Forging Market Size & Share Report, Growth, Trends, 2032

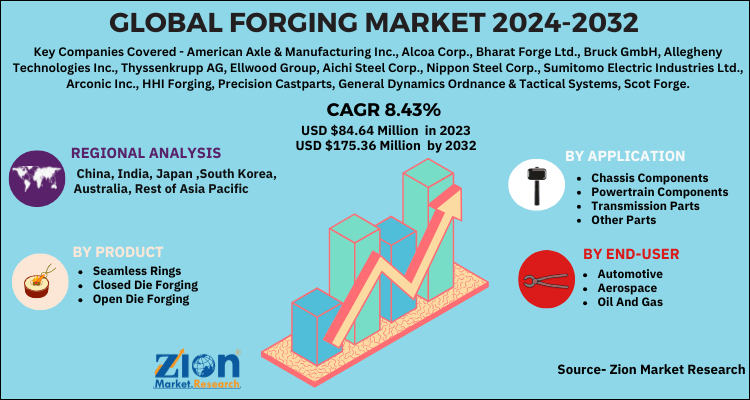

Forging Market: By Product (Seamless Rings, Closed Die Forging, and Open Die Forging), By Application (Chassis Components, Powertrain Components, Transmission Parts, and Other Parts), and By End-User (Automotive, Aerospace, Oil & Gas, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

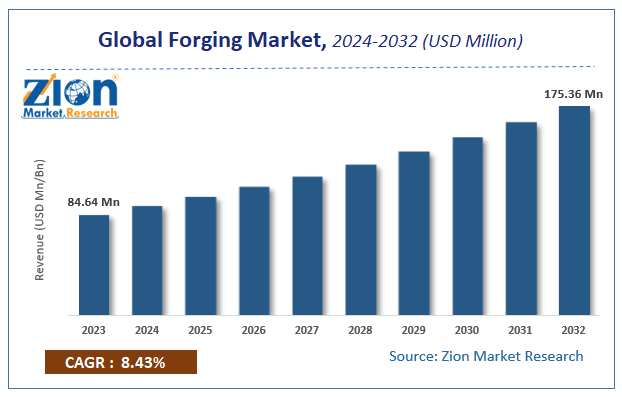

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 84.64 Million | USD 175.36 Million | 8.43% | 2023 |

Global Forging Market Insights

Zion Market Research has published a report on the global Forging Market, estimating its value at USD 84.64 Million in 2023, with projections indicating that it will reach USD 175.36 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 8.43% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Forging industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Forging is a process of controlled deformation of metal into a particular form by applying compressive forces. The forging process is advanced to casting process. In forging the parts formed have more defined grain patterns, less porosity, and denser microstructures which makes parts much stronger than a casting process. Every metal are forgeable, but each will have a forge ability rating from high to low or poor. The most forgeable materials are aluminum, copper, and magnesium. The fundamental types of forging process are open-die forging and impression or closed die forming. Forged metal components find in various applications in automotive, aerospace, construction, oil and gas, agriculture, shipbuilding, steel, bearing and power industries.

The global market for forging is expected to grow at a significant rate owing to growing automotive and aerospace industry worldwide. The aerospace industry is one of the top end-users in the forging market, as forged components are featured heavily to create commercial and defense aircraft. Furthermore, cost effective method of metal forming can boost the market growth in the upcoming years. However, availability of alternate metal forming processes is expected to be a restraining factor for the forging market in the near future.

Global Forging Market: Overview

Forging is a manufacturing process that includes the shaping of metal using localized compressive forces. The blows are either delivered with a die or a hammer. Forging is usually classified according to the temperature at which it is performed. The classification involves hot forging (a type of hot working), cold forging (a type of cold working), or warm forging. For the latter two, the metal is heated, generally in a forge. In weight, forged parts can range from less than a kilogram to hundreds of metric tons. Since the industrial revolution, forged parts are extensively utilized in machines and mechanisms wherever a component requires high strength. Henceforth, such forgings generally require further processing like machining to achieve a finished part. Currently, forging is a major worldwide industry.

Global Forging Market: Growth Factors

Rising end-use industries such as aerospace, automotive, oil & gas, and others are augmenting the target market growth. In addition, increasing demand for high-pressure valves, connecting rods, flanges, bolts, and other fitting materials in end-use industries is propelling the target market growth. Furthermore, vigorous demand for high-strength materials in the application sector is enhancing the target market growth. Moreover, the advantage of forging over other fabrication techniques is driving the target market growth. Additionally, forging results in the modification of internal gains metals which is fuelling the global forging market. Furthermore, forged arts have enhanced structural integrity, which ensures optimum performance by component or part under field conditions. This factor has been augmenting the target market growth. Also, forging makes the metal ductile, tough, as well as capable of withstanding fatigue while also imparting uniformity to the grain flow. This is anticipated to propel the target market growth over the forecast period. However, the availability of alternate metal-forming processes is likely to harm the forging market over the forecast period.

Global Forging Market: Segmentation

The Forging market is fragmented based on product, application, and end-user. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By product, the market is divided into seamless rings, closed die forging, and open die forging. Among these, the closed die category is anticipated to dominate the product segment in terms of revenue due to the finish of products that are obtained using this process.

On the basis of application, the forging market includes chassis components, powertrain components, transmission parts, and other parts. Among these categories, the powertrain components category is expected to lead the application segment over the forecast period owing to the growth of the automobile industry to cater to the high demand for automobiles.

The end-user segment of the forging market is classified into automotive, aerospace, oil and gas, and others.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Forging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Forging Market |

| Market Size in 2023 | USD 84.64 Million |

| Market Forecast in 2032 | USD 175.36 Million |

| Growth Rate | CAGR of 8.43% |

| Number of Pages | 110 |

| Key Companies Covered | American Axle & Manufacturing Inc., Alcoa Corp., Bharat Forge Ltd., Bruck GmbH, Allegheny Technologies Inc., Thyssenkrupp AG, Ellwood Group, Aichi Steel Corp., Nippon Steel Corp., Sumitomo Electric Industries Ltd., Arconic Inc., HHI Forging, Precision Castparts, General Dynamics Ordnance & Tactical Systems, Scot Forge, and Sypris Solutions, and others |

| Segments Covered | By Product, By Application, By End-User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Forging Market: Regional Analysis

The Asia Pacific is predicted to display prominent growth amongst other key regions. The development of the automotive industry is an important factor driving the region in terms of target market growth. In addition, developing economies of the region are major consumers of forged metal. This is another factor propelling the target market growth.

Geographically, in 2023 forging market was dominated by Asia Pacific followed by Europe. The growth in the Asia-Pacific region is mainly attributed to growing demand for infrastructural development in emerging countries and the emergence of India as manufacturing hub for the automotive industry would propel the growth of the market in this region.

Global Forging Market: Competitive Players

Some main participants of the Forging market are-

- American Axle & Manufacturing Inc.

- Alcoa Corp.

- Bharat Forge Ltd.

- Bruck GmbH

- Allegheny Technologies Inc.

- Thyssenkrupp AG

- Ellwood Group

- Aichi Steel Corp.

- Nippon Steel Corp.

- Sumitomo Electric Industries Ltd.

- Arconic Inc.

- HHI Forging

- Precision Castparts

- General Dynamics Ordnance & Tactical Systems

- Scot Forge

- Sypris Solutions

This report segments the Global Forging Market as follows:

Global Forging Market: The Product Analysis

- Seamless Rings

- Closed Die Forging

- Open Die Forging

Global Forging Market: The Application Analysis

- Chassis Components

- Powertrain Components

- Transmission Parts

- Other Parts

Global Forging Market: The End-use Analysis

- Automotive

- Aerospace

- Oil And Gas

Forging Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of The Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Rising end-use industries such as aerospace, automotive, oil & gas, and others are augmenting the target market growth. Moreover, the advantage of forging over other fabrication techniques is driving the target market growth

According to Zion Market Research, the global Forging Market, estimating its value at USD 84.64 Million in 2023, with projections indicating that it will reach USD 175.36 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 8.43% over the forecast period 2024-2032.

Asia Pacific is predicted to display the prominent growth amongst other key regions. Development of automotive industries is an important factor driving the region in terms of target market growth.

Some main participants of the Forging market are American Axle & Manufacturing Inc., Alcoa Corp., Bharat Forge Ltd., Bruck GmbH, Allegheny Technologies Inc., Thyssenkrupp AG, Ellwood Group, Aichi Steel Corp., Nippon Steel Corp., Sumitomo Electric Industries Ltd., Arconic Inc., HHI Forging, Precision Castparts, General Dynamics Ordnance & Tactical Systems, Scot Forge, and Sypris Solutions, among others, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed