Ground Chicory Market Size, Share, Trends, Growth & Forecast 2034

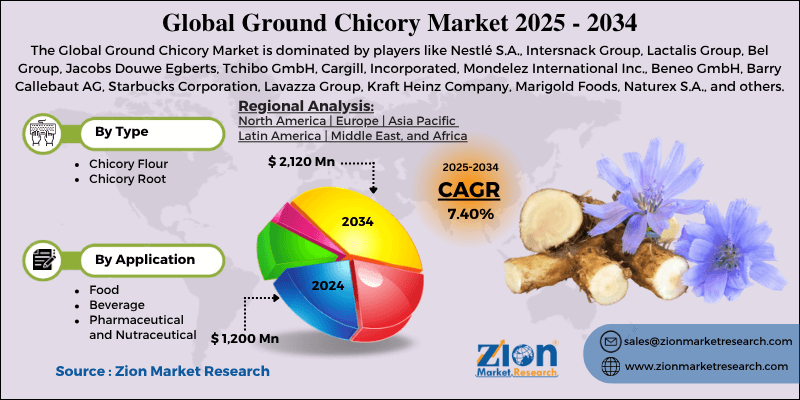

Ground Chicory Market By Type (Chicory Flour, Chicory Root), By Application (Food, Beverage, Pharmaceutical, and Nutraceutical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

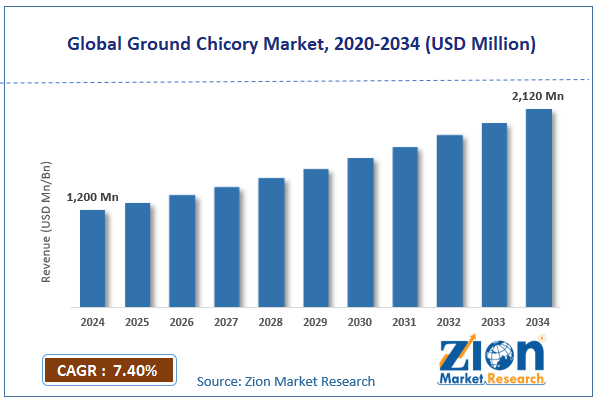

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,200 Million | USD 2,120 Million | 7.40% | 2024 |

Ground Chicory Industry Perspective:

The global ground chicory market size was approximately USD 1,200 million in 2024 and is projected to reach around USD 2,120 million by 2034, with a compound annual growth rate (CAGR) of approximately 7.40% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global ground chicory market is estimated to grow annually at a CAGR of around 7.40% over the forecast period (2025-2034)

- In terms of revenue, the global ground chicory market size was valued at around USD 1,200 million in 2024 and is projected to reach USD 2,120 million by 2034.

- The ground chicory market is projected to grow significantly due to the increasing health-conscious consumer base, growth of natural and organic product lines, and expansion in the hospitality and foodservice industry.

- Based on type, the chicory root segment is expected to lead the market, while the chicory flour segment is expected to grow considerably.

- Based on application, the beverage segment is the dominant segment, while the food segment is projected to witness sizable revenue growth over the forecast period.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Ground Chicory Market: Overview

Ground chicory is a caffeine-free and natural ingredient obtained from the roasted roots of the chicory plant. It is extensively used as an additive or coffee substitute due to its slightly bitter and rich flavor, which resembles that of coffee. Besides beverages, ground chicory is blended into functional ingredients, dietary supplements, and food products due to its high inulin content, supporting digestive health. The global ground chicory market is poised for significant growth due to increasing health awareness, the rising popularity of coffee substitutes, and the growing adoption of functional foods. Consumers worldwide are growing health-conscious, seeking alternatives to sugar-laden beverages and caffeine. Ground chicory, being naturally rich in inulin and caffeine-free, supports gut microbiota and digestive health. This trend leads to elevated adoption of chicory in bakery items, beverages, and dietary supplements.

With the rising concerns over caffeine-associated ill effects like acidity and insomnia, users are moving to coffee substitutes. Ground chicory mimics the flavor of coffee while being gentle on the digestive system, making it a preferred choice for all age groups. Additionally, the worldwide functional food industry is progressing, with users favoring foods that offer additional health benefits. Ground chicory, known for its weight management and prebiotic effects, is used in breakfast cereals, ready-to-drink beverages, and energy bars.

Nevertheless, the global market faces limitations due to factors such as the high cost of premium ground chicory and intense competition from other coffee substitutes. Organic and high-quality chicory products typically carry premium prices, which can limit their accessibility among price-sensitive users. This cost factor hinders adoption in emerging economies and low-income segments. Likewise, other substitutes, such as herbal teas, decaffeinated coffee, and chicory-coffee blends, compete directly, challenging standalone ground chicory products. Here, the industry differentiator becomes a vital factor for development.

Still, the global ground chicory industry benefits from several favorable factors, including product innovation, flavor blends, and growing demand for digestive health products. Introducing advanced blends, such as chicory with herbal infusions, coffee, or functional additives, can appeal to different consumer segments. Customization in form, flavor, and packaging increases appeal. Additionally, rising consumer focus on prebiotics and gut health offers opportunities for ground chicory in functional foods, wellness drinks, and dietary supplements. Its high inulin content ranks it strongly in the market.

Ground Chicory Market Dynamics

Growth Drivers

How does the growing popularity of the beverage and specialty coffee segments boost the growth of the ground chicory market?

Chicory's adoption in the specialty coffee market is on the rise, particularly in economies such as Europe and North America, where consumers prefer healthier alternatives and unique flavors over conventional coffee. In recent news, several cafés in the United States have introduced chicory lattes and hybrid drinks promoted as low-caffeine and antioxidant-rich options. This trend not only diversifies product offerings but also introduces new consumers to ground chicory, backing industry growth. The fusion of health benefits and taste enhances its appeal as a selling point.

How is the ground chicory market fueled by organic farming initiatives and supportive government policies?

Several nations are encouraging organic and sustainable cultivation practices, which directly benefit ground chicory producers. Governments in North America and Europe are offering technical assistance and subsidies for organic farming, improving the availability of high-quality ground chicory. Recent news from Belgium and France highlights investment in organic chicory processing facilities to meet the increasing demand for exports and domestic consumption. These policy programs not only boost the supply chain but also cater to the rising consumer preference for non-GMO and organic products. This regulatory support acts as a catalyst for the growth of the ground chicory market.

Restraints

Taste and consumer preference challenges adversely impact the market progress

Although ground chicory is promoted as a coffee substitute, its naturally earthy and bitter flavor does not appeal to all consumers. A recent FoodNavigator survey (2024) found that approximately 35% of first-time users preferred conventional coffee due to taste differences, especially in Latin America and Asia. Specialty cafés are actively experimenting with blending chicory with diverse flavors to reduce bitterness, but adoption is still steady. Consumer resistance based on taste may limit repeat purchases, making flavor a key restraining factor for wider industry acceptance.

Opportunities

How does the rising demand for organic and non-GMO products create promising avenues for the growth of the ground chicory industry?

Consumer preference for natural, organic, and non-GMO products is on the rise worldwide, and ground chicory is a perfect fit for this trend. According to FAO statistics, organic crop cultivation, including chicory, increased by 9% worldwide in 2023-24. Recent news from Europe highlights the growing investment in organic chicory farms to meet the increasing demand for both exports and domestic consumption. Companies that emphasize organic products can capitalize on this trend, offering higher consumer trust and premium pricing. This trend aligns with broader health and wellness movements, offering fresh avenues for the growth of the ground chicory industry.

Challenges

Trade barriers and regulatory compliance limit the market growth

Strict regulations associated with food labelling, imports, and health claims create obstacles for worldwide expansion. Industry reports suggest that compliance costs in North America and the EU can add 15% to total product pricing. Recent news highlights delays in Middle Eastern imports due to certification and labeling requirements. These regulations raise operational complexity and can slow entry into new markets. Navigating regulatory environments is a key challenge for international growth.

Ground Chicory Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ground Chicory Market |

| Market Size in 2024 | USD 1,200 Million |

| Market Forecast in 2034 | USD 2,120 Million |

| Growth Rate | CAGR of 7.40% |

| Number of Pages | 212 |

| Key Companies Covered | Nestlé S.A., Intersnack Group, Lactalis Group, Bel Group, Jacobs Douwe Egberts, Tchibo GmbH, Cargill, Incorporated, Mondelez International Inc., Beneo GmbH, Barry Callebaut AG, Starbucks Corporation, Lavazza Group, Kraft Heinz Company, Marigold Foods, Naturex S.A., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ground Chicory Market: Segmentation

The global ground chicory market is segmented based on type, application, and region.

Based on type, the global ground chicory industry is divided into chicory flour and chicory root. The chicory root segment dominated the global market due to its high inulin content and rich flavor, which supports digestive wellness and gut health. It is primarily ground and roasted to create coffee substitutes, natural flavoring agents, and functional beverages. The health benefits and versatility of chicory increase its preference by manufacturers and consumers alike. Its prominence is significantly strong in North America and Europe, where health-conscious consumption trends drive demand.

On the other hand, the chicory flour segment holds a leadership position, as it is widely used in dietary supplements, bakery products, and processed foods. It offers functional benefits, such as prebiotic fiber, while being easier to blend into formulations and recipes. Despite its growing adoption, chicory root remains slightly behind coffee and beverage substitutes due to its more limited mainstream use. Manufacturers are steadily incorporating chicory flour into health-oriented foods and nutraceuticals, thereby increasing its industry potential.

Based on application, the global ground chicory market is segmented into food, beverage, pharmaceutical, and nutraceutical. The beverage segment has registered a leading share, as chicory is extensively used as a coffee substitute, in health drinks, and as a tea additive. Its caffeine-free nature, combined with a rich, coffee-like flavor, appeals to health-conscious users and those seeking digestive wellness. Beverage manufacturers typically use roasted, ground chicory to develop specialty drinks, blends, and functional beverages. This strong adoption, fueled by wellness trends and café culture, augments the segmental dominance in North America and Europe.

Conversely, the food segment holds a second rank, with ground chicory being integrated into confectionery, bakery products, snacks, and cereals. Its high inulin content offers prebiotic benefits, improving digestive health, while also acting as a fiber fortifier and natural sweetener. Although its adoption is slower than that of beverages, rising consumer interest in functional foods is driving the demand. Manufacturers are exploring new product formulations to incorporate chicory into everyday foods, fueling steady growth in the category.

Ground Chicory Market: Regional Analysis

Why is Europe outperforming other regions in the global Ground Chicory Market?

Europe is projected to maintain its dominant position in the global ground chicory market, driven by high health awareness and wellness trends, established coffee culture, and the growing demand for chicory substitutes, as well as advanced retail and distribution networks. European users have a strong focus on natural ingredients and healthy lifestyles, fueling the demand for functional and caffeine-free beverages like ground chicory. According to recent industry data, nearly 45% of European users prefer products with digestive health benefits, further enhancing the prominence of chicory. This awareness leads to broader adoption of teas, substitutes, and functional drinks in the region.

Moreover, the region holds a long-standing coffee and café culture, with consumers open to experimenting with coffee substitutes. Economies such as France, Germany, and the UK are experiencing a surge in the consumption of coffee blends containing chicory, resulting in consistent industry demand. Roasted ground chicory is popular mainly because of its similar taste profile to coffee, while being healthier.

Furthermore, the presence of well-developed retail chains, online platforms, and specialty stores promises easy availability of ground chicory products. The region accounts for approximately 45% of worldwide ground chicory sales, supported by both e-commerce channels and brick-and-mortar stores catering to health-conscious and urban consumers.

North America maintains its position as the second-largest region in the global ground chicory industry, driven by rising demand for coffee substitutes, the growth of the functional food and beverage industry, and the expansion of direct-to-consumer and e-commerce channels. Health concerns and caffeine sensitivity have led to an increase in demand for coffee substitutes, including chicory blends. Industry reports denote that coffee alternatives in North America surged by 7% in 2024, with ground chicory being a key contributor. Specialty cafés and beverage brands are primarily offering chicory-based drinks to cater to this demand.

Additionally, the North American functional beverages and food segment is experiencing rapid growth, driven by trends in weight management, digestive health, and gut wellness. Ground chicory's inulin-rich nature enhances its appeal in this segment, contributing to its steady industry share of nearly 25-30% in North America. The growth of subscription services and online retail has improved the availability of ground chicory in Canada and the United States. Digital platforms enable brands to target health-conscious users directly, extending their reach beyond specialty shops and traditional retail stores.

Ground Chicory Market: Competitive Analysis

The leading players in the global ground chicory market are:

- Nestlé S.A.

- Intersnack Group

- Lactalis Group

- Bel Group

- Jacobs Douwe Egberts

- Tchibo GmbH

- Cargill

- Incorporated

- Mondelez International Inc.

- Beneo GmbH

- Barry Callebaut AG

- Starbucks Corporation

- Lavazza Group

- Kraft Heinz Company

- Marigold Foods

- Naturex S.A.

Ground Chicory Market: Key Market Trends

Expansion of direct-to-consumer and e-commerce sales:

Subscription-based delivery models and online retail platforms are becoming primary distribution channels for ground chicory products. Users can easily access specialty ingredients, while companies use influencer campaigns and digital marketing to raise awareness and adoption. This trend is strong among health-focused users and urban millennials.

Increased demand for prebiotic and functional products:

Consumers are increasingly preferring beverages and products that support gut health and overall wellness, driving the traction of ground chicory due to its high inulin content. This trend is fueling manufacturers to develop chicory-based functional drinks, dietary supplements, and snacks. The focus on prebiotics aligns with the broader health and wellness movement in developed regions.

The global ground chicory market is segmented as follows:

By Type

- Chicory Flour

- Chicory Root

By Application

- Food

- Beverage

- Pharmaceutical and Nutraceutical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ground chicory is a caffeine-free and natural ingredient obtained from the roasted roots of the chicory plant. It is extensively used as an additive or coffee substitute due to its slightly bitter and rich flavor, which resembles that of coffee. Besides beverages, ground chicory is blended into functional ingredients, dietary supplements, and food products due to its high inulin content, supporting digestive health.

The global ground chicory market is projected to grow due to rising demand for coffee alternatives, the expansion of the functional food and beverage segment, and increasing awareness of the digestive health benefits of chicory.

According to study, the global ground chicory market size was worth around USD 1,200 million in 2024 and is predicted to grow to around USD 2,120 million by 2034.

The CAGR value of the ground chicory market is expected to be approximately 7.40% from 2025 to 2034.

Market trends and consumer preferences are shifting toward organic, functional, and caffeine-free products with digestive health benefits.

Strict food safety regulations, sustainable farming practices, and organic certification requirements are shaping the growth of the ground chicory market.

Europe is expected to lead the global ground chicory market during the forecast period.

The key players profiled in the global ground chicory market include Nestlé S.A., Intersnack Group, Lactalis Group, Bel Group, Jacobs Douwe Egberts, Tchibo GmbH, Cargill, Incorporated, Mondelez International, Inc., Beneo GmbH, Barry Callebaut AG, Starbucks Corporation, Lavazza Group, Kraft Heinz Company, Marigold Foods, and Naturex S.A.

The ground chicory market is highly competitive, dominated by key global and regional players focusing on product innovation, strategic partnerships, and quality.

The report examines key aspects of the ground chicory market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed