Global Encapsulated Flavors and Fragrances Market Size, Share, Growth Analysis Report - Forecast 2034

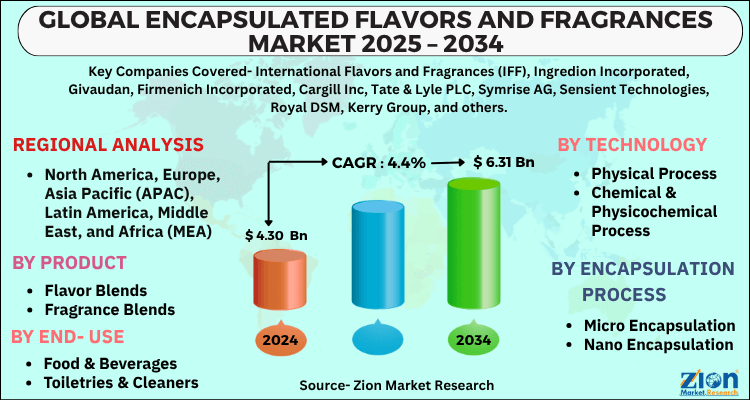

Encapsulated Flavors and Fragrances Market By Product (Flavor Blends, Fragrance Blends, Essential Oils & Natural Extracts, Aroma Chemicals), By Technology (Physical Process, Chemical & Physicochemical Process), Encapsulation Process (Micro Encapsulation, Nano Encapsulation, Hybrid Technology, Macro Encapsulation), End-Use (Food & Beverages and Toiletries & Cleaners), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

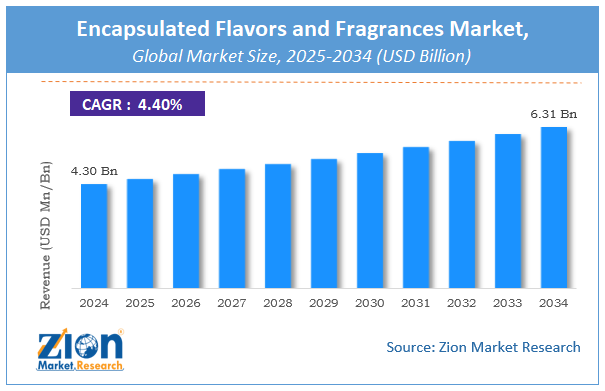

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.30 Billion | USD 6.31 Billion | 4.4% | 2024 |

Encapsulated Flavors and Fragrances Market: Industry Perspective

The global encapsulated flavors and fragrances market size was worth around USD 4.30 Billion in 2024 and is predicted to grow to around USD 6.31 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.4% between 2025 and 2034. The report analyzes the global encapsulated flavors and fragrances market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the encapsulated flavors and fragrances industry.

Encapsulated Flavors and Fragrances Market: Overview

Flavor and fragrance encapsulation are quite popular in the food & beverage industries and consumer products. The approach helps in the reduction of flavors and fragrance deterioration or loss during the manufacturing and storage processes. The envelope facilitates the provision of functional qualities in a specific environment, such as aromatic compounds. Flavors and fragrances are volatile substances with a strong tendency to evaporate. Due to the loss of flavors and fragrances due to poor chemical stability, encapsulation of flavors in foodstuffs has become critical in industrial handling and processing. Flavors and fragrances are a type of substance that is widely used as an addition in a variety of technological industries, including food, cosmetics, textiles, and others, to improve the product's taste and aromatic impressions.

Encapsulation protects the coated material from the outside environment. A technique to entrap flavors and fragrances within a coating material is known as encapsulation. The coated material is called as core or active material wherein coating material is called encapsulated material or shells. Microencapsulation is another process to encapsulate the flavors and fragrances on a micrometric scale. It is a process wherein droplets or tiny particles are coated in order to make small capsules. Microencapsulation or encapsulation of flavors and fragrances is used to provide uniform and improved fragrance, taste, colorings, increased shelf life, and protection from harsh conditions.

Key Insights

- As per the analysis shared by our research analyst, the global encapsulated flavors and fragrances market is estimated to grow annually at a CAGR of around 4.4% over the forecast period (2025-2034).

- Regarding revenue, the global encapsulated flavors and fragrances market size was valued at around USD 4.30 Billion in 2024 and is projected to reach USD 6.31 Billion by 2034.

- The encapsulated flavors and fragrances market is projected to grow at a significant rate due to rising demand for long-lasting and controlled-release scents in food, cosmetics, and household products, along with technological advancements in encapsulation and growing preference for natural ingredients.

- Based on Product, the Flavor Blends segment is expected to lead the global market.

- On the basis of Technology, the Physical Process segment is growing at a high rate and will continue to dominate the global market.

- Based on the Encapsulation Process, the Micro Encapsulation segment is projected to swipe the largest market share.

- By End-Use, the Food & Beverages segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Encapsulated Flavors and Fragrances Market: Growth Drivers

Increasing demand for instant drinks and beverages to foster the market growth

Due to changing consumer lifestyles, the beverage sector is thriving in every part of the world. The growth of the global encapsulated flavors and fragrances market will be boosted by a shift in customer preferences toward handy products, as well as rising disposable income in most developing countries. Customers today prefer well-balanced foods and beverages with a natural flavor and high nutritional value. Encapsulation allows fruit and vegetable nutrients to be converted into natural flavors while maintaining their nutritional value. Companies in the encapsulated flavors and fragrances market will create partnerships with various food and beverage manufacturers across geographies as the demand for natural ingredients grows. Moreover, the need for packaged and energy & sports drinks will drive up sales of beverage flavorings, which in turn is estimated to drive the market for encapsulated flavors and fragrances.

Encapsulated Flavors and Fragrances Market: Restraints

High cost associated with the encapsulation techniques

For enhancing the effectiveness of aroma compounds in fragranced consumer items, a variety of encapsulation techniques are accessible. In terms of fragrance performance, scalability, and prices, encapsulation techniques are continuously being refined. Also, volatile prices of raw materials add up to the overall cost. All these factors coupled with strict rules & regulations regarding the safety of its use may hamper the market growth.

Encapsulated Flavors and Fragrances Market: Opportunities

Growing preference for non-conventional and unique flavors to propel the market growth during the forecast period

The rising preference for nutty and spicy flavors in different food products is prompting manufacturers to come up with new flavors to fulfill consumer needs. Combination flavors are growing in popularity. These products combine two or more flavors into a single item. To protect organic and natural flavors from quality degradation, flavor and fragrance manufacturers are currently applying improved and updated technological versions. Over the projection period, technological advancements in the process of encapsulation will aid in the growth of encapsulated flavor and fragrance sales. In addition to this, factors such as increased investments in R&D activities and mergers & acquisitions to stay competitive in the global encapsulated flavors and fragrances market are estimated to generate numerous opportunities during the forecast period.

Encapsulated Flavors and Fragrances Market: Challenges

Flavoring qualities influencing the encapsulation process's ability to retain volatile components to act as a challenge for market growth

Flavorings are extensively used in a variety of food and beverage compositions and have a significant impact on food sensory qualities and, as a result, consumer satisfaction. Many aromatic chemicals are volatile, low-molecular-mass molecules that are vulnerable to evaporation and degrading reactions in manufacturing processes or under environmental circumstances such as high temperatures, oxygen, light, and pH changes. Encapsulation develops emulsification in a carbohydrate solution and produces a protective habitat for flavoring compounds that minimizes mobility and volatility while also protecting them from oxidative reactions by boosting mass transfer resistance. However, because flavorings are made up of a mixture of aromatic chemicals with varying solubility, sensory thresholds, and relative volatility, and are carried by solvents of varying natures, losses are noted all through preparation, storage, or manufacture are dependent on the classes of flavorings used. These factors alter the kinetic and thermodynamic properties of the entrapped flavoring, such as partitioning and mass transit rate, making it difficult to develop a unique and efficient formulation that yields the required flavor blend upon encapsulation. This poses a major challenge for market growth.

Encapsulated Flavors and Fragrances Market: Segmentation

The global encapsulated flavors and fragrances market is segmented based on Product, Technology, Encapsulation Process, End-Use, and region.

Based on Product, the global encapsulated flavors and fragrances market is divided into Flavor Blends, Fragrance Blends, Essential Oils & Natural Extracts, Aroma Chemicals.

On the basis of Technology, the global encapsulated flavors and fragrances market is bifurcated into Physical Process, Chemical & Physicochemical Process.

By Encapsulation Process, the global encapsulated flavors and fragrances market is split into Micro Encapsulation, Nano Encapsulation, Hybrid Technology, Macro Encapsulation.

In terms of End-Use, the global encapsulated flavors and fragrances market is categorized into Food & Beverages and Toiletries & Cleaners.

Encapsulated Flavors and Fragrances Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Encapsulated Flavors and Fragrances Market |

| Market Size in 2024 | USD 4.30 Billion |

| Market Forecast in 2034 | USD 6.31 Billion |

| Growth Rate | CAGR of 4.4% |

| Number of Pages | 199 |

| Key Companies Covered | International Flavors and Fragrances (IFF), Ingredion Incorporated, Givaudan, Firmenich Incorporated, Cargill Inc, Tate & Lyle PLC, Symrise AG, Sensient Technologies, Royal DSM, Kerry Group, and others. |

| Segments Covered | By Product, By Technology, By Encapsulation Process, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Encapsulated Flavors and Fragrances Market: Regional Landscape

North America to hold maximum share in the global market

Geographically, North America is projected to hold the maximum share in the global encapsulated flavors and fragrances market during the forecast period. Key factors driving demand for encapsulated flavors and fragrances in North America include the introduction of various encapsulation processes & technologies to improve product quality, demands for ready-to-eat & ready-to-cook food products, and rising consumer health & diet-related trends. Increased consumption of functional foods, along with an increase in health-conscious customers, will boost regional market statistics. Furthermore, rising consumer awareness about hygiene is boosting the regional market outlook by increasing the use of aromatic goods in cosmetic and cleaning applications. On the other hand, the market in Europe and the Asia Pacific is expected to grow at a healthy rate during the forecast period.

Recent Developments

- In March 2022, with AI techniques at the forefront, Symrise lifts the curtain on flavor development. Symrise offers proprietary digital techniques like predictive modeling to help flavor designers use Artificial Intelligence. They assist in the screening of the current Symrise inventory and the identification of suitable ingredients for the specialists to employ in the creation of a flavor.

- In December 2021, Givaudan introduced PlanetCaps™, a fragrance encapsulation invention. It is the first of its kind to hit the market and is for fabric softeners that provide a long-lasting fragrance sensation in a biodegradable and bio-sourced delivery method.

Encapsulated Flavors and Fragrances Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the encapsulated flavors and fragrances market on a global and regional basis.

The global encapsulated flavors and fragrances market is dominated by players like:

- International Flavors and Fragrances (IFF)

- Ingredion Incorporated

- Givaudan

- Firmenich Incorporated

- Cargill Inc

- Tate & Lyle PLC

- Symrise AG

- Sensient Technologies

- Royal DSM

- Kerry Group

The global encapsulated flavors and fragrances market is segmented as follows:

By Product

- Flavor Blends

- Fragrance Blends

- Essential Oils & Natural Extracts

- Aroma Chemicals

By Technology

- Physical Process

- Chemical & Physicochemical Process

By Encapsulation Process

- Micro Encapsulation

- Nano Encapsulation

- Hybrid Technology

- Macro Encapsulation

By End-Use

- Food & Beverages

- Toiletries & Cleaners

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Encapsulated flavors and fragrances are flavoring or scent compounds enclosed in a protective coating or shell. This encapsulation helps preserve their stability, control release, and enhance shelf life, commonly used in food, beverages, cosmetics, and household products.

The global encapsulated flavors and fragrances market is expected to grow due to increasing demand for long-lasting sensory experiences, rising use in food, beverages, and personal care products, advancements in microencapsulation technology, and growing preference for natural ingredients.

According to a study, the global encapsulated flavors and fragrances market size was worth around USD 4.30 Billion in 2024 and is expected to reach USD 6.31 Billion by 2034.

The global encapsulated flavors and fragrances market is expected to grow at a CAGR of 4.4% during the forecast period

North America is expected to dominate the encapsulated flavors and fragrances market over the forecast period.

Leading players in the global encapsulated flavors and fragrances market include International Flavors and Fragrances (IFF), Ingredion Incorporated, Givaudan, Firmenich Incorporated, Cargill Inc, Tate & Lyle PLC, Symrise AG, Sensient Technologies, Royal DSM, Kerry Group, among others.

The report explores crucial aspects of the encapsulated flavors and fragrances market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed