Flexible Workspace Market Size, Share, Industry Analysis, Trends, Growth, Forecasts, 2032

Flexible Workspace Market By type (assigned workspace, breakout spaces, co-working space, and others), By end use (office, home, and others) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

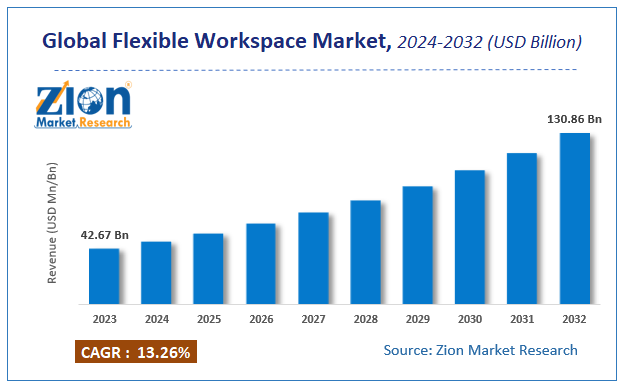

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.67 Billion | USD 130.86 Billion | 13.26% | 2023 |

Description

Flexible Workspace Market Insights

According to the report published by Zion Market Research, the global Flexible Workspace Market size was valued at USD 42.67 Billion in 2023 and is predicted to reach USD 130.86 Billion by the end of 2032. The market is expected to grow with a CAGR of 13.26% during the forecast period. The report analyzes the global Flexible Workspace Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Flexible Workspace industry.

Key Insights:

- As per the analysis shared by our research analyst, the flexible workspace market is anticipated to grow at a CAGR of 13.26% during the forecast period.

- The global flexible workspace market was estimated to be worth approximately USD 42.67 billion in 2023 and is projected to reach a value of USD 130.86 billion by 2032.

- The growth of the flexible workspace market is being driven by surge in commercial flexible workspaces, expansion strategies of the small, medium, as well as large enterprises, the evolving corporate landscape across the world, surging strategic alliances, and increasing penetration of technology & digital platforms in several countries.

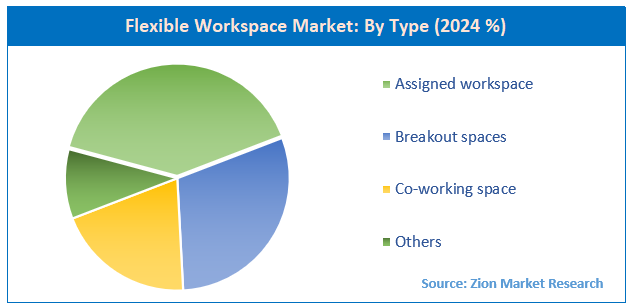

- Based on the type, the assigned workspace segment is growing at a high rate and is projected to dominate the market.

- On the basis of end use, the office segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Global Flexible Workspace Market: Overview

Flexible workspace operates as a type of asset for organizations. A flexible workplace in a company is far more adaptable to the general challenges faced by companies, which pushes the demand for such workplace models. A flexible workplace results in lower operational demand, fewer workplace costs & occupancy, and less worker support. Since a flexible workspace model is accessible and operational by companies in many industry verticals, this model contributes heavily to revenue generation. Flexible workspaces offer several advantages to the employees, as well as employers.

Apart from the cost-cutting, employers can augment the work setting choices and elevate the productivity of their employees. Thus, such a plan indirectly aids in the positive financial numbers. Moreover, a flexible workspace includes a flexible desk layout that can help in sorting out multitasks at immediate time periods. Company owners focus on increasing their employee productivity rates to increase their leads and sales volume. Therefore, with the adoption of flexible workspaces in most parts of the world, this market is propelling at a high growth rate and is set to grow tremendously during the anticipated period.

Global Flexible Workspace Market: Growth Factors

The prominent elements driving the growth of the global flexible workspace market are a surge in commercial flexible workspaces, expansion strategies of the small, medium, as well as large enterprises, the evolving corporate landscape across the world, surging strategic alliances, and increasing penetration of technology & digital platforms in several countries. For instance, in September 2020, IWG, a Belgium-based company signed a franchise contract with the Adams Group, Australia to launch ten new co-working spaces under its Regus brand. The Adams Group will look upon the Regus brand to open new locations through the state in Noosa, Townsville, Cairns, Mackay, Gladstone, Rockhampton, Bundaberg, the Sunshine Coast, Hervey Bay, and Airlie Beach. On the contrary, the data security of firms is a major concern revolving around this industry. Also, the flexible design of workspace outsourced services points out threats for the market in the forecast period. The lack of measures for security, as well as the unaffordability of startups to invest in top-notch security software platforms might decrease the preference rate of customers during the anticipated period.

An abrupt dropdown in the economy has been observed throughout the globe amidst the COVID-19 pandemic outbreak in 2020. There has been a rise in the cost of raw materials, unavailability of labor, and cessation in the production units of many companies. Owing to such factors, a wide array of organizations is inclining towards flexible workspace design. The Covid-19 pandemic is expected to have a positive outcome on the growth rate in the near future on the global flexible workspace market as many new entrants and new customers are employing this innovative workspace designs.

Global Flexible Workspace Market: Segmentation

The global flexible workspace market is categorized based on type, end use, and region.

Based on the Type, the global flexible workspace market is segmented into assigned workspace, breakout spaces, co-working space, and others.

On the basis of End Use, the global flexible workspace market is divided into office, home, and others.

Recent Developments

- In January 2022, WeWork acquired Common Desk, adding 23 locations across North Carolina and Texas.

- In May 2022, Industrious acquired Great Room Offices (Asia) and Welkin & Meraki (Europe), expanding its reach into six countries.

- In Late 2024, Yardi acquired a majority stake in WeWork for $450 million as part of WeWork's bankruptcy exit, and then acquired Deskpass (US) and Hubble (UK) in early 2025.

- In January 2025, CBRE fully acquired Industrious for $800 million, integrating it with its Building Operations and Experience division to prioritize flex space globally.

Flexible Workspace Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flexible Workspace Market |

| Market Size in 2023 | USD 42.67 Billion |

| Market Forecast in 2032 | USD 130.86 Billion |

| Growth Rate | CAGR of 13.26% |

| Number of Pages | 194 |

| Key Companies Covered | Urban Office, Herman Miller Furniture, BE Offices Limited, Awfis Space Solutions Pvt Ltd., Fora Space Ltd., Flexspace, OfficeRnD Ltd, Space&Co., JustCo, The Great Room Offices, Victory Offices Limited., The Working Capito, WOTSO Limited, WeWork Companies Inc., Servcorp Limited, IWG plc., Bizspace Limited, Haworth, The Great Room Offices, and Garage Society, among others |

| Segments Covered | By type, By end use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flexible Workspace Market Dynamics:

Key growth drivers

The Flexible Workspace Market is driven by a fundamental shift in how businesses view and use office space. The widespread adoption of hybrid and remote work models has made traditional long-term office leases less appealing, as companies seek greater agility and cost-efficiency. Flexible workspaces allow organizations to scale their office space up or down based on fluctuating needs, reducing capital expenditure and operational costs. This model is particularly attractive to startups and small to medium-sized enterprises (SMEs), which need a professional environment without the financial burden of a traditional office. The growth of the gig economy and a freelance culture also fuels demand, as independent professionals seek collaborative environments and essential amenities.

Restraints

Despite its popularity, the flexible workspace market faces several restraints. One significant concern for corporate clients is data security and privacy in a shared environment. The shared network infrastructure can be perceived as a risk, especially for companies handling sensitive or confidential information, which limits adoption in sectors like finance and law. The high cost of maintaining quality amenities and providing reliable technology can also compress profit margins for operators, particularly in a highly competitive market. Furthermore, while the model offers flexibility for tenants, it creates a revenue uncertainty for operators, who must manage potential vacancies and member churn, making their business model sensitive to economic downturns.

Opportunities

The flexible workspace market is ripe with opportunities for expansion and innovation. There is a growing trend of large enterprises and global corporations integrating flexible spaces into their real estate portfolios, not just for satellite offices but as a core part of their workplace strategy. The expansion into suburban and Tier-2 and Tier-3 cities presents a major opportunity, as companies seek to attract and retain talent in a more dispersed workforce. Furthermore, the market can grow by providing specialized offerings, such as private, dedicated offices for companies that need more security, or spaces focused on specific industries like technology or life sciences. The integration of smart office technologies can also enhance the user experience, making flexible spaces more efficient and attractive.

Challenges

The market is confronted with a number of challenges that can hinder its full potential. The lack of standardized contracts and regulations across different regions can complicate multi-city expansion for both operators and tenants. Fierce competition in major urban centers can lead to market saturation and a pricing race to the bottom, which can compromise service quality. Educating potential clients, especially traditional corporations, on the value proposition of flexible workspaces and overcoming their initial skepticism about the model is a constant challenge. Finally, the need to continuously invest in technology, design, and amenities to differentiate in a crowded market and meet the evolving expectations of a diverse clientele poses a significant operational and financial hurdle.

Global Flexible Workspace Market: Regional Analysis

North America held the majority share in 2020 in the global flexible workspace market. North American countries such as the US and Canada have increasingly adopted the flexible workspaces in organizations. Owing to the pandemic outbreak, many companies have ruled out traditional workspaces completely. A high number of corporates are shifting towards flexible workspaces due to the ease of manageability of this model. Moreover, Asia Pacific is anticipated to be the fastest-growing region during the forecast period.

The critical growth drivers include a surge in the co-working of many companies, acceptance of open workspaces, a rising number of startups & small establishments, and the implementation of smart office designs. Countries like India, China, and Australia have seen incubators and accelerator firms operating in the online mode through the use of a flexible workspace model. For instance, according to the 2019 Startup Genome Project, Bangalore, a metropolitan city in India, is ranked within the world’s 20 leading startup cities. The city is also positioned as one of the globe's five fastest-growing startup cities. Thus, such strategies are set to increase the growth rate of the regional market for flexible workspaces.

Global Flexible Workspace Market: Competitive Players

Some of the key players in the global flexible workspace market are:

- Urban Office

- Herman Miller Furniture

- BE Offices Limited

- Awfis Space Solutions Pvt Ltd.

- Fora Space Ltd.

- Flexspace

- OfficeRnD Ltd

- Space&Co.

- JustCo

- The Great Room Offices

- Victory Offices Limited.

- The Working Capito

- WOTSO Limited

- WeWork Companies Inc.

- Servcorp Limited, IWG plc.

- Bizspace Limited

- Haworth

- The Great Room Offices

- Garage Society, among others.

The Global Flexible Workspace Market is segmented as follows:

By Type

- Assigned workspace

- Breakout spaces

- Co-working space

- Others

By End Use

- Office

- Home

- Others

Global Flexible Workspace Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Factors such as a surge in commercial flexible workspaces, expansion strategies of the small, medium, as well as large enterprises, the evolving corporate landscape across the world, and increasing penetration of technology and digital platforms in ample countries boost the growth of the global flexible workspace market.

Some of the key players in the global flexible workspace market are Urban Office, Herman Miller Furniture, BE Offices Limited, Awfis Space Solutions Pvt Ltd., Fora Space Ltd., Flexspace, OfficeRnD Ltd, Space&Co., JustCo, The Great Room Offices, Victory Offices Limited., The Working Capito, WOTSO Limited, WeWork Companies Inc., Servcorp Limited, IWG plc., Bizspace Limited, Haworth, The Great Room Offices, and Garage Society, among others.

The North American region held the largest share in the market owing to the high level of adoption of flexible workspaces, established infrastructure, presence of key players in countries like the US, and the rise in startup support activities by government and non-government agencies.

Based on statistics from the Zion Market Research, the global Flexible Workspace Market size was projected at approximately US$ 42.67 Billion in 2023. Projections indicate that the market is expected to reach around US$ 130.86 Billion in revenue by 2032.

The global Flexible Workspace Market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 13.26% during the forecast period from2024 to 2032.

The global Flexible Workspace Market is driven by several key factors such as; rising demand for fresh and organic produce, population growth, and health-conscious consumer preferences.

The global Flexible Workspace Market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed