Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market Size & Forecast 2034

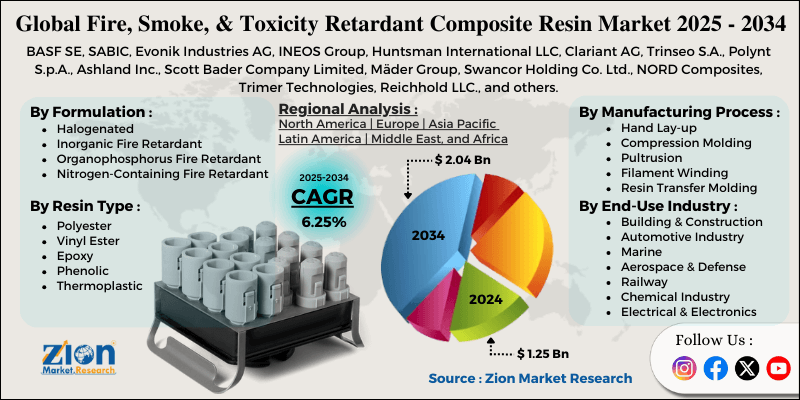

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market By Formulation (Halogenated, Inorganic Fire Retardant, Organophosphorus Fire Retardant, Nitrogen-Containing Fire Retardant), By Resin Type (Polyester, Vinyl Ester, Epoxy, Phenolic, Thermoplastic, and Others), By Manufacturing Process (Hand Lay-up, Compression Molding, Pultrusion, Filament Winding, Resin Transfer Molding, and Others), By End-Use Industry (Building & Construction, Automotive Industry, Marine, Aerospace & Defense, Railway, Chemical Industry, Electrical & Electronics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

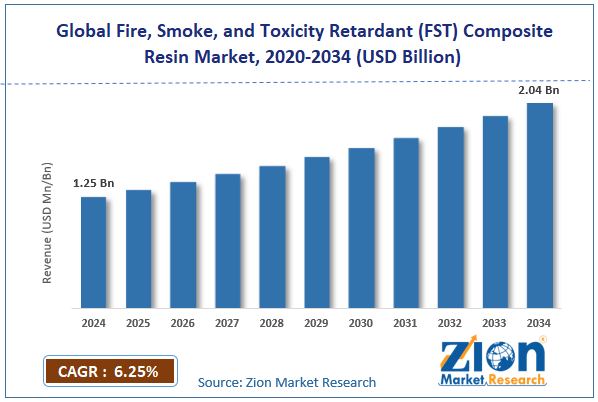

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.25 Billion | USD 2.04 Billion | 6.25% | 2024 |

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Industry Perspective:

What will be the size of the global fire, smoke, and toxicity retardant (FST) composite resin market during the forecast period?

The global fire, smoke, and toxicity retardant (FST) composite resin market size was approximately USD 1.25 billion in 2024 and is projected to reach USD 2.04 billion by 2034, with a compound annual growth rate (CAGR) of approximately 6.25% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fire, smoke, and toxicity retardant (FST) composite resin market is estimated to grow annually at a CAGR of around 6.25% over the forecast period (2025-2034)

- In terms of revenue, the global fire, smoke, and toxicity retardant (FST) composite resin market was valued at approximately USD 1.25 billion in 2024 and is projected to reach USD 2.04 billion by 2034.

- The fire, smoke, and toxicity retardant (FST) composite resin market is projected to grow significantly owing to stringent fire safety regulations and standards, the expansion of the infrastructure and construction sectors, and the growth of electric vehicles and the need for battery housing safety.

- Based on formulation, the halogenated segment is expected to lead the market, while the organophosphorus fire retardant segment is expected to grow considerably.

- Based on resin type, the epoxy segment is the largest, while the phenolic segment is projected to register sizeable revenue over the forecast period.

- Based on manufacturing process, the resin transfer molding segment dominates the market, while the pultrusion segment holds a second-leading share.

- Based on end-use industry, the aerospace & defense segment is expected to lead the market, followed by the railway segment.

- By region, the Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market: Overview

Fire-, smoke-, and toxicity-retardant composite resins are specialized materials designed to enhance safety in environments with high fire risk, such as rail, aerospace, and construction. These resins are formulated to limit flame speed, resist ignition, minimize the release of toxic gases, and reduce smoke generation when exposed to fire. The global fire, smoke, and toxicity retardant (FST) composite resin market is projected to grow substantially, driven by strict fire safety regulations, rising demand in the defense and aerospace sectors, and light-weighting across industries. Strict fire, smoke, and toxicity standards in the rail, construction, and aerospace industries are a key propeller. Compliance requirements mandate the use of licensed FST materials. This persistency drives the demand for advanced composite resins.

Moreover, structural components and aircraft interiors need lightweight materials with high fire resistance. Expanding worldwide air traffic and defense investments raise material consumption. FST composite resin meets performance and safety needs. Furthermore, industries aim to reduce weight to enhance fuel efficiency and energy performance. Composite materials replace metals without compromising safety standards. FST resins allow lightweight solutions without compromising fire resistance.

Although drivers exist, the global market is challenged by factors like complex manufacturing processes and environmental and health regulations. Precise control is required to achieve consistent FST performance. processing challenges raise rejection rates and production times. This increases operational complexity for manufacturers. Similarly, some flame retardants experience scrutiny because of toxicity concerns. Regulatory changes may restrict specific formulations. This creates uncertainty for long-term product development.

Even so, the global fire, smoke, and toxicity (FST) composite resin industry is well positioned owing to the development of environmentally friendly FST resins, customization for high-value applications, and demand for replacement and retrofit. Demand for low-toxicity and non-halogenated systems is increasing. This creates robust advancement opportunities. Industries seek application-specific rein solutions. Tailored FST systems command premium pricing. This backs margin growth and differentiation. Additionally, older infrastructure usually fails modern fire safety standards. Upgrades need FST-compliant materials, thus generating steady aftermarket demand.

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market: Dynamics

Growth Drivers

How do electrification and EV demand in the automotive industry drive the fire, smoke, and toxicity retardant (FST) composite resin market?

The global shift toward EVs is driving demand for lightweight, fire-resistant materials. FST-composite resins are essential for battery enclosures, interiors, and power electronics to reduce fire risk. OEMs are steadily integrating these resins to meet safety standards and improve vehicle performance. Rising EV production worldwide is driving overall industry adoption. This trend ranks the automotive segment as the leading consumer of FST composites.

How do innovations in eco-friendly high-performance resins noticeably fuel the fire, smoke, and toxicity retardant (FST) composite resin market?

Improvements in low-toxicity, non-halogenated, and bio-based FST resins are transforming the fire, smoke, and toxicity retardant (FST) composite resin market. These materials assimilate superior fire safety with environmental sustainability and reduced carbon footprint. R&D in high-performance resins allows applications in rail, aerospace, construction, and automotive. Eco-friendly innovation is becoming a differentiator for producers. The market steadily favors resins that offer safety without harming the environment.

Restraints

Complex processing requirements negatively impact the market progress

FST composites require curing cycles, precise temperature control, and handling techniques to achieve optimal performance. Improper processing may reduce fire retardancy, durability, or mechanical strength. Industries adopting these materials should invest in training and advanced manufacturing protocols. This complexity demotivates adoption in low-tech or small-scale operations. Hence, challenges act as constraints to the market growth.

Opportunities

How does urban infrastructure expansion in emerging economies create lucrative opportunities for the fire, smoke, and toxicity retardant (FST) composite resin market?

Rapid urbanization and large-scale infrastructure projects in Latin America, APAC, and the Middle East are creating new markets. FST resins can improve safety in high-rise buildings, tunnels, and public transport. Governments are focusing on fire-resistant materials for public safety. This trend offers significant potential for adoption in transportation and construction projects. Developing markets offer long-term revenue growth for suppliers of FST, thereby impacting the growth of the fire, smoke, and toxicity retardant (FST) composite resin industry.

Challenges

Balancing fire safety with mechanical performance restricts the market growth

FST resins should maintain strength while offering fire resistance, which is challenging primarily. Additives enhancing flame retardancy may at times reduce flexibility or toughness. Achieving the best balance requires advanced formulations and accurate processing. This technical challenge raises development costs. Failure to balance properties may restrict industry acceptance in high-performing applications.

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market |

| Market Size in 2024 | USD 1.25 Billion |

| Market Forecast in 2034 | USD 2.04 Billion |

| Growth Rate | CAGR of 6.25% |

| Number of Pages | 217 |

| Key Companies Covered | BASF SE, SABIC, Evonik Industries AG, INEOS Group, Huntsman International LLC, Clariant AG, Trinseo S.A., Polynt S.p.A., Ashland Inc., Scott Bader Company Limited, Mäder Group, Swancor Holding Co. Ltd., NORD Composites, Trimer Technologies, Reichhold LLC., and others. |

| Segments Covered | By Formulation, By Resin Type, By Manufacturing Process, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market: Segmentation

The global fire, smoke, and toxicity retardant (FST) composite resin market is segmented by formulation, resin type, manufacturing process, end-use industry, and region.

Why is the Halogenated segment projected to dominate the fire, smoke, and toxicity retardant (FST) composite resin market?

Based on formulation, the global fire, smoke, and toxicity retardant (FST) composite resin industry is divided into halogenated, inorganic, organophosphorus, and nitrogen-containing fire retardants. The halogenated segment dominates the worldwide market with 45% share. They have been widely used due to their excellent flame-retardant performance and relatively low loading levels. This makes them effective in transportation, aerospace, and construction composites.

On the other hand, the organophosphorus fire-retardant segment ranks second, with 30% market share. They are gaining substantial market share as an eco-friendlier and safer alternative to halogenated resins. They offer good flame-retardant performance, low smoke generation, and low toxicity.

Why is the Epoxy segment leading in the fire, smoke, and toxicity retardant (FST) composite resin market?

Based on resin type, the global fire, smoke, and toxicity retardant (FST) composite resin market is segmented into polyester, vinyl ester, epoxy, phenolic, thermoplastic, and others. The epoxy resin segment leads with 40% market share due to its excellent mechanical strength, strong adhesion to fibers, and thermal stability. They are widely used in rail interiors and the aerospace industry, where fire safety and structural performance are crucial.

However, the phenolic resin segment ranks second with a 25% market share. They are inherently flame-retardant and produce low-toxic gases and smoke. They are mainly used in applications where fire resistance is prioritized over mechanical flexibility, like aircraft interiors and insulation panels.

What factors help the Resin Transfer Molding segment lead the fire, smoke, and toxicity retardant (FST) composite resin market?

Based on manufacturing process, the global fire, smoke, and toxicity retardant (FST) composite resin market is segmented into hand lay-up, compression molding, pultrusion, filament winding, resin transfer molding, and others. The resin transfer molding segment accounts for nearly 35% of the market due to its broader adoption relative to resin infusion. This produces high-strength, complex parts with consistent smoke, fire, and toxicity performance, and it promises fiber wet-out. It is widely used in rail interiors and the aerospace industry.

Nonetheless, the pultrusion segment continues to grow, with a 25% market share, due to its suitability for producing continuous profiles with consistent quality and excellent fire-retardant characteristics. It is particularly suited to panels, structural components, and rail where straight, long sections with FST compliance are needed.

What are the key reasons for the leadership of the Aerospace & Defense segment in the fire, smoke, and toxicity retardant (FST) composite resin market?

Based on end-use industry, the global market is segmented into building & construction, automotive industry, marine, aerospace & defense, railway, chemical industry, electrical & electronics, and others. The aerospace & defense segment holds leadership with 40% market share. This growth is backed by stringent fire, smoke, and toxicity standards for structural components, aircraft interiors, and defense equipment. High-performance, lightweight FST composites are essential for fuel efficiency and safety.

Conversely, the railway segment ranks second with 25% market share. Metros and passenger trains increasingly require FST-compliant materials for interiors, structural components, and panels. Regulatory requirements for low-smoke, low-toxicity fuels have driven increased adoption in this industry.

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market?

Asia-Pacific is likely to maintain its leadership in the fire, smoke, and toxicity (FST) composite resin market, with an 8.4% CAGR, driven by a large market share, regional growth, industrialization, infrastructure expansion, and a strong manufacturing base. Asia Pacific holds the leading share of the global market, driven by infrastructure and industrial expansion. Economies like Japan, China, and India dominate regional demand. The industry continues to progress rapidly due to growing performance and safety requirements.

Moreover, rapid industrialization and urbanization create a heightened demand for fire-safe composite materials. Transportation, construction, and energy projects rely heavily on FST resins. This propels continuous market growth in the region. APAC houses major composite manufacturing hubs, mainly in India and China. High production of automotive, aerospace, and rail components fuels FST resin consumption. Local manufacturing promises cost-efficiency and availability.

Why does North America rank second in the global Fire Protection System Pipes Market?

North America continues to hold the second-highest share, with a 6.8% CAGR, in the fire, smoke, and toxicity retardant (FST) composite resin industry, owing to the developed aerospace and defense market, strict safety and fire regulations, and advanced transportation infrastructure. North America has the most developed aerospace and defense industries in the world, demanding fire-safe, high-performance composites. Manufacturers prioritize FST resins for structural components and aircraft interiors. This strong industry highlights primary regional industry demand.

Furthermore, regions in Canada and the United States enforce stringent fire, smoke, and toxicity regulations for buildings and transportation. Compliance fuels broader adoption of certified FST resins across aviation, rail, industrial, and construction segments. Regulatory pressure sustains continuous industry growth.

Additionally, established rail, automotive, and mass transit systems need flame-retardant composite materials. Electrification trends in public transport and vehicles further raise FST resin usage. Substantial infrastructure investment keeps regional demand strong.

Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market: Competitive Analysis

The leading players in the global fire, smoke, and toxicity retardant (FST) composite resin market are:

- BASF SE

- SABIC

- Evonik Industries AG

- INEOS Group

- Huntsman International LLC

- Clariant AG

- Trinseo S.A.

- Polynt S.p.A.

- Ashland Inc.

- Scott Bader Company Limited

- Mäder Group

- Swancor Holding Co. Ltd.

- NORD Composites

- Trimer Technologies

- Reichhold LLC.

What are the key trends in the global Fire, Smoke, and Toxicity Retardant (FST) Composite Resin Market?

Integration with high‑performance thermoplastics:

Thermoplastic composites are increasingly paired with FST resin systems to meet demand for durability, recyclability, and faster processing. This blends fire safety with benefits such as reprocessing capability and impact resistance, mainly in the transportation and automotive industries. This trend backs wider use of composites in high-volume applications.

Growth in electric and mass transportation applications:

The expansion of mass transit and electrification is driving increased demand for fire-safe materials for battery enclosures, high-speed trains, and electric vehicles. FST-compliant composites provide lightweight, safety-compliant solutions that meet smoke and fire performance criteria in these industries. This trend is fueling elevated adoption and innovation in resin formulations.

The global fire, smoke, and toxicity retardant (FST) composite resin market is segmented as follows:

By Formulation

- Halogenated

- Inorganic Fire Retardant

- Organophosphorus Fire Retardant

- Nitrogen-Containing Fire Retardant

By Resin Type

- Polyester

- Vinyl Ester

- Epoxy

- Phenolic

- Thermoplastic

- Others

By Manufacturing Process

- Hand Lay-up

- Compression Molding

- Pultrusion

- Filament Winding

- Resin Transfer Molding

- Others

By End-Use Industry

- Building & Construction

- Automotive Industry

- Marine

- Aerospace & Defense

- Railway

- Chemical Industry

- Electrical & Electronics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

List of Contents

Composite ResinIndustry Perspective:Key Insights: Composite Resin Overview Composite Resin Dynamics Composite Resin Report Scope Composite Resin Segmentation Composite Resin Regional Analysis Composite Resin Competitive AnalysisWhat are the key trends in the global Composite Resin Market?The global fire, smoke, and toxicity retardant (FST) composite resin market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed