Ethylene Market Size, Share, Global Trends, Forecast to 2032

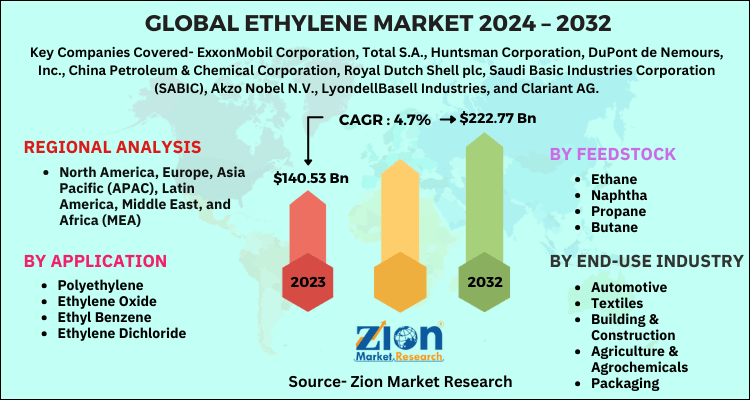

Ethylene Market- By Feedstock (Naphtha, Propane, Butane, and Ethane), By End-Use Industry (Automotive, Building & Construction, Agriculture & Agrochemicals, Packaging, and Textiles), By Application (Polyethylene, Ethyl Benzene, Ethylene Dichloride, and Ethylene Oxide), And By Region- Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

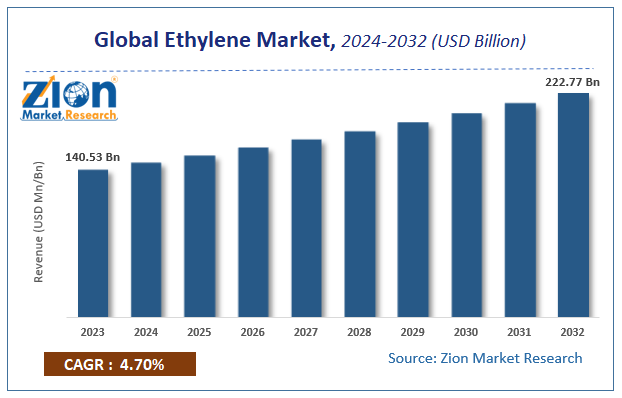

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 140.53 Billion | USD 222.77 Billion | 4.7% | 2023 |

Global Ethylene Market Insights

Zion Market Research has published a report on the global Ethylene Market, estimating its value at USD 140.53 Billion in 2023, with projections indicating that it will reach USD 222.77 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.7% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Ethylene Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Ethylene Market Size & Share

The report offers an assessment and analysis of the Ethylene Market on a global and regional level. The study offers a comprehensive assessment of the market competition, constraints, revenue estimates, opportunities, evolving trends, and industry-validated data. The report provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue USD Billion.

Ethylene Market: Synopsis

Ethylene finds a massive application in the chemical industry. Moreover, it also plays a major role in fruit ripening and inducing senescence in flowers & leaves as well as abscission of flower peduncles & leaf petioles. Apart from this, the compound maintains an apical hook at the time of dicot seed germination along with triggering a defense response under conditions such as extreme temperature, pest attack, floods, and pathogen attack. Furthermore, ethylene is utilized in the manufacturing of antifreeze, fibers, and fabricated plastics. It is also utilized in producing ethylene oxide, alcohol, plastic polyethylene, and mustard gas.

Ethylene Market: Growth Drivers

The surge in the use of the chemical compound in oxidation, hydro-halogenation, hydration, halogenation, alkylation, hydro formylation, and oligomerization is predicted to create new growth avenues for the ethylene market in the upcoming years. Reportedly, in Europe and the U.S., nearly 90% of ethylene is utilized for manufacturing ethylene oxide, ethyl benzene, polyethylene, and ethylene dichloride. Moreover, ethylene is utilized extensively for regulating freshness in fruits and horticulture activities.

Apart from this, the humungous use of ethylene in automotive, construction, textile, packaging, rubbers, agrochemicals, soaps, detergents, and plastics will drive the growth of the ethylene industry in the upcoming years. Beneficial features of products such as ease of use, easy processing, flexibility, and reduced costs will boost the growth of ethylene industry. Other major applications of the chemical compound include ethylene glycol and styrene. It also finds use in stretch & shrinks film applications for non-food packaging as well as producing low-density polyethylene, and linear low-density polyethylene. All these aforementioned factors will contribute majorly towards market revenue in upcoming years.

Furthermore, the rise in the usage of ethylene in packaged food & beverages will proliferate the growth of the ethylene market in upcoming years. Large-scale use of high-density polyethylene in blow molding & injection molding utilizations such as caps, containers, drums, household items, and pallets. This will drive market trends.

Additionally, HDPE is extruded into pipes for purpose of irrigation, water pipelines, carrier bags, film for refuse sacks, and industrial lining. This will extend the size of the ethylene market. However, strict laws enforced by the government regulating the utilization of petroleum products and the urgent requirement of firms to comply with these legislations can pose a big challenge to the growth of the ethylene market. Rapid fluctuations in crude oil costs as well as raw material prices can prove detrimental to progression of ethylene market.

Regional Landscape

Asia Pacific Ethylene Market To Register Huge Growth By 2032

The regional market surge over the forecast timeline can be credited to large capacity expansions at standalone units in countries such as China. Apart from this, technological breakthroughs have resulted in a surge in production along with a reduction in the turnaround period. This has paved the way to humungous growth of the ethylene market in Asia Pacific zone.

Ethylene Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ethylene Market |

| Market Size in 2023 | USD 140.53 Billion |

| Market Forecast in 2032 | USD 222.77 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 178 |

| Key Companies Covered | ExxonMobil Corporation, Total S.A., Huntsman Corporation, DuPont de Nemours, Inc., China Petroleum & Chemical Corporation, Royal Dutch Shell plc, Saudi Basic Industries Corporation (SABIC), Akzo Nobel N.V., LyondellBasell Industries, and Clariant AG. |

| Segments Covered | By Feedstock, By End-Use Industry, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Competitive Landscape

Key players influencing market growth and profiled in study include:

- ExxonMobil Corporation

- Total S.A.

- Huntsman Corporation

- DuPont de Nemours Inc.

- China Petroleum & Chemical Corporation

- Royal Dutch Shell plc

- Saudi Basic Industries Corporation (SABIC)

- Akzo Nobel N.V.

- LyondellBasell Industries

- Clariant AG.

The global Ethylene Market is segmented as follows:

By Feedstock

- Ethane

- Naphtha

- Propane

- Butane

By End-Use Industry

- Automotive

- Textiles

- Building & Construction

- Agriculture & Agrochemicals

- Packaging

By Application

- Polyethylene

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Surge in use of chemical compound in oxidation, hydro-halogenation, hydration, halogenation, alkylation, hydro formylation, and oligomerization is predicted to create new growth avenues for ethylene market in upcoming years. Reportedly, in Europe and the U.S., nearly 90% of ethylene is utilized for manufacturing ethylene oxide, ethyl benzene, polyethylene, and ethylene dichloride. Moreover, ethylene is utilized extensively for regulating freshness in fruits and horticulture activities. Apart from this, humungous use of ethylene in automotive, construction, textile, packaging, rubbers, agrochemicals, soaps, detergents, and plastics will drive growth of ethylene industry over upcoming years. Beneficial features of product such as ease of use, easy processing, flexibility, and reduced costs will boost growth of ethylene industry. Other major applications of chemical compound include ethylene glycol and styrene. It also finds use in stretch & shrink film application for non-food packaging as well as producing low density polyethylene, and linear low density polyethylene. All these aforementioned factors will contribute majorly towards market revenue in upcoming years.

According to Zion market research report, the global Ethylene Market accrued earnings worth approximately USD 140.53 Billion in 2023, with projections indicating that it will reach USD 222.77 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.7% over the forecast period 2024-2032.

Asia Pacific will contribute lucratively towards the regional market size over the projected timeline. The regional market surge is subject to large capacity expansions at standalone units in countries such as China. Apart from this, technological breakthroughs have resulted in surge in production along with reduction in turnaround period. This has paved way to humungous growth of ethylene market in Asia Pacific zone.

The key market participants include ExxonMobil Corporation, Total S.A., Huntsman Corporation, DuPont de Nemours, Inc., China Petroleum & Chemical Corporation, Royal Dutch Shell plc, Saudi Basic Industries Corporation (SABIC), Akzo Nobel N.V., LyondellBasell Industries, and Clariant AG.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed