Global Home Elevator Market Size, Share, Growth Analysis Report - Forecast 2034

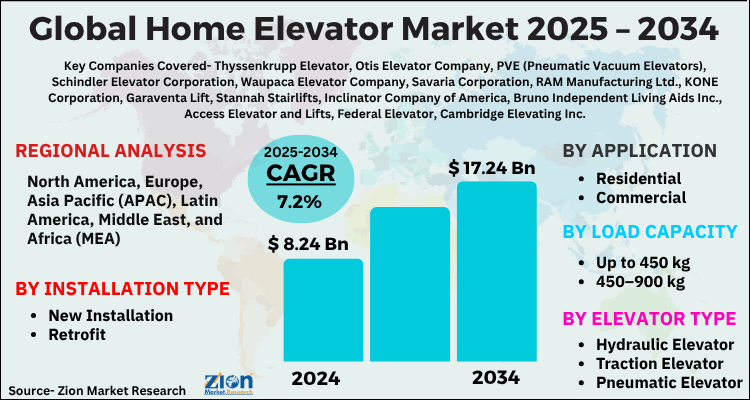

Home Elevator Market: By Elevator Type (Hydraulic Elevator, Traction Elevator, Pneumatic Elevator, Machine-Room-Less (MRL) Elevator), By Load Capacity (Up to 450 kg, 450–900 kg, Above 900 kg), By Application (Residential, Commercial), By Installation Type (New Installation, Retrofit), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.24 Billion | USD 17.46 Billion | 7.2% | 2024 |

Home Elevator Industry Perspective:

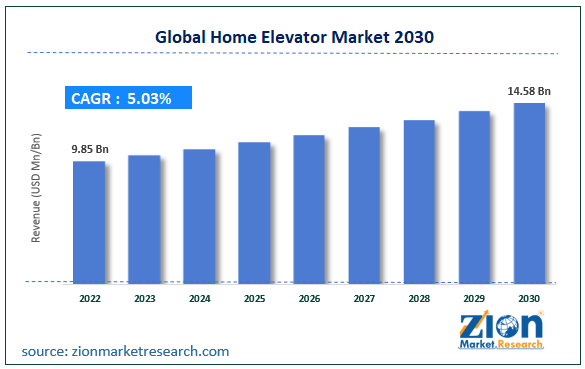

The global home elevator market size was worth around USD 8.24 Billion in 2024 and is predicted to grow to around USD 17.46 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.2% between 2025-2034. The report analyzes the global home elevator market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the home elevator industry.

Home Elevator Market: Overview

Home elevators are vertically transporting machines designed to be used in a residential or home setting. Home elevators should not be confused with home lifts. Although both the machines perform the same function, there is a significant difference between the two in terms of several factors including size and weight carrying capacity. Home elevators are larger than home lifts and can carry more weight. Furthermore, they are designed keeping in view multiple factors. For instance, while the primary goal is to transport people or objects from one floor to another, home elevators have to be aesthetically pleasing as well. They are available in various types such as hydraulic, pneumatic, traction, and others. Several companies are currently operating in the market delivering results as per client expectations by designing home elevators that not only serve the purpose but also fit in the overall residential structure. The rising research and innovation in terms of home elevator technology and the growing integration of advanced systems may help in delivering promising results during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global home elevator market is estimated to grow annually at a CAGR of around 7.2% over the forecast period (2025-2034).

- Regarding revenue, the global home elevator market size was valued at around USD 8.24 Billion in 2024 and is projected to reach USD 17.46 Billion by 2034.

- The home elevator market is projected to grow at a significant rate due to aging population, increasing mobility needs, and rising adoption of luxury and smart home features in residential buildings.

- Based on Elevator Type, the Hydraulic Elevator segment is expected to lead the global market.

- On the basis of Load Capacity, the Up to 450 kg segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Residential segment is projected to swipe the largest market share.

- By Installation Type, the New Installation segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Home Elevator Market: Growth Drivers

Rising number of 2 or more storey residential houses to create high demand

The global home elevator market is expected to grow due to the rising number of 2 or more storey homes across the globe. The increasing disposable income and changing preference for the normal population to live in separate homes away from main cities or urban areas has triggered a high construction rate of personally-owned residential homes housing all family members. Factors that are pushing the trend forward include a rising number of earning members in the family along with an increasing rate of home loans, migration of people from city areas to quiet and peaceful living areas, and a surge in home loan or financial assistance sanctions. For instance, India’s home loan market was valued at INR 22 lakh crore in 2022 and is expected to double in the coming 5 years. In homes with more than one floor, people tend to invest in home elevators especially if there is significant movement of people or objects from one floor to another. Home elevators ease the process of movement while improving the overall residential aesthetics.

Increasing geriatric population and people with medical conditions may contribute to higher consumption

The growing number of elderly population and people with medical conditions that restrict mobility are expected to fuel the demand and consumption of home elevators to new heights. As per an October 2022 report by the World Health Organization (WHO), the number of people over 60 years old was higher than children below 5 years in 2020. As per official statistics, WHO predicts between 2015 and 2050, the number of people over 60 years will double from 12% to 22%. In addition to this, there are millions of people affected by serious medical conditions such as cancer, diabetes, musculoskeletal disorders, genetic conditions, and cardiovascular diseases. These conditions are known to reduce or negatively impact mobility among patients requiring them to use external assistance for movement especially vertically. In such situations, home elevators can be highly beneficial since these machines can hold heavy weight including the weight of the patient and wheelchair if needed.

Home Elevator Market: Restraints

High machinery costs may restrict market growth

Home elevators are complex machines. Their production and installation cost is extremely high, which restricts global home elevator market growth. For instance, basic home elevators may cost around 1 million in initial placement. The expense increases gradually as additional maintenance cost burden piles up. These factors make home elevators a luxury product catering to the needs of a niche group of consumers. People with limited income in emerging or economically struggling nations may not have access to such high amounts for investing in home elevators. Furthermore, a large part of the potential consumers prefer using stairs for moving between floors. There are other alternate methods to assist in such transportation such as the installation of slopes for transporting goods or using stair chairs.

Home Elevator Market: Opportunities

New product launches and increased research & development may create expansion possibilities

The home elevator industry size may witness further expansion due to the ongoing research and development activities facilitating the launch of more advanced and premium home elevators as consumer preference continues to evolve. In May 2019, Thyssenkrupp Access, a leading manufacturer of lifts and other accessibility products, announced its plans to launch an affordable range of home elevators in the emerging Indian market thus expanding its presence in the global commercial world. Furthermore, developments such as connecting home elevators with renewable energy sources, employing better technical features, integration with smart home systems, voice-controlled attributes, and remote diagnostics are expected to help the market generate higher growth momentum during the projection period. Companies manufacturing home elevators are working on improving space efficiency by developing elevators that can be accommodated in smaller spaces as the world struggles with reducing land accessibility. For instance, shaft-less elevators, also known as through-floor elevators, are ideal for two-floor homes. They can be retrofitted into existing homes and do not require large areas as compared to traditional home elevators. Companies provide variations in mechanical designs, cab styles, and other installation requirements.

Home Elevator Market: Challenges

Machine safety and competition from home lifts to challenge market growth

The home elevator industry players face challenges owing to the confusion between home lifts and home elevators. While technically, both machines perform the role, there are significant differences between the two vertical transportation machines. More awareness about distinguishing factors will help companies operate without confusion from the consumer's end. Furthermore, the safety of the machines remains a critical point of concern for manufacturers and users. Only high-grade must be used along with advanced machine operating technology to ensure user safety. Any compromise on these aspects can lead to severe accidents.

Home Elevator Market: Segmentation

The global home elevator market is segmented based on elevator type, load capacity, application, installation type, and region.

Based on elevator type, the global home elevator market is divided into hydraulic elevator, traction elevator, pneumatic elevator, machine-room-less (mrl) elevator.

On the basis of load capacity, the global home elevator market is bifurcated into up to 450 kg, 450–900 kg, above 900 kg.

By application, the global home elevator market is split into residential, commercial.

In terms of installation type, the global home elevator market is categorized into new installation, retrofit.

Home Elevator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Home Elevator Market |

| Market Size in 2024 | USD 8.24 Billion |

| Market Forecast in 2034 | USD 17.46 Billion |

| Growth Rate | CAGR of 7.2% |

| Number of Pages | 228 |

| Key Companies Covered | Thyssenkrupp Elevator, Otis Elevator Company, PVE (Pneumatic Vacuum Elevators), Schindler Elevator Corporation, Waupaca Elevator Company, Savaria Corporation, RAM Manufacturing Ltd., KONE Corporation, Garaventa Lift, Stannah Stairlifts, Inclinator Company of America, Bruno Independent Living Aids Inc., Access Elevator and Lifts, Federal Elevator, Cambridge Elevating Inc., and others., and others. |

| Segments Covered | By Elevator Type, By Load Capacity, By Application, By Installation Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Home Elevator Market: Regional Analysis

North America to register the highest growth rate during the projected timeline

The global home elevator market is expected to witness the highest growth in North America with the US leading region. One of the primary reasons for higher regional growth is the presence of an extensive luxury home segment in the US. The standard of living in the US is higher with a large part of the population living in standalone homes with multiple storey. As per multiple official reports, New York is home to some of the most luxurious, rarest, and expensive penthouses. The average cost of a Manhattan penthouse is around USD 2621 per square foot. The country is also home to some of the most important manufacturers of home elevators working on deploying advanced systems for improved experience. Other factors such as a rising rate of geriatric population and high per capita income may further drive regional growth. Asia-Pacific is one of the most crucial emerging markets and has gained attention from several home elevator manufacturers and suppliers in recent times. Countries such as Singapore, India, China, South Korea, and Japan are the most essential regional markets.

Home Elevator Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the home elevator market on a global and regional basis.

The global home elevator market is dominated by players like:

- Thyssenkrupp Elevator

- Otis Elevator Company

- PVE (Pneumatic Vacuum Elevators)

- Schindler Elevator Corporation

- Waupaca Elevator Company

- Savaria Corporation

- RAM Manufacturing Ltd.

- KONE Corporation

- Garaventa Lift

- Stannah Stairlifts

- Inclinator Company of America

- Bruno Independent Living Aids Inc.

- Access Elevator and Lifts

- Federal Elevator

- Cambridge Elevating Inc.

- and others.

The global home elevator market is segmented as follows;

By Elevator Type

- Hydraulic Elevator

- Traction Elevator

- Pneumatic Elevator

- Machine-Room-Less (MRL) Elevator

By Load Capacity

- Up to 450 kg

- 450–900 kg

- Above 900 kg

By Application

- Residential

- Commercial

By Installation Type

- New Installation

- Retrofit

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Home elevators are vertically transporting machines designed to be used in a residential or home setting.

The global home elevator market is expected to grow due to aging population, increasing mobility needs, and rising adoption of luxury and smart home features in residential buildings.

According to a study, the global home elevator market size was worth around USD 8.24 Billion in 2024 and is expected to reach USD 17.46 Billion by 2034.

The global home elevator market is expected to grow at a CAGR of 7.2% during the forecast period.

North America is expected to dominate the home elevator market over the forecast period.

Leading players in the global home elevator market include Thyssenkrupp Elevator, Otis Elevator Company, PVE (Pneumatic Vacuum Elevators), Schindler Elevator Corporation, Waupaca Elevator Company, Savaria Corporation, RAM Manufacturing Ltd., KONE Corporation, Garaventa Lift, Stannah Stairlifts, Inclinator Company of America, Bruno Independent Living Aids Inc., Access Elevator and Lifts, Federal Elevator, Cambridge Elevating Inc., and others., among others.

The report explores crucial aspects of the home elevator market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Home ElevatorIndustry Perspective:Home Elevator OverviewKey Insights:Home Elevator Growth DriversHome Elevator RestraintsHome Elevator OpportunitiesHome Elevator ChallengesHome Elevator SegmentationHome Elevator Report ScopeHome Elevator Regional AnalysisHome Elevator Competitive AnalysisHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed