Feed Preservatives Market Size Report, Industry Share, Analysis, Growth, 2032

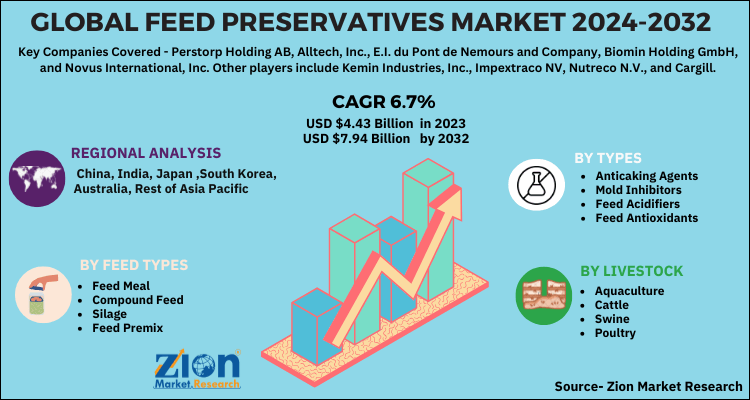

Feed Preservatives Market: By Types (Anticaking Agents, Mold Inhibitors, Feed Acidifiers, and Feed Antioxidants), and Livestock (Aquaculture, Cattle, Swine, Poultry, and Others), and by Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

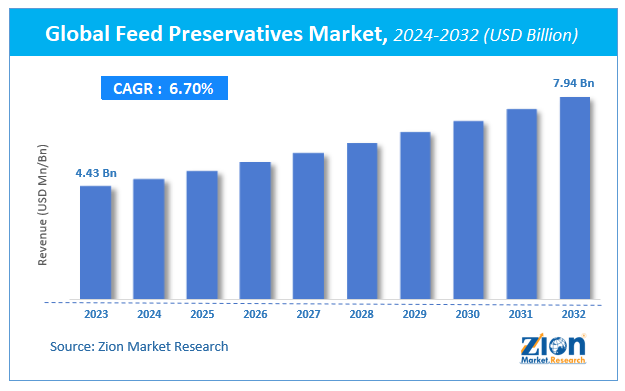

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.43 Billion | USD 7.94 Billion | 6.7% | 2023 |

Global Feed Preservatives Market Insights

According to Zion Market Research, the global Feed Preservatives Market was worth USD 4.43 Billion in 2023. The market is forecast to reach USD 7.94 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.7% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Feed Preservatives industry over the next decade.

Global Feed Preservatives Market: Overview

Preservatives play an important role in preventing spoilage of food. Feed preservatives are used in animal food products to avoid any spoilage of food product and enhance shelf life. Especially in animal food products, preservatives or antioxidants are essential to avoid animal fats and oils from oxidizing. They are also essential in kibble or dry pet food products. Preservatives are available in two forms, namely, natural and artificial preservatives. Artificial preservatives are also called as synthetic preservatives. Natural preservatives are naturally occurring in various forms such as citric acid, rosemary, and vitamin E. They also offer anti-inflammatory health benefits.

Global Feed Preservatives Market: Growth Factors

Feed preservatives are widely preferred in the feed premix industry, hence the demand for feed preservatives is growing rapidly; this is expected to boost the global market growth. They are also used in wide range of applications propelling the global feed preservatives market in future. Feed premixes are the broadly accepted in the feed preservatives market owing to increased need to sustain the quality of premix ingredients include amino acids, vitamins, and minerals those are easily perishable and can deteriorate in the presence of heat, and light. Escalating demand for feed premixes in order to maintain livestock health is projected to fuel usage of feed preservatives by many vendors in order to maintain the premix quality.

Global Feed Preservatives Market: Segmentation

The study provides a decisive view of the feed preservatives market by segmenting the market by feed types, by types, by livestock, and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on feed types as feed meal, compound feed, silage, feed premix, and others.

Based on types, the global market is fragmented as anticaking agents, mold inhibitors, feed acidifiers, and feed antioxidants.

On the basis of livestock, the global feed preservatives market is segregated as aquaculture, cattle, swine, poultry, and others.

The geographical region is segmented as Asia-Pacific, Europe, North America, Latin America, and the Middle East.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Feed Preservatives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Feed Preservatives Market |

| Market Size in 2023 | USD 4.43 Billion |

| Market Forecast in 2032 | USD 7.94 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 110 |

| Key Companies Covered | Perstorp Holding AB, Alltech, Inc., E.I. du Pont de Nemours and Company, Biomin Holding GmbH, and Novus International, Inc. Other players include Kemin Industries, Inc., Impextraco NV, Nutreco N.V., and Cargill, Incorporated, among others |

| Segments Covered | By Feed Types, By Types, By Livestock, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Feed Preservatives Market: Regional Analysis

Asia-Pacific region is anticipated to grow at the highest rate owing to consumer inclination towards organized farming in poultry and aquaculture sectors. Growth in the disposal income also fosters the global feed preservatives market growth. Emerging markets such as Vietnam, India, Malaysia, Thailand, and Indonesia are projected to propel the global market growth due to the growing demand for compound feed and feed premix in these regions. Adoption of innovative technologies in North America positively influences the global market in this region. Latin America may show significant growth in future.

Europe is also considerably grabbing the major market. Increasing popularity for feed acidifiers as a suitable alternative in this region is anticipated to foster the global market growth in future. The European region is prominently expanding its niche market across the country. The European regulatory authorities are focusing towards food safety and livestock health, which may positively affect the global market growth.

Global Feed Preservatives Market: Competitive Players

Some main participants of the Feed Preservatives market are-

- Perstorp Holding AB

- Alltech Inc

- E.I. du Pont de Nemours and Company

- Biomin Holding GmbH

- Novus International Inc

- Impextraco NV

- Nutreco N.V.

- Cargill

- Incorporated

- Others

This report segments the Global Feed Preservatives Market as follows:

Global Feed Preservatives Market: Feed Types Analysis

- Feed Meal

- Compound Feed

- Silage

- Feed Premix

- Others

Global Feed Preservatives Market: Types Analysis

- Anticaking Agents

- Mold Inhibitors

- Feed Acidifiers

- Feed Antioxidants

Global Feed Preservatives Market: Livestock Analysis

- Aquaculture

- Cattle

- Swine

- Poultry

- Others

Feed Preservatives Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed