Electrical Wiring Interconnection System (EWIS) Market Size, Share, Value 2034

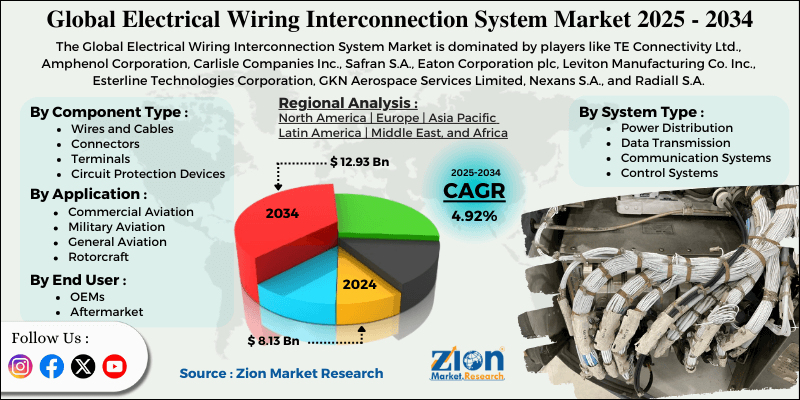

Electrical Wiring Interconnection System (EWIS) Market By Component Type (Wires and Cables, Connectors, Terminals, Circuit Protection Devices, Wire Harnesses, Cable Assemblies, and Others), By Application (Commercial Aviation, Military Aviation, General Aviation, Rotorcraft, Unmanned Aerial Vehicles, Spacecraft), By System Type (Power Distribution, Data Transmission, Communication Systems, Control Systems), By End-User (OEMs, Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

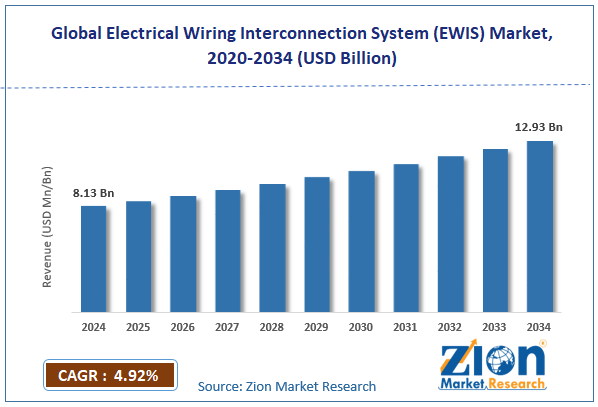

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.13 Billion | USD 12.93 Billion | 4.92% | 2024 |

Electrical Wiring Interconnection System (EWIS) Industry Perspective

The global electrical wiring interconnection system market size was worth approximately USD 8.13 billion in 2024 and is projected to grow to around USD 12.93 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.92% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global electrical wiring interconnection system market is estimated to grow annually at a CAGR of around 4.92% over the forecast period (2025-2034).

- In terms of revenue, the global electrical wiring interconnection system market size was valued at approximately USD 8.13 billion in 2024 and is projected to reach USD 12.93 billion by 2034.

- The electrical wiring interconnection system market is projected to grow significantly due to the increasing aircraft production, rising demand for more electric aircraft, growing retrofit and modernization programs, and expanding military aviation spending on advanced platforms.

- Based on component type, the wires and cables segment is expected to lead the electrical wiring interconnection system market, while the connectors segment is anticipated to experience significant growth.

- Based on application, the commercial aviation segment is expected to lead the electrical wiring interconnection system market, while the unmanned aerial vehicles segment is anticipated to witness notable growth.

- Based on system type, the power distribution segment is expected to lead the market compared to the data transmission segment.

- Based on end user, the OEMs are the dominating segment, and are projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global electrical wiring interconnection system market during the estimated period, followed by Europe.

Electrical Wiring Interconnection System (EWIS) Market: Overview

Electrical wiring interconnection systems are complete electrical networks in aircraft that carry power and data to all major systems, including avionics, flight controls, lighting, environmental equipment, and communication units through organized wiring structures. These systems contain wires, cables, connectors, terminals, circuit protection devices, junction boxes, harnesses, and cable assemblies that work together to support safe operation. Manufacturing uses precise engineering to meet strict aerospace rules for weight, reliability, fire resistance, electromagnetic control, and durability under heat, cold, and vibration. All components undergo tests for temperature changes, corrosion exposure, vibration strength, and electrical performance to confirm long-term safety.

Modern aircraft use miles of wiring and may include fiber optics, high-voltage systems, and advanced data links. Designers aim to reduce weight, improve safety, prevent interference, and allow easy maintenance. Aviation authorities require clear design rules, inspection programs, and approved materials for every aircraft wiring system. These systems also require careful routing and organized layouts to ensure smooth installation, easy inspections, and reliable performance across long aircraft service lifetimes.

The increasing aircraft production rates and growing need for reliable electrical infrastructure are expected to drive growth in the electrical wiring interconnection system market throughout the forecast period.

Electrical Wiring Interconnection System (EWIS) Market: Dynamics

Growth Drivers

Increasing aircraft production and fleet expansion

The electrical wiring interconnection system market is growing quickly as rising global air travel increases aircraft production and fleet expansion, requiring large wiring installations across all platforms. Commercial aviation grows steadily as airlines place frequent orders with Boeing, Airbus, Embraer, and Bombardier to meet passenger needs and replace older aircraft. Narrow-body programs, including the Boeing 737 MAX and the Airbus A320neo, remain strong, with heavy demand for regional and medium-distance routes across many countries. Wide-body programs such as Boeing 787 Dreamliner and Airbus A350 support long-haul travel using advanced electrical systems with complex EWIS requirements. Regional jet orders increase in developing regions seeking reliable domestic air networks supported by a complete electrical infrastructure. Business aviation is strengthened by Gulfstream, Bombardier Global, and Dassault Falcon platforms, offering high comfort and advanced avionics with intricate wiring. Military, helicopter, drone, and retrofit programs also expand EWIS demand across global aviation markets.

How is the growing adoption of electric aircraft architectures driving the electrical wiring interconnection system market growth?

The global electrical wiring interconnection system market is growing steadily as the aerospace industry shifts toward more electric aircraft, which use electrical systems for improved efficiency and reduced weight. Electric flight control actuators manage aircraft surfaces such as ailerons, elevators, rudders, and flaps using high-power distribution and precise wiring for safe operation. Environmental control systems rely on electric compressors and air conditioning equipment, requiring expanded electrical capacity across aircraft structures. Landing gear systems move toward electric actuation, improving reliability, lowering maintenance needs, and reducing fluid-related risks for operators. Engine-starting equipment uses electric motor-generators capable of meeting significant power demands during critical flight phases. Ice protection systems use electrical heating on wings, engines, and sensors, increasing total electrical load. Passenger cabins include entertainment, connectivity, lighting, and power outlets, creating large wiring requirements. Galleys, auxiliary units, energy storage, and digital avionics also contribute to rising EWIS demand in modern aircraft.

Restraints

How are stringent certification requirements and long development cycles affecting innovation in the global electrical wiring interconnection system market?

A major challenge for the electrical wiring interconnection system market comes from strict certification rules and long development stages required for aerospace equipment, which slows progress and raises costs. Design teams must prove compliance with standards for fire resistance, smoke behavior, arc prevention, and electromagnetic protection through careful laboratory testing. Environmental tests expose components to heat, cold, humidity, vibration, altitude, and corrosion over accelerated time periods. Reliability studies use large tests to measure failure patterns and set maintenance schedules for safe operation. Material choices remain limited because only approved insulations, connectors, and protective parts meet required safety histories. Strict change controls, documentation rules, supplier checks, and liability concerns further increase expenses and reduce the speed of new technology adoption. Extensive certification timelines also reduce flexibility for manufacturers seeking quicker design updates or improvements across evolving aircraft platforms.

Opportunities

Unmanned Aerial Vehicle Expansion

The electrical wiring interconnection system industry is gaining strong opportunities as unmanned aerial vehicle markets grow across military, commercial, and civilian sectors, requiring specialized wiring solutions for autonomous aircraft. Military drones expand worldwide, with missions involving surveillance, reconnaissance, strike support, cargo movement, and communication relay, using advanced electrical systems for sensors and control equipment. Commercial drone delivery programs from Amazon, UPS, and other logistics companies need dependable wiring for navigation, communication, and flight control functions. Agricultural drones assist with crop monitoring, pesticide spraying, and field management using weather-resistant electrical systems for long outdoor operations. Inspection services use drones for power lines, pipelines, bridges, and buildings requiring stable wiring for cameras and sensors. Emergency response agencies deploy drones for rescue operations and disaster support, requiring rugged electrical systems for extreme environments. Scientific research, urban air mobility concepts, electric propulsion, and autonomous platforms also increase EWIS demand across unmanned aircraft markets.

Challenges

How is supply chain complexity and material availability creating challenges for the electrical wiring interconnection system industry?

The electrical wiring interconnection system industry faces major challenges from complex global supply chains and periodic material shortages, disrupting production schedules and increasing overall manufacturing costs. Aerospace supply networks span multiple regions, with raw materials, components, and assemblies moving across countries with varying regulations and conditions. Specialized materials, including high-temperature insulation, precious metal contacts, aluminum conductors, and flame-resistant coatings, depend on limited suppliers, creating vulnerability during unexpected disruptions. Copper price swings influence conductor expenses and create budgeting pressure for companies working under fixed long-term contracts. Lead times remain lengthy for aerospace-qualified components due to specialized processes and strict inspections limiting rapid adjustments during demand shifts. Just-in-time practices reduce inventory but increase risk when material shortages interrupt production. Single-source components, trade disputes, cybersecurity threats, natural disasters, and regulatory shifts add further pressure across global EWIS supply chains.

Electrical Wiring Interconnection System (EWIS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electrical Wiring Interconnection System (EWIS) Market Research Report |

| Market Size in 2024 | USD 8.13 Billion |

| Market Forecast in 2034 | USD 12.93 Billion |

| Growth Rate | CAGR of 4.92% |

| Number of Pages | 220 |

| Key Companies Covered | TE Connectivity Ltd., Amphenol Corporation, Carlisle Companies Inc., Safran S.A., Eaton Corporation plc, Leviton Manufacturing Co. Inc., Esterline Technologies Corporation, GKN Aerospace Services Limited, Nexans S.A., and Radiall S.A. |

| Segments Covered | By Component Type, By Application, By System Type, By End User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electrical Wiring Interconnection System (EWIS) Market: Segmentation

The global electrical wiring interconnection system market is segmented based on component type, application, aircraft type, system type, end-user, and region.

Based on component type, the global electrical wiring interconnection system industry is divided into wires and cables, connectors, terminals, circuit protection devices, wire harnesses, cable assemblies, and others. Wires and cables lead the market due to their fundamental role in all electrical connections and the extensive lengths required throughout aircraft structures.

Based on application, the industry is classified into commercial aviation, military aviation, general aviation, rotorcraft, unmanned aerial vehicles, and spacecraft. Commercial aviation is expected to lead the market during the forecast period due to the large fleet sizes, high aircraft production rates, and continuous modernization programs.

Based on system type, the global electrical wiring interconnection system market is categorized into power distribution, data transmission, communication systems, and control systems. Power distribution holds the largest market share due to the fundamental importance of electrical power throughout aircraft and the high-current requirements for major systems.

Based on end user, the global market is segmented into OEMs and the aftermarket. OEMs hold the largest market share due to the complete EWIS installations required for new aircraft production, the design authority and component specifications controlled by manufacturers, and the volume production driving economies of scale in component procurement.

Electrical Wiring Interconnection System (EWIS) Market: Regional Analysis

North America leads the global market.

North America leads the electrical wiring interconnection system market because the region hosts major aircraft manufacturers, advanced aerospace infrastructure, strong military aviation spending, and broad leadership in modern electrical system development. The United States supports Boeing, which produces commercial airliners, military aircraft, and defense systems using large electrical networks across many platforms. Defense contractors, including Lockheed Martin, Northrop Grumman, and General Dynamics, manage major programs involving fighter aircraft, transport planes, and unmanned systems requiring advanced electrical interconnection solutions. Business jet manufacturers such as Gulfstream, Textron Aviation, and Bombardier operate large facilities that produce luxury aircraft with complex avionics and cabin systems, supported by intricate wiring installations. General aviation companies, including Cessna, Piper, and Cirrus, supply light aircraft for training and recreation, creating ongoing demand for electrical wiring components across multiple sectors. Military budgets maintain strong procurement of fighters, transports, helicopters, and unmanned aircraft, generating steady requirements for new electrical systems and replacement components.

Aftermarket operations across the region support commercial and military fleets that require inspections, repairs, and upgrades through long service periods. Supplier networks include many specialized companies producing harnesses, connectors, and assemblies with aerospace certifications, supporting manufacturers and maintenance providers. Research investment drives progress in fiber optics, high-voltage distribution, lightweight materials, and compact components for next-generation aircraft. Federal Aviation Administration rules guide global safety practices and influence worldwide certification processes for electrical systems. Engineering talent concentrated across North America strengthens development efforts through skilled electrical and aerospace specialists managing complex qualification programs. Canada adds further opportunities with Bombardier, CAE, and key suppliers supporting regional jet production and military aviation services.

What factors are contributing to Europe’s presence in the electrical wiring interconnection system market?

Europe holds a strong position in the electrical wiring interconnection system market because the region supports Airbus leadership, advanced aerospace facilities, major defense programs, and deep engineering expertise across aircraft electrical systems. Airbus operates large assembly sites in Germany, France, Spain, and the United Kingdom, producing commercial aircraft requiring extensive electrical wiring installations for global fleets. Military aircraft programs, including the Eurofighter Typhoon, Dassault Rafale, and Airbus A400M, involve multinational cooperation, creating demand for electrical components designed to meet varied national needs and specifications. Helicopter producers such as Airbus Helicopters and Leonardo supply the civilian and military markets with rotorcraft that use specialized electrical systems suited to constant-vibration environments. Regional aircraft manufacturers, including ATR, deliver turboprop airliners for short routes, using reliable electrical systems supporting frequent flight cycles across busy networks. Business aviation contributions from Dassault Falcon in France and Pilatus in Switzerland create premium aircraft markets needing complex avionics and cabin wiring for high comfort levels.

Supplier networks across Europe produce harnesses, connectors, and assemblies meeting strict aviation standards and customer requirements. Research initiatives under European Union programs support the development of lightweight materials, electric aircraft systems, and advanced manufacturing techniques, improving future electrical designs. European Union Aviation Safety Agency certification rules guide safety practices accepted worldwide for EWIS components. Defense spending across NATO members supports aircraft procurement and modernization programs requiring upgraded electrical systems for continued readiness. Maintenance operations across Europe serve aging commercial and military fleets requiring electrical inspections, component replacements, and system improvements throughout long service lives. Environmental goals are driving hybrid propulsion research, requiring innovative electrical systems and new EWIS solutions to support sustainable aviation growth.

Recent Developments

- In February 2025, Amphenol Aerospace (through distributor PEI‑Genesis) began supplying MT38999 multi-channel connectors enabling high-density fiber-optic and rugged wiring solutions suitable for aerospace EWIS applications.

- In September 2025, Amphenol Socapex announced the launch of its new VITA 91: MIL HD2 interconnect system. The MIL HD2 series offers up to 56 Gb/s data rates, high-density 1.80 mm pitch, robust EMI shielding, hot-plug capability, and ruggedized construction for military and aerospace embedded systems.

Electrical Wiring Interconnection System (EWIS) Market: Competitive Analysis

The leading players in the global electrical wiring interconnection system market are

- TE Connectivity Ltd

- Amphenol Corporation

- Carlisle Companies Inc

- Safran S A

- Eaton Corporation plc

- Leviton Manufacturing Co Inc

- Esterline Technologies Corporation

- GKN Aerospace Services Limited

- Nexans S A

- and Radiall SA

The global electrical wiring interconnection system market is segmented as follows:

By Component Type

- Wires and Cables

- Connectors

- Terminals

- Circuit Protection Devices

- Wire Harnesses

- Cable Assemblies

- Others

By Application

- Commercial Aviation

- Military Aviation

- General Aviation

- Rotorcraft

- Unmanned Aerial Vehicles

- Spacecraft

By System Type

- Power Distribution

- Data Transmission

- Communication Systems

- Control Systems

By End User

- OEMs

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

What will be the CAGR value of the electrical wiring interconnection system market during 2025-2034?

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed