Global Endoscopic Clips Market Size, Share, Growth Analysis Report - Forecast 2034

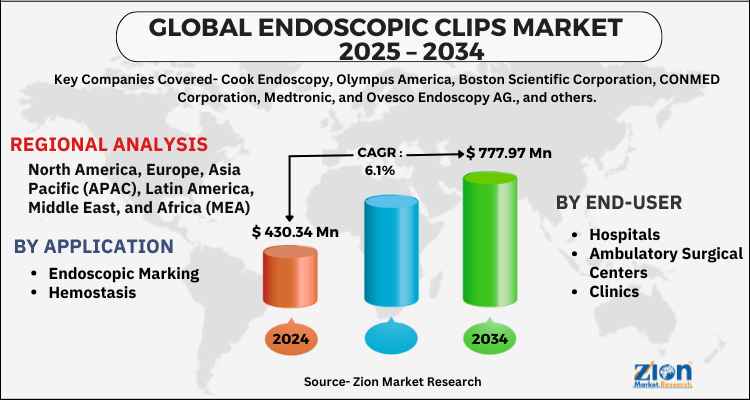

Endoscopic Clips Market By Application (Endoscopic Marking, Hemostasis, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, Clinics, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

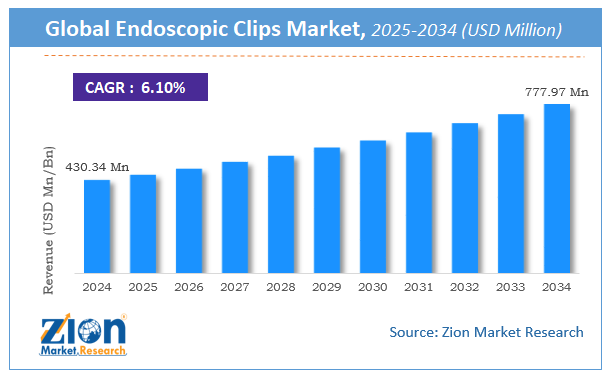

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 430.34 Million | USD 777.97 Million | 6.1% | 2024 |

Endoscopic Clips Market Size

The global endoscopic clips market size was worth around USD 430.34 Million in 2024 and is predicted to grow to around USD 777.97 Million by 2034 with a compound annual growth rate (CAGR) of roughly 6.1% between 2025 and 2034.

The report analyzes the global endoscopic clips market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the endoscopic clips industry.

Endoscopic Clips Market: Overview

An endoscope clip is a device that specializes in nature. These clips are intended to take over the tissue estimation in gastrointestinal endoscopy. These clamps were initially issued solely to perform the task of hemostasis in gastrointestinal bleeding, especially in the case of bleeding from gastric ulcer disease. Such important applications could impact the global endoscope clip market in the coming years. However, the use of endoscopic clips has recently expanded beyond gastrointestinal bleeding.

Currently, many new application areas for clips are expected to drive global market growth during the evaluation period. It can now be used to complete punctures, arterial bleeding less than 2 mm, Dieulafoy's injury, polyps less than 1.5 cm wide, and varicose veins of the gastrointestinal tract. Increased worldwide prevalence of gastrointestinal (GI) hemorrhagic diseases such as colon & pancreatic cancer, inflammatory bowel disease & gastroesophageal reflux disease (GERD), and cardiovascular & gastrointestinal bleeding is likely to drive the market expansion.

Key Insights

- As per the analysis shared by our research analyst, the global endoscopic clips market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2025-2034).

- Regarding revenue, the global endoscopic clips market size was valued at around USD 430.34 Million in 2024 and is projected to reach USD 777.97 Million by 2034.

- The endoscopic clips market is projected to grow at a significant rate due to rising prevalence of gastrointestinal diseases and advancements in minimally invasive surgeries.

- Based on Application, the Endoscopic Marking segment is expected to lead the global market.

- On the basis of End-user, the Hospitals segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America & Europe is predicted to dominate the global market during the forecast period.

Endoscopic Clips Market: Growth Drivers

The rising adoption of minimally invasive therapies is expected to drive the global market growth

Endoscopic surgery has made great strides as endoscopic imaging has become a major technique for detecting and treating chronic and acute diseases due to its unique ability to target difficult-to-reach areas. Minimally invasive surgery has evolved into highly accurate, delicate, and less invasive surgery. It also contributes to the global endoscopic clips market growth with benefits such as shorter hospital stays, reduced costs, improved patient experience, and faster recovery. According to Olympus Medical, more than 22.5 million outpatients in the United States undergo upper gastrointestinal endoscopy each year, with approximately 527,000 clips placed during these surgeries. This is expected to drive market growth, coupled with the benefits provided by advanced clipping features such as improved vision, better lesion access, and lower procedural costs.

Endoscopic Clips Market: Restraints

Side effects due to the usage of endoscopic clips are likely to hamper the market growth

According to the American Journal of Roentgenology, side effects from using endoscopic clips such as severe abdominal pain, heavy rectal bleeding, fever, chills, sweating, and safety issues are the biggest concerns at most centers. Up to 36% can be continued if certain conditions are met. For example, 16% scheduled MRI more than 6 weeks after endoscopy, but there is evidence that some endoscopic clips, such as resolution clip models, can stay in the human intestine for up to 33 weeks. Similarly, 18% of centers perform MRI with magnetic field strengths limited to 1.5 T. Still, studies show that even these weak magnetic fields interact with some endoscopic clip models, and in some cases, they can be separated from the intestinal wall. Several different safety measures have been reported for patients undergoing MRI with endoscopic clips, but they are ultimately used only in a small part of the center, which may act as a limiting factor for market growth.

Endoscopic Clips Market: Segmentation

The global endoscopic clips market is segregated on the basis of application, end-user, and region.

By application, the market is divided into endoscopic marking, hemostasis, and others. Among these, the endoscopic marking segment dominates the market due to its wide usage in various surgical interventions to treat bleeding arteries, ulcers, polypectomies, and others.

By end-use, the market is classified into hospitals, ambulatory surgical centers, clinics, and others. The hospital segment dominates the market owing to increasing volume through collaboration with hospitals and research institutes to develop advanced surgical procedures. This is expected to drive demand in this segment and global endoscopic clips during the forecast period.

Endoscopic Clips Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Endoscopic Clips Market |

| Market Size in 2024 | USD 430.34 Million |

| Market Forecast in 2034 | USD 777.97 Million |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 254 |

| Key Companies Covered | Cook Endoscopy, Olympus America, Boston Scientific Corporation, CONMED Corporation, Medtronic, and Ovesco Endoscopy AG., and others. |

| Segments Covered | By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- STERIS Corporation, a leading provider of endoscopic devices, acquired Aponos Medical in April 2017. Steris has added the Padlock Clip System to its existing endoscopic device product portfolio with this acquisition.

- According to the Centers for Disease Control and Prevention, as of 2020, there will be about 75 million endoscopies each year in the United States, of which about 68% will be GI endoscopy.

Endoscopic Clips Market: Regional Analysis

Increasing arterial bleeding among cardiac patients to drive the North American market

North America is expected to dominate the global endoscope clip market throughout the forecast period. The predominance is due to increased arterial bleeding in patients with heart disease and gastrointestinal surgery in the United States, which holds the largest market share due to many patients. For example, according to a 2018 World Gastroenterology Organization report, the prevalence of GERD in North America ranges from 18% to 28%, which could drive the market. In addition, several factors, such as established direct reimbursement policies and the availability of advanced medical infrastructure, may favor regional markets and contribute to outstanding market share during the forecast period.

Endoscopic Clips Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the endoscopic clips market on a global and regional basis.

The global endoscopic clips market is dominated by players like:

- Cook Endoscopy

- Olympus America

- Boston Scientific Corporation

- CONMED Corporation

- Medtronic

- and Ovesco Endoscopy AG.

The global endoscopic clips market is segmented as follows;

By Application

- Endoscopic Marking

- Hemostasis

- and Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global endoscopic clips market is expected to grow due to rising prevalence of gastrointestinal disorders, increasing adoption of minimally invasive procedures, and advancements in endoscopic technology.

According to a study, the global endoscopic clips market size was worth around USD 430.34 Million in 2024 and is expected to reach USD 777.97 Million by 2034.

The global endoscopic clips market is expected to grow at a CAGR of 6.1% during the forecast period.

North America & Europe is expected to dominate the endoscopic clips market over the forecast period.

Leading players in the global endoscopic clips market include Cook Endoscopy, Olympus America, Boston Scientific Corporation, CONMED Corporation, Medtronic, and Ovesco Endoscopy AG., among others.

The report explores crucial aspects of the endoscopic clips market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed