Food Fortifying Agents Market Size & Share Report, Growth, Trends, 2032

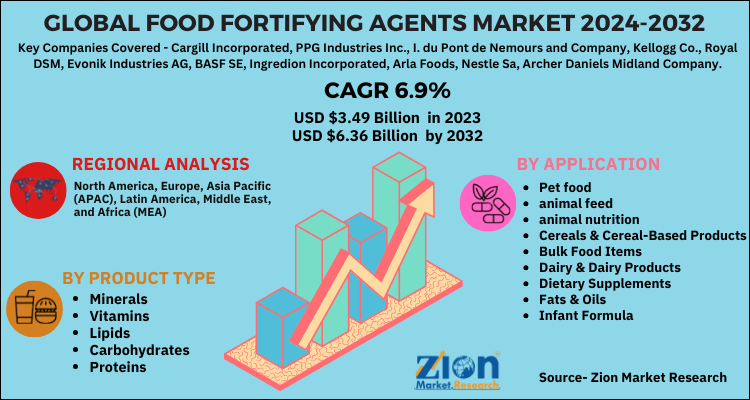

Food Fortifying Agents Market: Form Analysis (Minerals, Vitamins, Lipids, Carbohydrates, Proteins And Others ), End User Analysis (Pet Food, Animal Feed, And Animal Nutrition, Cereals & Cereal-Based Products, Bulk Food Items, Dairy & Dairy Products, Dietary Supplements, Fats & Oils, Infant Formula And Others.), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

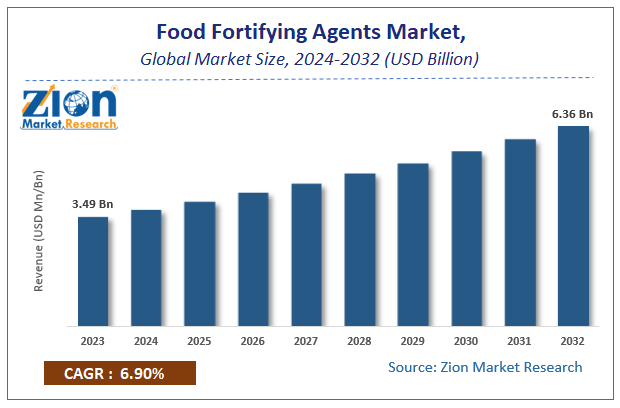

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.49 Billion | USD 6.36 Billion | 6.9% | 2023 |

Global Food Fortifying Agents Market Insights

According to a report from Zion Market Research, the global Food Fortifying Agents Market was valued at USD 3.49 Billion in 2023 and is projected to hit USD 6.36 Billion by 2032, with a compound annual growth rate (CAGR) of 6.9% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Food Fortifying Agents industry over the next decade.

Global Food Fortifying Agents Market: Overview

In Global Food Fortifying Agents Market Report, The nutritional fortification method contributes micronutrients and vitamins to food products. Food becomes more nutritious after the food fortification process. By adding food fortifying agents to improve micronutrients and vitamins in their food products , food manufacturers use this technique. Food fortifying agents are used in staple foods to reduce nutritional insufficiency. To improve the nutrients, nutritional fortifying agents are added to dietary foods and cereals. The growing demand for nutritious food is the main driving force for food fortifying agents.

Owing to their changing habits, customer perception of nutritious food items is growing. There are several reasons that serve as barriers to the development of the demand for food fortifying agents. Over-absorption of food-fortifying agents contributes to the body developing toxins. Vitamins A, Vitamin D, E are fat-soluble vitamins that are incorporated into fat and contribute to their quantity in the body being saturated.

Global Food Fortifying Agents Market: Growth Factors

Growing market consciousness, along with the increasing cases of chronic diseases such as cardiovascular diseases, Alzheimer's disease, high blood pressure, and many others, is the key factor driving the demand for food fortifying agents. In addition, there has been a record rise in vitamin deficiency cases, which has been another prime factor boosting revenue in the global market for nutrient fortifying agents. In addition, many food producers worldwide have begun to realise the advantages of food fortification in achieving a strategic edge, thus driving greater demand for food fortification agents. Rapid advances in the food fortification industry have also added greatly to the growing market for food fortification agents, as the simplicity of increasing the nutritional content of the diet has improved tremendously.

Global Food Fortifying Agents Market: Segmentation

The Food Fortifying Agents market is fragmented based on the form, and by end user. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By form, the market is divided into minerals, vitamins, lipids, carbohydrates, proteins, and others.

On the basis of end user, the Food Fortifying Agents market includes pet food, animal feed, and animal nutrition, cereals & cereal-based products, bulk food items, dairy & dairy products, dietary supplements, fats & oils, infant formula and others.

There has been an growing trend in demand for fortified foods and drinks market due to rising customer health perception and vitamin shortages that can cause health diseases such as anaemia, scurvy, beriberi, and pellagra, to name a few.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Food Fortifying Agents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Fortifying Agents Market |

| Market Size in 2023 | USD 3.49 Billion |

| Market Forecast in 2032 | USD 6.36 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 110 |

| Key Companies Covered | Cargill Incorporated, PPG Industries Inc., I. du Pont de Nemours and Company, Kellogg Co., Royal DSM, Evonik Industries AG, BASF SE, Ingredion Incorporated, Arla Foods, Nestle Sa, Archer Daniels Midland Company, Hansen Holdings A/S etc., among others |

| Segments Covered | By Product Type, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Food Fortifying Agents Market: Regional Analysis

Due to the growing prevalence of diseases and increasing cases of obesity in the region , North America has become the global leader in demand for food fortifying agents. This, along with significant knowledge of food fortifying agents and rising government preference for their use, has collectively led to North America 's supremacy in the global market for food fortifying agents. Another influential field is Asia Pacific, which is contributing significantly to the exponential growth of the global demand for food fortification agents. In China and India, the increasingly growing prevalence of chronic diseases is prominently fuelling revenues in the food fortifying agents industry of the APAC.

Global Food Fortifying Agents Market: Competitive Players

Some main participants of the Food Fortifying Agents market are-

- Cargill Incorporated

- PPG Industries Inc.

- I. du Pont de Nemours and Company

- Kellogg Co.

- Royal DSM

- Evonik Industries AG

- BASF SE

- Ingredion Incorporated

- Arla Foods

- Nestle Sa

- Archer Daniels Midland Company

- Hansen Holdings A/S etc.

- Among others

This report segments the Global Food Fortifying Agents Market as follows:

Global Food Fortifying Agents Market: Form Analysis

- Minerals

- Vitamins

- Lipids

- Carbohydrates

- Proteins and Others

Global Food Fortifying Agents Market: End User Analysis

- Pet Food

- Animal Feed

- And Animal Nutrition

- Cereals & Cereal-based Products

- Bulk Food Items

- Dairy & Dairy Products

- Dietary Supplements

- Fats & Oils

- Infant Formula And Others.

Food Fortifying Agents Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed