Grease Market Size, Share, And Growth Report 2032

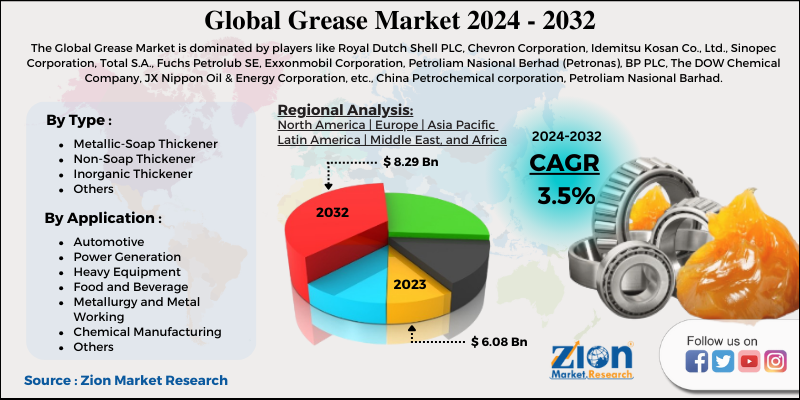

Grease Market - By Thickener Type (Metallic-Soap Thickener, Non-Soap Thickener, Inorganic Thickener, and Others), By Application (Automotive, Power Generation, Heavy Equipment, Food and Beverage, Metallurgy and Metal Working, Chemical Manufacturing, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.08 Billion | USD 8.29 Billion | 3.5% | 2023 |

Grease Market: Insights

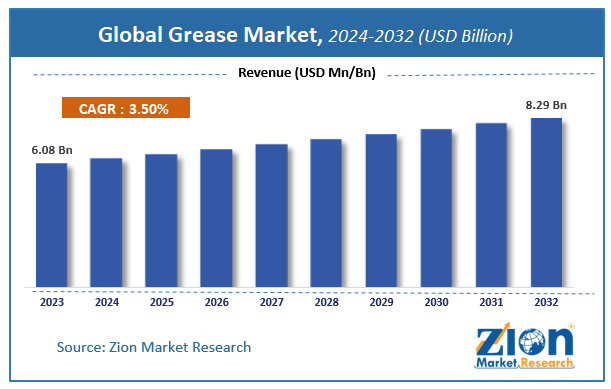

The global grease market size was worth around USD 6.08 billion in 2023 and is predicted to grow to around USD 8.29 billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.5% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Grease market on a global and regional level.

Global Grease Market: Overview

In the Global Grease Market Report, Grease is characterized as a semi-solid compound produced by the liquid lubricant deposition of a thickening agent. It is a chemical blend of additives, gasoline, and thickeners. The action of grease is primarily characterized in the formulations by the composition of base oil & additives. Additives in the grease are used to improve the favorable properties, suppress the unfavorable properties, or add additional properties to improve the efficiency of its operation.

Grease promotes various excellent properties such as water resistance, under gravity, friction, or centrifugal action lubrication to the moving body. It also avoids pollution, lack of wear tears, and decreases the use of noise and fuel. Different end-user sectors, such as mining, general manufacturing, automobile, building, and rail, among others, use grease.

Global Grease Market: Dynamics

Increased demand from end users for metallic soap thickeners, rapid growth in the automobile industry and technical advances in grease production are the key factors driving the grease market. In the forecast timeframe, improvements in the usage of grease in other sectors benefiting from increased productivity could be a growth opportunity for the grease industry.

Factors such as exchange rate fluctuations, the production of self-lubricating machinery and the unfavorable supply of raw materials are, however, projected to hamper demand growth over the forecast period.

Global Grease Market: Segmentation

The Grease market is fragmented based on thickener type, applications, and region.

By thickener type, the market is divided into metallic-soap thickeners, non-soap thickeners, inorganic thickeners, and others.

On the basis of applications, the Grease market includes automotive, power generation, heavy equipment, food and beverage, metallurgy and metal working, chemical manufacturing, and others. The automobile industry is the biggest and fastest-growing grease end-use industry. The market for high-performance grease in the car industry is pushing passenger and commercial vehicles.

In the automotive industry, grease is used because of its properties (including mechanical integrity, temperature tolerance, water resistance, and anti-oxidants) in various car components, such as wheel bearings, universal joints, suspensions, gears, switches, and connectors.

Grease Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Grease Market |

| Market Size in 2023 | USD 6.08 Billion |

| Market Forecast in 2032 | USD 8.29 Billion |

| Growth Rate | CAGR of 3.5% |

| Number of Pages | 210 |

| Key Companies Covered | Royal Dutch Shell PLC, Chevron Corporation, Idemitsu Kosan Co., Ltd., Sinopec Corporation, Total S.A., Fuchs Petrolub SE, Exxonmobil Corporation, Petroliam Nasional Berhad (Petronas), BP PLC, The DOW Chemical Company, JX Nippon Oil & Energy Corporation, etc., China Petrochemical Corporation, Petroliam Nasional Barhad, CITGO Petroleum Corporation, Harrison Manufacturing, Indian oil corporation Ltd., and Others |

| Segments Covered | By Thickener Type, By Applications, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Grease Market: Regional Analysis

North America and Europe, which can be attributed to their well-established automotive sectors, were prominent regions in the global grease industry in 2023. The highest market share in 2019 was retained by the Asia Pacific. Due to the rapidly growing automotive industry in these countries, the market for goods is greatly led by India, China, Thailand, and Japan.

In addition, rising infrastructure and increasing foreign direct investor involvement in this area will directly influence the dynamics of the construction industry, which will drive product demand over the forecast period. Because of rising industrialization and urbanization in Brazil, Latin America is expected to raise commodity demand over the next few years.

Global Grease Market: Competitive Landscape

Some main participants in the Grease market are:

- Royal Dutch Shell PLC

- Chevron Corporation

- Idemitsu Kosan Co. Ltd.

- Sinopec Corporation

- Total S.A.

- Fuchs Petrolub SE

- ExxonMobil Corporation

- Petroliam Nasional Berhad (Petronas)

- BP PLC

- The DOW Chemical Company

- JX Nippon Oil & Energy Corporation etc.

- China Petrochemical Corporation

- Petroliam Nasional Barhad

- CITGO Petroleum Corporation

- Harrison Manufacturing

- Indian Oil Corporation Ltd.

The Global Grease Market is segmented as follows:

By Thickener Type

- Metallic-Soap Thickener

- Non-Soap Thickener

- Inorganic Thickener

- Others

By Application

- Automotive

- Power Generation

- Heavy Equipment

- Food and Beverage

- Metallurgy and Metal Working

- Chemical Manufacturing

- Others

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Over the last few years, the grease industry has seen a growing use of biodegradable greases. Both are fast performing, and either synthetic ester or vegetable oil is dependent on their additives. Compared to its mineral oil-based counterparts, it degrades earlier and does not emit environmental-damaging residues after use.

According to study, the Grease Market size was worth around USD 6.08 billion in 2023 and is predicted to grow to around USD 8.29 billion by 2032, growing at a CAGR of around 3.5% during 2024-2032.

North America has been leading the Grease Market and is anticipated to continue on the dominant position in the years to come.

Some main participants of the Grease market are Royal Dutch Shell PLC, Chevron Corporation, Idemitsu Kosan Co., Ltd., Sinopec Corporation, Total S.A., Fuchs Petrolub SE, ExxonMobil Corporation, Petroliam Nasional Berhad (Petronas), BP PLC, The DOW Chemical Company, JX Nippon Oil & Energy Corporation, etc., China Petrochemical Corporation, Petroliam Nasional Barhad, CITGO Petroleum Corporation, Harrison Manufacturing, Indian oil corporation Ltd., and Others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed