Durable Medical Equipment Market Size, Trends, Growth & Forecast 2034

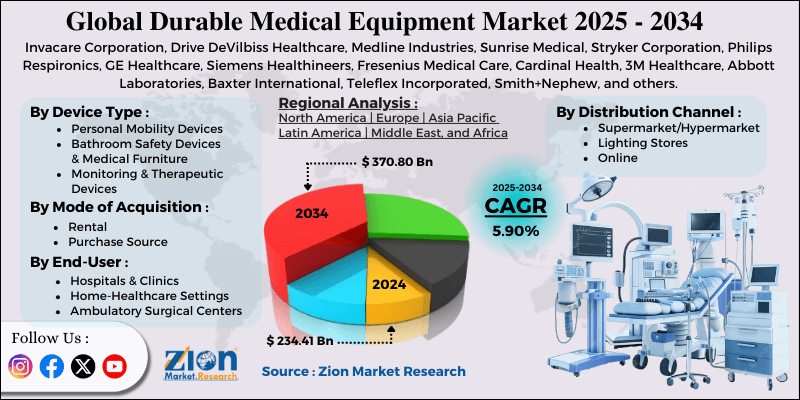

Durable Medical Equipment Market By Device Type (Personal Mobility Devices, Bathroom Safety Devices & Medical Furniture, Monitoring & Therapeutic Devices), By Mode of Acquisition (Rental, Purchase Source), By Distribution Channel (Hospital & Clinic Pharmacies / DME Suppliers, Retail Pharmacies & DME Stores, Online & Direct-to-Patient Channels), By End-User (Hospitals & Clinics, Home-Healthcare Settings, Ambulatory Surgical Centers, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

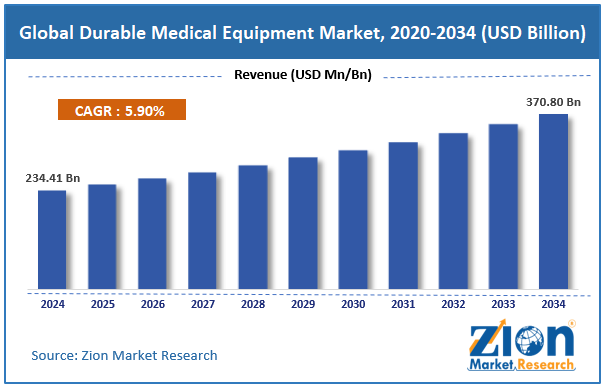

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 234.41 Billion | USD 370.80 Billion | 5.90% | 2024 |

Durable Medical Equipment Industry Perspective:

What will be the size of the global durable medical equipment market during the forecast period?

The global durable medical equipment market size was around USD 234.41 billion in 2024 and is projected to reach USD 370.80 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global durable medical equipment market is estimated to grow annually at a CAGR of around 5.90% over the forecast period (2025-2034)

- In terms of revenue, the global durable medical equipment market size was valued at around USD 234.41 billion in 2024 and is projected to reach USD 370.80 billion by 2034.

- The durable medical equipment market is projected to grow significantly, driven by the rising prevalence of chronic diseases, increasing adoption of home healthcare, and government support and reimbursement policies.

- Based on device type, the personal mobility devices segment is expected to lead the market, while the monitoring & therapeutic devices segment is expected to grow considerably.

- Based on mode of acquisition, the purchase source segment is the dominating segment, while the rental segment is projected to witness sizeable revenue over the forecast period.

- Based on distribution channel, the hospital & clinic pharmacies/DME suppliers segment is expected to lead the market, followed by the retail pharmacies & DME stores segment.

- Based on end-user, the home-healthcare settings segment holds a dominant share, while the hospitals & clinics segment is projected to witness substantial growth in the coming years.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Durable Medical Equipment Market: Overview

Durable Medical Equipment (DME) are reusable medical device prescribed by health professionals to support patients in managing medical conditions or recovering at home. These items are designed for long-term use and include equipment such as blood glucose monitors, oxygen systems, walkers, hospital beds, and wheelchairs. The global durable medical equipment market is poised for notable growth driven by an aging population, rising cases of chronic diseases, and technological advancements. The worldwide growth in the senior population has substantially increased demand for assistive care devices and mobility aids. Older adults are more prone to chronic illnesses and physical limitations. This fuels sustained adoption of durable medical equipment.

Moreover, chronic conditions like respiratory disorders, cardiovascular diseases, and diabetes need long-term management. DME supports continuous treatment and monitoring outside the hospital and clinics. This creates recurring and consistent demand. Furthermore, connectivity, automation, and smart sensors enhance device usability and functionality. Improved DME enhances provider efficiency and patient outcomes. Technology also expands the scope of equipment applications.

Nevertheless, the global market faces limitations, including the high cost of advanced equipment, complex reimbursement procedures, and regulatory compliance challenges. Technologically advanced DMEs are usually high-priced, limiting affordability for uninsured and low-income patients. Cost is still a key barrier to broader adoption. Lengthy approval processes delay patients' access to equipment. Administrative pressure discourages providers from prescribing durable medical equipment, thus slowing the industry penetration. Likewise, varied and strict regulatory requirements increase approval schedules. Compliance increases operational and developmental costs for manufacturers. This may hamper market entry and innovation.

Still, the global durable medical equipment industry benefits from several favorable factors, such as the integration of connected and smart devices, the expansion of home care services, and the adoption of telehealth. Smart DME enables data-driven care and remote monitoring. Integration with digital health platforms improves value. This creates new revenue streams and differentiation. The growth of home healthcare providers increases demand for equipment. DME is crucial for home-based treatment models, supporting long-term market growth. Additionally, telemedicine increases the need for remote monitoring equipment. DME complements virtual care delivery. This expands usage beyond conventional settings.

Durable Medical Equipment Market: Dynamics

Growth Drivers

How are government policies and reimbursement favoring the durable medical equipment market?

Supportive government policies and insurance reimbursements make DME more accessible and affordable. Coverage comprises wheelchairs, home monitoring devices, and oxygen therapy systems. Policy incentives promote preventive care and chronic disease management. Reimbursement architecture fuels elevated adoption rates and industry penetration. Manufacturers gain confidence to expand and innovate product portfolios. These policies promise steady growth and accessibility of DME across the globe.

How is the durable medical equipment market augmented by the growth in surgical and rehabilitation procedures?

Increasing demand for rehabilitation and surgical procedures is fueling DME demand worldwide. Devices like therapy aids, rehab equipment, and patient lifts support recovery and mobility. Expanding healthcare infrastructure in the developing markets drives adoption. Post-surgical care and rehab programs depend on durable medical equipment. Home care settings and hospitals are adopting more specialized, advanced devices. This trend boosts the role of DME as a vital component of patient care, thus propelling the durable medical equipment market.

Restraints

Lack of awareness among end users hinders the market progress

Several patients and caregivers are unfamiliar with the benefits and availability of advanced DME. Misconceptions regarding reliability, usability, and cost deter adoption. Training and education gaps in the home healthcare setting contribute to underutilization. Low awareness is majorly evident in emerging and rural markets. Providers and hospitals should spend more resources on patient education. Without understanding, even high-end devices may remain underused, thereby restricting market growth.

Opportunities

How are technological integration and the use of smart devices advantageous for the development of the durable medical equipment market?

IoT, AI, and wearable technology offer opportunities for advanced DME solutions. Predictive maintenance, remote monitoring, and patient data improve care quality. Integration with telehealth platforms raises device utility and engagement. Smart devices can enhance adherence and lower hospital readmissions. Continuous innovation allows premium product offerings with higher value. Technology-based solutions increase industry reach and patient-centric care options, favoring the growth of the durable medical equipment industry.

Challenges

Rapid technological obsolescence restricts the market growth

Fast-paced advancements can render devices obsolete in a matter of months. Patients and hospitals may hesitate to invest in products with short lifecycles. Older devices may lack compatibility with new systems or software platforms. Manufacturers face pressure to update products while maintaining backward compatibility. Obsolescence risks impact pricing and long-term consumer loyalty. Balancing durability and advancement is a persistent challenge.

Durable Medical Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Durable Medical Equipment Market |

| Market Size in 2024 | USD 234.41 Billion |

| Market Forecast in 2034 | USD 370.80 Billion |

| Growth Rate | CAGR of 5.90% |

| Number of Pages | 213 |

| Key Companies Covered | Invacare Corporation, Drive DeVilbiss Healthcare, Medline Industries, Sunrise Medical, Stryker Corporation, Philips Respironics, GE Healthcare, Siemens Healthineers, Fresenius Medical Care, Cardinal Health, 3M Healthcare, Abbott Laboratories, Baxter International, Teleflex Incorporated, Smith+Nephew, and others. |

| Segments Covered | By Device Type, By Mode of Acquisition, By Distribution Channel, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Durable Medical Equipment Market: Segmentation

The global durable medical equipment market is segmented based on device type, mode of acquisition, distribution channel, end-user industry, and region.

Based on device type, the global durable medical equipment industry is divided into personal mobility devices, bathroom safety devices & medical furniture, and monitoring & therapeutic devices. The personal mobility devices segment accounts for 40% of the total market, driven by the high prevalence of mobility-related conditions and an aging population worldwide.

On the other hand, the monitoring & therapeutic devices segment holds a second-leading share of 30% in the overall market. This growth is supported by the surge in chronic diseases and the adoption of home healthcare.

Based on mode of acquisition, the global durable medical equipment market is segmented into rental and purchase sources. The purchase source segment leads with 70% of the total market share, as a majority of patients and healthcare providers prefer to own equipment outright, mainly for long-term needs such as home hospital beds, wheelchairs, and monitoring devices. Ownership eliminates and offers better convenience.

Conversely, the rental segment holds second position with 30% of the overall market. They are mainly used for short-term use and are high-priced equipment. These comprise mobility scooters, hospital beds, and oxygen concentrators, but it still registers for a smaller share than purchases.

Based on distribution channel, the global market is segmented into hospital & clinic pharmacies/DME suppliers, retail pharmacies/DME stores, and online & direct-to-patient channels. The hospital & clinic pharmacies/DME suppliers segment dominates the market with a 45% share, as most DME is prescribed by health professionals and supplied through medical institutions, thereby offering insurance coverage, proper guidance, and compliance.

Nonetheless, the retail pharmacies & DME stores segment captured 35% of the total market. They serve patients who buy equipment directly for home use, primarily for accessibility and convenience.

Based on end-user, the global market is segmented into hospitals & clinics, home healthcare settings, ambulatory surgical centers, and others. The home healthcare segment leads with 45% market share, driven by growing demand for home-based care, rising cases of chronic diseases, and an aging population. Patients increasingly need home monitoring devices, respiratory equipment, and mobility aids.

However, the hospitals & clinics segment holds 35% market share, as they buy DME for inpatient care, outpatient services, and rehabilitation. Still, much of their equipment is institutional rather than long-term personal use.

Durable Medical Equipment Market: Regional Analysis

Why does North America hold a dominant position in the global Durable Medical Equipment Market?

North America is projected to maintain its dominant position in the global durable medical equipment market, with a 5.8% CAGR, owing to its large market share and scale, advanced healthcare infrastructure, and significant healthcare expenditure. North America consistently holds the leading share of the worldwide market, remarkably higher than other regions. This growth signifies strong demand and investment in DME in the region’s healthcare systems. High industry share highlights North America’s leading role in both innovation and revenue. The region holds highly developed medical infrastructure, broader hospital networks, and advanced care facilities that support early adoption of quality durable medical equipment. Strong facilities and technology adoption drive the procurement and use of equipment such as mobility aids and monitoring devices. This exhaustive infrastructure fuels deeper industry penetration.

Furthermore, the region’s healthcare spending is the highest among others, with the United States alone spending trillions of dollars every year on equipment and health services. Such expenditure enables broader access to DME and supports the purchase of specialized and advanced devices. Generous spending power fuels demand in care settings.

Europe maintains its position as the second-largest region in the global durable medical equipment industry, with a 5.5% CAGR, driven by an aging population, high rates of chronic disease, and strong healthcare infrastructure and public funding. More than 1/5th of the EU populace is aged 65+, increasing the need for long-term care devices and mobility aids. Older adults need equipment for rehabilitation, daily living support, and chronic disease management. This demographic trend fuels DME adoption. Chronic conditions like diabetes, cardiovascular diseases, and respiratory disorders are broader in Europe. This drives demand for therapeutic and monitoring equipment, such as oxygen devices and glucose monitors. Increasing disease prevalence reinforces the regional market.

Additionally, developed healthcare systems in countries such as France, Germany, and the United Kingdom enable broader DME use in homes, hospitals, and clinics. Reimbursement and public funding enhance patient access to equipment. These supports promise continuous industry growth.

Durable Medical Equipment Market: Competitive Analysis

The leading players in the global durable medical equipment market are:

- Invacare Corporation

- Drive DeVilbiss Healthcare

- Medline Industries

- Sunrise Medical

- Stryker Corporation

- Philips Respironics

- GE Healthcare

- Siemens Healthineers

- Fresenius Medical Care

- Cardinal Health

- 3M Healthcare

- Abbott Laboratories

- Baxter International

- Teleflex Incorporated

- Smith+Nephew

Durable Medical Equipment Market: Key Market Trends

Growth of home healthcare and remote care:

There is a substantial shift away from institutional care toward home-based treatment and rehabilitation due to patient preference and cost-efficiency. Durable equipment, such as remote monitoring tools and portable oxygen systems, is increasingly adopted in homes. This trend increases demand for compact, easy-to-use devices.

Focus on customized and patient‑centric solutions:

Manufacturers are focusing on ergonomic design, modularity, and personalization in DME products. Customization enhances safety, comfort, and long-term adherence to therapy. Patient-centric devices are prevalent among aging populations and among users of chronic care.

The global durable medical equipment market is segmented as follows:

By Device Type

- Personal Mobility Devices

- Bathroom Safety Devices & Medical Furniture

- Monitoring & Therapeutic Devices

By Mode of Acquisition

- Rental

- Purchase Source

By Distribution Channel

- Hospital & Clinic Pharmacies / DME Suppliers

- Retail Pharmacies & DME Stores

- Online & Direct-to-Patient Channels

By End-User

- Hospitals & Clinics

- Home-Healthcare Settings

- Ambulatory Surgical Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed