Ferroalloy Market Trend, Share, Growth, Size, Analysis and Forecast 2032

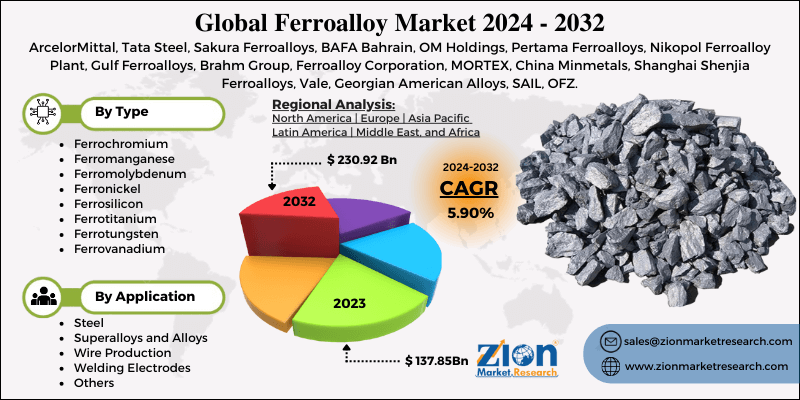

Ferroalloy Market By Type (Ferrochromium, Ferromanganese, Ferromolybdenum, Ferronickel, Ferrosilicon, Ferrotitanium, Ferrotungsten, Ferrovanadium, and Others) and By Application (Steel, Superalloys and Alloys, Wire Production, Welding Electrodes, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

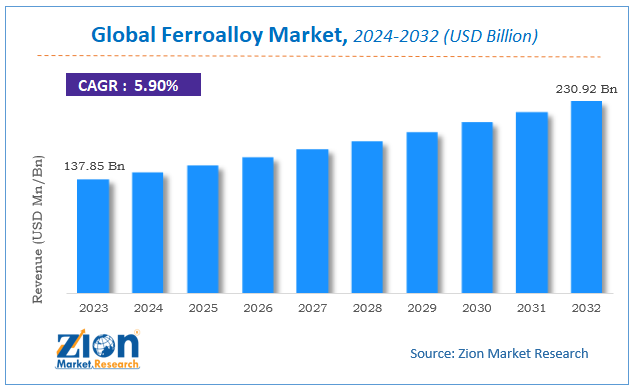

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 137.85 Billion | USD 230.92 Billion | 5.90% | 2023 |

Ferroalloy market: Size

The global ferroalloy market size was worth around USD 137.85 billion in 2023 and is predicted to grow to around USD 230.92 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.90% between 2024 and 2032.

The report covers a forecast and an analysis of the ferroalloy market on a global and regional level. The study provides the data of historic data from 2018 to 2022 and a forecast period from 2024 to 2032 based on volume (Kilotons) and revenue (USD Billion).

Ferroalloy Market: Overview:

The global ferroalloy market is expected to witness substantial growth in the future, owing to the flourishing building and construction industry, particularly in emerging economies. Ferroalloy is one of the major materials required for steel production. Ferroalloy is produced via the carbothermic reaction process. Primarily, ferroalloy is formed with chromium, silicon, and manganese. The major function of the ferroalloy is to enhance the properties of different metals, such as increasing resistance to erosion and oxidation and improving tensile strength in high temperature and with other chemical reactions. The rising demand for steel across various end-user industries, such as construction, automotive, shipbuilding, etc., is one of the major factors driving the ferroalloy market globally. However, stringent government regulations pertaining to environment protection and high operational costs may limit the global ferroalloys market. Alternatively, the growing demand for ferroalloy from the Asia Pacific is expected to provide new growth opportunities for the key players in the ferroalloy market in the upcoming years. The rapid industrialization in the region along with a large population base is also expected to aid the ferroalloy market.

The study includes the drivers and restraints of the ferroalloy market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the ferroalloy market on a global level.

In order to give the users of this report a comprehensive view of the ferroalloy market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

Ferroalloy Market: Segmentation

The study provides a decisive view of the ferroalloy market by segmenting it based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on type, the ferroalloy market includes ferrovanadium, ferromanganese, ferrochromium, ferromolybdenum, ferrosilicon, ferronickel, ferrotungsten, ferrotitanium, and others. Ferromanganese is expected to show the fastest growth rate over the estimated time period, due to its wide usage in steel production. The process of steel production requires ferromanganese as a desulfurizing agent, as it removes nitrogen bubbles and reduces the amount of iron oxide that is undesirable during production.

Steel, superalloys and alloys, wire production, welding electrodes, and others form the application segment of the global ferroalloy market. Steel manufacturing is the primary application of ferroalloys and is expected to dominate the global ferroalloy market over the forecast timeframe. Most of the bulk ferroalloys are used in intensifying the properties of steel, due to the low prices of bulk ferroalloys and high production.

Ferroalloy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ferroalloy Market Research Report |

| Market Size in 2023 | USD 137.85 billion |

| Market Forecast in 2032 | USD 230.92 billion |

| Growth Rate | CAGR of 5.90% |

| Number of Pages | 110 |

| Key Companies Covered | ArcelorMittal, Tata Steel, Sakura Ferroalloys, BAFA Bahrain, OM Holdings, Pertama Ferroalloys, Nikopol Ferroalloy Plant, Gulf Ferroalloys, Brahm Group, Ferroalloy Corporation, MORTEX, China Minmetals, Shanghai Shenjia Ferroalloys, Vale, Georgian American Alloys, SAIL, OFZ. |

| Segments Covered | By Application, By Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ferroalloy Market: Regional Analysis

The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

The Asia Pacific is expected to hold a major share of the global ferroalloy market over the forecast time period, owing to the flourishing end-use industries in the region. The Asia Pacific has established itself as a hub of various end-user industries, such as oil and gas, steel, electronics, automotive, and consumer electronics. Ferroalloy is used in the production of automotive radiators, switches, wires, water heaters, metal casting, refrigerators, and various other chemical processing machines. Emerging technologies for the production of ferroalloys along with increased ferroalloy consumption and exports from China, Japan, and India is also expected to drive the region’s ferroalloy market in the upcoming years.

Ferroalloy Market: Key Players Analysis

Some key players operating in the global ferroalloy market are:

- ArcelorMittal

- Tata Steel

- Sakura Ferroalloys

- BAFA Bahrain

- OM Holdings

- Pertama Ferroalloys

- Nikopol Ferroalloy Plant

- Gulf Ferroalloys

- Brahm Group

- Ferroalloy Corporation

- MORTEX

- China Minmetals

- Shanghai Shenjia Ferroalloys

- Vale

- Georgian American Alloys

- SAIL

- OFZ

This report segments the global ferroalloy market into:

Global Ferroalloy Market: Type Analysis

- Ferrochromium

- Ferromanganese

- Ferromolybdenum

- Ferronickel

- Ferrosilicon

- Ferrotitanium

- Ferrotungsten

- Ferrovanadium

- Others

Global Ferroalloy Market: Application Analysis

- Steel

- Superalloys and Alloys

- Wire Production

- Welding Electrodes

- Others

Global Ferroalloy Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ferroalloy is one of the major materials required for steel production. Ferroalloy is produced via the carbothermic reaction process. Primarily, ferroalloy is formed with chromium, silicon, and manganese.

According to study, the global Ferroalloy Market size was worth around USD 137.85 billion in 2023 and is predicted to grow to around USD 230.92 billion by 2032.

The CAGR value of Ferroalloy Market is expected to be around 5.90% during 2024-2032.

Asia Pacific has been leading the global Ferroalloy Market and is anticipated to continue on the dominant position in the years to come.

The global Ferroalloy Market is led by players like ArcelorMittal, Tata Steel, Sakura Ferroalloys, BAFA Bahrain, OM Holdings, Pertama Ferroalloys, Nikopol Ferroalloy Plant, Gulf Ferroalloys, Brahm Group, Ferroalloy Corporation, MORTEX, China Minmetals, Shanghai Shenjia Ferroalloys, Vale, Georgian American Alloys, SAIL, OFZ.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed