Next Generation Battery Market Trend, Share, Growth, Size, Analysis and Forecast 2032

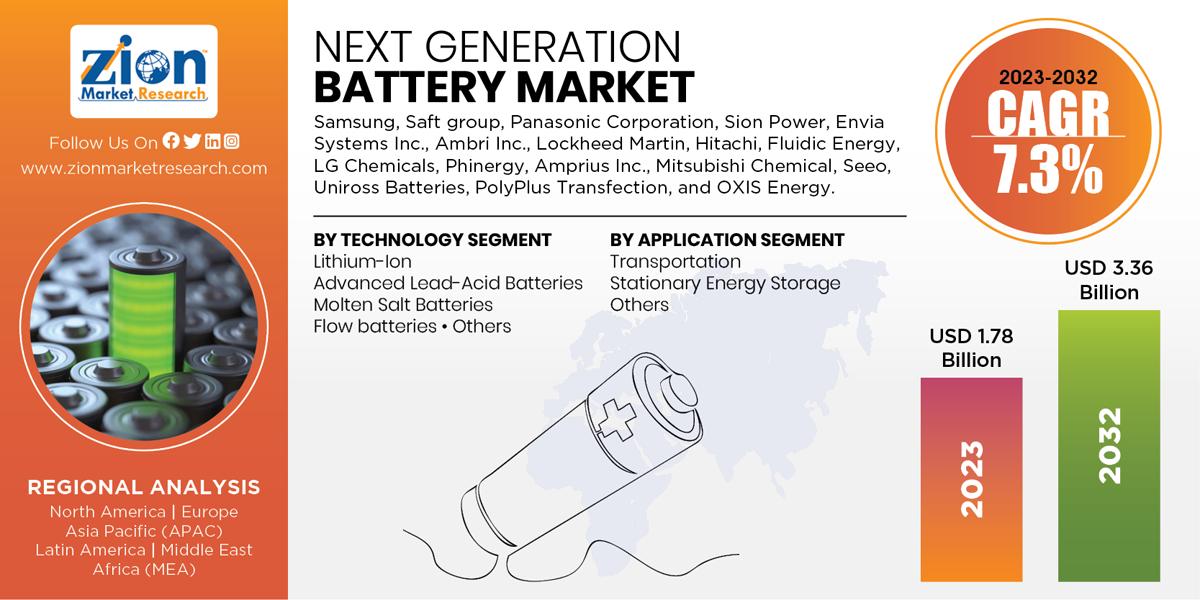

Next Generation Battery Market Analysis by Technology (Lithium-ion(Advanced Li-ion, Lithium Sulfur, Lithium Solid-state), Advanced Lead-Acid Batteries, Molten Salt Batteries, Flow Batteries, and Others), and by Application (Transportation, Stationary Energy Storage, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

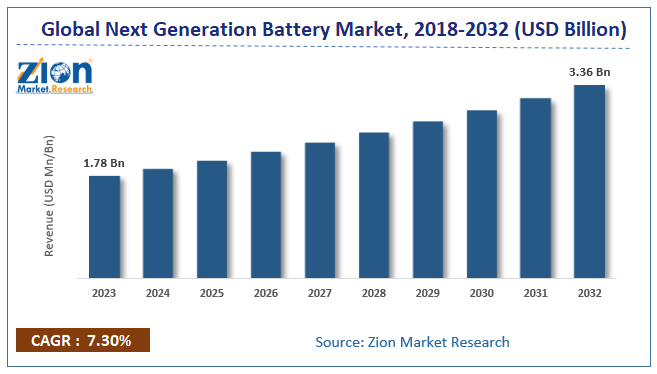

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.78 Billion | USD 3.36 Billion | 7.3% | 2023 |

The global Next Generation Battery market size accrued earnings worth approximately USD 1.78 Billion in 2023 and is predicted to gain revenue of about USD 3.36 Billion by 2032, is set to record a CAGR of nearly 7.3% over the period from 2024 to 2032.

Next Generation Battery Market Overview

Batteries are the devices consisting of one or more electrochemical cells with external connections provided to power electrical devices and other applications. They are present in different shapes and sizes, from small cells used in smartphones, hearing aids, and wristwatches, to large batteries used in cars and trucks, and industries such as computer data centers and telecommunication companies for power backup. Next generation batteries include rechargeable solid-state batteries, flow batteries, thin film batteries, poly-lithium-ion batteries, and advanced lead-acid. These batteries provide some remarkable properties like being compact, lightweight, and enhanced with safety features. Furthermore, the next-generation batteries have proved to be safe under harsh conditions, along with major improvements in terms of overall performance and are eco-friendly as compared to conventional Li-ion batteries.

Next Generation Battery Market Growth Dynamics

Increasing demand for high storage and efficient batteries in the automotive industry and the growing consumption of consumer electronics are factors driving the growth of the next generation battery market. In addition, factors such as high demand from the consumer electronics sector coupled with a rising need for less power usage and less heat production, among others are supporting the growth of the next generation batteries market. Furthermore, increasing popularity for the battery-operated vehicles around the world is spurring the demand for the long-lasting batteries for better fuel economy. These are some of the factors which are increasing the demand for next generation batteries in the market. However, high initial costs of the batteries are considered to be one of the major factors restraining the market growth. In addition, lack of awareness regarding green initiatives is another factor which could cause hindrance in the growth of next generation battery market.

Next Generation Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Next Generation Battery Market |

| Market Size in 2023 | USD 1.78 Billion |

| Market Forecast in 2032 | USD 3.36 Billion |

| Growth Rate | CAGR of 7.3% |

| Number of Pages | 204 |

| Key Companies Covered | Samsung, Saft group, Panasonic Corporation, Sion Power, Envia Systems Inc., Ambri Inc., Lockheed Martin, Hitachi, Fluidic Energy, LG Chemicals, Phinergy, Amprius Inc., Mitsubishi Chemical, Seeo, Uniross Batteries, PolyPlus Transfection, and OXIS Energy. |

| Segments Covered | By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Based on technology, the global next generation battery market is fragmented into Lithium-ion, advanced lead-acid batteries, molten salt batteries, flow batteries, and others. Lithium-ion is again classified into advance Li-ion, lithium sulfur, and lithium solid state. Transportation, stationary energy storage, and others are the application segment of the global next generation battery market. All the segments are analyzed based on the present and the future trends and the market is projected from 2024 to 2032. Based on regions, the global next generation battery market is segmented into the Asia Pacific, North America, Latin America, Europe, and the Middle East and Africa with its further categorization into the U.S., UK, Germany, France, China, India, Japan, and Brazil.

North America and Europe held the majority of the market share of the global next generation battery market in 2023 and is set to dominate the world marketplace within the forecast period. Presence of significant market player in both the regions is predicted to shape the next generation battery market massively. Asia Pacific is expected to hold the remarkable market share and is expected to grow with the highest CAGR during the analysis period. The growth in this region is due to the high demand for electric vehicles and consumer electronics appliances in China, Japan, India, and Korea.

The major players of next generation batteries market include

- Samsung

- Saft group

- Panasonic Corporation

- Sion Power

- Envia Systems Inc.

- Ambri Inc.

- Lockheed Martin

- Hitachi

- Fluidic Energy

- LG Chemicals

- Phinergy

- Amprius Inc.

- Mitsubishi Chemical

- Seeo

- Uniross Batteries

- PolyPlus Transfection

- and OXIS Energy.

The report segments of the next generation battery market are as follows:

By Technology Segment Analysis

- Lithium-Ion

- Advanced Li-ion

- Lithium Sulfur

- Lithium Solid-state

- Advanced Lead-Acid Batteries

- Molten Salt Batteries

- Flow batteries

- Others

By Application Segment Analysis

- Transportation

- Stationary Energy Storage

- Others

By Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed