Elastic Bonding Adhesive & Sealant Market Size, Share and Forecast 2032

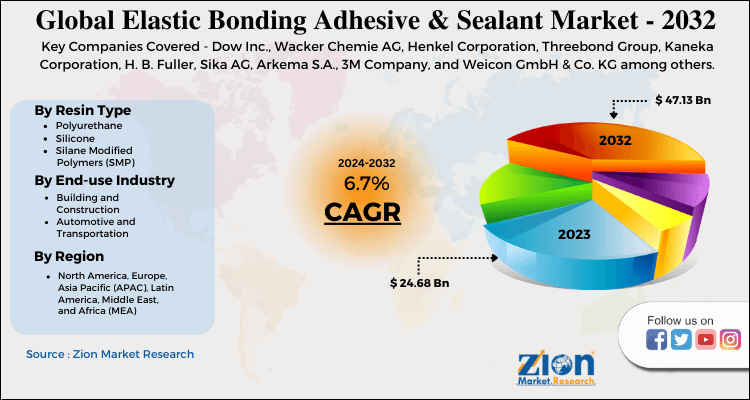

Elastic Bonding Adhesive & Sealant Market By Resin Type (Polyurethane, Silicone, Silane Modified Polymers and Others), By End-use Industry (Building and Construction, Automotive and Transportation and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

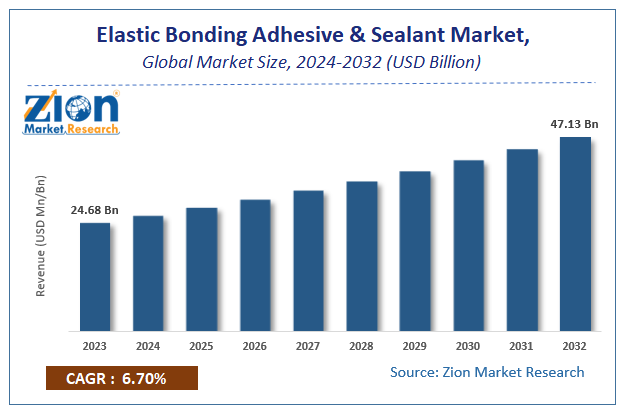

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.68 Billion | USD 47.13 Billion | 6.7% | 2023 |

Elastic Bonding Adhesive & Sealant Market Insights

According to Zion Market Research, the global Elastic Bonding Adhesive & Sealant Market was worth USD 24.68 Billion in 2023. The market is forecast to reach USD 47.13 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.7% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Elastic Bonding Adhesive & Sealant Market industry over the next decade.

Elastic Bonding Adhesive & Sealant Market: Overview

Elastic Bonding Adhesives can be simply described as substances that have the ability to connect two or more components, due to their sticking capabilities while being flexible at the same time. On the other hand, Sealants can be defined as substances that have the ability to block off the flow of liquids. Owing to their adhesive, flexible and sealing-off properties, Elastic Bonding Adhesives & Sealants have found relevance in a large number of end-use industries.

Increasing demand for Polyurethane and Silicone Bonding Adhesives & Sealants across a multitude of segments such as Automotive, Aerospace, Furniture, and Construction, among others, will augment the growth of the Elastic Bonding Adhesive & Sealant market, during the forecast period.

Due to the lockdown, manufacturing facilities across various countries were shut down which affected the manufacturing and thereby, sales of Elastic Bonding Adhesives & Sealants. The efforts of the companies to widen their reach and sales had come to a halt as they saw a sudden disruption in their supply chain as well as demand. Subsequently, the Construction, Automotive, Aerospace, and Packaging industries were impacted negatively due to the shutdown of manufacturing facilities, travel bans, and import and export restrictions. This, in turn, had repercussions for the Elastic Bonding Adhesives & Sealants market as these industries are among the largest consumers of Elastic Bonding Adhesives & Sealants.

Elastic Bonding Adhesive & Sealant Market: Growth Factors

Technological advancements, growth of the construction industry, enhanced lifestyle standards, and accelerated growth of the industrial sector are some of the major factors that drive the Elastic Bonding Adhesive & Sealant market. Elastic Bonding Adhesives & Sealants have diminished thermal conductivity. Due to this, they are used for the purpose of insulation in electronic gadgets, equipment, and appliances. Additionally, they have adhesive and sealing properties. Owing to this, they are widely utilized in the Construction industry. With economic growth, development, and increasing population, the Construction and Infrastructure development sectors have been growing. This enhances the market for Elastic Bonding Adhesives & Sealants, globally.

Furthermore, Elastic Bonding Adhesives & Sealants have applications in furniture and flooring segments. With enhanced lifestyle standards, the demand for these segments has risen. This, in turn, drives the market for Elastic Bonding Adhesives & Sealants. Subsequently, accelerated growth of the packaging, manufacturing, and assembling sectors, promotes market growth.

Elastic Bonding Adhesive & Sealant Market: Segment Analysis

This dominance can be credited to the stellar characteristics of Polyurethane Bonding Adhesives & Sealants that include resistance to UV light and scratching, protection against wear and tear, ability to dry off quickly and to provide a long-lasting surface finish. Additionally, they are relatively cost-effective, enhance the lifespan of the product on which they are applied and show ease during application. Owing to these features, Polyurethane Bonding Adhesives & Sealants are widely used in the Construction and automotive industries.

Subsequently, the Silicone segment holds a significant share in the Elastic Bonding Adhesive & Sealant Market. This can be accredited to the notable characteristics of Silicone Bonding Adhesives & Sealants that include high durability, strong impact resistance, distinguished adhesive properties, and low thermal conductivity.

This is attributable to the immense demand and usage of Elastic Bonding Adhesives & Sealants, for a multitude of purposes, in the Building and Construction industry. They are utilized while putting up floors, roofs, and tiles. They have applications in the furniture segment too as they are utilized in the manufacturing and assembly of cabinets, wardrobes, chairs, and tables among others. Additionally, they are employed for glazing purposes and as insulation materials too. The rise of the construction and building industry will advance the market for Elastic Bonding Adhesives & Sealants.

Subsequently, the Automotive and Transportation segment held a notable share of the Elastic Bonding Adhesive & Sealant market in 2020. This is attributable to the widespread use of Elastic Bonding Adhesives & Sealants in aircraft, ships, trains, and vehicles among others.

Elastic Bonding Adhesive & Sealant Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Elastic Bonding Adhesive & Sealant Market |

| Market Size in 2023 | USD 24.68 Billion |

| Market Forecast in 2032 | USD 47.13 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 146 |

| Key Companies Covered | Dow Inc., Wacker Chemie AG, Henkel Corporation, Threebond Group, Kaneka Corporation, H. B. Fuller, Sika AG, Arkema S.A., 3M Company, and Weicon GmbH & Co. KG among others |

| Segments Covered | By Resin Type, By End-use Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

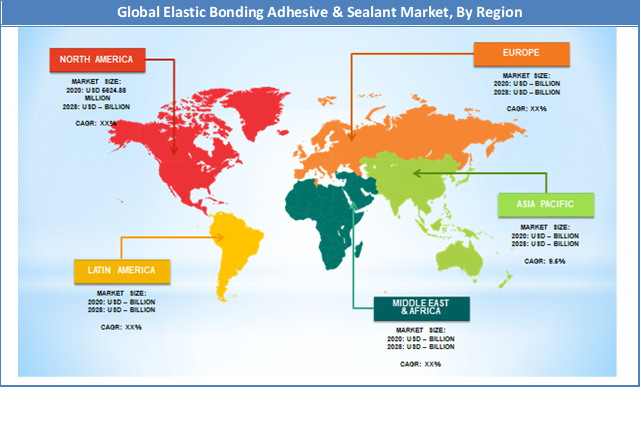

Elastic Bonding Adhesive & Sealant Market: Regional Analysis

This is attributable to various factors such as economic development, rising Construction and Automotive industries, enhanced lifestyle standards, and significant growth of infrastructure repair and development activities, in the region.

The North American region is undergoing economic growth and development. Due to this, the lifestyle standards of the residents have been on the rise. This promotes the growth of the Building and Construction industry as residents are investing huge amounts to make their living spaces aesthetically pleasing, efficient, and convenient. This, in turn, enhances the market for Elastic Bonding Adhesives & Sealants as they are widely utilized in the Building and Construction industry.

The Asia Pacific region is densely populated thus, to cater to the needs of the growing population; the real estate industry in the region has been growing significantly. This drives the construction industry in the Asia Pacific, thereby, enhancing the Elastic Bonding Adhesives & Sealants market, in the region. Additionally, Asia Pacific has been undergoing a rapid industrialization phase. This promotes the growth and development of a wide range of industries such as manufacturing, transportation, automotive, packaging, and appliances among others, in the region. These industries are among the top consumers of Elastic Bonding Adhesives & Sealants. This further drives the market for Elastic Bonding Adhesives & Sealants, in the region.

Elastic Bonding Adhesive & Sealant Market: Key Players & Competitive Landscape

Some of the key players in the Elastic Bonding Adhesive & Sealant market are

- Dow Inc

- Wacker Chemie AG

- Henkel Corporation

- Threebond Group

- Kaneka Corporation

- H. B. Fuller

- Sika AG

- Arkema S.A

- 3M Company

- Weicon GmbH & Co. KG

The global elastic bonding adhesive & sealant market is segmented as follows:

By Resin Type

- Polyurethane

- Silicone

- Silane Modified Polymers (SMP)

- Others

By End-use Industry

- Building and Construction

- Automotive and Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

List of Contents

Elastic Bonding Adhesive Sealant Market InsightsElastic Bonding Adhesive Sealant OverviewElastic Bonding Adhesive Sealant Growth FactorsElastic Bonding Adhesive Sealant Segment AnalysisElastic Bonding Adhesive Sealant Report ScopeElastic Bonding Adhesive Sealant Regional AnalysisElastic Bonding Adhesive Sealant Key Players Competitive LandscapeThe global elastic bonding adhesive sealant market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed