HbA1c Testing Device Market Size, Share, Growth and Forecast 2032

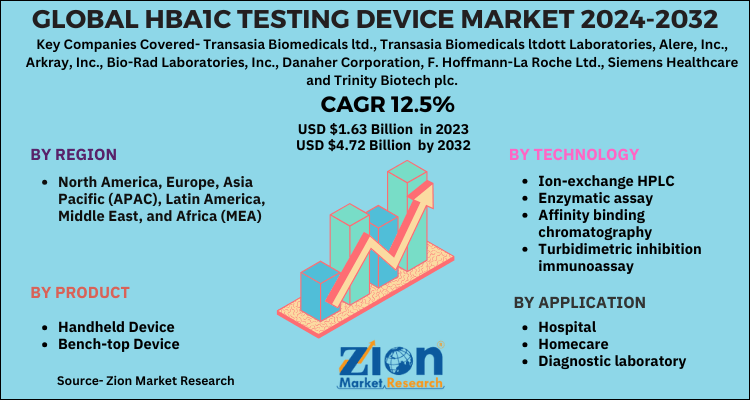

HbA1c Testing Device Market By Product (Handheld Device and Bench-top Device), By Technology (Ion-exchange HPLC, and Enzymatic assay, Affinity Binding Chromatography, Turbidimetric Inhibition Immunoassay and Other), By Application (Hospital, Homecare, and Diagnostic laboratory): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

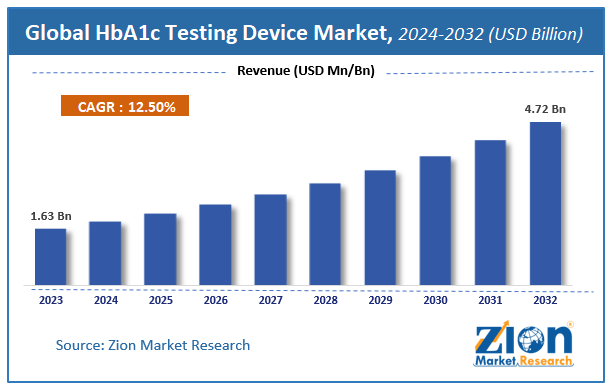

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.63 Billion | USD 4.72 Billion | 12.5% | 2023 |

HbA1c Testing Device Market Insights

Zion Market Research has published a report on the global HbA1c Testing Device Market, estimating its value at USD 1.63 Billion in 2023, with projections indicating that it will reach USD 4.72 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 12.5% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the HbA1c Testing Device Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

HbA1c Testing Device Market: Overview

HbA1c is also called Hemoglobin A1c. It is the blood test performed for diagnosis and monitoring Product of diabetes. Hemoglobin is a protein that links with sugars such as glucose found inside red blood cells. The high amount of glucose increases the risk of diabetes. This test reports the amount of HbA1c as a proportion of total hemoglobin in the bloodstream.

The giant players in the market are focusing on launching new products to expand their product portfolio and customer base. For instance, in June 2019, Transasia Biomedicals ltdott Laboratories launched Afinion HbA1c Dx test, a 3-minute, in-office A1c blood test for diagnosing diabetes. Moreover, Reportedly, on 20th August 2018, the National Institutes of Health conducted the study and revealed that blood test carried out during the tenth week of pregnancy can assist in identifying the risks related to gestational diabetes occurrence.

HbA1c Testing Device Market: Growth Factors

A steep rise in the population of diabetics along with prominent cases of diabetes witnessed across the countries having low-income & middle-income populations is predicted to propel the demand for Hba1c testing. Apart from this, an increase in awareness levels pertaining to preventive care and diabetes management will further drive the growth of the Hba1c testing device market in the years ahead. The introduction of new technologies for measuring HbA1c will further contribute to the HbA1C testing device market revenue over the ensuing years.

Escalating product costs and lack of accuracy in the derived outcomes observed from clinical tests performed on pregnant women, old persons, and the non-Hispanic black population, are anticipated to obstruct the Hba1c testing device market progression in the near future. Nevertheless, unexplored market potential and the global popularity of medical tourism are projected to provide lucrative opportunities for industry growth in the coming years, thereby normalizing the impact of hindrances on the Hba1c testing device market.

HbA1c Testing Device Market: Segment Analysis

On the basis of Product, the global gas market is segmented into Handheld devices and Bench-top Devices. Bench-top Device segment held the largest market share due to bench-top HbA1c testing devices being relatively higher and the trend is anticipated to remain so over the next few years.

On the basis of Technology, the HbA1c Testing Device market is segmented into Ion-exchange HPLC, Enzymatic assay, Affinity Binding Chromatography, Turbidimetric Inhibition Immunoassay, and Other. Ion-exchange HPLC technology is the most widely used for hemoglobin A1c testing and gives accurate HbA1c values in the presence of hemoglobin variants in the case of a highly diversified population.

On the basis of Application, the HbA1c Testing Device market is segmented into hospitals, Homecare's, and Diagnostic laboratories. The hospital segment held the largest market share due to huge demand across the globe for the growth of the HbA1c Testing Device market.

HbA1c Testing Device Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | HbA1c Testing Device Market |

| Market Size in 2023 | USD 1.63 Billion |

| Market Forecast in 2032 | USD 4.72 Billion |

| Growth Rate | CAGR of 12.5% |

| Number of Pages | 145 |

| Key Companies Covered | Transasia Biomedicals ltd., Transasia Biomedicals ltdott Laboratories, Alere, Inc., Arkray, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Siemens Healthcare and Trinity Biotech plc. |

| Segments Covered | By Product, By Technology, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

HbA1c Testing Device Market: Regional Analysis

North America has been leading the worldwide Hba1c testing device market and is anticipated to continue in the dominant position in the years to come, states the Hba1c testing device market study. The presence of a well-established healthcare infrastructure and growing incidences of diabetes mellitus witnessed in the region is the main factor behind the dominance of the North American Hba1c testing device market.

HbA1c Testing Device Market Players & Competitive Landscape

The major players operating in the HbA1c Testing Device market are

- Transasia Biomedicals ltd

- Transasia Biomedicals ltdott Laboratories

- Alere, Inc

- Arkray, Inc

- Bio-Rad Laboratories, Inc

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Siemens Healthcare

- Trinity Biotech plc

The global HbA1c Testing Device market is segmented as follows:

By Product

- Handheld Device

- Bench-top Device

By Technology

- Ion-exchange HPLC

- Enzymatic assay

- Affinity binding chromatography

- Turbidimetric inhibition immunoassay

- Other

By Application

- Hospital

- Homecare

- Diagnostic laboratory

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zion Market Research has published a report on the global HbA1c Testing Device Market, estimating its value at USD 1.63 Billion in 2023, with projections indicating that it will reach USD 4.72 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 12.5% over the forecast period 2024-2032.

Major driving factors for the growth of HbA1c Testing Device market are increasing demand for Steep rise in population of diabetics along with prominent cases of diabetes witnessed across the countries having low-income & middle-income population.

North America has been leading the worldwide Hba1c testing device market and is anticipated to continue on the dominant position in the years to come, states the Hba1c testing device market study. The presence of a well-established healthcare infrastructure and growing incidences of diabetes mellitus witnessed in the region is the main factor behind the dominance of the North America Hba1c testing device market.

The major players operating in the HbA1c Testing Device market are Transasia Biomedicals ltd., Transasia Biomedicals ltdott Laboratories, Alere, Inc., Arkray, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Siemens Healthcare and Trinity Biotech plc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed