EPDM (Ethylene Propylene Diene Monomer) Market Size, Share, Trends, Growth 2032

EPDM (Ethylene Propylene Diene Monomer) Market By Application (Automotive, Building & Construction, Tires & Tubes, Wires & Cables, Lubricant Additives, and Others), By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

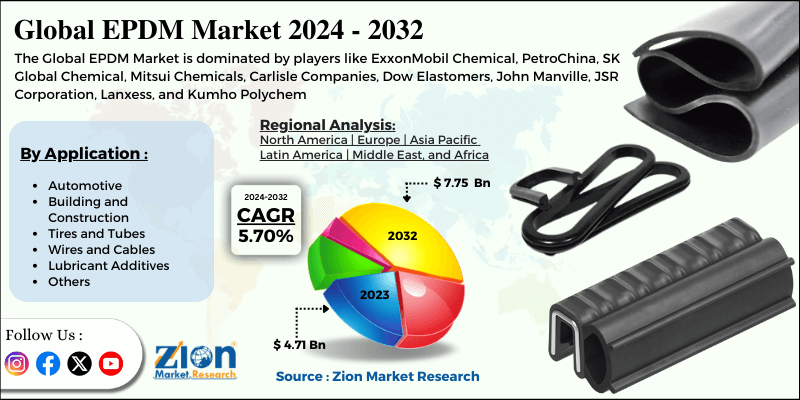

| USD 4.71 Billion | USD 7.75 Billion | 5.70% | 2023 |

EPDM (Ethylene Propylene Diene Monomer) Industry Perspective:

The global EPDM (Ethylene Propylene Diene Monomer) market size was worth around USD 4.71 Billion in 2023 and is predicted to grow to around USD 7.75 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.70% between 2024 and 2032.

The study includes the drivers and restraints of the EPDM (Ethylene Propylene Diene Monomer) market along with their impact on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the EPDM (Ethylene Propylene Diene Monomer) market on a global level.

EPDM (Ethylene Propylene Diene Monomer) Market: Growth Factors

The global EPDM (Ethylene Propylene Diene Monomer) market is expected to witness substantial growth in the future, owing to the flourishing automotive industry in several regions across the globe. EPDM (Ethylene Propylene Diene Monomer) is a type of synthetic rubber that can be used in a wide range of applications. EPDM is made from ethylene, propylene and a diene comonomer and is compatible with polar substances, such as fireproof hydraulic fluids, hot and cold water, ketones, and alkalis. EPDM is commonly used in vehicles for making window seals, door seals, trunk seals, and hood seals. EPDM has a high resistance to solvents, tearing, extreme temperatures, and abrasives. EPDM can be finished to a particularly smooth surface along with having excellent elasticity at extremely high and low temperatures.

EPDM is used in various industries like building and construction, tires and tubes, plastic modification, automotive, lubricant additives, and wires and cables. The increasing use of EPDM for plastic modification applications and rising domestic consumption of EPDM in China is expected to further drive the global EPDM (Ethylene Propylene Diene Monomer) market over the forecast time period. The growing EPDM demand from the Asia Pacific is likely to provide new growth opportunities for the global EPDM (Ethylene Propylene Diene Monomer) market in the upcoming years.

In order to give the users of this report a comprehensive view of the EPDM (Ethylene Propylene Diene Monomer) market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

EPDM (Ethylene Propylene Diene Monomer) Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | EPDM (Ethylene Propylene Diene Monomer) Market Research Report |

| Market Size in 2023 | USD 4.71 Billion |

| Market Forecast in 2032 | USD 7.75 Billion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 218 |

| Key Companies Covered | ExxonMobil Chemical, PetroChina, SK Global Chemical, Mitsui Chemicals, Carlisle Companies, Dow Elastomers, John Manville, JSR Corporation, Lanxess, and Kumho Polychem. |

| Segments Covered | By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

EPDM (Ethylene Propylene Diene Monomer) Market: Segmentation

The study provides a decisive view of the EPDM (Ethylene Propylene Diene Monomer) market by segmenting the market based on application and region.

The global EPDM (Ethylene Propylene Diene Monomer) market is fragmented based on application into automotive, building and construction, tires and tubes, wires and cables, lubricant additives, and others. The automotive segment is expected to grow at the highest rate, owing to the wide EPDM usage in the automotive industry. EPDM in the automotive industry is used for manufacturing radiator, brake parts, wipers, glass-run channel, body sealing, engine mounts, and roofing membrane along with making vehicle glazing systems, moisture barriers, O-rings, valves, and pumps. This wide range of EPDM applications in the automotive segment is expected to drive this segment over the forecast time period. The lubricant additive is another segment that is expected to grow rapidly in the future, owing to EPDM’s propensity to absorb oil, making it advantageous to be used in oil viscosity improving applications.

EPDM (Ethylene Propylene Diene Monomer) Market: Regional Analysis

The regional segment includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

The Asia Pacific region is expected to hold a major share in the EPDM (Ethylene Propylene Diene Monomer) market globally over the forecast time period. China is expected to drive the Asia Pacific EPDM (Ethylene Propylene Diene Monomer) market. The region’s flourishing automotive industry is majorly boosting this market. India and Malaysia are expected to be the major countries that will contribute to this market’s growth.

EPDM (Ethylene Propylene Diene Monomer) Market: Competitive Analysis

Some key players operating in the global EPDM (Ethylene Propylene Diene Monomer) market are

- ExxonMobil Chemical

- PetroChina

- SK Global Chemical

- Mitsui Chemicals

- Carlisle Companies

- Dow Elastomers

- John Manville

- JSR Corporation

- Lanxess

- Kumho Polychem

This report segments the global EPDM (Ethylene Propylene Diene Monomer) market into:

Global EPDM (Ethylene Propylene Diene Monomer) Market: Application Analysis

- Automotive

- Building and Construction

- Tires and Tubes

- Wires and Cables

- Lubricant Additives

- Others

Global EPDM (Ethylene Propylene Diene Monomer) Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

EPDM (Ethylene Propylene Diene Monomer) is a synthetic rubber that is extensively employed in a variety of industrial and consumer applications as a result of its exceptional properties.

For applications including weatherstripping, seals, hoses, and pulleys, the automotive industry is a significant consumer of EPDM. The demand for EPDM is directly influenced by the increase in automotive production and sales.

The global EPDM (Ethylene Propylene Diene Monomer) market size was worth around USD 4.71 Billion in 2023 and is predicted to grow to around USD 7.75 Billion by 2032.

The global EPDM (Ethylene Propylene Diene Monomer) market a compound annual growth rate (CAGR) of roughly 5.70% between 2024 and 2032.

The regional segment includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Some key players operating in the global EPDM (Ethylene Propylene Diene Monomer) market are ExxonMobil Chemical, PetroChina, SK Global Chemical, Mitsui Chemicals, Carlisle Companies, Dow Elastomers, John Manville, JSR Corporation, Lanxess, and Kumho Polychem.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)