High Purity Tin Market Size, Share, Trends, Price and Industry Forecast 2030

High Purity Tin Market: By Type (5N Tin, 6N Tin, 7N Tin), By Application (Superconducting Material, Tin Alloy, Solder, Pyroelectric Materials, Others), And By Region: Global Industry Analysis, Size, Share, Price, Trends, and Forecast, 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,684.37 Million | USD 5,987.64 Million | 6.26% | 2022 |

Description

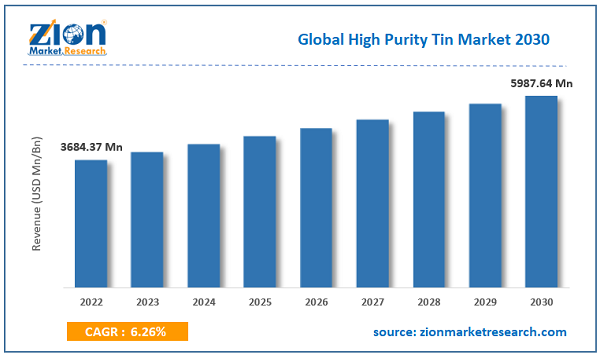

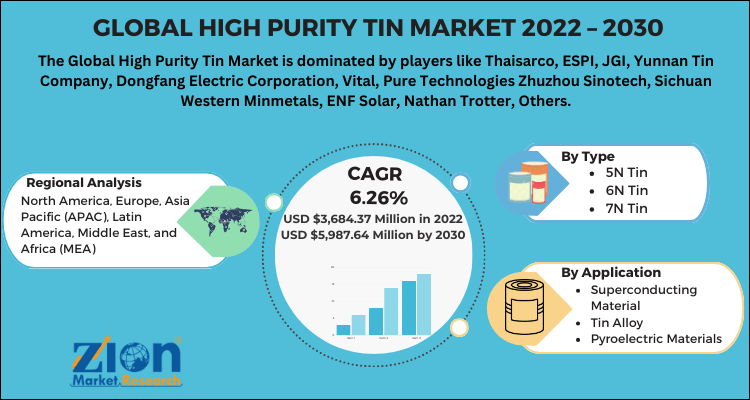

According to the report published by Zion Market Research, the global High Purity Tin Market size was valued at USD 3,684.37 Million in 2022 and is predicted to reach USD 5,987.64 Million by the end of 2030. The market is expected to grow with a CAGR of 6.26% during the forecast period.

The report analyzes the global High Purity Tin Market’s growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the High Purity Tin Market Industry.

The Global High Purity Tin Market: Overview

The report covers forecast and analysis for the high purity tin market on a global and regional level. The study provides historical data from 2017 to 2021 along with a forecast from 2023 to 2030 based on revenue (USD billion) and volume (Kilotons). The study includes drivers and restraints for the high purity tin market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities and various trends in the high purity tin market on a global as well as regional level.

As per the report, the global demand for the high purity tin market was valued at approximately 3,684.37 Million in 2022 and is anticipated to generate revenue of around USD 5,987.64 Million by end of 2030, growing at a CAGR of around 6.26% between 2023 and 2030.

High purity tin metal is generally utilized in making of high purity alloy, compound semiconductor, electrical conduction material, and solder. High purity tin metal is used as a protective coat for other metals. It offers a protective oxide layer to prevent oxidation.

The Global High Purity Tin Market: Growth Factors

The global high purity tin market is experiencing significant growth that is anticipated to continue over the upcoming years. The massive rise in demand for high purity tin by growing industrial activities is likely to act as a key driver of the market. Increasing investments in industrial activities, along with increasing demand for high purity tin from the electronics industry for electronics design materials are expected to propel the high purity tin market in the upcoming years. Increasing urbanization, rapid industrialization, and population growth are expected to increase the demand for high purity tin during the years to come.

The raw material availability and price volatility act as a restraining factor that may hamper the growth of the high purity tin market. The improved manufacturing process and technological innovations in emerging countries are likely to set new opportunities for the major players of the market.

Global High Purity Tin Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | High Purity Tin Market |

| Market Size in 2023 | USD 3,684.37 Million |

| Market Forecast in 2030 | USD 5,987.64 Million |

| Compound Annual Growth Rate | CAGR of 6.26% |

| Number of Pages | 270 |

| Forecast Units | Value (USD Million), and Volume (Units) |

| Key Companies Covered | Thaisarco, ESPI, JGI, Yunnan Tin Company, Dongfang Electric Corporation, Vital, Pure Technologies Zhuzhou Sinotech, Sichuan Western Minmetals, ENF Solar, Nathan Trotter, Others |

| Segments Covered | By Type, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latian America, Middle East and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The Global High Purity Tin Market: Segmentation

The global high purity tin market is mainly segmented into type, application, and region.

By type, the high purity tin market is mainly segmented into 5N Tin, 6N Tin, and 7N Tin.

By application, the global high purity tin market is mainly segmented into a superconducting material, tin alloy, solder, pyroelectric materials, and others.

The Global High Purity Tin Market: Regional analysis

Geographically, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In terms of revenue, the Asia Pacific region was the leading region in 2018. Furthermore, rapid urbanization and industrialization contribute to fueling the market growth in the region.

The Global High Purity Tin Market: Competitive Players

The major players of the global high purity tin market include:

- Thaisarco

- ESPI

- JGI

- Yunnan Tin Company

- Dongfang Electric Corporation

- Vital

- Pure Technologies

- Zhuzhou Sinotech

- Sichuan Western Minmetals

- ENF Solar

- Nathan Trotter

- Others.

Global High Purity Tin Market: Segmentation

By Type

- 5N Tin

- 6N Tin

- 7N Tin

By Application

- Superconducting Material

- Tin Alloy

- Solder

- Pyroelectric Materials

- Others

By Region

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

- Chapter 1. Preface

- 1.1. Report Description And Scope

- 1.2. Research Scope

- 1.3. Research Methodology

- 1.3.1. Market Research Process

- 1.3.2. Market Research Methodology

- Chapter 2. Executive Summary

- 2.1. High Purity Tin, 2015–2025 (USD Billion)

- 2.2. High Purity Tin: Snapshot

- Chapter 3. High Purity Tin – Industry Analysis

- 3.1. High Purity Tin: Market Dynamics

- 3.2. Market Drivers

- 3.2.1. Driver 1

- 3.2.2. Driver 2

- 3.3. Restraints

- 3.3.1. Restraint 1

- 3.3.2. Restraint 2

- 3.4. Opportunity

- 3.4.1. Government Funding And Support

- 3.5. Porter’s Five Forces Analysis

- 3.6. Market Attractiveness Analysis

- 3.6.1. Market Attractiveness Analysis by Type

- 3.6.2. Market Attractiveness Analysis by Application

- 3.6.3. Market Attractiveness Analysis by Region

- Chapter 4. High Purity Tin– Competitive Landscape

- 4.1. Company Market Share Analysis

- 4.1.1. Global High Purity Tin: Company Market Share, 2018

- 4.2. Strategic Development

- 4.2.1. Acquisitions & Mergers

- 4.2.2. New Type Launches

- 4.2.3. Agreements, Partnerships, Cullaborations And Joint Ventures

- 4.2.4. Research And Development And Regional Expansion

- 4.3. Price Trend Analysis

- 4.1. Company Market Share Analysis

- Chapter 5. Global High Purity Tin –Type Analysis

- 5.1. Global High Purity Tin Overview: by Type

- 5.1.1. Global High Purity Tin Share, by Type,2018 And 2025

- 5.2. 5N Tin

- 5.2.1. Global High Purity Tin by 5N Tin, 2015–2025 (USD Billion)

- 5.3. 6N Tin

- 5.3.1. Global High Purity Tin by 6N Tin, 2015–2025 (USD Billion)

- 5.4. 7N Tin

- 5.4.1. Global High Purity Tin by 7N Tin, 2015–2025 (USD Billion)

- 5.1. Global High Purity Tin Overview: by Type

- Chapter 6. Global High Purity Tin –Application Analysis

- 6.1. Global High Purity Tin Overview: by Application

- 6.1.1. Global High Purity Tin Share, by Application, 2018 And 2025

- 6.2. Superconducting Material

- 6.2.1. Global High Purity Tin by Superconducting Material, 2015–2025 (USD Billion)

- 6.3. Tin Alloy

- 6.3.1. Global High Purity Tin by Tin Alloy, 2015–2025 (USD Billion)

- 6.4. Sulder

- 6.4.1. Global High Purity Tin by Sulder, 2015–2025 (USD Billion)

- 6.5. Pyroelectric Materials

- 6.5.1. Global High Purity Tin by Pyroelectric Materials, 2015–2025 (USD Billion)

- 6.6. Others

- 6.6.1. Global High Purity Tin by Other, 2015–2025 (USD Billion)

- 6.1. Global High Purity Tin Overview: by Application

- Chapter 7. Global High Purity Tin - Regional Analysis

- 7.1. Global High Purity Tin Overview: by Region

- 7.1.1. Global High Purity Tin Share, by Region, 2018 And 2025

- 7.2. North America

- 7.2.1. North America High Purity Tin, 2015–2025 (USD Billion)

- 7.2.2. North America High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.2.3. North America High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.2.4. The U.S.

- 7.2.4.1. The U.S.High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.2.4.2. The U.S.High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.2.5. Rest of North America

- 7.2.5.1. Rest of North America High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.2.5.2. Rest of North America High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.3. Europe

- 7.3.1. Europe High Purity Tin, 2015–2025 (USD Billion)

- 7.3.2. Europe High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.3.3. Europe High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.3.4. UK

- 7.3.4.1. U.K.High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.3.4.2. U.K.High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.3.5. France

- 7.3.5.1. France High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.3.5.2. France High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.3.6. Germany

- 7.3.6.1. Germany High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.3.6.2. Germany High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.3.7. Rest of Europe

- 7.3.7.1. Rest of Europekeyword # Revenue, by Type,2015–2025 (USD Billion)

- 7.3.7.2. Rest of Europekeyword# Revenue, by Application, 2015–2025 (USD Billion)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific High Purity Tin, 2015–2025 (USD Billion)

- 7.4.2. Asia Pacific High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.4.3. Asia Pacific High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.4.4. China

- 7.4.4.1. China High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.4.4.2. China High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.4.5. Japan

- 7.4.5.1. Japan High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.4.5.2. Japan High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.4.6. India

- 7.4.6.1. India High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.4.6.2. India High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.4.7. Rest of Asia Pacific

- 7.4.7.1. Rest of Asia Pacific High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.4.7.2. Rest of Asia Pacific High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.5. Latin America

- 7.5.1. Latin America High Purity Tin, 2015–2025 (USD Billion)

- 7.5.2. Latin America High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.5.3. Latin America High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.5.4. Brazil

- 7.5.4.1. Brazil High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.5.4.2. Brazil High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.5.5. Rest of Latinamerica

- 7.5.5.1. Rest of Latinamerica High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.5.5.2. Rest of Latinamerica High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.6. The Middle East And Africa

- 7.6.1. The Middle East And Africa High Purity Tin, 2015–2025 (USD Billion)

- 7.6.2. The Middle East And Africa High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

- 7.6.3. The Middle East And Africa High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

- 7.1. Global High Purity Tin Overview: by Region

- Chapter 8. Company Profiles

- 8.1. Thaisarco

- 8.1.1. Overview

- 8.1.2. Financials

- 8.1.3. Type Portfolio

- 8.1.4. Business Strategy

- 8.1.5. Recent Developments

- 8.2. ESPI

- 8.2.1. Overview

- 8.2.2. Financials

- 8.2.3. Type Portfolio

- 8.2.4. Business Strategy

- 8.2.5. Recent Developments

- 8.3. JGI

- 8.3.1. Overview

- 8.3.2. Financials

- 8.3.3. Type Portfolio

- 8.3.4. Business Strategy

- 8.3.5. Recent Developments

- 8.4. Yunnan Tin Company

- 8.4.1. Overview

- 8.4.2. Financials

- 8.4.3. Type Portfolio

- 8.4.4. Business Strategy

- 8.4.5. Recent Developments

- 8.5. Dongfang Electric Corporation

- 8.5.1. Overview

- 8.5.2. Financials

- 8.5.3. Type Portfolio

- 8.5.4. Business Strategy

- 8.5.5. Recent Development

- 8.6. Vital

- 8.6.1. Overview

- 8.6.2. Financials

- 8.6.3. Type Portfolio

- 8.6.4. Business Strategy

- 8.6.5. Recent Development

- 8.7. Pure Technologies

- 8.7.1. Overview

- 8.7.2. Financials

- 8.7.3. Type Portfolio

- 8.7.4. Business Strategy

- 8.7.5. Recent Development

- 8.8. Zhuzhou Sinotech

- 8.8.1. Overview

- 8.8.2. Financials

- 8.8.3. Type Portfolio

- 8.8.4. Business Strategy

- 8.8.5. Recent Development

- 8.9. Sichuan Western Minmetals

- 8.9.1. Overview

- 8.9.2. Financials

- 8.9.3. Type Portfolio

- 8.9.4. Business Strategy

- 8.9.5. Recent Development

- 8.10. ENF Sular

- 8.10.1. Overview

- 8.10.2. Financials

- 8.10.3. Type Portfolio

- 8.10.4. Business Strategy

- 8.10.5. Recent Development

- 8.11. Nathan Trotter

- 8.11.1. Overview

- 8.11.2. Financials

- 8.11.3. Type Portfolio

- 8.11.4. Business Strategy

- 8.11.5. Recent Development

- 8.1. Thaisarco

List Of Figures

List of Figures

1. Market Research Process

2. Market Research Methodology

3. Global High Purity Tin, 2015–2025 (USD Billion)

4. Porter’s Five Forces Analysis

5. Global High Purity Tin Attractiveness, by Type

6. Global High Purity Tin Attractiveness, by Application

7. Global High Purity TinMarket Share, by Type, 2018 And 2025

8. Global High Purity Tin by 5N Tin, 2015–2025 (USD Billion)

9. Global High Purity Tin by 6N Tin,2015–2025 (USD Billion)

10. Global High Purity Tin by 7N Tin,2015–2025 (USD Billion)

11. Global High Purity Tin Share, by Application, 2018 And 2025

12. Global High Purity Tin by Superconducting Material, 2015–2025 (USD Billion)

13. Global High Purity Tin by Tin Alloy, 2015–2025 (USD Billion)

14. Global High Purity Tin by Solder, 2015–2025 (USD Billion)

15. Global High Purity Tin by Pyroelectric Materials, 2015–2025 (USD Billion)

16. Global High Purity Tin by Other, 2015–2025 (USD Billion)

17. Global High Purity Tin Share, by Region, 2018and 2025

18. North America High Purity Tin, 2015–2025 (USD Billion)

19. Europe High Purity Tin, 2015–2025 (USD Billion)

20. Asia Pacific High Purity Tin, 2015–2025 (USD Billion)

21. Latin America High Purity Tin, 2015–2025 (USD Billion)

22. The Middle East And Africa High Purity Tin, 2015–2025 (USD Billion)

Table Of Tables

List of Tables

1. Global High Purity Tin: Snapshot

2. Drivers of Thekeyword#: Impact Analysis

3. Restraints of Thekeyword#: Impact Analysis

4. North America High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

5. North America High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

6. The U.S. High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

7. The U.S. High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

8. Rest of North America High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

9. Rest of North America High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

10. Europe High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

11. Europe High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

12. U.K.High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

13. U.K.High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

14. France High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

15. France High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

16. Germany High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

17. Germany High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

18. Rest of Europekeyword # Revenue, by Type,2015–2025 (USD Billion)

19. Rest of Europekeyword # Revenue, by Application, 2015–2025 (USD Billion)

20. Asia Pacific High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

21. Asia Pacific High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

22. China High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

23. China High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

24. Japan High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

25. Japan High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

26. India High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

27. India High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

28. Rest of Asia Pacific High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

29. Rest of Asia Pacific High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

30. Latin America High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

31. Latin America High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

32. Brazil High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

33. Brazil High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

34. Rest of Latin America High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

35. Rest of Latin America High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

36. The Middle East And Africa High Purity Tin Revenue, by Type,2015–2025 (USD Billion)

37. The Middle East And Africa High Purity Tin Revenue, by Application, 2015–2025 (USD Billion)

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed