High Strength Steel Market Size, Share, Trends, Growth 2032

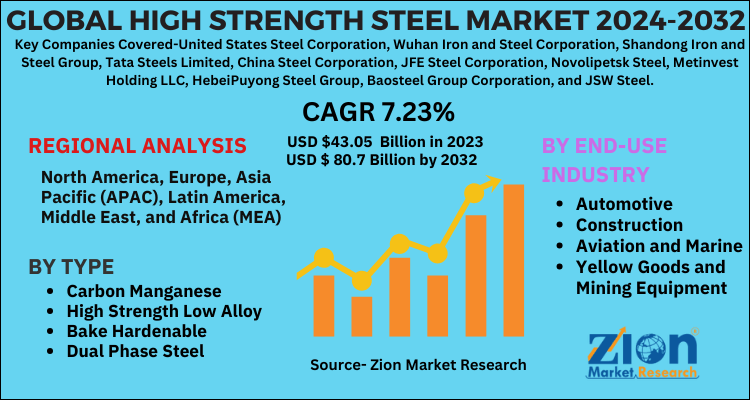

High Strength Steel Market By Type (Carbon Manganese, High Strength Low Alloy, Bake Hardenable, and Dual Phase Steel) and End-Use Industry (Automotive, Construction, Aviation & Marine, Yellow Goods & Mining Equipment, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 43.05 Billion | USD 80.7 Billion | 7.23% | 2023 |

High Strength Steel Industry Perspective:

The global high strength steel market size was worth around USD 43.05 billion in 2023 and is predicted to grow to around USD 80.7 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.23% between 2024 and 2032.

In order to offer the users of this report, a comprehensive view of the high strength steel market, we have enclosed a detailed value chain analysis. To know the competitive landscape within the market, an analysis of Porter’s Five Forces model for the high strength steel market has additionally been enclosed within the study. The study includes a market attractiveness analysis, wherein all the segments are benchmarked supported their market size, rate, and general attractiveness.

High Strength Steel Market: Growth Drivers

High strength steel is generally produced by using low-carbon compositions with phosphorous and manganese for its high strength. The steel is then cast into slabs and hot rolled. Furthermore, hot rolled coils are further processed and cold reduced into lighter gauges. High strength steel is widely used for structural applications and also called structural steel.

The global high strength steel market is expected to grow considerably in the next few years, owing to the rising demand for high strength steel across various industries, such as construction and automotive. Moreover, the rapidly growing demand for infrastructure and the flourishing manufacturing industries are projected to further propel the global high strength steel market in the future.

However, the high cost for production of high strength steel may hinder the market in the years ahead. Alternatively, the increasing investments and government support are anticipated to offer lucrative opportunities in the high strength steel market in the future.

The study also includes the market share of the key participant’s operating in the high strength steel market across the globe. Additionally, the report covers the strategic development together with acquisitions & mergers, agreements, partnerships, collaborations, and joint ventures, and regional growth of the key players within the market on a regional basis.

High Strength Steel Market: Segmentation

The global high strength steel market is classified based on the type and end-user industry.

The type segment includes carbon manganese, high strength low alloy, bake hardenable, and dual phase steel. The high strength low alloy segment held a significant share, i.e., around 37%, of the global high strength steel market in 2018, owing to its wide application across myriad sectors, such as structural engineering due to its excellent corrosion resistance properties. The dual-phase steel segment is projected to grow rapidly in the upcoming years, owing to the growing product usage in the automotive industry.

Based on end-use industry, the global high strength steel market includes automotive, construction, aviation and marine, yellow goods and mining equipment, and others. In 2018, the automotive segment dominated the global market and is anticipated to continue its dominance in the upcoming years as well.

High Strength Steel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High Strength Steel Market |

| Market Size in 2023 | USD 43.05 Billion |

| Market Forecast in 2032 | USD 80.7 Billion |

| Growth Rate | CAGR of 7.23% |

| Number of Pages | 110 |

| Key Companies Covered | United States Steel Corporation, Wuhan Iron and Steel Corporation, Shandong Iron and Steel Group, Tata Steels Limited, China Steel Corporation, JFE Steel Corporation, Novolipetsk Steel, Metinvest Holding LLC, HebeiPuyong Steel Group, Baosteel Group Corporation, and JSW Steel |

| Segments Covered | By type, By end-use industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

High Strength Steel Market: Regional Analysis

The regional classification includes Europe, North America, Latin America, Asia Pacific, and the Middle East and Africa.

By region, Asia Pacific contributed the largest share in the global high strength steel market in 2018 and is projected to lead in the future as well. The growing construction industry coupled with a rising population and strong economic conditions is driving factors this regional market. North America is the second largest regional market for high strength steel, followed by Europe.

High Strength Steel Market: Competitive Analysis

The global high strength steel market is led by players like:

- United States Steel Corporation

- Wuhan Iron and Steel Corporation

- Shandong Iron and Steel Group

- Tata Steels Limited

- China Steel Corporation

- JFE Steel Corporation

- Novolipetsk Steel

- Metinvest Holding LLC

- HebeiPuyong Steel Group

- Baosteel Group Corporation

- JSW Steel

This report segments the global high strength steel market into:

Global High Strength Steel Market: Type Analysis

- Carbon Manganese

- High Strength Low Alloy

- Bake Hardenable

- Dual Phase Steel

Global High Strength Steel Market: End-Use Industry Analysis

- Automotive

- Construction

- Aviation and Marine

- Yellow Goods and Mining Equipment

- Others

Global High Strength Steel Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

High-strength steel (HSS) is a type of steel that is designed to possess a higher tensile strength and yield strength than conventional steels. As a result, it is capable of withstanding increased loads and tension without deforming or ultimately failing. High-strength steels are frequently employed in applications that necessitate structural integrity, weight reduction, and durability.

The automotive sector is a significant contributor, as HSS is employed to produce vehicles that are lighter and more fuel-efficient, while simultaneously upholding safety and performance standards. The demand for HSS is also driven by the transition to electric vehicles (EVs) in order to reduce vehicle weight. The demand for HSS is being driven by the growing investments in infrastructure projects and the construction of high-rise buildings, bridges, and other structures, which necessitate materials with exceptional durability and strength.

The global high strength steel market size was worth around USD 43.05 billion in 2023 and is predicted to grow to around USD 80.7 billion by 2032.

The global high strength steel market a compound annual growth rate (CAGR) of roughly 7.23% between 2024 and 2032.

The regional classification includes Europe, North America, Latin America, Asia Pacific, and the Middle East and Africa.

Some key manufacturers of global high strength steel market are United States Steel Corporation, Wuhan Iron and Steel Corporation, Shandong Iron and Steel Group, Tata Steels Limited, China Steel Corporation, JFE Steel Corporation, Novolipetsk Steel, Metinvest Holding LLC, HebeiPuyong Steel Group, Baosteel Group Corporation, and JSW Steel.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed