Energy As A Service Market Size, Share, Trends, Growth, Analysis, Forecast 2032

Energy As A Service Market by Service Type (Generation, Operation & Maintenance, and Energy Efficiency & Optimization) and by End-User (Industrial and Commercial): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

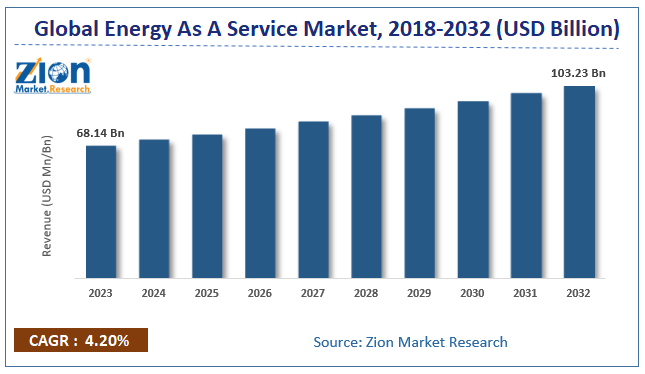

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 68.14 Billion | USD 103.23 Billion | 4.20% | 2023 |

Energy As A Service Market: Industry Perspective

The global Energy As A Service Market size was worth around USD 68.14 Billion in 2023 and is predicted to grow to around USD 103.23 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.20% between 2024 and 2032.

Key Insights

- As per the analysis shared by our research analyst, the energy as a service market is anticipated to grow at a CAGR of 4.20% during the forecast period (2024-2032).

- The global energy as a service market was estimated to be worth approximately USD 68.14 billion in 2023 and is projected to reach a value of USD 103.23 billion by 2032.

- The growth of the energy as a service market is being driven by the increasing demand for flexible, cost-effective, and sustainable energy solutions across commercial, industrial, and residential sectors.

- Based on the service type, the generation segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the industrial segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Energy As A Service Market Overview

Rapid industrialization has led to the emission of carbon dioxide and increased the level of greenhouse gases in the atmosphere, which has led to the adoption of decarbonization expected to propel market growth. Decarbonization involves the use of renewable energy sources to reduce the intensity of carbon, which has also resulted in the transformation of the transport sector, and the introduction of electric vehicles is expected to drive market growth.

Energy as a service can be best described as the effective and efficient utilization of energy. As per the first law of thermodynamics, energy can neither be created nor destroyed. It can only be channeled for its proper utilization. An energy service when designed should be able to attain some energy efficiency improvements when compared to the previous energy utilization level, while meeting other criteria, such as comfort level, production throughput, safety, etc. Production throughput can be considered as an important criterion followed by safety measures to cater to the needs of energy services. Energy services comprise of energy supply contracting, energy performance contracting, energy consultants (audits and others), energy management systems, project design and maintenance, and performance monitoring. These are some of the well-known energy services offered by various energy service providers in the energy as a service market.

Energy As A Service Market Growth Dynamics

Energy as a service market is set to witness a considerable rate of growth over the coming years, owing to the effective utilization of energy services in developed and developing countries. The rising demand for renewable energy is likely to propel this market. The demand for solar, tidal, and wind energies in developing countries for smart building and infrastructure activities is likely to fuel the energy as a service market in the upcoming years. Additionally, business organizations have effectively managed their energy usage patterns in recent times. Manufacturers and other industrial OEM firms are consistently monitoring cooling and heating performance of their energy equipment with the help of smart sensors that can designate breakdowns or malfunctions, antedate and avert instabilities, and notify when major maintenance is required. Manufacturers and owners of commercial building infrastructures are significantly installing energy monitors to measure the energy variations in consumption and forecast future energy necessities and requirements. These are some factors likely to help the market grow in the upcoming years.

The report covers forecast and analysis for the energy as a service market on a global and regional level. The study provides historical data from 2017 to 2023 along with a forecast from 2023 to 2032 based on revenue (USD Million). The study includes drivers and restraints for the energy as a service market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the energy as a service market on a global level.

Global Energy As A Service Market: Growth Factors

In order to give the users of this report a comprehensive view on the energy as a service market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein service type and end-user segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and product portfolio of various companies according to the region.

Global Energy As A Service Market: Segmentation

The study provides a decisive view of the energy as a service market by segmenting the market based on service type, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

North American region is likely to witness the highest growth in the global energy as a service market in the forecast timeframe. This regional market growth can be attributed to various government standards, such as ISO 9001, ISO 14001, and ISO 50001, that is driving the expansion of energy service efficiency programs across the region. Moreover, the launch of new energy projects by the government and public organizations is anticipated to further drive the industry growth in the region over the forecast time period. The Asia Pacific is predicted to contribute a substantial revenue share to the global energy as a service market. The cost-effective pricing of rooftop solar PV for their implementation in smart buildings and infrastructures for conserving energy and cutting energy costs are mainly likely to drive the energy as a service market globally during the forecast timeframe.

The regional segmentation includes the historic and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. This segmentation includes demand for energy as a service market based on all the segments in all regions and countries.

Energy As A Service Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Energy As A Service Market Size Report |

| Market Size in 2023 | USD 68.14 Billion |

| Market Forecast in 2032 | USD 103.23 Billion |

| Growth Rate | CAGR of 4.20% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | General Electric, Siemens AG, WGL Energy, Engie, Contemporary Energy Solutions, Solarus, Bernhard Energy, EDF Energy, SmartWatt, and Edison Energy. |

| Segments Covered | By service type, By end-user, and By region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The key players in the global Energy As A Service Market are -

The report also includes detailed profiles of market players, such as-

- General Electric

- Siemens AG

- WGL Energy

- Engie

- Contemporary Energy Solutions

- Solarus

- Bernhard Energy

- EDF Energy

- SmartWatt

- Edison Energy.

This report segments the global energy as a service market as follows:

Global Energy as a Service Market: Service Type Segment Analysis

- Generation

- Operation & Maintenance

- Energy Efficiency & Optimization

Global Energy as a Service Market: End-User Segment Analysis

- Industrial

- Commercial

Global Energy as a Service Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Energy As A Service Market size was worth around USD 68.14 Billion in 2023 and is predicted to grow to around USD 103.23 Billion by 2032

compound annual growth rate (CAGR) of roughly 4.20% between 2024 and 2032.

The largest share of the Energy As A Service Market is held by Asia Pacific. Developing countries of Asia Pacific such as China, Japan, and India will be dominating the market scenario mainly due to the rising constructional activities. The growth of Asia-Pacific region is expected to be followed by the Middle East and North America. Also, significant growth is expected from Western Europe owing to the developments taking place in this region especially in countries such as Italy, Germany, the U.K, France, and Spain. However, growth in Africa, Latin America, and Eastern Europe is anticipated to be moderate over the forecast period.

General Electric, Siemens AG, WGL Energy, Engie, Contemporary Energy Solutions, Solarus, Bernhard Energy, EDF Energy, SmartWatt, and Edison Energy.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed