Home Potassium Monitoring Devices Market Size, Share, Trends, Growth and Forecast 2034

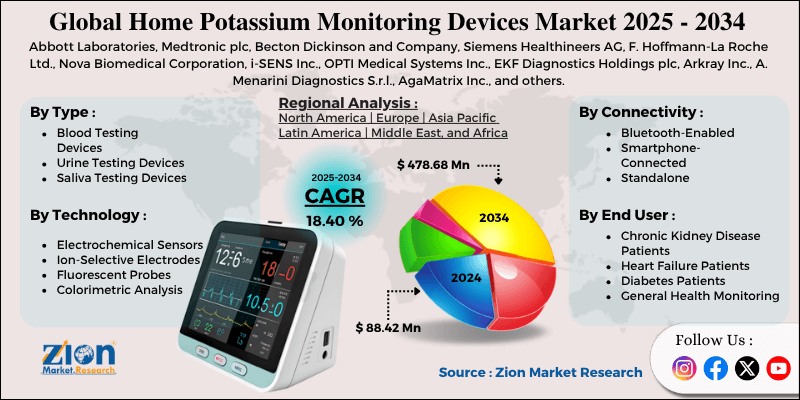

Home Potassium Monitoring Devices Market By Type (Blood Testing Devices, Urine Testing Devices, and Saliva Testing Devices), By Technology (Electrochemical Sensors, Ion-Selective Electrodes, Fluorescent Probes, and Colorimetric Analysis), By Connectivity (Bluetooth-Enabled, Smartphone-Connected, and Standalone), By End User (Chronic Kidney Disease Patients, Heart Failure Patients, Diabetes Patients, and General Health Monitoring), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

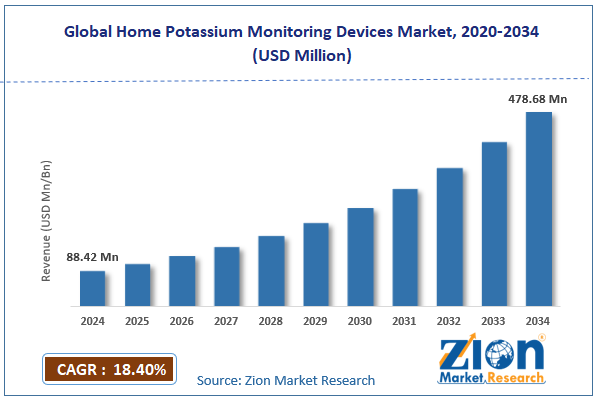

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 88.42 Million | USD 478.68 Million | 18.40% | 2024 |

Home Potassium Monitoring Devices Industry Perspective:

The global home potassium monitoring devices market was valued at approximately USD 88.42 million in 2024 and is expected to reach around USD 478.68 million by 2034, growing at a compound annual growth rate (CAGR) of roughly 18.40% between 2025 and 2034.

Home Potassium Monitoring Devices Market: Overview

A home potassium monitor is a medical device that allows patients to measure their blood, urine, or saliva potassium levels outside the clinic for conditions requiring electrolyte monitoring. These devices combine sensor technology, sample processing, and result interpretation to give patients accurate readings for conditions like kidney disease, heart failure, and diuretic therapy.

Modern potassium monitors are portable, user-friendly, and have sharing options for healthcare providers and data management systems to track trends over time.

Products range from traditional blood testing devices that require finger pricks to non-invasive devices that use saliva or urine samples, with varying levels of accuracy, convenience, and price points to suit different patient needs.

The growing prevalence of chronic conditions requiring electrolyte monitoring, increasing patient preference for home-based healthcare solutions, and technological advancements enabling accurate point-of-care testing are expected to drive substantial growth in the global home potassium monitoring devices industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global home potassium monitoring devices market is estimated to grow annually at a CAGR of around 18.40% over the forecast period (2025-2034)

- In terms of revenue, the global home potassium monitoring devices market size was valued at around USD 88.42 million in 2024 and is projected to reach USD 478.68 million by 2034.

- The home potassium monitoring devices market is projected to grow significantly due to increasing healthcare spending, rising awareness of electrolyte imbalances, and growing integration of AI in diagnostic devices.

- Based on type, blood testing devices lead the segment and will continue to lead the global market.

- Based on the technology, ion-selective electrodes lead the market with the largest revenue share.

- Based on connectivity, smartphone-connected devices are anticipated to command the largest market share.

- Based on the end-user, chronic kidney disease patients represent the predominant market segment during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Home Potassium Monitoring Devices Market: Growth Drivers

Chronic disease prevalence and telehealth expansion

The global home potassium monitoring devices market is growing due to more chronic conditions needing electrolyte management and telehealth's rapid rise.

Chronic kidney disease affects many adults worldwide, and they need to regularly check their potassium levels to avoid dangerous imbalances that can lead to heart problems. Heart failure cases have increased in the past decade, and many patients take medications requiring careful monitoring of electrolytes.

The COVID-19 pandemic increased the use of telehealth and built long-term systems and support for remote monitoring, including potassium testing. Home potassium monitoring can lower hospital visits by allowing early treatment before problems become severe.

Technological innovation and clinical integration

The home potassium monitoring devices industry has revolutionized patient self-management across multiple chronic disease states. Miniaturization of sensor technology has reduced sample volume requirements compared to previous generation devices, making it less invasive and more convenient to use regularly.

Machine learning algorithms now provide personalized results based on patient history, medication, and comorbidities. Integration with electronic health records and physician portals allows for seamless data sharing, so clinicians can remotely monitor trends and get automated alerts for concerning patterns that need attention.

Non-invasive and continuous monitoring with new technologies like wearable micro sensors is a big step from periodic testing, giving more insight into electrolyte fluctuations throughout the day and medication cycles.

Home Potassium Monitoring Devices Market: Restraints

Accuracy concerns and reimbursement limitations

The home potassium monitoring devices market faces technical and healthcare system integration challenges despite the growing demand. Accuracy variations between home testing and laboratory reference standards are a concern; home devices are ±0.3-0.5 mmol/L compared to the gold standard ±0.1 mmol/L in clinical labs, leading to misinterpretation in borderline cases.

Reimbursement policies vary widely across healthcare systems, which creates a financial barrier to adoption, especially for vulnerable populations.

Regulatory approval pathways require substantial clinical validation data comparing home testing to established laboratory methods, which extends development time and cost for new solutions.

Home Potassium Monitoring Devices Market: Opportunities

Integration with digital health ecosystems and patient-centered design

The home potassium monitoring devices market has huge opportunities through integration with existing digital health platforms and developing solutions that address unmet user needs.

Integrating disease management apps that combine medication reminders, diet tracking, and symptom monitoring creates more valuable ecosystems for patients managing conditions affecting electrolyte balance.

Patient-centric design approaches that focus on simplicity, intuitive interfaces, and precise results interpretation address the barriers to testing, especially among the elderly with multiple coexisting conditions.

Home Potassium Monitoring Devices Market: Challenges

Technical complexity and education requirements

The home potassium monitoring devices market has to balance technical performance with usability for patients with varying health literacy. Training programs for doctors and patients are essential, but they take a lot of time and resources because everyone needs to learn how to use the devices, understand the results, and know what to do with them. Ensuring the devices are working correctly is hard at home, where temperature and humidity cannot be controlled like in a hospital.

Hence, the devices must be built well to give correct readings in different situations. These devices cost a lot of money for patients who do not have insurance, which makes it hard for many people to get them, even though they could save money over time by not having to go to the doctor as much and by avoiding health problems.

Home Potassium Monitoring Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Home Potassium Monitoring Devices Market |

| Market Size in 2024 | USD 88.42 Million |

| Market Forecast in 2034 | USD 478.68 Million |

| Growth Rate | CAGR of 18.40% |

| Number of Pages | 213 |

| Key Companies Covered | Abbott Laboratories, Medtronic plc, Becton Dickinson and Company, Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., Nova Biomedical Corporation, i-SENS Inc., OPTI Medical Systems Inc., EKF Diagnostics Holdings plc, Arkray Inc., A. Menarini Diagnostics S.r.l., AgaMatrix Inc., and others. |

| Segments Covered | By Type, By Technology, By Connectivity, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Home Potassium Monitoring Devices Market: Segmentation

The global home potassium monitoring devices market is segmented into type, technology, connectivity, end user, and region.

Based on type, the market is segregated into blood testing devices, urine testing devices, and saliva testing devices. Blood testing devices lead the market due to their established accuracy profiles and clinical validation through extensive research studies.

Based on the technology, the home potassium monitoring devices industry is classified into electrochemical sensors, ion-selective electrodes, fluorescent probes, and colorimetric analysis. Ion-selective electrodes hold the largest market share due to their proven reliability in detecting potassium ions and the favorable balance between accuracy and manufacturing costs.

Based on connectivity, the home potassium monitoring devices market is divided into Bluetooth-enabled, smartphone-connected, and standalone devices. The smartphone-connected is expected to lead the market during the forecast period due to the ubiquity of smartphones across patient demographics, and the ability to provide enhanced data visualization and interpretation/

Based on the end user, the industry is categorized into chronic kidney disease patients, heart failure patients, diabetes patients, and general health monitoring. Chronic kidney disease patients are expected to lead the market due to the critical importance of potassium management in preventing serious complications, and clear clinical guidelines recommending regular monitoring.

Home Potassium Monitoring Devices Market: Regional Analysis

North America to lead the market

North America leads the global home potassium monitoring devices market, with the U.S. being the most significant consumer due to a large patient population and a developed telehealth ecosystem. Patients in North America who use home potassium monitoring devices go to the emergency room much less often for electrolyte problems than those using regular care.

The region has established remote patient monitoring programs of large health systems, including home testing in chronic disease management protocols. Strong insurance coverage for preventive technologies, especially for Medicare patients with qualifying conditions, reduces the financial barrier to adoption.

The presence of major medical device companies and significant venture capital investment in digital health solutions creates an environment for innovation and product development for home diagnostics.

Europe is to maintain a substantial market share.

Europe represents a significant home potassium monitoring devices market characterized by strong public healthcare systems, aging populations with high chronic disease burden, and growing emphasis on home-based care models. Countries like Germany, the UK, France, and the Nordic countries have established structured reimbursement pathways for remote monitoring technologies.

The region’s centralized healthcare systems allow coordinated remote monitoring programs with standardized protocols and quality metrics across large patient populations.

European regulatory frameworks have established specific pathways for home diagnostics validation for this market. Strong focus on prevention and reducing hospital utilization drives the adoption of technologies that enable early intervention before complications develop.

Recent Market Developments:

- In January 2025, AccurKardia, which uses AI to detect hyperkalemia using ECG data, AK+ Guard software, received FDA Breakthrough Device Designation.

Home Potassium Monitoring Devices Market: Competitive Analysis

The global home potassium monitoring devices market is led by players like:

- Abbott Laboratories

- Medtronic plc

- Becton Dickinson and Company

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd.

- Nova Biomedical Corporation

- i-SENS Inc.

- OPTI Medical Systems Inc.

- EKF Diagnostics Holdings plc

- Arkray Inc.

- A. Menarini Diagnostics S.r.l.

- AgaMatrix Inc.

The global home potassium monitoring devices market is segmented as follows:

By Type

- Blood Testing Devices

- Urine Testing Devices

- Saliva Testing Devices

By Technology

- Electrochemical Sensors

- Ion-Selective Electrodes

- Fluorescent Probes

- Colorimetric Analysis

By Connectivity

- Bluetooth-Enabled

- Smartphone-Connected

- Standalone

By End User

- Chronic Kidney Disease Patients

- Heart Failure Patients

- Diabetes Patients

- General Health Monitoring

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

List of Contents

Home Potassium Monitoring DevicesIndustry Perspective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisRecent Market Developments:Competitive AnalysisThe global home potassium monitoring devices market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed