to the established markets; Latin America, APAC, and parts of the Middle East are essentially embracing these trends. CBRE 2024 reported a 35% YoY rise in requests for human-centric design in Southeast Asian and Indian corporate campuses. Multinationals are extending HCW standards to regional offices to provide a continuous employee experience. Governments in the UAE, India, and Singapore incentivize well-being-focused and sustainable office deployments. This offers opportunities for the local contractors, technology integrators, and design consultancies, impacting the human centric workplace industry.

Challenges

Regulatory and legal compliance complexities restrict the market growth

Compliance with regional, local, and international workplace safety, data privacy regulations, and accessibility offers barriers. APAC and EU jurisdictions are actively enforcing workplace ergonomics and mental health regulations. In 2024, GDPR-associated data handling challenges rose for companies using sensorized workplace solutions in Europe. Non-compliance may lead to reputational risk, project delays, and penalties. Keeping up with the changing regulations is a continual challenge for worldwide HCW deployments.

Human Centric Workplace Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Human Centric Workplace Market |

| Market Size in 2024 | USD 9.30 Billion |

| Market Forecast in 2034 | USD 18.81 Billion |

| Growth Rate | CAGR of 9.20% |

| Number of Pages | 216 |

| Key Companies Covered | Microsoft, Google (Alphabet), Cisco Systems, Zoom Video Communications, Salesforce, Slack (Salesforce), ServiceNow, IBM, Steelcase, Herman Miller (MillerKnoll), Haworth, Knoll (MillerKnoll), WeWork, Accenture, Atlassian, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Human Centric Workplace Market: Segmentation

The global human centric workplace market is segmented based on type, application, and region.

Based on type, the global human centric workplace industry is divided into furniture and fixtures, lighting solutions, wellness amenities, and technology integration. The technology integration holds a dominating share, fueled by smart workplace platforms, AI-enabled HVAC and lighting, collaboration tools, and IoT-based occupancy analytics. Hybrid work models raise demand for personalized employee experiences and data-driven space optimization. Its measurable impact on productivity, compliance, and comfort boosts the segmental dominance.

On the other hand, the furniture and fixtures segment holds a second-leading share, comprising ergonomic chairs, modular pods, acoustic solutions, and adjustable desks. Flexible and hybrid work arrangements fuel enterprises to advance workstations for collaboration and comfort. Investments reduce musculoskeletal issues and support total workplace flexibility, increasing the segmental dominance.

Based on application, the global human centric workplace market is segmented into corporate offices, healthcare, hospitality, education, and others. The corporate offices segment holds leadership, fueled by the adoption of strategies for hybrid work, productivity, focused design, and employee experience. Investments in ergonomic furniture, wellness amenities, and smart technology are leading in this segment. Large-scale businesses prioritize corporate HQs as flagship spaces to retain, attract, and engage talent.

Conversely, the healthcare segment holds a second position, adopting human-centric design to improve staff efficiency, patient safety, and comfort. Solutions comprise smart lighting, wellness-focused layouts, and ergonomic workstations for support staff and clinicians. Regulatory pressures and well-being standards further augment investments in the domain.

Human Centric Workplace Market: Regional Analysis

What enables North America to have a strong foothold in the global Human Centric Workplace Market?

North America is anticipated to retain its leading role in the global human centric workplace market as a result of early adoption of flexible and hybrid work models, high corporate spending on EX, and advanced technology integration. North American companies were among the first to adopt hybrid work post-pandemic, creating demand for human-centric office redesigns. More than 70% of the United States companies are offering hybrid arrangements, fueling investments in flexible layouts, smart technology, and wellness-focused infrastructure. Early adoption has given the region a significant first-mover advantage in terms of industry size.

Moreover, regional businesses allocate over 30% more per employee to workplace design and wellness than other regions. Large corporations view human-centric workplace as a tool to improve retention, productivity, and employer branding. This willingness to spend augments industry expansion in furniture, wellness solutions, and technology.

Furthermore, the region dominates in deploying AI-based occupancy analytics, IoT, smart lighting, and HVAC controls in companies. Nearly 65% of regional offices have at least one digital workplace platform, supporting real-time data-driven employee experience management. Technology adoption improves safety, comfort, and operational efficiency, strengthening industry dominance.

Europe ranks as the second-leading region in the global human centric workplace industry due to its strong focus on employee wellness and work-life balance, the adoption of flexible and hybrid work models, and advanced regulatory environments and compliance standards. European companies prioritize employee wellness and work-life balance, supporting stringent labor regulations. Surveys signify that more than 65% of European businesses offer flexible work arrangements and wellness initiatives. This focus fuels investments in ergonomic furniture, collaborative office design, and wellness amenities. Post-pandemic, hybrid work has gained remarkable attention in Europe, especially in France, Germany, and the UK. Nearly 58% of employees in the leading EU economies are working in a hybrid model, driving businesses to redesign office spaces for collaboration, comfort, and productivity. Smart technology and flexible layouts are actively deployed.

Additionally, EU labor and safety norms, comprising psychological and ergonomic health mandates, force companies to adopt human-centric designs. Businesses implement wellness-focused layouts, mental health initiatives, and ergonomic workstations to comply with laws like Directive 89/391/EEC. Compliance-driven adoption propels continuous industry growth.

Human Centric Workplace Market: Competitive Analysis

The leading players in the global human centric workplace market are:

- Microsoft

- Google (Alphabet)

- Cisco Systems

- Zoom Video Communications

- Salesforce

- Slack (Salesforce)

- ServiceNow

- IBM

- Steelcase

- Herman Miller (MillerKnoll)

- Haworth

- Knoll (MillerKnoll)

- WeWork

- Accenture

- Atlassian

Human Centric Workplace Market: Key Market Trends

Smart workplace technologies:

AI-driven occupancy analytics, IoT, sensor-based lighting, and climate control systems are broadly adopted. These tools personalize, boost productivity, and enhance employee comfort. Technology-driven insights also guide future workplace investments.

ESG and sustainability-driven design:

Energy-efficient lighting, green building certifications, and low-impact materials are largely focused. Workplaces are actively supporting employee experience with social and environmental governance objectives. Sustainability considerations are becoming a strategic priority in design and procurement.

Wellness and mental health integration

Businesses are integrating wellness rooms, medical areas, biophilic design, and nap pods. Focusing on stress reduction and mental health is associated with productivity and retention. ESG reporting primarily refers to these wellness investments.

The global human centric workplace market is segmented as follows:

By Type

- Furniture and Fixtures

- Lighting Solutions

- Wellness Amenities

- Technology Integration

By Application

- Corporate Offices

- Healthcare

- Hospitality

- Education

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A human-centric workplace is a work environment dedicated explicitly to the needs, productivity, and well-being of employees, rather than merely focusing on infrastructure or processes. It incorporates digital, physical, and cultural fundamentals to create supportive, adaptive, and inclusive spaces that improve engagement, comfort, and collaboration.

The global human centric workplace market is projected to grow due to an inclination toward employee mental health and well-being, demand for experience-enhancing technologies, productivity, and increasing corporate ESG and sustainability mandates.

According to the study, the global human-centric workplace market size was worth around USD 9.30 billion in 2024 and is predicted to grow to around USD 18.81 billion by 2034.

The CAGR value of the human centric workplace market is expected to be around 9.20% during 2025-2034.

Investment and partnership opportunities exist in ergonomic furniture, technology integration, AI-driven workplace analytics, wellness solutions, and ESG-aligned design services.

Pricing trends show a shift toward subscription-based, premium, and modular solutions, with wellness-focused offerings and higher costs for advanced technology.

North America is expected to lead the global human centric workplace market during the forecast period.

The key players profiled in the global human centric workplace market include Microsoft, Google (Alphabet), Cisco Systems, Zoom Video Communications, Salesforce, Slack (Salesforce), ServiceNow, IBM, Steelcase, Herman Miller (MillerKnoll), Haworth, Knoll (MillerKnoll), WeWork, Accenture, and Atlassian.

Leading players are focusing on partnerships, mergers, smart workplace solutions, product innovation, and geographic expansion to strengthen market presence.

The report examines key aspects of the human centric workplace market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed